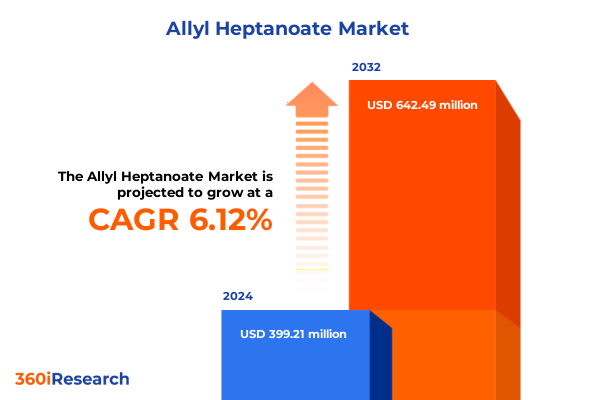

The Allyl Heptanoate Market size was estimated at USD 423.18 million in 2025 and expected to reach USD 453.88 million in 2026, at a CAGR of 6.14% to reach USD 642.49 million by 2032.

Exploration of Allyl Heptanoate’s Unique Molecular Characteristics and Its Expanding Role in Flavor, Fragrance, Cleaning, and Pharma Industries

The landscape of specialty esters is evolving at an unprecedented pace, and among these critical compounds Allyl Heptanoate stands out for its unique sensory and functional attributes. As a naturally sourced or synthetically produced ester, it imparts a rich, fruity, and sometimes floral character that is highly valued in countless formulations. Its molecular profile makes it a versatile ingredient in flavor and fragrance chemistries, where subtle nuances can shift consumer perceptions and influence brand loyalty.

In recent years, innovation in extraction processes and synthesis pathways has driven greater availability and consistency of Allyl Heptanoate. Technological advances have enabled producers to fine-tune reaction conditions for higher yields, as well as to explore bio-based feedstocks that align with sustainability goals. This intensified focus on green chemistry is reshaping procurement strategies, as brand owners seek esters with reliable provenance and reduced environmental footprint.

Given its broad sensory appeal and regulatory acceptance, Allyl Heptanoate is increasingly incorporated into diverse consumer products. From imparting crisp, fruity notes to confectionery and beverages to enhancing top notes in fine fragrances, its applications span multiple end markets. The compound’s physicochemical properties further extend its utility into cleaning formulations, where ester-based surfactants can offer performance benefits. This introductory overview sets the stage for a deeper examination of the transformative trends, regulatory shifts, and segmentation dynamics that together define the current state of the Allyl Heptanoate market.

Identification of Paradigm Shifts Reshaping the Allyl Heptanoate Landscape in Response to Regulatory, Consumer and Technological Drivers

A confluence of regulatory, consumer, and technological forces is driving paradigm shifts in the Allyl Heptanoate market. Regulatory bodies worldwide are tightening guidelines around synthetic ingredients, prompting manufacturers to explore bio-derived and naturally identical compounds. As a result, there is growing momentum towards validating greener production routes and achieving certifications that resonate with eco-conscious consumers.

Simultaneously, consumer awareness of ingredient transparency has surged. End users demand clean labels and familiar-sounding names, motivating suppliers to highlight the natural or nature-identical origins of Allyl Heptanoate. This consumer-driven transparency is complemented by digital traceability solutions that enable brand owners to verify each production batch, fostering trust in global supply chains.

On the technological front, process intensification and continuous manufacturing techniques are enabling more efficient esterification and purification steps. Such innovations reduce energy consumption and lower production costs, making it feasible to scale high-purity esters for niche applications. Moreover, advanced analytics and real-time monitoring systems are optimizing reaction parameters, ensuring consistent quality even under varying feedstock conditions.

Taken together, these transformative shifts are reshaping supplier strategies. Partnerships between specialty chemical producers and fragrance or flavor houses are becoming more collaborative, focusing on co-development of custom esters. This strategic collaboration underscores the adaptive nature of the Allyl Heptanoate landscape in response to evolving industry demands.

Analyzing the Comprehensive Effects of United States Tariffs Enacted in 2025 on Production Costs, Supply Chains, and Market Accessibility for Allyl Heptanoate

The imposition of United States tariffs on certain chemical imports in 2025 has reverberated across the Allyl Heptanoate supply chain, influencing cost structures and sourcing decisions. Import duties on precursor alcohols and acid derivatives have elevated raw material expenses, compelling manufacturers to reassess procurement strategies. These increased costs have translated into upward pressure on downstream pricing, affecting brand owners that rely on consistent ester supplies for their formulations.

In response, some producers have pivoted to alternative jurisdictions with preferential trade agreements, seeking tariff relief through longer supply routes but at more favorable duty rates. This recalibration, however, introduces complexity in logistics and inventory planning. Tightening lead times and fluctuating freight costs further complicate efforts to stabilize supply, particularly for time-sensitive applications in flavors and fragrances.

Moreover, higher import duties have prompted stakeholders to explore domestic synthesis capacities. Investments in local esterification plants and intensified focus on feedstock recovery have gained traction as means to mitigate exposure to tariff volatility. Such vertical integration initiatives can enable streamlined production flows and reduce dependency on cross-border shipments.

While these adaptive strategies may cushion immediate financial impacts, they also require meticulous risk management and capital allocation. Moving forward, alignment between tariff policies and supply chain resilience will be paramount to sustaining the availability and cost competitiveness of Allyl Heptanoate in the US market.

Unveiling Key Segmentation Patterns by Application, Form, Sales Channel and Price Range That Shape the Allyl Heptanoate Market Dynamics

The Allyl Heptanoate market exhibits distinct nuances when viewed through the lens of application, form, sales channel, and price range segmentation. In terms of application, the compound finds its most extensive use in the food and beverage sector, where it flavors beverages, confectioneries, frozen products, and savory snacks. Within beverages, both alcoholic and non-alcoholic categories leverage its fruity top notes, with energy drinks, juices, and soft drinks capitalizing on the bright aroma profile. Fragrances and personal care products also represent a major segment, spanning bath and shower preparations, designer and mass fragrances, hair treatments, and skin care formulations. Here, the appeal of niche and high-end perfume constructions has driven a premium on designer and niche variants. Meanwhile, household and industrial cleaning incorporates Allyl Heptanoate in dishwashing, laundry solutions, and surface cleaners that require a pleasant scent profile alongside functional performance. Lastly, the pharmaceutical sector, with its injectable, oral, and topical dosage forms, utilizes the ester for taste-masking and olfactory masking functions in medicinal products.

Evaluating the form-based segmentation, liquid esters predominate due to ease of blending, while emulsions are increasingly adopted in water-based applications, and powders offer stability advantages for certain end uses.

Across sales channels, direct sales favor large-volume end users seeking customized grades, distributors serve a diverse customer base with smaller-lot requirements, and online retail is emerging as a flexible sourcing channel for specialty needs.

Price range dynamics reflect demand for economy-grade formulations in high-volume cleaning, standard grades in personal care and food applications, and premium grades for niche fragrance houses. These segmentation insights collectively shape market strategies and inform targeted product positioning.

This comprehensive research report categorizes the Allyl Heptanoate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- Form

- Sales Channel

- Price Range

Examining the Distinctive Regional Dynamics, Demand Drivers and Strategic Trends Across the Americas, Europe Middle East Africa and Asia Pacific Markets

Distinct regional characteristics play a pivotal role in shaping demand and supply patterns for Allyl Heptanoate. In the Americas, strong innovation in beverage and snack flavor applications drives consistent uptake of fruity esters, while regulatory frameworks such as GRAS notifications support rapid product rollouts. Regional logistics infrastructure and proximity to major agricultural feedstock sources further enhance responsiveness to fluctuating demand.

Moving to Europe, the Middle East, and Africa, stringent environmental and safety regulations have spurred investments in sustainable production processes. Consumer preferences in EMEA increasingly favor naturally derived formulations, prompting regional producers to expand bio-based offerings. Moreover, the growth of fine fragrance houses in Europe accentuates demand for premium grades, while emerging markets in the Middle East and Africa emphasize cost-effective solutions in cleaning and personal care.

In Asia-Pacific, rapid urbanization, rising disposable incomes, and expanding processed food industries underpin robust growth. China and India lead regional consumption, with a growing number of domestic chemical companies enhancing local production capacities. Cross-border trade dynamics within Asia-Pacific benefit from regional trade agreements, reducing lead times and tariff burdens. Additionally, the diversification of sales channels, including e-commerce platforms, enables smaller brands to access specialty esters quickly.

By understanding these regional nuances, stakeholders can fine-tune distribution networks, align product portfolios with local preferences, and capitalize on emerging opportunities in each geography.

This comprehensive research report examines key regions that drive the evolution of the Allyl Heptanoate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Approaches, Innovation Portfolios and Competitive Positioning of Leading Producers in the Allyl Heptanoate Sector

Leading companies in the Allyl Heptanoate domain are leveraging innovation, strategic partnerships, and capacity expansions to secure competitive advantage. Key producers are investing in green chemistry initiatives, integrating continuous flow reactors and solvent-free processes that reduce energy consumption and enhance sustainability credentials. Many of these firms have also entered joint ventures with flavor and fragrance houses to co-develop custom ester grades that cater to evolving olfactory and taste profiles.

In addition, strategic acquisition of specialty chemical manufacturers has enabled top players to broaden their product portfolios and strengthen global distribution networks. Collaboration with academic institutions and research consortia further accelerates the development of next-generation synthesis pathways and high-purity intermediates. These partnerships facilitate accelerated innovation cycles and knowledge exchange, translating into differentiated product offerings.

Another notable trend involves investment in digitalization of supply chains. Advanced analytics, blockchain tracking, and AI-driven forecasting tools are being deployed by forward-thinking companies to enhance traceability, optimize inventory management, and anticipate demand fluctuations. This digital pivot not only improves operational agility but also supports compliance with emerging regulatory requirements.

As competition intensifies, the ability to combine R&D prowess with robust commercial networks will determine market leadership. Companies that deliver consistent quality, demonstrate environmental stewardship, and offer tailored solutions will be best positioned to thrive in the complex Allyl Heptanoate ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Allyl Heptanoate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- Firmenich International SA

- Givaudan SA

- International Flavors & Fragrances Inc.

- Mane SA

- Robertet SA

- Sensient Technologies Corporation

- Symrise AG

- T. Hasegawa Co., Ltd.

- Takasago International Corporation

Delivering Clear and Pragmatic Recommendations to Empower Industry Leaders in Optimizing Production, Supply Chain and Market Positioning for Allyl Heptanoate

Industry leaders seeking to optimize their position in the Allyl Heptanoate market must adopt a multi-pronged strategy that balances efficiency, differentiation, and resilience. First, enhancing production efficiency through process intensification and adoption of modular manufacturing units can deliver cost savings and flexibility. By evaluating continuous flow technologies and energy-recovery systems, manufacturers can improve margins and reduce environmental impact.

At the same time, differentiation through bespoke ester grades tailored to specific end-use requirements will serve as a key competitive lever. Engaging in early-stage collaboration with flavor and fragrance formulators ensures alignment with consumer trends and minimizes time to market for novel scent and taste profiles. Moreover, building robust traceability frameworks, underpinned by digital supply chain platforms, will bolster brand credibility and facilitate rapid compliance with evolving regulations.

To address tariff-driven cost pressures, diversifying sourcing strategies and establishing regional production hubs can mitigate exposure to trade fluctuations. Firms should assess opportunities to form strategic alliances with local feedstock suppliers or pursue toll manufacturing arrangements in tariff-advantaged jurisdictions.

Finally, investing in talent and cross-functional expertise will support agile decision-making. Empowering teams with analytics capabilities and market intelligence ensures that strategic choices are grounded in real-time data. By implementing these recommendations, industry players can fortify their operational backbone, drive sustainable growth, and maintain leadership in the dynamic Allyl Heptanoate marketplace.

Illustrating the Robust Research Methodology Employed to Gather, Validate and Analyze Qualitative and Quantitative Data for Insightful Allyl Heptanoate Analysis

The research methodology underpinning this analysis integrates multiple data collection and validation approaches to ensure robust insights. Primary research included in-depth interviews with industry experts, senior R&D professionals, and key stakeholders across the flavor, fragrance, cleaning, and pharmaceutical segments. These conversations illuminated emerging innovation priorities, regulatory considerations, and operational challenges specific to the production and use of Allyl Heptanoate.

Secondary research comprised a comprehensive review of technical literature, patent filings, regulatory dossiers, and reputable trade publications. Data triangulation techniques were employed to cross-verify information from diverse sources, enhancing the reliability of the findings. Market intelligence databases provided qualitative context on supply chain structures and company profiles, while sustainability reports and environmental impact assessments informed analysis of green chemistry trends.

Analytical frameworks such as SWOT and PESTEL were applied to evaluate internal strengths, external drivers, and potential disruptors. Scenario analysis helped assess the impact of tariff changes and regulatory shifts on supply chain resilience. Furthermore, methodological rigor was maintained through peer review by subject-matter experts and iterative validation rounds to refine key insights.

This layered approach, combining qualitative depth with structured analytical rigor, ensures that the report delivers a comprehensive and accurate portrayal of the Allyl Heptanoate landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Allyl Heptanoate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Allyl Heptanoate Market, by Application

- Allyl Heptanoate Market, by Form

- Allyl Heptanoate Market, by Sales Channel

- Allyl Heptanoate Market, by Price Range

- Allyl Heptanoate Market, by Region

- Allyl Heptanoate Market, by Group

- Allyl Heptanoate Market, by Country

- United States Allyl Heptanoate Market

- China Allyl Heptanoate Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Summarizing the Critical Insights, Strategic Implications and Future Outlook Drawn from the Comprehensive Evaluation of the Allyl Heptanoate Market Landscape

This analysis synthesizes the intricate web of factors influencing the Allyl Heptanoate market, from molecular innovation to geopolitical and regulatory shifts. The compound’s versatile sensory profile has underpinned its adoption across food and beverage, fragrance, cleaning, and pharmaceutical segments, while emerging sustainability mandates and consumer transparency requirements propel ongoing advancements.

Tariff adjustments introduced in 2025 have catalyzed strategic realignments in sourcing and production, driving interest in domestic manufacturing and alternative trade routes. Segmentation insights reveal differentiated demand patterns by application, form, sales channel, and price tier, highlighting the need for tailored product offerings and dynamic positioning.

Regional analysis underscores the importance of local regulatory frameworks, infrastructure capabilities, and consumption behaviors that vary widely across the Americas, EMEA, and Asia-Pacific. Concurrently, leading companies are strengthening competitive moats through green chemistry, digitalization, and collaborative innovation, setting new benchmarks for quality and traceability.

Looking ahead, stakeholders that embrace process efficiency, product customization, and resilient supply chains will be best equipped to navigate market complexities. The insights presented herein offer a strategic compass for decision-makers seeking to harness the full potential of Allyl Heptanoate and sustain growth in a rapidly evolving environment.

Engage with Ketan Rohom for Customized Insights and Secure Your Access to the Definitive Allyl Heptanoate Market Research Report Today

For tailored guidance on leveraging the insights presented in this report and to secure comprehensive access to in-depth analysis, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. By connecting with Ketan Rohom, you can discuss customized data packages, explore value-added services, and arrange a demonstration of key findings that align with your strategic priorities. Engage now to unlock expert support, expedite decision-making, and gain a competitive edge through exclusive channels and detailed, actionable intelligence on Allyl Heptanoate.

- How big is the Allyl Heptanoate Market?

- What is the Allyl Heptanoate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?