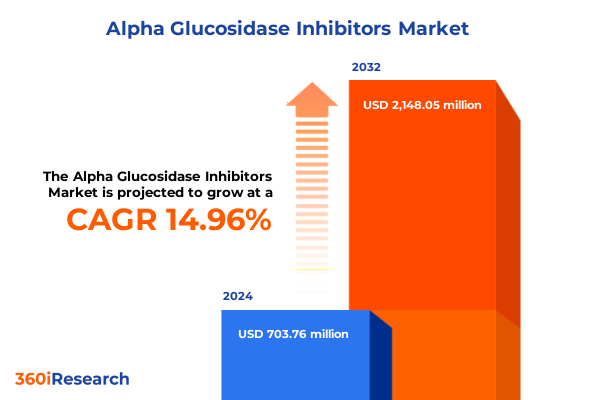

The Alpha Glucosidase Inhibitors Market size was estimated at USD 4.08 billion in 2025 and expected to reach USD 4.23 billion in 2026, at a CAGR of 4.24% to reach USD 5.46 billion by 2032.

Exploring the Critical Mechanisms and Strategic Importance of Alpha-Glucosidase Inhibitors in the Evolving Landscape of Diabetes Care

Alpha-glucosidase inhibitors represent a specialized class of oral antidiabetic agents designed to reduce postprandial hyperglycemia by impeding the enzymatic breakdown of complex carbohydrates into absorbable monosaccharides. This mechanism of action, rooted in competitive inhibition of brush-border enzymes such as glucoamylase, sucrase, maltase, and isomaltase, effectively slows glucose absorption and attenuates rapid blood glucose spikes following meals. Among the primary agents in clinical use are acarbose, miglitol, and voglibose, each distinguished by unique absorption and excretion profiles that influence tolerability and efficacy; for example, acarbose undergoes colonic metabolism with minimal systemic absorption, whereas miglitol is absorbed extensively and renally excreted.

In recent years, these inhibitors have found utility both as monotherapy and as components of combination regimens, particularly when targeting patients with pronounced postprandial glycemic excursions. Their role is further underscored in populations where dietary carbohydrate intake remains high, guiding prescribers toward therapies that align pharmacological effects with nutritional patterns. As the global burden of type 2 diabetes continues to intensify, appreciating the pharmacodynamics and clinical positioning of alpha-glucosidase inhibitors is essential for stakeholders seeking to navigate therapeutic choices, optimize treatment protocols, and shape informed market strategies.

Unveiling the Pivotal Technological and Therapeutic Advances Reshaping the Alpha-Glucosidase Inhibitor Segment in Diabetes Treatment

The alpha-glucosidase inhibitor sector is undergoing rapid transformation driven by technological innovations, evolving therapeutic guidelines, and shifting patient needs. Foremost among these shifts is the integration of continuous glucose monitoring (CGM) and digital health platforms, which empower clinicians and patients with real-time glycemic data and decision-support tools. The American Diabetes Association’s 2025 Standards of Care now recommend CGM for adults with type 2 diabetes on noninsulin regimens, reflecting evidence that real-time feedback enhances postprandial glucose management when combined with enzymatic inhibitor therapies. Concurrently, remote patient monitoring models have expanded reimbursable telehealth services, facilitating virtual visits and coaching that reinforce adherence to alpha-glucosidase regimens while providing timely intervention for adverse effects.

Simultaneously, the landscape is shaped by a growing emphasis on personalized medicine, wherein insights into genetic, metabolic, and lifestyle factors guide the selection and dosing of inhibitors. Healthcare organizations are tailoring treatment algorithms to individual carbohydrate metabolism profiles, optimizing postprandial control and minimizing gastrointestinal side effects. Moreover, the advent of fixed-dose combination therapies that pair alpha-glucosidase inhibitors with other oral antihyperglycemics reflects a broader trend toward simplifying regimens and improving patient adherence. These advances, coupled with enhanced patient education initiatives and digital coaching applications, underscore a transition from reactive to proactive management-transforming alpha-glucosidase inhibitors from niche options into integral components of comprehensive, technology-enabled diabetes care.

Assessing the Far-Reaching Consequences of Expanded U.S. Tariffs on Alpha-Glucosidase Inhibitor Supply Chains and Cost Dynamics

In April 2025, the imposition of a broad 10% global tariff on nearly all imported goods, including active pharmaceutical ingredients (APIs), marked a watershed moment for manufacturers and distributors of alpha-glucosidase inhibitors. This blanket tariff has incrementally raised raw material costs and pressured profit margins, particularly among firms reliant on foreign APIs. More pronounced, however, has been the targeted tariffs on Chinese pharmaceutical imports, which escalated to an effective rate of up to 245% in some categories. Given that approximately 80% of APIs are sourced internationally, and that Chinese suppliers contribute significantly to the global generic API supply chain, these levies have elevated production costs steeply and introduced volatility into sourcing decisions.

Generic manufacturers, already operating on narrow margins, are grappling with the calculus of passing cost increases to customers versus reshoring production to mitigate tariff exposure. Industry reports suggest that even a 5% to 25% increase in input costs can render generic alpha-glucosidase products economically unviable, spurring some producers to exit less profitable markets or delay new production lines. Moreover, regulatory exemptions for certain pharmaceutical imports have been temporary, underscoring an ongoing risk of further policy shifts. In response, leading companies are reevaluating supply chain resilience, exploring alternative API sources, and accelerating domestic manufacturing investments to navigate tariff uncertainties.

These cumulative tariff impacts have broader implications for patient access and healthcare budgets. As manufacturers adjust pricing, healthcare providers and payers face the prospect of higher drug expenditures and potential formulary changes. Simultaneously, advocacy groups are intensifying efforts to secure exemptions for critical medications, highlighting the risk of supply shortages and emphasizing the importance of regulatory clarity. The complex interplay between tariffs, supply chain strategies, and policy advocacy will continue to shape the accessibility and affordability of alpha-glucosidase inhibitors throughout 2025 and beyond.

Deriving Actionable Understandings from In-Depth Segmentation of Product Types, Dosage Forms, Channels, Modalities, and Patient Demographics

A nuanced understanding of market dynamics emerges when examining multiple segmentation dimensions, revealing distinct patterns in product uptake, patient preferences, and distribution strategies. Across product types, acarbose remains the dominant agent due to its extensive clinical experience and broad global availability, while miglitol commands attention for its superior systemic absorption and renal elimination profile, appealing to regions with robust monitoring infrastructure. Voglibose, although less prevalent in the United States, continues to gain traction in select Asian markets where it offers a favorable tolerability profile.

Dosage form innovations further diversify therapeutic options, with conventional tablets coexisting alongside extended-release formulations designed to minimize dosing frequency and reduce gastrointestinal adverse events. The emergence of both suspension-based oral solutions and softgel capsules enables precise dose titration, catering to patient segments that value ease of administration and minimized pill burden. Hospitals and retail pharmacies remain critical distribution touchpoints, but the growth of online pharmacies is reshaping purchasing behaviors, particularly among tech-savvy and homebound patients seeking convenience and confidentiality.

Treatment modalities bifurcate the market into monotherapy regimens for early-stage disease management and combination therapies that integrate alpha-glucosidase inhibitors with metformin or SGLT2 inhibitors, responding to evolving clinical guidelines that advocate early combination strategies. Meanwhile, age-specific considerations underpin prescribing trends: adult patients prioritize glycemic efficacy and long-term outcomes, geriatric populations emphasize tolerability and simplicity of regimens, and pediatric use, though limited, is emerging in selected regions under specialized supervision. Collectively, these segmentation insights inform targeted product development, optimized marketing strategies, and adaptive supply chain planning.

This comprehensive research report categorizes the Alpha Glucosidase Inhibitors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Dosage Form

- Treatment Modality

- Patient Age Group

- Distribution Channel

Highlighting Critical Regional Dynamics Influencing the Adoption and Growth Trajectories of Alpha-Glucosidase Inhibitors Globally

Regional market trajectories for alpha-glucosidase inhibitors display pronounced variability, shaped by healthcare infrastructure, regulatory landscapes, and epidemiological trends. In the Americas, robust insurance frameworks and well-established hospital and retail pharmacy networks ensure widespread availability, while heightened focus on formulary optimization drives competitive pricing and generic uptake. Patient education campaigns in the United States and Canada have bolstered awareness of postprandial glucose control, reinforcing the role of these therapies as adjuncts to first-line treatments.

In Europe, Middle East, and Africa, stringent health technology assessment processes and variable reimbursement policies influence adoption rates. Western European countries benefit from harmonized regulatory standards and established distribution channels, yet face pricing pressures under cost-containment mandates. In contrast, emerging markets in the Middle East and Africa contend with access disparities, prompting local partnerships and patient assistance initiatives to expand reach and address affordability concerns.

Asia-Pacific represents the most dynamic region, driven by rapidly escalating diabetes prevalence and expanding healthcare access. China and India lead growth through large-scale generic production and government-supported diabetes management programs, while Japan and South Korea prioritize innovative dosage forms and digital integration of treatment regimens. Across these markets, strategic collaborations between multinational and domestic firms accelerate product launches and foster localized clinical research. Understanding these regional nuances empowers stakeholders to align market entry strategies, optimize distribution networks, and tailor educational efforts to regional healthcare imperatives.

This comprehensive research report examines key regions that drive the evolution of the Alpha Glucosidase Inhibitors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Maneuvers in the Alpha-Glucosidase Inhibitor Market Landscape

The competitive landscape for alpha-glucosidase inhibitors is anchored by legacy pharmaceutical leaders and bolstered by agile generic manufacturers. Bayer’s acarbose franchise-marketed as Precose in North America and Glucobay in Europe-continues to leverage brand recognition and long-standing clinical data to maintain a strong presence in developed markets. Novartis’s portfolio includes miglitol under the Glyset brand, which has demonstrated sustained efficacy in improving postprandial glycemic control, earning preference in regions with comprehensive renal monitoring infrastructure.

Takeda and other regional innovators have introduced voglibose formulations in select Asian markets, capitalizing on differential tolerability and regional dietary profiles to gain market share. Generic entrants such as Teva, Mylan, and Sun Pharmaceutical Industries have intensified competition by offering cost-effective alternatives focused on extended-release and film-coated tablets, enabling rapid substitution in price-sensitive markets. Meanwhile, strategic alliances between originators and contract manufacturing organizations are streamlining API sourcing and production scalability, a critical response to evolving tariff environments and supply chain disruptions.

Collectively, these competitive strategies underscore a dual emphasis on product differentiation-through novel dosage forms and combination therapies-and operational resilience, via diversified manufacturing footprints. As market dynamics evolve, leading companies are investing in real-world evidence studies, patient support programs, and digital engagement platforms to strengthen brand loyalty and drive long-term growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Alpha Glucosidase Inhibitors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alkem Laboratories Ltd.

- AstraZeneca PLC

- Aurobindo Pharma Limited

- Bayer AG

- Boehringer Ingelheim International GmbH

- Bristol-Myers Squibb Company

- Cadila Healthcare Limited

- Daiichi Sankyo Company, Limited

- Dr. Reddy's Laboratories Ltd.

- Eli Lilly and Company

- GlaxoSmithKline plc

- Glenmark Pharmaceuticals Ltd.

- Intas Pharmaceuticals Ltd.

- Lupin Limited

- Merck & Co., Inc.

- Mylan N.V.

- Novartis AG

- Pfizer Inc.

- Sanofi S.A.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Torrent Pharmaceuticals Ltd.

- Wockhardt Limited

Formulating Targeted Strategic Imperatives to Empower Industry Leaders and Optimize Alpha-Glucosidase Inhibitor Market Opportunities

To capitalize on emergent opportunities and mitigate macroeconomic risks, industry leaders should adopt a multifaceted strategic approach. First, embedding digital health solutions across the patient journey, from CGM integration to telemedicine-based adherence support, can differentiate offerings and enhance therapeutic outcomes. Second, diversifying API sourcing and expanding domestic manufacturing capabilities will insulate supply chains from tariff volatility, ensuring consistent product availability.

Third, deepening collaboration with payers and healthcare providers to secure favorable formulary placements and reimbursement terms is essential, particularly in markets experiencing cost-containment pressures. Fourth, advancing fixed-dose combination therapies that integrate alpha-glucosidase inhibitors with complementary antihyperglycemics can streamline regimens, improve compliance, and align with evolving clinical guidelines advocating early combination strategies. Fifth, tailoring product portfolios and educational initiatives to regional and demographic nuances-such as geriatric patients’ tolerability considerations and pediatric specialist requirements-will foster targeted market penetration.

By executing these action items in concert, stakeholders can reinforce market resilience, enhance patient-centric value propositions, and sustain competitive advantage in a rapidly evolving therapeutic landscape.

Outlining a Rigorous Mixed-Method Research Framework for Comprehensive Analysis of the Alpha-Glucosidase Inhibitor Domain

This study employs a rigorous mixed-method research framework, combining secondary and primary research to ensure data robustness and relevance. Secondary research encompassed comprehensive reviews of peer-reviewed literature, regulatory filings, clinical trial registries, and government policy documents, complemented by analyses of industry white papers and corporate disclosures. These sources provided foundational insights into mechanism of action, regulatory shifts, and competitive landscapes.

Primary research was conducted through in-depth interviews with key opinion leaders, endocrinologists, pharmacist stakeholders, and supply chain executives to validate secondary findings and capture real-world perspectives on prescribing behaviors and procurement strategies. Quantitative data was triangulated through a synthesis of sales records, import/export databases, and reimbursement schedules, enabling a holistic view of market dynamics.

Data integrity was upheld through cross-validation against multiple independent sources and expert review panels, while methodological limitations-such as evolving tariff policies and emerging clinical data-were transparently documented. This structured approach ensures that the analysis reflects both the current state and prospective trajectories of the alpha-glucosidase inhibitor market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Alpha Glucosidase Inhibitors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Alpha Glucosidase Inhibitors Market, by Product Type

- Alpha Glucosidase Inhibitors Market, by Dosage Form

- Alpha Glucosidase Inhibitors Market, by Treatment Modality

- Alpha Glucosidase Inhibitors Market, by Patient Age Group

- Alpha Glucosidase Inhibitors Market, by Distribution Channel

- Alpha Glucosidase Inhibitors Market, by Region

- Alpha Glucosidase Inhibitors Market, by Group

- Alpha Glucosidase Inhibitors Market, by Country

- United States Alpha Glucosidase Inhibitors Market

- China Alpha Glucosidase Inhibitors Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Insights to Illuminate Future Pathways for Alpha-Glucosidase Inhibitor Innovation and Market Resilience

In summary, alpha-glucosidase inhibitors are strategically positioned within the broader diabetes management paradigm, offering unique benefits in postprandial glucose control. The market landscape is being transformed by digital health integration, personalized medicine approaches, and dosing innovations that respond directly to patient and provider needs. Concurrently, the implementation of expansive U.S. tariffs in 2025 has introduced new cost dynamics, compelling stakeholders to reevaluate supply chain resilience and pricing strategies.

Segmentation insights underscore the importance of aligning product portfolios with specific patient demographics and distribution channels, while regional analyses reveal diverse growth patterns influenced by regulatory environments and healthcare infrastructure. Competitive analyses highlight the actions of originator and generic manufacturers as they navigate pricing pressures, formulation differentiation, and strategic partnerships. In this context, actionable recommendations focused on digital integration, supply chain diversification, reimbursement collaboration, and combination therapy development emerge as critical enablers of sustained success.

Looking ahead, industry leaders who embrace data-driven decision making, foster innovation in both product and patient engagement, and anticipate policy shifts will be best equipped to navigate market complexities and drive enduring value.

Take Decisive Steps to Enhance Strategic Positioning by Engaging with Ketan Rohom for Access to the Comprehensive Alpha-Glucosidase Inhibitors Market Research Report

Avoid leaving strategic opportunities to chance when understanding market intricacies can determine competitive advantage; connect with Ketan Rohom to access a detailed alpha-glucosidase inhibitors market research report tailored for decisive action

- How big is the Alpha Glucosidase Inhibitors Market?

- What is the Alpha Glucosidase Inhibitors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?