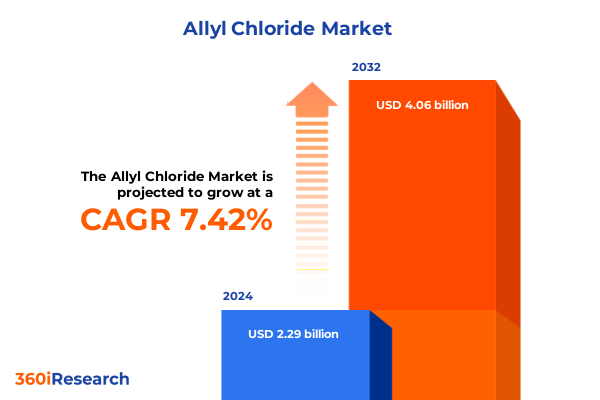

The Allyl Chloride Market size was estimated at USD 2.44 billion in 2025 and expected to reach USD 2.60 billion in 2026, at a CAGR of 7.54% to reach USD 4.06 billion by 2032.

Unveiling the Strategic Importance of Allyl Chloride in Contemporary Chemical Manufacturing and Its Extensive Influence Across Multiple Industry Verticals

Allyl chloride is a pivotal organochloride compound, characterized by the chemical formula CH₂=CHCH₂Cl, that serves as a cornerstone building block across a spectrum of industrial value chains. This colorless liquid, although insoluble in water, readily dissolves in common organic solvents, rendering it a versatile feedstock for downstream chemical syntheses. Its high reactivity as an alkylating agent underpins its role in generating epichlorohydrin, which subsequently forms the backbone of epoxy resins used in coatings, adhesives, and composites. Additionally, allyl chloride undergoes transformation into allyl alcohol, allylamine, and various specialty ethers and esters, further amplifying its relevance within pharmaceutical, agrochemical, and materials science applications. Despite its beneficial attributes, the handling of allyl chloride demands rigorous safety protocols due to its toxic and flammable nature, requiring manufacturers to maintain stringent process controls and personal protective measures to mitigate exposure risks and environmental releases.

Examining the Transformative Shifts Reshaping the Allyl Chloride Market Amid Sustainability Technological Innovation and Evolving Regulatory Dynamics

Over the past decade, the allyl chloride landscape has undergone transformative shifts driven by evolving sustainability mandates, technological innovation, and tightening regulatory frameworks. The traditional dominance of the propylene-based production route has increasingly faced competition from glycerol-derived pathways, motivated by the growing imperative to reduce reliance on petrochemical feedstocks and to valorize biodiesel byproducts. Concurrently, the surge in demand for epichlorohydrin, particularly for high-performance epoxy systems, has spurred advancements in continuous flow reactors and process intensification techniques aimed at enhancing operational efficiency and reducing waste streams. Moreover, digitalization initiatives are reshaping asset management and quality assurance practices, as leading producers adopt real-time monitoring and predictive maintenance to optimize throughput and mitigate plant downtime. Regulatory developments addressing halogenated solvents and greenhouse gas emissions are further propelling investment into cleaner production capacities and alternative chemistries. As these forces converge, stakeholders must adapt to a dynamic environment where agility, innovation, and environmental stewardship dictate competitiveness and long-term resilience.

Assessing the Cumulative Impact of 2025 United States Tariffs on Allyl Chloride Supply Chains Operational Costs and Domestic Production Strategies

The introduction of new United States tariffs in early 2025 has exerted significant pressure on the allyl chloride supply chain, compelling both domestic manufacturers and multinational suppliers to reevaluate sourcing and production strategies. With an across-the-board baseline duty of 10% on chemical imports and elevated reciprocal tariffs reaching 20% for European Union exports and 54% for shipments from China, cost structures have shifted fundamentally. This reappraisal has prompted some producers to accelerate investments in domestic capacity expansions and vertically integrated operations, thereby insuring against tariff volatility and protecting margins. Meanwhile, import-dependent specialty chemical distributors are facing pronounced margin compression, as higher input costs constrain the availability of competitively priced feedstocks. Despite certain exemptions for large-volume petrochemicals, the unpredictability surrounding future tariff extensions and potential Section 232 inquiries into critical industrial inputs has intensified supply chain recalibrations. As a result, alliances between U.S.-based plants and regional partners have become increasingly pivotal to securing uninterrupted access to key precursors and maintaining production continuity in an atmosphere of policy-driven trade realignment.

Key Insights into Allyl Chloride Market Segmentation and How Diverse Application Industry Use Distribution Purity Form and Production Methods Drive Dynamics

The allyl chloride market exhibits pronounced complexity when analyzed through multiple segmentation lenses. Within the application dimension, chemical intermediates such as epichlorohydrin and allyl alcohol represent a primary consumption channel, while corrosion inhibitors and demulsifiers underpin oil and gas treatments, and further derivatives support active pharmaceutical ingredients, excipients, and plasticizers, including both phthalate and non-phthalate variants. This diversity of end-use extends into water treatment, where biocides and disinfectants derived from allyl chloride underpin potable and wastewater purification. Simultaneously, the end-use industries encompass agriculture, where crop protection chemistries benefit from alkylation reactions; the automotive sector’s reliance on advanced coatings and adhesives; construction materials formed with epoxy resins; precision electronics manufacturing requiring high-purity reagents; and packaging solutions capitalizing on durable polymer formulations. Distribution channels further differentiate market dynamics, as direct sales arrangements often cater to high-volume industrial users, whereas distributor networks facilitate broader geographic reach, and online retail channels are emerging as a flexible conduit for smaller-scale specialty and research-grade purchases. Purity stratification between industrial-grade and reagent-grade specifications defines product suitability for bulk processing versus laboratory and pharmaceutical applications, and the physical form of allyl chloride-whether gas or liquid-affects handling requirements, storage logistics, and reactor design. Underpinning all these distinctions, the choice between glycerol and propylene production routes influences both feedstock economics and environmental footprints, driving procurement strategies and competitive positioning. By examining these intersecting segmentation frameworks, industry stakeholders can tailor their value propositions, streamline supply chains, and align product portfolios with evolving customer requirements.

This comprehensive research report categorizes the Allyl Chloride market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Purity

- Production Process

- Distribution Channel

- Application

- End Use Industry

Decoding Regional Dynamics of the Global Allyl Chloride Landscape and How Americas EMEA and Asia-Pacific Territories Are Steering Market Growth

Regionally, the allyl chloride market demonstrates distinct growth trajectories and strategic imperatives across the Americas, Europe Middle East and Africa, and Asia-Pacific realms. In the Americas, the United States remains a major epicenter of epoxy resin production, fueling demand for epichlorohydrin derived from allyl chloride and encouraging domestic investments to mitigate trade uncertainties and leverage shale gas feedstock advantages. Transitioning to Europe, the Middle East, and Africa, stringent environmental regulations and circular economy initiatives are shaping production processes, with value chains increasingly integrating bio-based glycerol routes and waste valorization practices to comply with decarbonization targets and chemical safety standards. Market players in this region also benefit from established logistics networks that facilitate cross-border distribution and access to emerging markets in North Africa and the Gulf Cooperation Council states. In contrast, the Asia-Pacific landscape is characterized by robust industrial expansion and infrastructure development, particularly in China and India, where rapid urbanization and manufacturing growth drive escalating requirements for water treatment chemicals, construction materials, and consumer goods packaging derived from allyl chloride pathways. Moreover, capacity expansions and technology transfers from mature markets are intensifying competition, highlighting the need for supply chain agility and localization strategies to capture opportunities within this dynamic regional milieu.

This comprehensive research report examines key regions that drive the evolution of the Allyl Chloride market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Players in the Allyl Chloride Arena and Their Strategic Moves to Enhance Production Capacities and Sustainable Innovations

A cadre of leading chemical manufacturers commands influence over the allyl chloride sector through a combination of vertical integration, technological prowess, and global distribution networks. Olin Corporation has fortified its market position by leveraging extensive chlor-alkali assets and proprietary alkylation technologies to ensure a stable supply of propylene-based allyl chloride while optimizing logistics efficiencies. INEOS, with its diversified petrochemical portfolio, employs flexible production configurations across multiple geographies, enabling rapid feedstock substitutions and capacity adjustments in response to feedstock cost fluctuations and regulatory changes. Solvay focuses on advancing green chemistry by piloting glycerol-derived processes for epichlorohydrin synthesis, aligning with broader sustainability commitments, and reinforcing partnerships with renewable feedstock suppliers. Osaka Soda and Sumitomo Chemical have similarly prioritized research and development expenditures to refine catalyst systems and enhance process yields, while Befar Group, OSAKA SODA, and Kashima Chemical exemplify regional champions in Asia, capitalizing on local manufacturing clusters and streamlined regulatory approvals to expand production footprints. Collectively, these players are investing in digitalization, quality management, and downstream integration to differentiate offerings, deepen customer relationships, and secure long-term competitive advantages in a market that rewards both scale and innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Allyl Chloride market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AccuStandard, Inc.

- ALPHA CHEMIKA

- Arkema Inc.

- BASF SE

- Central Drug House (P) Ltd.

- Chemical Corp Pvt Ltd.

- China Petroleum & Chemical Corporation

- Evonik Industries AG

- Gelest, Inc. by Mitsubishi Chemical Group Company

- INEOS AG

- Kashima Chemical Co., Ltd. by AGC Inc.

- Loba Chemie Pvt. Ltd.

- LyondellBasell Industries Holdings B.V.

- Merck KGaA

- Minglang Group

- Mubychem Group

- Olin Corporation

- Osaka Soda Co., Ltd.

- SIELC Technologies

- Sisco Research Laboratories Pvt. Ltd.

- Solvay S.A.

- Sumitomo Chemical Co., Ltd.

- TCI Chemicals (India) Pvt. Ltd.

- Thermo Fisher Scientific, Inc.

- Vizag Chemical International

- W.W. Grainger, Inc.

Actionable Recommendations Empowering Industry Leaders to Optimize Allyl Chloride Production Navigate Tariffs and Capitalize on Emerging Market Opportunities

To navigate the evolving complexities of the allyl chloride market and sustain competitive momentum, industry leaders should consider a multi-pronged strategic agenda. First, diversifying feedstock portfolios by integrating glycerol-derived production routes alongside conventional propylene pathways can shield operations from petrochemical price volatility and align with stakeholder expectations for lower carbon footprints. Next, forging collaborative partnerships with renewable feedstock suppliers and technology licensors can accelerate the adoption of continuous flow and process intensification solutions, thereby reducing energy consumption and minimizing waste streams. Concurrently, optimizing supply chain resiliency through nearshoring initiatives, dynamic rerouting capabilities, and tiered safety stock policies will be critical in mitigating tariff risks and ensuring consistent access to critical precursors. Furthermore, companies must double down on digital transformation efforts, deploying advanced process analytics and predictive maintenance tools to bolster throughput reliability and reduce unplanned outages. Lastly, engaging proactively with regulatory bodies and trade associations will allow stakeholders to influence policy developments, secure essential tariff exemptions, and contribute to the formulation of realistic environmental standards that support both innovation and public health goals.

Uncovering the Rigorous Research Methodology Underpinning This Allyl Chloride Analysis Through Comprehensive Data Collection and Expert Validation

This analysis is grounded in a rigorous research methodology encompassing both secondary and primary data sources. Extensive desk research drew from scientific literature, industry white papers, and regulatory filings to map production technologies, feedstock landscapes, and regulatory frameworks. To validate quantitative and qualitative insights, structured interviews were conducted with senior executives, technical directors, and supply chain specialists from leading global chemical companies, as well as regulatory experts and trade association representatives. Data triangulation techniques ensured consistency across multiple information streams, reconciling discrepancies between proprietary databases and public disclosures. In addition, thematic workshops facilitated scenario planning around tariff impacts, sustainability imperatives, and digital transformation trajectories. The segmentation framework adopted in this study was refined through iterative validation rounds with industry stakeholders, ensuring that application, end use, distribution, purity, form, and production process categories accurately reflect market realities. This methodological rigor underpins the credibility of the insights and recommendations presented throughout this executive summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Allyl Chloride market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Allyl Chloride Market, by Form

- Allyl Chloride Market, by Purity

- Allyl Chloride Market, by Production Process

- Allyl Chloride Market, by Distribution Channel

- Allyl Chloride Market, by Application

- Allyl Chloride Market, by End Use Industry

- Allyl Chloride Market, by Region

- Allyl Chloride Market, by Group

- Allyl Chloride Market, by Country

- United States Allyl Chloride Market

- China Allyl Chloride Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Concluding Perspectives on Navigating the Allyl Chloride Market Amid Geopolitical Tariffs Innovation Imperatives and Sustainable Growth Imperatives

In conclusion, the allyl chloride market stands at a pivotal juncture shaped by policy shifts, technological breakthroughs, and an expanding array of end-use applications. The advent of heightened U.S. tariffs has catalyzed supply chain realignments and underscored the value of domestic production resilience, while sustainability mandates and digitalization initiatives are redefining process efficiency benchmarks. By leveraging diversified feedstock strategies, embracing innovative production technologies, and deepening end-use segment expertise, industry participants can not only mitigate emerging challenges but also capitalize on growth opportunities across regional markets and application domains. The capacity to adapt swiftly to evolving trade environments, regulatory landscapes, and customer demands will determine the competitive hierarchy as stakeholders seek to optimize margins and foster long-term industry leadership. Ultimately, the integration of strategic agility, environmental stewardship, and operational excellence will serve as the cornerstone for achieving sustainable growth in the global allyl chloride arena.

Engage with Ketan Rohom to Secure Your Comprehensive Allyl Chloride Market Research Report and Gain Strategic Insights for Informed Decision-Making

Prioritizing strategic intelligence can empower leaders to stay ahead amid the fast-evolving allyl chloride ecosystem. Connect with Ketan Rohom, Associate Director, Sales & Marketing, to access the full market research report, tailored to unlock competitive advantages and address your organization’s specific needs. Through this collaboration, you’ll gain exclusive access to nuanced market analyses, in-depth supply chain assessments, and actionable insights spanning regulatory, technological, and operational domains. Ketan’s expertise ensures a streamlined pathway to secure the intelligence driving confident investment decisions and robust growth strategies. Reach out today to elevate your understanding of global consumption patterns, segmentation trends, and tariff implications, and position your enterprise for sustained success in the allyl chloride sector

- How big is the Allyl Chloride Market?

- What is the Allyl Chloride Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?