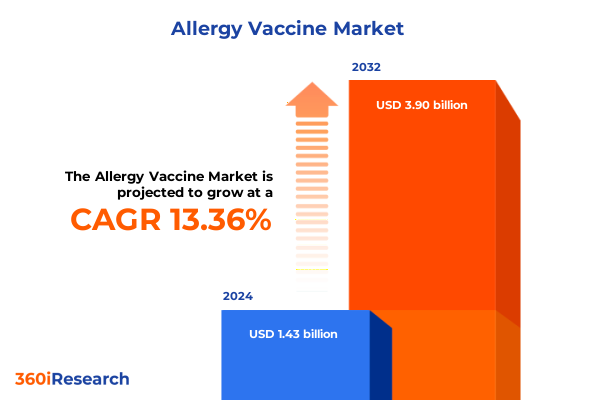

The Allergy Vaccine Market size was estimated at USD 1.60 billion in 2025 and expected to reach USD 1.79 billion in 2026, at a CAGR of 13.58% to reach USD 3.90 billion by 2032.

Pioneering the Future of Allergy Vaccines Amid Evolving Therapeutic Innovations and Rising Patient Expectations in a Competitive Biologics Landscape

The landscape of allergy vaccines is at a pivotal juncture characterized by rapid scientific advancements, heightened clinical interest, and a growing recognition of immunotherapy’s potential to transform patient outcomes. As allergic diseases become more prevalent across diverse demographics, the need for safe, effective, and patient-centric vaccine solutions has never been more pronounced. Moreover, the convergence of biotechnology innovations and precision medicine approaches is reshaping traditional paradigms of allergy management, opening new avenues for customized vaccine formulations and delivery methods.

In this context, stakeholders ranging from biopharmaceutical companies to healthcare providers are increasingly prioritizing investments in next-generation platforms that offer improved tolerability and extended efficacy. Additionally, digital health technologies and remote monitoring tools are facilitating greater patient adherence and real-world evidence collection, thereby enhancing the overall value proposition of allergy vaccines. As a result, decision-makers must navigate a complex interplay of scientific breakthroughs, regulatory milestones, and evolving patient preferences to maintain a competitive edge.

Against this backdrop, this executive summary provides an integrated overview of transformative shifts, policy impacts, segmentation dynamics, and regional nuances shaping the future of allergy vaccines in the United States and beyond. By synthesizing these critical insights, industry leaders will be better equipped to craft agile strategies, optimize resource allocation, and capitalize on emerging growth opportunities in this dynamic field.

Unprecedented Therapeutic Breakthroughs and Regulatory Reforms Reshape Allergy Vaccine Development Pathways and Market Trajectories

Recent years have witnessed a series of transformative shifts that are redefining the development and deployment of allergy vaccines on multiple fronts. Breakthroughs in molecular allergology have enabled the identification of novel epitopes and recombinant allergens, thereby enhancing immunogenic specificity and reducing off-target reactions. Furthermore, progress in adjuvant technology is improving immune modulation, increasing the potency of vaccine candidates while minimizing adverse events.

In parallel, the accelerated adoption of sublingual immunotherapy formulations has marked a departure from invasive injection-based protocols, reflecting a broader industry move toward patient-friendly administration routes. As regulatory agencies in key markets streamline clinical pathways for biologics, sponsors are exploring adaptive trial designs and real-world evidence registries to expedite market entry. Simultaneously, strategic collaborations between biotech firms and contract development organizations are optimizing R&D operations, lowering time-to-market for promising vaccine candidates.

Taken together, these factors are converging to create a more dynamic and competitive environment, where agility in product innovation and regulatory navigation will be critical for sustained success. Industry leaders must therefore embrace a culture of continuous innovation and foster strategic partnerships that can harness these transformative trends.

Analyzing the Compound Effects of Newly Imposed United States Tariffs on Allergy Vaccine Supply Chains and Manufacturer Economic Models

The introduction of new U.S. tariff regimes in 2025 is exerting a significant cumulative impact on allergy vaccine supply chains and manufacturer cost structures. Beginning April 5, 2025, a uniform 10% tariff was implemented on virtually all imported goods, including active pharmaceutical ingredients utilized in vaccine production. This measure, aimed at bolstering domestic manufacturing capacity, has led to heightened procurement costs for both branded extracts and recombinant allergen intermediates. Consequently, manufacturers are reassessing international sourcing strategies and exploring nearshoring options to mitigate financial pressures.

At the same time, targeted duties of up to 25% on key intermediates sourced from China and India-including specialized adjuvants and stabilizing excipients-have introduced further complexity into supply chain resilience planning. Since these intermediates are critical to the stability and potency of both subcutaneous and sublingual formulations, the heightened cost burden is being passed downstream, potentially affecting overall vaccine affordability for providers and payers. In response, industry players are accelerating efforts to qualify alternative suppliers in regions with preferential trade agreements and investing in domestic API manufacturing initiatives.

Looking ahead, ongoing legal challenges and potential exemption requests may offer temporary relief, yet uncertainty remains a defining feature of the regulatory landscape. Decision-makers are consequently prioritizing scenario planning and flexible contracting frameworks to navigate evolving tariff policies while safeguarding product quality and supply continuity.

Dissecting Market Dynamics Through Multifaceted Segmentation Reveals Distinct Patient and Channel Profiles Driving Strategic Priorities

A nuanced understanding of market dynamics emerges when examining the diverse dimensions through which allergy vaccines are segmented. Patient targeting varies significantly by route of administration, with traditional subcutaneous injections maintained via both standard and accelerated dosing regimens, and patient-preferred sublingual treatments offered in drop and tablet formats. Simultaneously, the nature of the allergen payload differentiates long-term perennial antigen preparations-such as dust mite and animal dander extracts-from seasonally tailored formulations addressing pollens and molds.

Moreover, strategic differentiation by vaccine type plays a crucial role, where single-antigen monovalent offerings compete alongside broad-coverage polyvalent complexes. The retail landscape further fragments based on distribution channels, as hospitals, clinics, home healthcare providers, and both online and brick-and-mortar pharmacies serve distinct patient cohorts. Underpinning all of this, the choice between recombinant platforms and traditional extract-based technologies reflects a key technological crossroads, one that influences both development timelines and pricing models.

In addition, demographic factors such as patient age group-ranging from pediatric and adult to geriatric populations-shape clinical protocols, dosing schedules, and patient adherence strategies. Finally, end-user segmentation spanning hospitals, specialized clinics, and homecare scenarios underscores the importance of tailored delivery solutions and support services. Together, these intersecting segmentation layers offer a roadmap for targeted market entry strategies and resource allocation.

This comprehensive research report categorizes the Allergy Vaccine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vaccine Type

- Route Of Administration

- Allergens Targeted

- Technology

- Patient Age Group

- End User

- Distribution Channel

Decoding Regional Variations Illuminates Distinct Growth Drivers and Barriers Across Americas, EMEA, and Asia-Pacific Allergy Vaccine Markets

Regional variations in allergy vaccine adoption and market development reflect distinct healthcare infrastructures, reimbursement frameworks, and epidemiological patterns. In the Americas, widespread insurance coverage and a high prevalence of allergic rhinitis have fueled demand for both conventional and advanced immunotherapy options. In response, manufacturers are tailoring their portfolios to include user-friendly sublingual tablets alongside established subcutaneous products to meet evolving patient expectations and payer requirements.

Meanwhile, the Europe, Middle East & Africa region presents a tapestry of regulatory landscapes and access models. European markets benefit from centralized approvals and value-based procurement practices, incentivizing innovations that demonstrate clear clinical benefits. In contrast, emerging markets within the Middle East and Africa exhibit variable infrastructure maturity, leading manufacturers to deploy flexible distribution strategies and hybrid financing models to overcome access hurdles.

Across the Asia-Pacific region, rapid economic growth and expanding healthcare budgets are catalyzing investments in new production capacity and clinical research collaborations. Localized manufacturing partnerships are increasingly common, driven by preferential trade policies and an emphasis on securing supply chain resiliency. Collectively, these regional insights underscore the need for adaptive go-to-market approaches that align with heterogeneous market conditions and long-term growth trajectories.

This comprehensive research report examines key regions that drive the evolution of the Allergy Vaccine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Competitive Strategies Highlights How Leading Biopharma Firms Are Advancing Pipeline Innovation and Market Position in Allergy Vaccines

Major industry participants are steering their strategies through a combination of R&D acceleration, strategic alliances, and portfolio diversification. Leading biologics developers have intensified their focus on recombinant allergen platforms, recognizing the potential for enhanced specificity and consistency. Concurrently, established extract manufacturers are expanding their global footprint through capacity upgrades and novel adjuvant collaborations.

Strategic partnerships have also led to co-development agreements aimed at advancing cutting-edge technologies, while mergers and acquisitions continue to reshape the competitive landscape. This environment has prompted companies to re-evaluate their pipelines, placing greater emphasis on late-stage assets with differentiated clinical profiles. At the same time, a handful of emerging biotech firms specializing in nanoparticle-based delivery and peptide-engineered vaccines are attracting significant venture capital interest.

In parallel, global players are leveraging real-world evidence and value-demonstration studies to secure favorable reimbursement terms and accelerate product uptake. As such, competitive success hinges on a firm’s ability to integrate scientific innovation with agile market access strategies and operational scalability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Allergy Vaccine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adamis Pharmaceuticals Corporation

- ALK‑Abelló A/S

- Allergopharma GmbH & Co. KG

- Allergy Therapeutics plc

- Anergis SA

- Biomay AG

- Boehringer Ingelheim International GmbH

- Circassia Group plc

- CSL Limited

- DBV Technologies S.A.

- HAL Allergy B.V.

- Inmunotek S.L.

- Jubilant HollisterStier LLC

- Laboratorios LETI, S.L.U.

- Merck KGaA

- Mitsubishi Tanabe Pharma Corporation

- Novartis International AG

- Pfizer Inc.

- Regeneron Pharmaceuticals, Inc.

- Sanofi S.A.

- Stallergenes Greer International AG

- Thermo Fisher Scientific Inc.

- Torii Pharmaceutical Co., Ltd.

- Zhejian Wolwo Bio‑pharmaceutical Co., Ltd.

- Zydus Lifesciences Ltd.

Implementing Proactive Supply Chain Strategies and Adaptive Clinical Designs to Secure Long-Term Leadership in Allergy Vaccines

Given the evolving market context, industry leaders should pursue a series of targeted actions to fortify their competitive position. First, stakeholders would benefit from accelerating investments in alternative API manufacturing, thereby mitigating tariff-related supply chain disruptions. By establishing dual-sourcing agreements and leveraging regional free-trade zones, companies can enhance resilience and control input costs.

Second, it is critical to broaden clinical development strategies to include adaptive trial designs that incorporate real-world evidence endpoints. This approach not only expedites regulatory milestones but also strengthens payer negotiation positions by demonstrating patient-centered value. Furthermore, forging cross-sector collaborations-spanning digital health innovators, medical device partners, and specialty retailers-can amplify patient engagement and adherence, ultimately driving long-term treatment success.

Finally, decision-makers should implement dynamic portfolio reviews to prioritize high-potential assets across multiple segmentation vectors. By aligning internal capabilities with market segment opportunities-whether through route of administration, allergen specificity, or patient age group-organizations can streamline resource allocation and maximize return on innovation.

Employing a Comprehensive Mixed-Methods Framework Combining Primary Expert Interviews and Secondary Data Analysis to Generate Reliable Allergy Vaccine Insights

This research adheres to a robust, multi-tiered methodology designed to ensure the highest levels of rigor and reliability. Primary data was gathered through in-depth interviews with key opinion leaders, including allergist-immunologists, pharmaceutical executives, and supply chain experts. These qualitative insights were complemented by secondary research encompassing peer-reviewed journals, regulatory documents, and industry news outlets.

Quantitative analyses utilized proprietary datasets on import duties, distribution networks, and technology adoption rates to construct segmentation models and regional profiles. A dedicated tariff impact framework was applied to assess cost trajectories under various policy scenarios. Additionally, competitive landscape mapping integrated corporate press releases, patent filings, and clinical trial registries to identify strategic inflection points.

Throughout the process, findings were validated via expert panels and cross-referenced against publicly available government and industry data. This triangulated approach ensures that the conclusions and recommendations presented here reflect both current realities and emerging trends within the allergy vaccine ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Allergy Vaccine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Allergy Vaccine Market, by Vaccine Type

- Allergy Vaccine Market, by Route Of Administration

- Allergy Vaccine Market, by Allergens Targeted

- Allergy Vaccine Market, by Technology

- Allergy Vaccine Market, by Patient Age Group

- Allergy Vaccine Market, by End User

- Allergy Vaccine Market, by Distribution Channel

- Allergy Vaccine Market, by Region

- Allergy Vaccine Market, by Group

- Allergy Vaccine Market, by Country

- United States Allergy Vaccine Market

- China Allergy Vaccine Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Leveraging Strategic Agility and Scientific Excellence to Navigate Complexities and Capitalize on Emerging Opportunities in Allergy Vaccines

As the allergy vaccine domain enters a period of accelerated innovation and strategic realignment, stakeholders are confronted with both unprecedented opportunities and complex challenges. Scientific advancements are rapidly expanding the therapeutic toolkit, yet new policy measures and supply chain pressures call for agile responses. Stakeholders capable of integrating advanced technologies with resilient operational structures will be best positioned to capture the value inherent in this dynamic market.

By embracing tailored segmentation strategies, adaptive clinical development pathways, and region-specific market access models, organizations can not only navigate present uncertainties but also lay the groundwork for sustainable growth. The insights and recommendations distilled in this executive summary offer a clear blueprint for action, enabling decision-makers to align their resources and capabilities with the most promising market segments. Ultimately, success in the allergy vaccine arena will hinge on the ability to combine scientific excellence with strategic foresight and operational dexterity.

Take Action Now to Partner with Our Associate Director of Sales & Marketing for Exclusive Access to Cutting-Edge Allergy Vaccine Research

Don't miss the opportunity to gain a competitive edge with the most comprehensive and actionable insights in the allergy vaccine landscape. Reach out to Ketan Rohom, the Associate Director of Sales & Marketing, for a customized briefing on how our in‐depth analysis can guide your strategic planning and investment decisions. Contact him today to secure your copy of the report and unlock tailored recommendations that will keep your organization at the forefront of innovation in allergy vaccines.

- How big is the Allergy Vaccine Market?

- What is the Allergy Vaccine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?