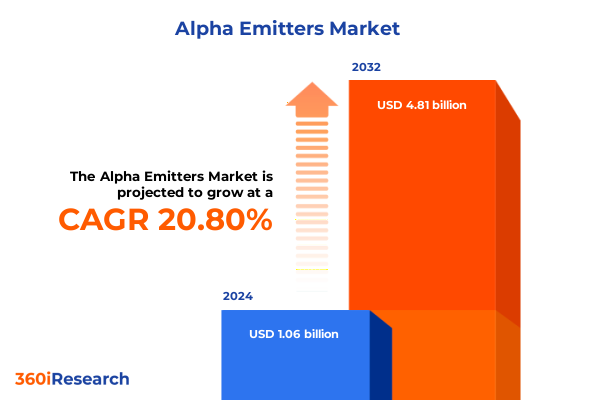

The Alpha Emitters Market size was estimated at USD 1.28 billion in 2025 and expected to reach USD 1.52 billion in 2026, at a CAGR of 20.74% to reach USD 4.81 billion by 2032.

A high‑level introduction describing how alpha emitters have become a strategic crossroads between clinical innovation, industrial monitoring, and global supply considerations

Alpha-emitting isotopes have moved from niche laboratory curiosities to strategic inputs across clinical, environmental, and industrial domains, driven by breakthroughs in production technologies and an expanding pipeline of targeted therapies. This introduction situates the reader at the intersection of scientific innovation and commercial urgency: targeted alpha therapies and precision detection systems are no longer speculative; they are advancing through pivotal clinical trials while industry participants race to secure reliable, regulatory-compliant supplies and distribution pathways. As a result, stakeholders must reconcile the technical complexity of isotope production, the strict regulatory and transport regimes that govern radioactive materials, and the evolving trade environment that increasingly shapes cost and availability. The following analysis synthesizes current supply developments, policy shifts, segmentation dynamics, regional differences, and company strategies to provide a comprehensive entry point for decision-makers who require a clear line of sight into how alpha emitters will affect clinical programs, procurement strategies, and industrial monitoring use cases over the next strategic planning horizon.

An integrated view of the technological, commercial, regulatory, and trade shifts rapidly redefining alpha emitter supply chains and downstream applications

The landscape for alpha emitters is being transformed by several overlapping shifts that are technological, commercial, and geopolitical in nature. First, production methods are diversifying: traditional generator and reactor pathways are being complemented and in some cases supplanted by cyclotron-based production and industrial proton-bombardment platforms, enabling higher-purity outputs and production scalability. This technical advance is enabling pharmaceutical developers to plan for later‑stage trials with greater confidence in material quality and traceability, while also opening opportunities for manufacturers to offer distinct product configurations such as carrier-free and no-carrier-added grades. Second, clinical momentum for targeted alpha therapy has intensified investment across the value chain, prompting pharmaceutical firms and radiopharma suppliers to form strategic supply agreements and joint ventures that lock in capacity and accelerate GMP-compliant output. These commercial alignments are reshaping how R&D budgets and procurement strategies are coordinated across clinical and manufacturing teams. Third, detection and equipment innovation-spanning advanced solid state detectors, CdZnTe platforms, and improved scintillation technologies-is expanding the operational envelope for environmental monitoring and industrial non-destructive testing, enabling safer, more sensitive field operations and more refined laboratory analytics. Fourth, regulatory and logistical frameworks are maturing to better accommodate routine commercial flows of alpha isotopes, but they remain complex: transportation, packaging, and cross-border transfer protocols impose lead times and compliance burdens that favor vertically integrated suppliers with specialized logistics. Finally, trade policy and tariff regimes have injected a new layer of supply-risk calculus; reciprocal tariffs, country-specific levies, and selective tariff exemptions are altering landed costs and prompting reshoring and regional diversification strategies. Together, these transformative shifts create both immediate operational challenges and strategic openings for organizations that can combine technical depth with agile supply planning and policy intelligence. Empirical markers of these shifts include public announcements from new production facilities, strategic supply partnerships, and regulatory approvals that indicate the sector is moving from constrained pilot production to scalable commercial supply chains, thereby setting the conditions for broader clinical adoption and industrial deployment.

A focused analysis of how United States tariff developments during 2025 have affected upstream inputs, procurement strategies, and decisions to localize critical production capacity

United States tariff actions in 2025 have had a cumulative and asymmetric impact on the supply chain for components, equipment, and precursor materials relevant to alpha emitter production and distribution. While tariffs have not typically targeted isotopes directly, the 2025 policy environment-characterized by selective reciprocal tariffs and Section 301 reviews-has increased costs and complexity across upstream inputs such as specialized metal substrates, cyclotron components, and certain chemical precursors used in target manufacture and radiochemical processing. This has pressured procurement teams to re-evaluate supplier portfolios and to plan for longer lead times on imported capital equipment and spare parts. In some instances, tariff-driven cost increases have accelerated onshoring decisions and investment in domestic manufacturing capacity; firms that could secure capital and regulatory approvals moved to expand cyclotron and generator installations to mitigate exposure to volatile import duties. For clinical developers, the practical consequence has been a heightened emphasis on securing guaranteed supply through multi-year agreements and co-investment in production capacity rather than relying on spot purchases from overseas producers. At the same time, selective tariff exemptions and targeted carve-outs for pharmaceutical inputs have provided partial relief for certain finished products and raw materials, tempering the worst-case impacts and enabling some suppliers to maintain viable commercial pathways for GMP-grade isotopes. These mixed effects have encouraged supply-chain segmentation: capital-intensive equipment and long-lead production assets are being localized where policy risk and logistics favor domestic solutions, while more fungible consumables and certain precursor chemicals continue to be sourced internationally under revised contractual terms that reflect tariff pass-through and contingency stock strategies. The net result is a more layered supply architecture in which procurement, regulatory, and legal teams must work closely with technical operations to model landed cost under multiple tariff scenarios and to prioritize investments that improve resilience without undermining cost-efficiency. Where tariff regime adjustments occur-through executive orders or administrative updates-companies with flexible contracting and diversified supplier portfolios are best positioned to translate policy volatility into operational advantage.

A synthesis of application, end‑user, emitter type, equipment, delivery mode, purity grade, and detection technique segmentation to illuminate commercial and clinical priorities

Segmentation insight reveals where technical, clinical, and commercial priorities converge and diverge, and it frames practical choices for portfolio managers and procurement leads. In applications, alpha emitters serve environmental monitoring needs such as air, soil, and water surveillance while simultaneously addressing industrial testing requirements through non-destructive testing and thickness gauging; on the clinical side, use cases split between pain palliation and targeted alpha therapy, and research activity is concentrated in clinical trials and preclinical research. End users span public environmental agencies, hospitals and clinics, industrial non-destructive testing providers, and research institutes, each of which imposes different quality, logistics, and regulatory expectations that in turn shape product configuration and service models. Emitter types in commercial circulation include actinium‑225, americium‑241, polonium‑210, and radium‑223, and suppliers must address the distinct production pathways and purity requirements of each isotope to satisfy medical versus industrial applications. Equipment choices gravitate toward detectors, generators, and sources; detector technology includes gas-filled detectors, scintillation detectors, solid state detectors, and more advanced alternatives such as CdZnTe and HPGe platforms, while generator formats are divided between cartridge and column systems and source formats include sealed and unsealed sources with differing regulatory handling needs. Delivery modes range from composite materials to liquid solutions and sealed sources, with liquid solutions further segmented into buffered and saline matrices and sealed sources subdivided into electroplated and thin-film constructions. Purity grade expectations vary from bulk material to carrier-free and no-carrier-added specifications, and detection technique preferences include CdZnTe, HPGe, ionization chambers, NaI(Tl) scintillators, plastic scintillators, proportional counters, and solid state detectors. When these segmentation layers are considered together, it becomes clear that clinical programs typically prioritize carrier-free, high-purity actinium-225 delivered in validated liquid solution chemistries compatible with radiolabeling workflows, while industrial and environmental monitoring users place greater emphasis on sealed source robustness, detector sensitivity, and long-term operational stability. Research institutes straddle both sets of priorities because they require flexible source forms for experimental protocols and access to a range of detection techniques. Consequently, suppliers and equipment manufacturers that can offer configurable product families-spanning sealed thin-film sources for industrial use to GMP-grade, no-carrier-added liquid Ac-225 for therapeutic manufacturing-will capture differentiated value by aligning technical form factors to end-user regulatory and operational requirements.

This comprehensive research report categorizes the Alpha Emitters market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Emitter Type

- Equipment Type

- Delivery Mode

- Purity Grade

- Detection Technique

- Application

- End User

A regional analysis showing how production capacity, regulatory frameworks, and clinical adoption vary across the Americas, Europe‑Middle East‑Africa, and Asia‑Pacific

Regional dynamics shape strategy and execution for market participants because regulatory regimes, production capacity, and clinical adoption timelines differ materially across geographies. In the Americas, recent investments in cyclotron and generator capacity, together with emerging commercial production initiatives, are reducing reliance on legacy external suppliers and shortening lead times for clinical programs that require actinium-225 and other alpha isotopes. North American momentum is also supported by strong clinical trial pipelines and an ecosystem of contract manufacturing and specialized logistics providers that can handle GMP material under stringent temperature and radiation controls; these strengths favor faster clinical-to-commercial transitions for therapeutic developers headquartered in the region. In Europe, Middle East & Africa, Europe leads in diversified production approaches-including cyclotron-based production and collaborative public-private projects-while regulatory harmonization across the European Union and advanced nuclear regulatory frameworks facilitate cross-border clinical supply but still impose complex import/export controls for precursor materials. The Middle East and Africa present a mixed picture: advanced economies in the Gulf are investing in capability development, whereas many African markets remain nascent with limited domestic production and higher import dependency. In Asia-Pacific, a patchwork of highly capable national programs and manufacturing hubs coexists with markets that are early in adoption; countries with strong existing nuclear infrastructure and active radiopharmaceutical pipelines are scaling production quickly, while others remain reliant on imports. Across regions, trade policy shifts and tariff dynamics in 2025 have prompted an acceleration of regional supply networks and of collaborative commercial models that link production in lower-risk jurisdictions with distribution networks that can meet local regulatory demands. These regional distinctions mean that commercial strategy should be crafted with sensitivity to local regulatory timelines, logistics constraints, and the relative maturity of clinical ecosystems, because a one-size-fits-all go-to-market model will not deliver consistent access or competitive advantage across these geographies.

This comprehensive research report examines key regions that drive the evolution of the Alpha Emitters market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

An assessment of how strategic partnerships, capacity expansions, and vertical integration by producers and pharmaceutical firms are stabilizing supply and changing commercial models

Company activity is reshaping the ecosystem as incumbent radiopharma suppliers, specialized isotope producers, and large pharmaceutical firms each pursue strategies that secure supply and accelerate commercialization. New commercial-scale producers have announced routine production and capacity expansions that address historic shortages for key isotopes, including actinium-225, by deploying cyclotron-based or generator-derived approaches and by establishing GMP-compliant manufacturing lines. Strategic partnerships and investments by major pharmaceutical companies have been used to secure long-term access to isotopes for their therapeutic pipelines, and contract manufacturers and logistics specialists are scaling capabilities to provide regulatory-compliant distribution and “white glove” services for time‑sensitive materials. At the same time, nimble technology vendors and detector manufacturers are differentiating via higher-sensitivity detection platforms and modular generator designs that cater to the varying technical demands of clinical, environmental, and industrial end users. Firms that combine production scale with validated supply chains and specialized handling expertise are achieving early commercial traction because they reduce risk for clinical developers and institutional buyers. Public announcements and press releases from leading producers and partners provide concrete evidence of this activity: multiple organizations have transitioned from pilot production to routine commercial output, and others have signed strategic collaborations to industrialize production at scale. These moves reflect an ecosystem-level shift from scarcity-driven, opportunistic procurement to coordinated, contract-based supply models that underpin predictable clinical development and operational deployment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Alpha Emitters market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Actinium Pharmaceuticals Inc.

- Alpha Tau Medical Ltd.

- Bayer AG

- Bracco Imaging S.p.A.

- Cardinal Health, Inc.

- Fusion Pharmaceuticals Inc.

- Jubilant Pharma Limited

- Lantheus Holdings, Inc.

- Nihon Medi-Physics Co., Ltd.

- Niowave, Inc.

- NorthStar Medical Radioisotopes, LLC

- Novartis AG

- Orano Med

- Phoenix LLC

- RadioMedix Inc.

- Telix Pharmaceuticals Limited

- Theragenics Corporation

- Viewpoint Molecular Targeting Inc.

Concrete strategic actions for senior executives to secure supply, de‑risk clinical and industrial programs, and convert tariff uncertainty into operational advantage

Industry leaders should pursue three complementary and actionable lines of response to manage risk and seize opportunity as the alpha emitter ecosystem matures. First, integrate supply‑security clauses and multi-year capacity commitments into clinical development contracts, and where feasible, co-invest in or secure exclusive access to production slots that align with pivotal trial timelines. This approach reduces exposure to tariff volatility and equipment lead-time uncertainty while providing a predictable path through regulatory submission windows. Second, prioritize supplier diversity that balances domestic production partners with vetted international producers who can provide contingency capacity; build contractual terms that reflect tariff pass‑through mechanics and include inventory buffers and emergency replenishment clauses. Third, invest in end-to-end logistics and compliance capability - or partner with logistics specialists - to ensure that packaging, transport, and cross-border documentation meet the stringent regulatory requirements for alpha-emitting materials, thereby preventing shipment delays that could derail clinical dosing schedules or industrial operations. In parallel, product and commercial teams should align around differentiated value propositions: clinical customers demand high-purity, carrier-free formats with validated chelation chemistries, while industrial and environmental customers prioritize sealed source robustness and detector sensitivity. Finally, allocate resources to active policy monitoring and scenario planning that model tariff outcomes and regulatory changes; organizations that develop rapid-response procurement playbooks and that engage publicly with policy makers to secure carve-outs for essential pharmaceutical inputs will be better placed to maintain continuity of supply and to protect margins during periods of tariff uncertainty.

A transparent description of the research approach combining primary corporate disclosures, regulatory notices, expert validation, and scenario modeling to ensure robust insights

This analysis synthesizes primary and secondary research, regulatory filings, company press releases, and expert interviews to produce an integrated view of market dynamics and supply chain risk. Primary inputs included approved company communications detailing capacity expansions and commercial production plans, regulatory announcements and tariff notices published by government trade agencies, and industry briefings that illuminate logistical and regulatory constraints. Secondary sources comprised peer-reviewed commentary on isotope production pathways and reputable industry reporting that chronicles strategic partnerships and investments. Analysis prioritized cross‑verification: where a production claim appeared in corporate communications it was checked against regulatory filings, facility certifications, or complementary third-party reporting to confirm operational timelines and the stated GMP status of outputs. The methodology also incorporated scenario modeling for tariff and logistics risk to show how landed cost and lead times evolve under multiple policy outcomes. Finally, segmentation mapping was used to align technical product forms and purity grades to end-user requirements, enabling practitioners to translate high-level trends into concrete procurement and commercialization choices. Where direct, contemporaneous data on production volumes or proprietary contract terms was unavailable, the analysis relied on validated public disclosures and triangulation across multiple reputable sources to maintain factual accuracy while explicitly avoiding speculative market sizing or forecasting.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Alpha Emitters market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Alpha Emitters Market, by Emitter Type

- Alpha Emitters Market, by Equipment Type

- Alpha Emitters Market, by Delivery Mode

- Alpha Emitters Market, by Purity Grade

- Alpha Emitters Market, by Detection Technique

- Alpha Emitters Market, by Application

- Alpha Emitters Market, by End User

- Alpha Emitters Market, by Region

- Alpha Emitters Market, by Group

- Alpha Emitters Market, by Country

- United States Alpha Emitters Market

- China Alpha Emitters Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2703 ]

A concise conclusion emphasizing that securing reliable access to alpha emitters requires integrated procurement, regulatory, and technical strategies to realize clinical and commercial value

In conclusion, alpha emitters are transitioning from constrained, experimental inputs to strategically essential materials that require integrated technical, regulatory, and commercial approaches. The confluence of diversified production technologies, active clinical pipelines for targeted alpha therapies, and shifting trade policies in 2025 has produced a market environment where securing high‑purity isotopes and compliant logistics is now a competitive imperative rather than an operational nicety. Organizations that align cross-functional teams around supply continuity, invest in tailored supplier relationships, and adopt flexible contracting approaches will be positioned to transform supply risk into strategic advantage. Conversely, actors that treat supply as a transactional procurement problem without accounting for regulatory, transport, and policy complexity are likely to experience delays, cost overruns, and potential interruptions to clinical programs or industrial deployments. Ultimately, the pathway to reliable access is visible: mature production platforms are coming online, partnerships are scaling capacity, and detection and delivery technologies are improving. Those who act decisively by integrating procurement, clinical development, and regulatory strategy will realize the earliest clinical and commercial benefits from the expanding alpha emitter ecosystem.

Immediate executive access and a single‑point contact to acquire the comprehensive alpha emitters market report and secure customized commercial briefings

For executive teams, clinical program leaders, and commercial strategists seeking the full market research report and tailored briefings, please contact Ketan Rohom (Associate Director, Sales & Marketing at 360i Research) to purchase the market research report and arrange a customized executive briefing. Ketan can coordinate licensing options, custom data extracts, and vendor briefings that align with clinical development timelines and procurement cycles. Engaging with a single point of contact will accelerate access to the dataset, proprietary supplier mapping, and regulatory impact analysis needed to support near‑term project decisions and longer‑term strategic planning.

- How big is the Alpha Emitters Market?

- What is the Alpha Emitters Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?