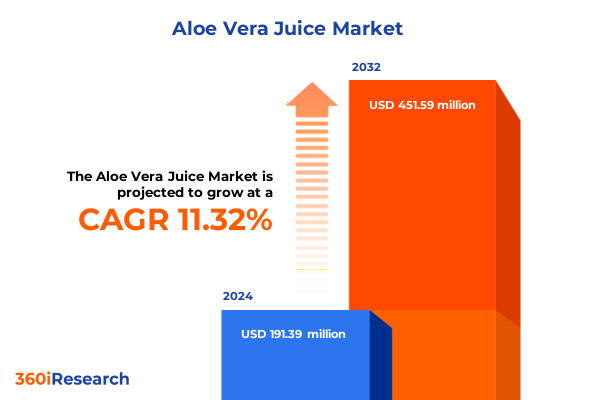

The Aloe Vera Juice Market size was estimated at USD 213.55 million in 2025 and expected to reach USD 237.72 million in 2026, at a CAGR of 11.29% to reach USD 451.59 million by 2032.

Understanding the Rising Appeal of Aloe Vera Juice Through Emerging Wellness and Sustainability Trends Garnering Global Consumer Attention

The convergence of health consciousness, clean label expectations, and sustainability commitments has propelled aloe vera juice into the spotlight, turning a once niche offering into a mainstream staple in wellness routines. Consumers today view aloe vera not just as a traditional remedy but as a multifunctional ingredient that aligns with natural lifestyles and preventive health care. As a result, the product’s transparency from farm to shelf, its minimalistic processing techniques, and its recognizable origin story all contribute to a compelling value narrative for end users.

Parallel to these shifts, the global food and beverage landscape has embraced plant-based formulations as consumers increasingly seek functional beverages that support digestive health, immunity, and skin care. Aloe vera juice has benefited directly from this trend, carving a distinct category that bridges hydration, supplement alternatives, and holistic well-being. Its appeal extends beyond a single occasion, as it is consumed both as an on-the-go refreshment and a daily supplement for lifelong wellness routines. Moreover, the ingredient’s botanical heritage adds an authentic storytelling element that resonates strongly with consumers craving genuine natural experiences. Consequently, aloe vera juice has emerged at the intersection of tradition and innovation, offering industry stakeholders a fertile ground for portfolio expansion and value creation.

Exploring the Key Industry Shifts Driving Product Innovation Digital Transformation and Sustainability in the Aloe Vera Juice Market Landscape

Over the past few years, the aloe vera juice market has navigated a series of transformative shifts, underscored by digital acceleration, product innovation, and heightened environmental accountability. E-commerce platforms have amplified the brand-to-consumer connection, enabling smaller niche producers to gain national visibility without requiring extensive brick-and-mortar footprints. This development has democratized access to new product launches, from herbal-flavored blends formulated for digestive wellness to fortified offerings enriched with probiotics and botanical extracts.

Simultaneously, research and development teams have introduced novel extraction methods and juice stabilization techniques to preserve bioactive compounds, thereby maximizing both efficacy and shelf life. This wave of technological advancement has also fostered cross-industry collaborations, with personal care brands integrating aloe vera juice into topical formulations to promote skin hydration and anti-inflammatory benefits. Moreover, the market has observed a proliferation of sustainability initiatives, ranging from renewable energy usage on farms to compostable packaging solutions, reflecting a broader consumer insistence on eco-responsibility.

Taken together, these shifts signal a strategic pivot toward agile business models that prioritize consumer engagement, product differentiation, and supply chain resilience. Industry players who invest in digital infrastructure, advanced processing technologies, and transparent sustainability frameworks are poised to lead the next phase of market evolution.

Examining How United States Tariff Adjustments in 2025 Are Reshaping Supply Chains Pricing Strategies and Competitive Dynamics for Aloe Vera Juice

In 2025, the United States implemented revised tariff schedules affecting imported botanical extracts and juices, reshaping cost structures and sourcing strategies for aloe vera juice producers. These adjustments include targeted increases on concentrate and powder imports, which have elevated input costs for manufacturers reliant on overseas cultivation hubs. Consequently, producers are reevaluating their procurement models, exploring near-shoring opportunities in partner countries under favorable trade agreements to mitigate tariff burdens.

Furthermore, the updated tariff regime has had a cascading effect on packaging materials, as duties on aluminum, glass, and specific polymers have tightened margin thresholds for businesses using cans, glass bottles, and PET containers. To navigate these shifts, companies have accelerated their packaging innovation roadmaps, adopting lighter weight materials and exploring sustainable alternatives to reduce duty-impacted costs and maintain competitive price points.

On the pricing front, end-market players have adjusted retail strategies to absorb part of the tariff impact without eroding consumer demand. Premium segments have leveraged value-added messaging around traceability and clean extraction to justify modest price increases, while mass-market brands have streamlined SKU assortments to optimize inventory turnover and minimize exposure to duty fluctuations. Overall, the cumulative effect of the 2025 tariff revisions has underscored the importance of agile supply chain management, diversified sourcing, and cost-efficiency initiatives in preserving both profitability and market positioning.

Unveiling Comprehensive Segmentation Perspectives to Illuminate Product Form Packaging Channels Applications and Flavor Preferences Influencing Aloe Vera Juice Demand

Segmentation in the aloe vera juice industry reveals diverse consumer preferences and operational complexities across multiple dimensions. When considering product form, manufacturers balance the concentrate segment’s cost efficiencies against the premium positioning of ready-to-drink offerings, while powder formats cater to customization trends through mix-and-match applications. In packaging material, decisions around cans, glass, PET, and pouches reflect the trade-off between brand positioning, sustainability targets, and logistics costs, with each format resonating differently among eco-conscious shoppers and traditional retail outlets.

Distribution channel analysis highlights distinct growth vectors: while convenience stores and supermarkets leverage impulse buys and shelf visibility, specialty stores curate premium experiences and high-touch education, and online retail ecosystems amplify reach through direct-to-consumer subscriptions, multi-brand platforms and online grocery partnerships. Application insights show that dietary supplements capitalize on the ingredient’s digestive and immune benefits, whereas food and beverage innovators integrate aloe vera juice into smoothies, cocktails and nutrient-dense shots. Meanwhile, personal care formulators turn to its soothing properties in topical products, and pharmaceutical developers rely on its bioactive compounds for novel therapeutic research. Flavour preferences-ranging from herbal and mixed-fruit infusions to plain variants-underscore the importance of taste personalization, with innovation pipelines exploring exotic blends and functional pairings to cater to health-driven palates.

By synthesizing these segmentation lenses, market participants can pinpoint high-potential niches, optimize channel strategies, and tailor product portfolios to evolving consumer demands.

This comprehensive research report categorizes the Aloe Vera Juice market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Form

- Packaging Material

- Distribution Channel

- Application

- Flavour

Assessing Regional Trajectories in the Aloe Vera Juice Industry Across Americas Europe Middle East Africa and Asia Pacific to Identify Growth Hotspots

Regional dynamics in the aloe vera juice market are shaped by consumer attitudes, regulatory frameworks, and supply chain infrastructures. In the Americas, robust health and wellness trends have spurred demand for functional beverages, with North American consumers increasingly seeking certified organic and non-GMO labels, while Latin American producers benefit from proximity to cultivation zones and established botanical expertise. Infrastructure investments in cold chain logistics and retail modernization have further bolstered product availability and variety.

Across Europe, Middle East and Africa, stringent quality and labeling regulations drive innovation in traceability and certification, with the European Union’s novel food regulations influencing new product approvals and safety assessments. Consumers in Western Europe demonstrate a premium orientation toward clean-label aloe vera juice variants, whereas Middle Eastern markets present opportunities for flavored functional drinks adapted to local taste profiles. In Africa, sustainable cultivation practices and community-focused initiatives are emerging as key differentiators, aligning with global demand for ethically sourced botanicals.

Asia-Pacific remains a cornerstone region, blending traditional consumption patterns with rapid urbanization. Mature markets such as Japan and South Korea exhibit high penetration of premium ready-to-drink aloe vera beverages, leveraged by advanced retail networks and wellness education. Meanwhile, emerging Southeast Asian economies show strong growth potential, driven by rising disposable incomes and expanding e-commerce platforms. Overall, understanding these regional nuances is essential for crafting targeted market entry, localization, and expansion strategies.

This comprehensive research report examines key regions that drive the evolution of the Aloe Vera Juice market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Initiatives Competitive Positioning and Partnership Dynamics of Leading Corporations in the Global Aloe Vera Juice Space

Leading corporations in the aloe vera juice market are deploying strategic partnerships, product diversification, and vertical integration to fortify their competitive positions. Some have invested in proprietary extraction technologies and quality control systems at farm level to ensure consistent bioactive profiles, while others have established alliances with packaging innovators to roll out eco-friendly containers. Key players are also strengthening distribution relationships by forging exclusive agreements with national retail chains and premier online grocers, securing prime shelf placement and digital storefront visibility.

In response to evolving consumer demand, these companies have expanded their portfolios beyond conventional juice offerings to include hybrid functional blends and cross-category extensions, such as aloe-infused teas, smoothies, and wellness shots. Additionally, sustainability commitments have taken center stage, with leading brands publishing annual impact reports detailing water conservation, waste reduction, and fair-trade sourcing milestones. Corporate social responsibility initiatives, including community development programs in cultivation regions, further reinforce brand authenticity and social license to operate.

As competitive dynamics intensify, firms are doubling down on data analytics platforms to glean real-time insights into consumer behavior and supply chain performance. Emphasizing speed to market and agile innovation cycles, these entrants are well positioned to capture emerging niches and respond proactively to regulatory shifts, thereby cementing their status as frontrunners in the global aloe vera juice arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aloe Vera Juice market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ALO Beverage Company, Inc.

- Aloe Pura Limited

- Aloe Vera of America, Inc.

- Aloecorp, Inc.

- AloeCure International

- Amway Corporation

- Dabur India Limited

- DXN Marketing Sdn. Bhd.

- Forever Living Products International, Inc.

- Fruit of the Earth, Inc.

- Kapiva Ayurveda Private Limited

- L.O.D.C., Inc.

- Lakewood Organic Juice Company

- Nature's Way Products, LLC

- OKF Corporation Co., Ltd.

- Patanjali Ayurved Limited

- Salus Haus GmbH & Co. KG

- Shree Baidyanath Ayurved Bhawan Private Limited

- Simplee Aloe LLC

- The Himalaya Drug Company

Deploying Targeted Action Plans for Industry Leaders to Capitalize on Consumer Trends Technological Advances and Regulatory Shifts in Aloe Vera Juice Sector

To excel in a dynamic aloe vera juice market, industry leaders must enact targeted strategies that leverage emerging consumer trends and operational efficiencies. First, investing in advanced digital platforms-ranging from direct-to-consumer portals to AI-driven demand forecasting systems-will enhance customer engagement, reduce inventory risks, and personalize product offerings based on behavioral analytics. Concurrently, fostering open innovation partnerships with botanical research institutions and food science labs can unlock novel formulations that differentiate brands through clinically validated health claims.

Cost management is equally critical in the wake of shifting tariff landscapes. Companies should consider strategic sourcing alliances and diversified supplier networks to spread risk and negotiate volume discounts. At the same time, experimenting with alternative packaging materials and lightweight designs can offset duty increases and strengthen sustainability credentials. From a channel perspective, balancing traditional retail footprints with robust e-commerce ecosystems will ensure broad market reach while preserving margins through subscription-based and direct fulfillment models.

Finally, embedding sustainability and social responsibility at the core of corporate strategy will resonate across stakeholder groups. Establishing transparent traceability systems, securing recognized certifications, and engaging in impact-driven community projects will not only meet regulatory demands but also cultivate brand advocates in a crowded marketplace. By integrating these recommendations into their strategic playbooks, industry leaders can accelerate growth, enhance resilience, and sustain long-term competitive advantage.

Detailing the Robust Research Framework Employing Multi-Source Data Collection Qualitative Interviews and Quantitative Analysis for Accurate Market Understanding

Our research framework integrates a comprehensive mix of primary and secondary methodologies to deliver robust and actionable insights. Primary research included structured interviews with C-level executives, operations managers, and R&D specialists across leading aloe vera juice producers, packaging innovators, and distribution partners. These discussions provided first-hand perspectives on strategic priorities, pain points, and future outlooks. Supplementing this qualitative input, we conducted consumer focus groups and online surveys targeting health-oriented demographics in key markets to capture usage patterns, flavor preferences, and willingness to pay for premium attributes.

On the secondary research front, we analyzed trade publications, regulatory filings, industry conferences, and sustainability reports to validate emerging trends and benchmark best practices. Additionally, we leveraged proprietary databases to track tariff schedules, import-export volumes, and patent filings related to extraction and stabilization technologies. Data triangulation and cross-validation techniques ensured that conclusions drawn were grounded in multiple sources and reflective of market realities.

Finally, our analytical approach applied advanced statistical models and scenario-planning tools to test supply chain alternatives under various tariff and demand forecasts. This holistic methodology equips stakeholders with both a granular understanding of current market dynamics and strategic foresight to navigate future uncertainties.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aloe Vera Juice market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aloe Vera Juice Market, by Product Form

- Aloe Vera Juice Market, by Packaging Material

- Aloe Vera Juice Market, by Distribution Channel

- Aloe Vera Juice Market, by Application

- Aloe Vera Juice Market, by Flavour

- Aloe Vera Juice Market, by Region

- Aloe Vera Juice Market, by Group

- Aloe Vera Juice Market, by Country

- United States Aloe Vera Juice Market

- China Aloe Vera Juice Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Drawing Insights from Market Trends Regulatory Developments and Consumer Behavior Patterns to Synthesize a Clear Path Forward for Aloe Vera Juice Stakeholders

In synthesizing the multifaceted drivers of the aloe vera juice market, clear imperatives emerge for stakeholders seeking to thrive. The intersection of health-driven consumption patterns, digital commerce acceleration, and regulatory complexity underscores the need for agile, consumer-centric business models. As companies navigate tariff fluctuations, sustainability mandates, and evolving taste profiles, those that proactively align their strategies to these forces will unlock new value pools and mitigate risks.

The segmentation matrix-from product form and packaging to distribution channels, applications, and flavour innovations-provides a roadmap for tailored offerings that resonate authentically with target audiences. Regional analysis further refines market entry and expansion strategies by highlighting differentiated consumer behaviors and regulatory landscapes across the Americas, EMEA, and Asia-Pacific. Meanwhile, competitive benchmarking reveals that leading entities are redefining benchmarks in extraction technology, transparency, and social impact, raising the bar for the entire sector.

Ultimately, the path forward hinges on a holistic approach that blends digital transformation, responsible sourcing, and relentless innovation. In doing so, industry players will not only navigate current challenges but also position themselves to capitalize on the long-term growth trajectory of the global aloe vera juice market.

Engaging with Ketan Rohom to Secure the Complete Aloe Vera Juice Market Research Intelligence and Empower Strategic Decision Making Across Your Enterprise

Thank you for exploring our executive summary on the aloe vera juice market. To gain a thorough understanding of competitive landscapes, evolving regulations, consumer preferences, and strategic growth opportunities, connect with Ketan Rohom, Associate Director of Sales & Marketing. Ketan can guide you through tailored data modules, in-depth analyses, and customized consultancy services that address your organization’s specific objectives. His expertise in navigating complex market dynamics will enable you to transform insights into actionable strategies and capitalize on emerging trends. Reach out to secure your comprehensive market research report today and empower your team with the intelligence needed to stay ahead in the rapidly evolving aloe vera juice industry.

- How big is the Aloe Vera Juice Market?

- What is the Aloe Vera Juice Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?