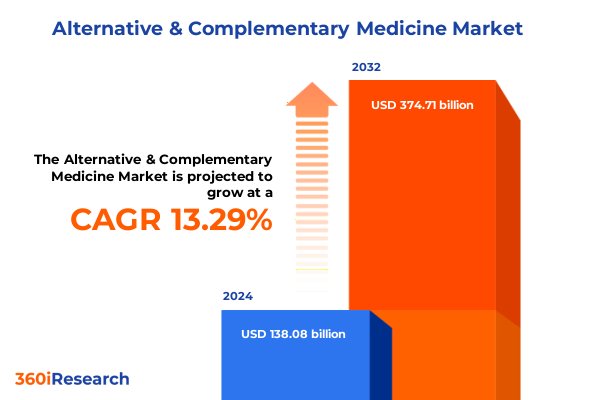

The Alternative & Complementary Medicine Market size was estimated at USD 155.44 billion in 2025 and expected to reach USD 175.19 billion in 2026, at a CAGR of 13.39% to reach USD 374.71 billion by 2032.

Pioneering Holistic Health Trends and Innovations Reshaping Patient Care and Research Priorities across the Complementary and Alternative Medicine Sector

Emergence of Holistic Health Paradigm Drives New Opportunities and Challenges in the Alternative and Complementary Medicine Sector

Over the past two decades, complementary and alternative medicine approaches have transitioned from niche practices to integral components of mainstream healthcare across the United States. Usage of at least one CAM modality among U.S. adults soared from 19.2% in 2002 to 36.7% in 2022, underscoring the growing consumer trust in holistic health strategies and symptom management alternatives to conventional pharmaceuticals. This rise has been fueled by robust clinical research published in high-impact journals and increased insurance coverage for services such as acupuncture, chiropractic care, and meditation-based therapies.

Simultaneously, the prevalence of nonvitamin, nonmineral natural products remains pronounced, with fish oil, probiotics, and melatonin consistently ranking among the most widely used supplements. Data from the National Health Interview Survey reveal that while some natural products like glucosamine experienced declines between 2007 and 2012, emerging ingredients have captured consumer attention, reflecting a dynamic shift in supplement preferences and wellness priorities among American adults. This evolution has prompted healthcare providers and researchers to prioritize rigorous evidence generation and educational outreach, shaping a competitive environment where scientific validation and consumer transparency are paramount.

Digital Health, Telemedicine, and Personalized Therapies Are Catalyzing Unprecedented Transformations in Alternative and Complementary Medicine

Digital Health, Telemedicine, and Personalized Therapies Are Catalyzing Unprecedented Transformations in Alternative and Complementary Medicine

The integration of digital health technologies into CAM practice is redefining patient access, engagement, and outcomes. Telemedicine platforms now routinely incorporate acupuncture, nutrition counseling, and mind-body consultations, enabling patients in remote or underserved areas to receive evidence-based CAM modalities without geographic constraints. A comprehensive scoping review of 62 studies demonstrated that CAIM delivered via telemedicine is both feasible and acceptable, yielding clinically meaningful improvements in conditions ranging from chronic pain to mental health disorders while addressing logistical and cost barriers.

Moreover, artificial intelligence and wearable devices are being leveraged to personalize patient experiences and treatment plans in real time. Federal and state regulators are preparing more rigorous oversight frameworks for AI-driven diagnostics and telehealth services, recognizing their potential to enhance care quality and safety. For instance, digital therapeutics are emerging as adjuncts to traditional herb-based and mind-body practices, offering data-driven insights that empower providers to fine-tune interventions and demonstrate value to payers and policy makers. This digital transformation is creating new pathways for research, collaboration, and commercialization within the CAM sector.

Complex Layers of New Tariff Policies Are Disrupting Global Supply Chains and Cost Structures in the Complementary Medicine and Nutraceuticals Industry

Complex Layers of New Tariff Policies Are Disrupting Global Supply Chains and Cost Structures in the Complementary Medicine and Nutraceuticals Industry

In early 2025, the U.S. government implemented a two-tiered tariff regime that has materially impacted the importation of CAM ingredients. Effective April 5, a universal 10% ad valorem tariff was applied broadly, followed by country-specific reciprocal tariffs ranging from 11% to 50% on eligible trading partners starting April 9. These duties are additive and, in select cases involving Section 301 measures, have driven total tariffs on some Chinese imports above 145%, exacerbating cost pressures for manufacturers reliant on global supply chains.

However, a strategic exemption list announced on April 24 relieved key nutritional and supplement components-including essential vitamins, amino acids, CoQ10, and trace minerals-from these levies. Despite these relief measures, botanicals and specialty herbal extracts, which are central to many CAM formulations, remain subject to significant duties, with industry associations warning of prolonged procurement delays, inventory shortages, and price volatility. Experts caution that the uncertainty surrounding potential future adjustments will continue to strain margins and compel supply chain reconfigurations through near-term 2025.

Multidimensional Market Segmentation Across Therapy Types, Disease Indications, End Users, and Distribution Channels Reveals Strategic Opportunities in CAM

Multidimensional Market Segmentation Across Therapy Types, Disease Indications, End Users, and Distribution Channels Reveals Strategic Opportunities in CAM

Examining the market across therapy type highlights the nuanced roles of complementary strategies in patient care. Biologically based therapies, especially dietary supplements and functional foods, dominate consumer spending, while mind-body modalities like yoga and meditation have demonstrated the steepest uptake, nearly tripling in adoption between 2002 and 2022. Similarly, energy therapies such as acupuncture and Reiki have gained traction as insurers broaden coverage and clinical guidelines increasingly endorse their use for select conditions.

When viewed through the lens of disease indication, CAM usage concentrates in pain management, stress and anxiety relief, and cardiovascular health, reflecting the sector’s alignment with chronic and lifestyle-related conditions. Pain management alone accounts for nearly half of all CAM applications, driven by growing concerns over opioid dependency and the search for nonpharmacological alternatives. Conversely, segments like cancer support and palliative care are witnessing steady integration of mind-body and nutritional interventions as comprehensive care protocols evolve.

End-user segmentation underscores the prominence of hospitals, specialty clinics, and academic research institutions as pivotal adoption channels, where integrative medicine centers and clinical trials act as catalysts for broader acceptance. Home care settings, individual practitioners, and wellness centers continue to expand their service portfolios, leveraging digital and in-person delivery models to meet personalized health demands.

Finally, distribution pathways are bifurcated between rapid e-commerce growth-spurred by online platforms offering subscription-based nutraceutical delivery-and the enduring dominance of health and wellness retail stores and pharmacies. This dual channel dynamic compels stakeholders to refine omnichannel strategies that balance digital convenience with traditional in-store experiences.

This comprehensive research report categorizes the Alternative & Complementary Medicine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Therapy Type

- Disease Indication

- End-User

- Distribution Channel

Divergent Adoption Patterns and Regulatory Environments across the Americas, Europe Middle East Africa, and Asia Pacific Offer Distinct Growth Pathways

Divergent Adoption Patterns and Regulatory Environments across the Americas, Europe Middle East Africa, and Asia Pacific Offer Distinct Growth Pathways

In the Americas, CAM adoption continues to accelerate, with over one-third of adults utilizing at least one complementary health approach in recent years. The U.S. market, characterized by robust insurance reimbursements for select modalities and a mature nutraceutical ecosystem, remains the global leader in CAM expenditure and innovation. However, regulatory scrutiny by the FDA and proactive legislative measures addressing ingredient safety are shaping entry barriers for new market entrants.

Europe, while exhibiting a stable overall usage rate near 27.7%, presents marked country-specific variations. Nations like Lithuania and France have reported upticks in CAM engagement, whereas Germany and Finland have experienced slight declines. Despite widespread interest, less than 21% of European countries integrate traditional and complementary medicine into national health policies, highlighting regulatory fragmentation as a persistent challenge. Conversely, leading research institutions across Germany, Switzerland, and the U.K. are advancing evidence-based frameworks that bolster clinical integration.

Asia-Pacific stands out as the fastest-growing region, underpinned by deep cultural roots in Ayurveda, Traditional Chinese Medicine, and Unani systems. Governments in China and India are both reinforcing TCM integration into public health systems and investing in global traditional medicine initiatives, leveraging platforms such as the WHO Global Centre for Traditional Medicine. While regulatory alignment and standardization gaps persist, this region’s sheer population scale and governmental support make it an indispensable growth frontier for CAM stakeholders.

This comprehensive research report examines key regions that drive the evolution of the Alternative & Complementary Medicine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Herbal Supplement and Telehealth Platform Providers Are Strengthening Competitive Advantages through Innovation, Sustainability, and Strategic Partnerships

Leading Herbal Supplement and Telehealth Platform Providers Are Strengthening Competitive Advantages through Innovation, Sustainability, and Strategic Partnerships

Within the herbal supplement segment, established brands are doubling down on sustainability and supply chain transparency to differentiate offerings. Gaia, Inc.’s inclusion in the Russell 2000 Index highlights its financial resilience and investor confidence, reflecting a strategic focus on blending conscious media, community engagement, and product integrity. This milestone underscores Gaia’s trajectory of disciplined growth and market credibility.

Simultaneously, nutritional products firms are pivoting toward technology-driven personalization. Herbalife’s recent first-quarter results demonstrated management’s prioritization of AI-enabled platforms and personalized supplement manufacturing through acquisitions in digital health and nutrition technology. These initiatives aim to deepen distributor engagement and unlock premium revenue streams, despite macroeconomic headwinds and regional currency headwinds in key markets.

Industry associations such as the American Herbal Products Association have also been vocal about the disruptive impact of tariffs on botanical sourcing. Their leaders emphasize the need for supply chain diversification and proactive policy advocacy to mitigate uncertainty and maintain product availability. This collective call to action is galvanizing collaboration among ingredient suppliers, contract manufacturers, and brand owners to fortify resilience and uphold quality standards amid evolving trade policies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Alternative & Complementary Medicine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AmeriCare Physical Therapy by Ivy Rehab

- AYUSH Ayurvedic Pte Ltd.

- Baidyanath Group

- Boiron

- Cipla Limited

- Dabur India Ltd.

- Dr. Willmar Schwabe India Pvt. Ltd.

- Emami Limited

- First Natural Brands Ltd.

- Full Motion Physical Therapy

- Herb Pharm, LLC

- Mountain Rose Herbs

- Nature's Bounty, Inc. by Nestlé Health Science

- Nelson & Co Ltd.

- Nordic Naturals

- PEKANA Naturheilmittel GmbH

- Pharmesis International Ltd.

- Rocky Mountain Oils LLC

- schwa-medico GmbH

- Seirin Corporation

- Sheng Chang Pharmaceutical Company

- The Arya Vaidya Pharmacy (CBE) Ltd.

- The Healing Company, Inc.

- The Himalaya Drug Company

- Vicco Laboratories

- Weleda AG

- Wen Ken Group

Strategic Imperatives for Industry Leaders to Navigate Supply Chain Volatility, Regulatory Complexity, and Emerging Digital Health Opportunities in CAM

Strategic Imperatives for Industry Leaders to Navigate Supply Chain Volatility, Regulatory Complexity, and Emerging Digital Health Opportunities in CAM

To sustain momentum in this dynamically shifting environment, industry leaders must prioritize supply chain diversification, exploring regional manufacturing hubs and nearshoring options to mitigate tariff risks and raw material shortages. Establishing multi-tiered supplier networks and leveraging ingredient substitution strategies can fortify operational continuity and cost stability.

At the same time, aligning with evolving regulatory frameworks calls for proactive engagement with policy makers and compliance experts. Companies should invest in robust quality assurance systems and pursue recognized certifications to preempt market access barriers and build consumer trust. Collaborative advocacy through trade associations can further influence policy outcomes.

Finally, capitalizing on digital health trends demands an agile approach to technology adoption. Organizations should pilot AI-driven diagnostics, telehealth platforms, and remote monitoring tools in controlled clinical settings, documenting outcomes that validate ROI for payers and healthcare systems. By co-creating research partnerships with academic institutions and technology providers, leaders can accelerate evidence generation and differentiate their value proposition in a crowded marketplace.

Rigorous Mixed-Method Research Framework Combining Primary Interviews, Secondary Data Analysis, and Expert Validation to Illuminate CAM Market Dynamics

Rigorous Mixed-Method Research Framework Combining Primary Interviews, Secondary Data Analysis, and Expert Validation to Illuminate CAM Market Dynamics

This report synthesizes insights derived from a structured research methodology that integrates primary qualitative interviews with senior executives, regulatory specialists, and clinical experts. These conversations were supplemented by secondary data collection from peer-reviewed journals, government databases, and industry publications to contextualize market trends and regional nuances.

Quantitative analysis involved the aggregation and triangulation of historical usage patterns, trade statistics, and tariff schedules to quantify the impact of policy changes on cost structures and supply chains. Finally, expert validation workshops were conducted to test emerging hypotheses, ensuring that findings accurately reflect market realities and stakeholder perspectives. This comprehensive approach underpins the strategic recommendations and segmentation insights presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Alternative & Complementary Medicine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Alternative & Complementary Medicine Market, by Therapy Type

- Alternative & Complementary Medicine Market, by Disease Indication

- Alternative & Complementary Medicine Market, by End-User

- Alternative & Complementary Medicine Market, by Distribution Channel

- Alternative & Complementary Medicine Market, by Region

- Alternative & Complementary Medicine Market, by Group

- Alternative & Complementary Medicine Market, by Country

- United States Alternative & Complementary Medicine Market

- China Alternative & Complementary Medicine Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Consolidating Insights on Market Drivers, Challenges, and Strategic Imperatives to Guide Future Decisions in the Alternative and Complementary Medicine Landscape

Consolidating Insights on Market Drivers, Challenges, and Strategic Imperatives to Guide Future Decisions in the Alternative and Complementary Medicine Landscape

In an era marked by the convergence of digital innovation, regulatory upheavals, and evolving consumer preferences, the complementary and alternative medicine sector stands at a pivotal crossroads. The sustained increase in CAM adoption, fueled by mounting evidence of efficacy and broader insurance support, heralds a fundamental reshaping of healthcare delivery models.

Yet, the imposition of multi-layered tariffs, coupled with diverse regional regulatory regimes, underscores the critical need for strategic agility and stakeholder collaboration. By leveraging nuanced segmentation analyses, market participants can identify high-growth niches and optimize channel strategies, while adherence to rigorous research and quality standards will remain the cornerstone of credibility.

Ultimately, those organizations that adeptly balance innovation, operational resilience, and evidence-based practice will emerge as leaders, poised to drive holistic health solutions forward and capture the full potential of this rapidly evolving industry.

Engage Directly with Ketan Rohom to Secure Critical Alternative and Complementary Medicine Market Research and Insights

Unlock unparalleled strategic insights tailored to the complementary and alternative medicine sector by engaging directly with Associate Director of Sales & Marketing, Ketan Rohom. His dedicated team is poised to guide you through every facet of this in-depth market research report, ensuring you gain actionable intelligence and a competitive edge. Reach out to Ketan Rohom to secure your access to comprehensive data, expert analysis, and bespoke support designed to drive informed decisions and accelerate your organization’s growth trajectory within the evolving CAM landscape

- How big is the Alternative & Complementary Medicine Market?

- What is the Alternative & Complementary Medicine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?