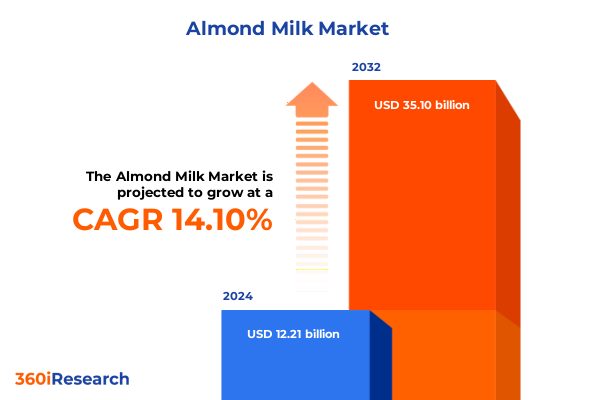

The Almond Milk Market size was estimated at USD 13.87 billion in 2025 and expected to reach USD 15.76 billion in 2026, at a CAGR of 14.17% to reach USD 35.10 billion by 2032.

Unveiling the Rising Demand for Almond Milk Driven by Health Consciousness, Environmental Sustainability, and Shifting Consumer Preferences

Almond milk has transcended its origins as a niche dairy alternative to emerge as a mainstream staple revered for its nutritional benefits and environmental credentials. Crafted from blanched almonds blended with water and often enriched with vitamins and minerals, this plant-based beverage has captured the attention of health-conscious consumers, flexitarians, and committed vegans alike. Its light texture, subtle nutty flavor, and versatility across coffee, smoothies, cereal, and cooking applications have underpinned its ascent in competitive dairy and dairy-alternative ecosystems.

Emerging health concerns associated with lactose intolerance, dairy allergies, and the rising awareness of cholesterol management have propelled almond milk into the limelight as a heart-healthy substitute. At the same time, growing scrutiny of dairy’s environmental footprint has amplified the appeal of nuts sourced from water-efficient practices. This confluence of nutritional priorities and sustainability considerations has fostered a robust foundation for almond milk’s proliferation. Consequently, manufacturers and retailers alike have accelerated investment in innovative formulations and strategic distribution channels to meet evolving consumer demands.

As retail outlets expand their plant-based portfolios and e-commerce platforms refine direct-to-consumer fulfillment, almond milk continues to solidify its role as a versatile fixture on grocery shelves and digital storefronts. In parallel, premium positioning through organic sourcing, fortified blends, and indulgent flavor extensions has broadened its demographic reach. Moving forward, stakeholders must navigate an increasingly complex interplay of consumer expectations, regulatory developments, and supply chain dynamics to capitalize effectively on this vibrant category.

Navigating a Dynamic Almond Milk Landscape Fueled by Technological Innovation, Sustainability Initiatives, and Evolving Retail Ecosystems

The almond milk sector has entered a transformative era characterized by rapid innovation and strategic repositioning. Advancements in plant-based protein extraction, enzymatic stabilization, and natural flavor encapsulation have elevated the sensory profile and nutrient density of almond beverages. Manufacturers now deploy cutting-edge techniques to enhance creaminess, extend shelf stability, and incorporate functional ingredients, thereby addressing earlier consumer perceptions of thin texture and limited nutritional value.

In tandem with formulation improvements, sustainability has taken center stage as companies embrace renewable packaging, water stewardship, and carbon-reduction initiatives. The rollout of recyclable cartons, lightweight bottles, and bulk bag-in-box solutions underscores a commitment to minimizing environmental impact across the value chain. These eco-centric practices, when paired with transparent sourcing narratives, resonate strongly with a growing cohort of eco-aware buyers.

Meanwhile, the retail landscape is undergoing a parallel shift as online channels complement traditional brick-and-mortar distribution. Direct-to-consumer subscriptions, niche e-commerce platforms, and digitally native brands have emerged to capture consumers seeking convenience and personalization. Legacy dairy cooperatives and emerging challengers alike are forging omnichannel strategies that mesh in-store sampling, loyalty-driven promotions, and tailored digital experiences.

Moreover, private labels have rapidly expanded their presence, driven by retailer ambitions to offer value-oriented alternatives. By harnessing in-house development and streamlined supply chains, these store brands challenge branded incumbents across pricing, flavor variety, and packaging formats. As a result, the competitive landscape has evolved into a dynamic battleground where product innovation, sustainability credentials, and channel mastery determine market leadership.

Assessing the Far-Reaching Implications of 2025 United States Tariff Measures on Almond Milk Supply Chains and Cost Structures

In 2025, newly enacted tariff measures within the United States have generated significant ripples across almond milk supply networks, compelling stakeholders to reassess cost structures and sourcing strategies. These levies, imposed on a spectrum of almond imports and related processing inputs, have increased the landed cost of raw materials, prompting manufacturers to weigh the trade-off between maintaining quality and preserving margin integrity.

Consequently, producers have embarked on a series of supply chain adjustments. Some have deepened partnerships with domestic almond growers to secure preferential pricing, while others have diversified procurement to include alternative origins offering competitive quality. This strategic pivot has fostered a renewed emphasis on supply chain resilience, with firms investing in traceability platforms and collaborative forecasting to mitigate future tariff fluctuations.

Retailers, facing elevated shelf prices, have responded by revising promotional strategies and amplifying value-added offerings. Limited-edition flavor variants, multi-pack discounts, and loyalty incentives have emerged as primary levers to sustain consumption momentum. At the same time, premium positioning through organic, fortified, or barista-grade almond milks has insulated certain portfolios from price sensitivity, thereby preserving volume among discerning consumers.

In parallel, research and development teams are exploring formulation refinements that optimize almond-to-water ratios and leverage cost-efficient binding agents without compromising sensory quality. These innovations aim to alleviate tariff-induced cost pressures while delivering a consistency that meets evolving expectations. Taken together, the cumulative effect of the 2025 tariff regime has unleashed a wave of strategic realignments, ultimately redefining competitive paradigms within the almond milk domain.

Unlocking Strategic Insights from Core Almond Milk Market Segmentation Across Channels, Product Types, Sources, Packaging Formats, and End Uses

A nuanced exploration of channel dynamics reveals that supermarkets and hypermarkets serve as the cornerstone for mainstream almond milk distribution, providing broad consumer reach through standardized shelving and promotional activity. In contrast, convenience locations and specialty stores cater to on-the-go purchases and premium segments, respectively, offering unique touchpoints for incremental growth. At the same time, online retail has unlocked streamlined access via direct-to-consumer subscriptions and diverse e-commerce platforms that facilitate personalized assortment and data-driven marketing, setting a new standard for agility.

Product differentiation plays a vital role, with unflavored or original almond milk anchoring everyday use cases in coffee, cooking, and baking, while indulgent variants in chocolate, strawberry, and vanilla appeal to taste-driven occasions. This flavor diversity augments consumer engagement and encourages trial, especially when paired with limited-edition or seasonal offerings that drive excitement.

Source transparency underscores a critical bifurcation between conventional and organic almond supplies. While conventional almonds support cost-effective production, the organic cohort commands a premium, anchored by narratives of pesticide-free cultivation and soil health stewardship. Producers adept at certifying organic credentials can tap into a distinct consumer segment that prioritizes sustainability throughout the entire product lifecycle.

Packaging formats-from bulk bag-in-box solutions favored by institutional kitchens to glass bottles emphasizing premium positioning, plastic bottles for on-shelf convenience, and Tetra Pak cartons for extended shelf life-serve as both functional and strategic differentiators. These diverse pack types enable tailored applications, ranging from high-volume foodservice deployments to single-serve household usage.

End-use segmentation further highlights contrasting requirements: households prioritize ease of use, portion control, and flavor variety, whereas commercial users in hospitality and institutional settings demand consistent supply, cost efficiency, and reliable performance in beverage and culinary applications. Recognizing these multi-dimensioned needs empowers stakeholders to craft targeted solutions that resonate across distinct consumption environments.

This comprehensive research report categorizes the Almond Milk market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Source

- Packaging

- End Use

- Distribution Channel

Exploring Regional Variations in Almond Milk Adoption, Regulatory Environments, and Consumer Preferences Across Americas, EMEA, and Asia-Pacific Markets

Across the Americas, almond milk consumption is buoyed by a confluence of health awareness and mainstream retail expansion. North American markets have witnessed robust retail adoption in supermarkets and club stores, supported by promotional campaigns that highlight heart-healthy benefits and plant-based credentials. Latin American consumers, influenced by rising middle-class incomes and a growing appetite for Western dietary trends, have also embraced almond beverages, particularly in urban centers where modern retail networks proliferate.

In Europe, Middle East & Africa, the regulatory landscape drives distinct product formulations and labeling standards. The European Union’s emphasis on nutritional labeling and environmental reporting has prompted manufacturers to refine ingredient declarations and bolster sustainability communications. Meanwhile, premium enclaves in Western Europe leverage organic certifications and artisan-style packaging. In Middle Eastern markets, almond milk’s compatibility with regional culinary traditions and its perceived digestive benefits have fostered niche demand, whereas African nations present emerging prospects linked to urban retail growth.

Asia-Pacific displays a tapestry of adoption patterns informed by cultural preferences and evolving dietary norms. East Asian consumers, accustomed to soy-based alternatives, are increasingly sampling almond milk for its perceived lightness and flavor innovation. Southeast Asian urbanites, attuned to global wellness trends, have welcomed flavored and fortified almond variants. In South Asia, historical use of nut milks in traditional cuisine provides an entrée for broader almond milk acceptance, especially when localized flavors and spice infusions align with regional palates.

While each geography bears unique drivers and challenges-ranging from cold-chain infrastructure in developing economies to stringent import regulations in advanced markets-collective growth is underpinned by universal themes of health, sustainability, and innovation.

This comprehensive research report examines key regions that drive the evolution of the Almond Milk market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Competitive Strategies of Leading Almond Milk Producers Through Innovation, Brand Differentiation, and Supply Chain Optimization

Leading almond milk producers have embraced differentiated strategies to navigate intensifying competition and evolving consumer demands. Emphasis on novel product extensions-such as high-protein blends, probiotic-infused formulations, and botanical-enhanced variants-has allowed certain brands to carve out specialized niches. Others have prioritized organic and non-GMO certifications to reinforce clean-label propositions, thereby deepening loyalty among wellness-oriented cohorts.

In parallel, investment in supply chain transparency has emerged as a key battleground. Companies are integrating blockchain traceability, farm-to-shelf reporting tools, and strategic partnerships with almond growers to authenticate origin claims and ensure consistent quality. This proactive stance on provenance not only assuages consumer concerns but also fortifies resilience against supply disruptions and tariff volatility.

On the branding front, major players have amplified omnichannel marketing tactics, blending in-store experiential activations with influencer collaborations and targeted digital advertising. By leveraging social media platforms to showcase recipe inspiration, behind-the-scenes sustainability stories, and user-generated content, these firms cultivate emotional connections that transcend functional benefits.

Finally, packaging optimization has become a critical focus. Some incumbents have introduced lightweight, recyclable cartons that reduce environmental footprint, while small-batch innovators have revived glass packaging to signal artisanal quality. Simultaneously, bag-in-box solutions and portion-controlled containers address volume needs in commercial and institutional contexts, underscoring the strategic interplay between format and end-use requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Almond Milk market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Blue Diamond Growers

- Califia Farms, LLC

- Daiya Foods, Inc.

- Danone S.A.

- Earth's Own Food Company, Inc.

- Elmhurst Milked Direct, LLC

- Freedom Foods Group Limited

- Good Karma Foods, Inc.

- Hain Celestial Group, Inc.

- Koita Foods, Inc.

- MALK Organics, LLC

- Milkadamia LLC

- Nature’s Fynd, Inc.

- Nestlé S.A.

- Oatly Group AB

- Pacific Foods of Oregon, LLC

- Pureharvest Plant Based Foods Ltd.

- Ripple Foods PBC

- Sanitarium Health & Wellbeing Company

- SunOpta, Inc.

- Three Trees Organics, Inc.

- Vitasoy International Holdings Limited

Implementing Actionable Strategies to Enhance Market Positioning, Drive Innovation, and Strengthen Resilience in the Almond Milk Industry

To thrive in acceleration-driven almond milk markets, industry leaders should prioritize resilient sourcing strategies that mitigate input cost volatility. This entails forging long-term partnerships with almond growers, exploring contract farming models, and evaluating nearshoring options that curtail exposure to tariff fluctuations. Complementary investment in digital traceability and inventory planning tools will further safeguard supply continuity.

Simultaneously, relentless product innovation remains essential. Brands must continue enhancing nutritional profiles through protein enrichment, fortified micronutrients, and functional ingredients that address gut health and cognitive support. At the same time, flavor innovation-potentially derived from locally relevant infusions-can ignite trial and elevate engagement.

Sustainability should permeate every facet of the value chain, from water-efficient agricultural practices and renewable energy integration to circular packaging initiatives and end-of-life recycling programs. Clear, transparent communication of these efforts will fortify brand reputation and foster consumer trust. Moreover, collaboration with non-profit organizations or industry coalitions can amplify environmental and social impact narratives.

In parallel, channel strategies must balance traditional retail dominance with digital acceleration. Crafting seamless omnichannel experiences-featuring hybrid loyalty programs, virtual sampling, and subscription models-can drive repeat purchasing and unlock deeper consumer insights. Retail partnerships anchored in joint innovation labs or co-branded promotions will further optimize shelf presence and visibility.

Finally, empowering consumers through nutrition education and culinary inspiration will enhance category penetration. Brands should develop robust content ecosystems-comprising recipe platforms, instructional videos, and in-store demo initiatives-to illustrate almond milk’s versatility and reinforce positive associations.

Outlining Rigorous Research Methodology Combining Primary Interviews, Secondary Analysis, and Data Triangulation to Ensure Comprehensive Market Insights

This research integrates a robust primary approach that encompasses in-depth interviews with senior executives across manufacturing, processing, and distribution, ensuring firsthand insights into operational challenges and strategic priorities. Concurrently, detailed discussions with key buyers in retail, foodservice, and institutional segments provide a granular understanding of purchase drivers, channel preferences, and emerging demand patterns.

Complementing primary efforts, secondary research draws upon an extensive review of industry white papers, sustainability reports, regulatory filings, and peer-reviewed journals. Publicly available trade association data and corporate financial disclosures supplement these sources, offering context on production capabilities, import/export dynamics, and environmental benchmarks.

Data triangulation lies at the heart of this methodology, aligning qualitative perspectives with quantitative indicators to validate findings and ensure holistic reliability. This process cross-references multiple data points to reconcile inconsistencies, refine thematic insights, and strengthen analytical rigor. Structured workshops with subject matter experts further reinforce the integrity of conclusions.

Quality assurance protocols include iterative peer reviews, methodological audits, and continuous validation checkpoints. By engaging an editorial board of industry veterans to critique analytical frameworks, the research attains elevated precision and relevance. The outcome is a comprehensive, credible body of knowledge that empowers stakeholders to make informed strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Almond Milk market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Almond Milk Market, by Product Type

- Almond Milk Market, by Source

- Almond Milk Market, by Packaging

- Almond Milk Market, by End Use

- Almond Milk Market, by Distribution Channel

- Almond Milk Market, by Region

- Almond Milk Market, by Group

- Almond Milk Market, by Country

- United States Almond Milk Market

- China Almond Milk Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing Critical Findings and Highlighting Emerging Trends Shaping the Future Trajectory and Landscape of the Almond Milk Market

The cumulative analysis presented herein underscores that almond milk’s evolution extends well beyond its role as a simple dairy substitute. Its trajectory is shaped by intertwined dynamics of consumer wellness aspirations, environmental stewardship, and digital-native retail innovation. As formulation science advances, so too does the potential for functional, sensory, and sustainable differentiation across the product spectrum.

Regional heterogeneity further enriches this narrative, revealing distinct regulatory frameworks and cultural preferences that guide market entry and expansion strategies. At the same time, tariff-driven adjustments in the United States highlight the critical importance of adaptive supply chain governance. Companies that integrate forward-thinking sourcing partnerships, packaging innovations, and targeted consumer engagement will be best positioned to navigate the complexities of an increasingly crowded landscape.

Key findings relating to segmentation dynamics, competitive methodologies, and actionable recommendations converge to form a strategic blueprint for agile, future-oriented decision-making. Stakeholders who embrace rigorous research insights, foster collaborative industry ecosystems, and prioritize consumer-centric innovation will unlock the greatest opportunities for sustained success.

Take Action Today to Secure In-Depth Almond Milk Market Intelligence by Engaging Ketan Rohom for Custom Analysis and Strategic Partnerships

To explore how comprehensive insights on distribution nuances, competitive dynamics, and emerging opportunities can guide your strategic decision-making, reach out now to Ketan Rohom, Associate Director of Sales & Marketing. By partnering with Ketan, you gain direct access to a tailored consultation that highlights critical findings, uncovers untapped segments, and aligns research outcomes with your organizational priorities. Secure your executive briefing to examine in depth how distribution channel shifts, tariff impacts, and evolving consumer preferences converge to shape actionable roadmaps. Engage today to receive a bespoke proposal outlining research scope, customized deliverables, and implementation support designed to deliver tangible impact. Take the next step toward data-driven growth by contacting Ketan Rohom and unlocking the full potential of in-depth almond milk market intelligence

- How big is the Almond Milk Market?

- What is the Almond Milk Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?