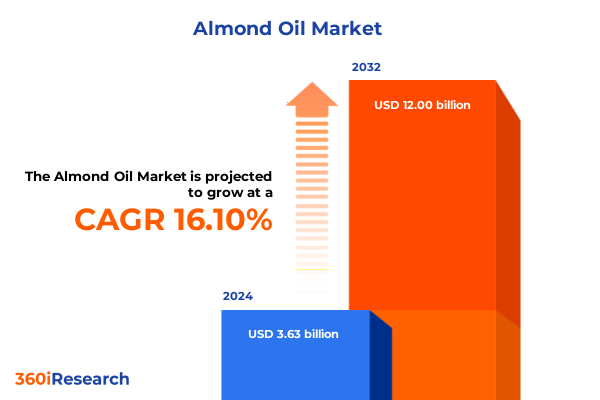

The Almond Oil Market size was estimated at USD 4.19 billion in 2025 and expected to reach USD 4.83 billion in 2026, at a CAGR of 16.22% to reach USD 12.00 billion by 2032.

Unveiling the Exceptional Growth Potential of Almond Oil Across Nutritional Wellness, Cosmetic Innovations, and Emerging Industrial Uses in Today’s Global Landscape

The almond oil industry has evolved from a niche artisanal commodity to a multifaceted global market driven by surging demand across food, cosmetic, industrial, and pharmaceutical sectors. Rooted in millennia-old traditions, almond oil’s nutrient-rich composition, featuring high concentrations of monounsaturated fatty acids, vitamins, and antioxidants, has been continually reappraised by modern consumers seeking “clean label” and functional ingredients. Initially prized for culinary uses in Mediterranean diets, almond oil today is a cornerstone in high-performance skincare formulations, therapeutic massage blends, and value-added nutraceuticals. Concurrently, industrial applications have emerged where biodegradable lubricants and specialty coatings harness almond oil’s unique rheological properties.

Against this backdrop of diversifying adoption, market participants face both opportunity and complexity. Shifts in consumer preferences toward plant-based, ethically sourced, and traceable ingredients compel producers and brands to innovate across the value chain, from sustainable cultivation practices to transparent supply networks. Regulatory scrutiny around purity standards and labeling protocols heightens the imperative for rigorous quality controls. Moreover, digital commerce has disrupted traditional distribution ecosystems, reshaping how manufacturers engage end users and capture insights.

This executive summary sets the stage for an in-depth examination of the forces catalyzing almond oil’s growth trajectory, from transformative technological and policy shifts to granular segmentation trends and regional dynamics. It ultimately empowers decision-makers with strategic clarity on harnessing almond oil’s expanding potential.

Exploring the Transformative Forces Shaping the Almond Oil Industry From Technological Breakthroughs to Evolving Consumer Preferences and Regulatory Shifts Impacting Market Dynamics

The almond oil sector is experiencing a convergence of technological innovation and evolving stakeholder expectations that is fundamentally reshaping market boundaries. Advances in cold-pressing machinery, for instance, enable producers to maximize oil yield while preserving delicate bioactive compounds, thereby creating new premium tiers in the edible and nutraceutical segments. Simultaneously, breakthrough solvent-free extraction techniques leveraging supercritical CO₂ are gaining traction, catering to stringent clean label mandates and premium cosmetics brands that demand contaminant-free raw materials.

Consumer consciousness around sustainability continues to accelerate environmental stewardship initiatives within almond cultivation. Integrated pest management and drip-irrigation systems are increasingly adopted to mitigate water consumption concerns, especially in traditionally water-stressed growing regions. Coupled with blockchain-powered traceability platforms, these practices address demand for provenance verification and social responsibility, bolstering brand equity.

Furthermore, regulatory landscapes are shifting to reflect emerging safety and labeling standards. Stricter criteria around residual solvents and peroxide values compel manufacturers to refine quality assurance measures, while international harmonization efforts aim to simplify cross-border trade. In parallel, digital commerce innovations-from direct-to-consumer subscription models to AI-driven recommendation engines-are redefining how almond oil products are marketed, sold, and consumed.

Collectively, these transformative shifts underscore a dynamic environment where technological sophistication, sustainability imperatives, and regulatory evolution intersect to unlock new growth horizons for the almond oil industry.

Assessing the Consequential Effects of 2025 United States Tariff Adjustments on Almond Oil Trade Flows Supply Chains and Pricing Strategies Across Import and Export Channels

In 2025, the imposition and adjustment of United States tariffs have introduced a pivotal inflection point for almond oil importers, exporters, and domestic processors. Heightened duties on select vegetable oils under Section 232 and Section 301 actions have driven strategic realignments across supply chains. For instance, tariffs on certain imported oils exceeding 10 percent have increased landed costs, prompting distributors to renegotiate contracts or seek alternative sources to maintain margin integrity.

Domestic processors have responded by ramping up local procurement of sweet and bitter almond feedstock, leveraging the comparative stability of domestic prices. These shifts have crystallized new competitive advantages for U.S. growers who can capitalize on economies of scale and established processing infrastructure. At the same time, exporters targeting markets such as the European Union and Asia-Pacific are recalibrating pricing models to offset reciprocal tariffs, exploring preferential trade agreements and bilateral supply partnerships that mitigate exposure to punitive duties.

Moreover, tariff volatility has galvanized stakeholders to invest in risk-management strategies. Hedging instruments and forward contracts have seen increased adoption, enabling buyers and sellers to lock in costs ahead of potential tariff escalations. Supply chain diversification has also become a strategic priority, as companies cultivate relationships with emerging suppliers in Latin America and the Middle East to insulate operations from policy-driven disruptions.

As a result, the 2025 tariff landscape has not only reshaped cost structures but also accelerated a broader shift toward regionalized production networks, fostering resilience and competitive differentiation in an increasingly protectionist era.

Deep Dive into Almond Oil Market Segmentation Illuminating How Type Extraction Techniques and Varied End-User Applications Are Driving Differentiated Demand Patterns Globally

Discerning the nuances of almond oil demand requires a close examination of type, extraction methodology, application category, and distribution strategy. Market behaviors diverge markedly between bitter almond oil, prized for specialized flavor and fragrance profiles, and sweet almond oil, which enjoys broader acceptance in culinary and personal care formulations due to its mild aroma and high nutritional value. Within extraction methods, cold-pressed oil is typically positioned at a premium tier, capitalizing on consumer perceptions of superior nutrient retention, whereas solvent extraction remains indispensable for industrial and large-scale pharmaceutical uses that prioritize yield.

From an application standpoint, the cosmetics and personal care segment commands significant attention, as hair care serums, massage oils, and skin care emollients leverage almond oil’s emollient and antioxidant properties. In parallel, the food and beverage sector incorporates almond oil into baking, cooking, and salad dressing innovations, with product developers emphasizing its clean flavor profile and thermal stability. Industrial end-users rely on almond oil’s lubricative attributes to formulate biodegradable greases and specialty coatings, and pharmaceutical manufacturers integrate nutraceutical concentrates and therapeutic derivatives to address wellness formulations.

Distribution strategies further delineate market reach and consumer access. Offline channels such as pharmacies and specialty stores offer curated experiences and expert recommendations, while supermarkets and hypermarkets deliver volume-oriented distribution. The online domain-encompassing direct-to-consumer brand websites and multi-merchant e-commerce platforms-facilitates seamless purchasing journeys, subscription services, and data-driven personalization.

Together, these segmentation pillars reveal that a multi-dimensional approach-balancing type differentiation, extraction quality, application innovation, and channel optimization-is essential for stakeholders seeking to capture distinct pockets of value in the almond oil market.

This comprehensive research report categorizes the Almond Oil market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Extraction Method

- Application

- Distribution Channel

Decoding Regional Market Dynamics to Reveal Strategic Insights Across the Americas Europe Middle East Africa and the Asia-Pacific for Targeted Almond Oil Growth Pathways

Regional variances in almond oil consumption and production reflect a tapestry of cultural preferences, agricultural capacities, and regulatory frameworks. In the Americas, robust cultivation in California underpins a mature supply base, while growing consumer interest in wellness and plant-based foods fuels innovation in culinary and nutraceutical segments. Companies operating here benefit from well-established distribution infrastructures and proximity to research institutions advancing cold-pressing and refinement technologies.

Across Europe, Middle East & Africa, regulatory stringency around food safety and cosmetic standards drives demand for certified organic and traceable almond oil variants. The European Union’s emphasis on clean labeling and sustainability has catalyzed investments in eco-friendly packaging and carbon footprint reduction initiatives. Meanwhile, markets in the Middle East and North Africa are experiencing rising household consumption as culinary traditions embrace almond oil’s flavor nuances.

The Asia-Pacific region represents both a burgeoning opportunity and a dynamic challenge. Rapid urbanization and rising disposable incomes are expanding the addressable market in skincare and gourmet food sectors. Key markets such as China, Japan, and India are witnessing premiumization trends, as consumers gravitate toward cold-pressed and specialty almond oils. However, fragmentation in distribution and varying import regulations necessitate localized market entry strategies and strategic alliances with regional partners.

In sum, regional insights underscore that a geographically tailored approach-leveraging local cultivation strengths, regulatory compliance capabilities, and consumer behavior intelligence-is crucial for optimizing market penetration and fostering long-term growth in the global almond oil arena.

This comprehensive research report examines key regions that drive the evolution of the Almond Oil market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Leaders in the Almond Oil Landscape Revealing Competitive Strategies Product Innovations and Partnerships Shaping Market Leadership Trajectories

Leading players in the almond oil domain are distinguished by their integrated supply chain capabilities, robust R&D pipelines, and brand equity in targeted end-use categories. Global agribusiness conglomerates, which control significant acreage of almond orchards and processing facilities, maintain competitive scale advantages in both sweet and bitter almond oil segments. These firms have broadened their portfolios through strategic acquisitions of specialty oil producers, reinforcing their foothold in premium cosmetics and nutraceutical markets.

Commodity traders and specialty ingredient suppliers alike are leveraging partnerships with research institutes to pioneer solvent-free extraction solutions and develop bioactive almond oil derivatives. These innovations are often co-branded with leading skincare and therapeutic product manufacturers, strengthening collaborative market positioning. Additionally, digital native brands have emerged as disruptors, harnessing e-commerce analytics to refine product formulations and deliver personalized consumer experiences.

Smaller, regionally focused companies differentiate themselves through certifications such as organic, fair trade, and sustainability endorsements, catering to discerning consumer segments in Europe and North America. These firms frequently engage in community-based sourcing initiatives, forging direct relationships with growers to ensure traceability and social impact.

Collectively, the competitive landscape is characterized by a blend of scale-driven incumbents, technologically innovative suppliers, and nimble niche players. Success in this environment demands agility in product development, strategic alliances across the value chain, and a keen understanding of evolving consumer and regulatory expectations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Almond Oil market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AAK AB

- AOS Products Private Limited

- Ashwin Fine Chemicals & Pharmaceuticals

- Aura Cacia

- Bajaj Consumer Care Ltd.

- Blue Diamond Growers, Inc.

- Caloy Company, LP

- Dabur India Ltd.

- Eden Botanicals, Inc.

- ESI S.p.A.

- Flora Manufacturing & Distributing Ltd.

- Frontier Co‑op, Inc.

- Huiles Bertin

- Humco Holding Group, Inc.

- Indian Natural Oils Pvt Ltd

- Jiangxi Baicao Pharmaceutical Co., Ltd.

- K.K. Enterprise

- Liberty Vegetable Oil Company

- Mountain Ocean Ltd.

- Natural Oils International, LLC

- NOW Health Group, Inc.

- Oliofora S.r.l.

- Plimon S.L.

- Proteco Oils Pty Ltd

- Provital Group

Strategic Actionable Recommendations Crafted for Industry Leaders to Harness Almond Oil Market Opportunities Strengthen Competitive Positioning and Drive Sustainable Growth Today

To capitalize on emerging opportunities in the almond oil market, industry leaders should prioritize investments in advanced extraction technologies that align with clean label and sustainability imperatives. By transitioning legacy solvent-based facilities to cold-press and supercritical CO₂ systems, organizations can command premium pricing while meeting regulatory benchmarks for residual solvent levels. Equally important is the integration of digital traceability solutions that provide end-to-end visibility across the value chain, thereby fortifying brand trust and adherence to evolving compliance frameworks.

In parallel, companies should pursue strategic segmentation of their product portfolios. Tailoring sweet and bitter almond oil variants to specific end-use categories-whether by enriching formulations for massage and skincare or enhancing thermal stability for cooking and industrial lubrication-can unlock differentiated revenue streams. Collaboration with innovative cosmetics brands, gourmet food producers, and pharmaceutical partners will foster co-development of next-generation specialty oils with bespoke functional attributes.

Building resilient supply networks is another critical lever. Stakeholders must diversify sourcing footprints beyond traditional growing regions, exploring emerging cultivation hubs in Latin America and the Middle East to mitigate tariff and climate risks. Concurrently, establishing forward-looking contractual agreements and employing hedging mechanisms will help stabilize input costs amid policy fluctuations.

Ultimately, a holistic strategy that intertwines technological modernization, segmentation precision, and supply chain resilience will position industry players to harness almond oil’s dynamic growth potential, drive sustainable profitability, and outpace competitive pressures in a rapidly evolving marketplace.

Outlining Rigorous Research Methodologies Employed in Compiling Comprehensive Almond Oil Market Insights Ensuring Data Integrity Analytical Robustness and Actionable Accuracy

This research synthesis is grounded in a rigorous methodology designed to ensure analytical integrity and actionable precision. Primary data was gathered through in-depth interviews with supply chain executives, cultivation experts, and end-user brand managers, providing first-hand insights into emerging trends, quality benchmarks, and strategic imperatives. Secondary research encompassed a wide spectrum of publicly available literature, including peer-reviewed journals on extraction science, trade publications on regulatory updates, and academic studies on consumer behavior patterns.

Quantitative analysis involved data triangulation from multiple sources such as import-export databases, agricultural commodity price trackers, and patent filings related to oil processing technologies. Cutting-edge statistical modeling and scenario planning techniques were employed to interpret tariff impacts and to simulate supply chain risk matrices under various policy and environmental contingencies.

Furthermore, the segmentation framework was validated through cluster analysis of consumption patterns across demographic cohorts, product reviews, and retail audit data. Regional dynamics were assessed using GIS-enabled mapping tools, enabling spatial analysis of cultivation density, infrastructure access, and logistics corridors.

By combining qualitative perspectives with robust quantitative methodologies, this research ensures a comprehensive, nuanced, and empirically substantiated view of the almond oil landscape, equipping stakeholders with the insights needed to make informed strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Almond Oil market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Almond Oil Market, by Type

- Almond Oil Market, by Extraction Method

- Almond Oil Market, by Application

- Almond Oil Market, by Distribution Channel

- Almond Oil Market, by Region

- Almond Oil Market, by Group

- Almond Oil Market, by Country

- United States Almond Oil Market

- China Almond Oil Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesizing Critical Takeaways and Future Outlooks to Conclude the Almond Oil Analysis with Clear Emphasis on Key Trends Strategic Imperatives and Growth Motivators

This executive summary has illuminated the multi-dimensional nature of the almond oil market, tracing its expansion across food, cosmetic, industrial, and pharmaceutical realms. It has highlighted how transformative shifts-from advanced extraction technologies to sustainability mandates and digital commerce-are redefining competitive landscapes. The evaluation of United States tariff changes in 2025 demonstrates the critical need for supply chain agility, price risk management, and strategic regional diversification.

Segmentation insights underscore that a nuanced approach to product type, extraction method, application focus, and channel strategy is paramount for capturing distinct value pockets. Regional analysis confirms that tailored market entry and compliance strategies, aligned with local cultivation capacities and consumer preferences, are essential for sustainable expansion. Meanwhile, profiling of key companies reveals a mosaic of scale-driven incumbents, innovative specialty players, and agile digital brands vying for leadership.

Taken together, these findings emphasize that success in the almond oil sector will hinge on the intersection of technological modernization, precise segmentation execution, and resilient supply chain architectures. As stakeholders navigate evolving regulatory landscapes and consumer expectations, the strategic deployment of these imperatives will be instrumental in driving growth, differentiation, and long-term value.

Engage with Associate Director of Sales and Marketing for In-Depth Almond Oil Market Intelligence Customized Insights and Exclusive Access to Comprehensive Research Findings

For a comprehensive and tailored deep dive into the almond oil market, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Engaging with Ketan offers unparalleled access to proprietary insights, nuanced analysis, and customizable data solutions that align with your strategic goals. By leveraging his expertise and the full report’s detailed findings, stakeholders can refine their market entry strategies, optimize product portfolios, and accelerate time-to-market with confidence. To secure your copy of the report and explore bespoke consulting options, contact Ketan Rohom today and transform your understanding of the almond oil landscape into actionable business growth

- How big is the Almond Oil Market?

- What is the Almond Oil Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?