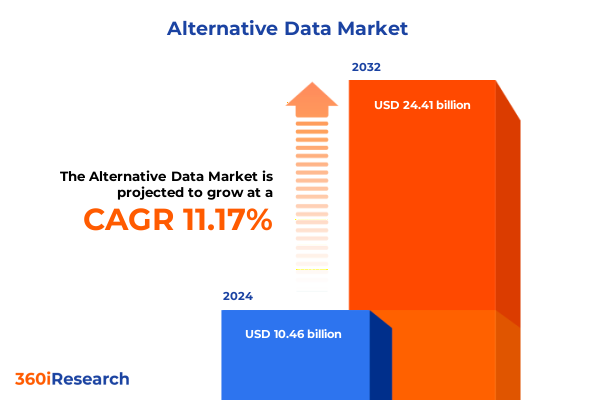

The Alternative Data Market size was estimated at USD 11.56 billion in 2025 and expected to reach USD 12.80 billion in 2026, at a CAGR of 11.26% to reach USD 24.41 billion by 2032.

Exploring the Evolution, Strategic Significance, and Emerging Opportunities of Alternative Data to Enhance Intelligence and Drive Superior Decision Strategies

The constantly evolving world of enterprise intelligence has witnessed a remarkable shift driven by the emergence of alternative data. Once considered peripheral, nontraditional data sources have now ascended to the forefront of strategic decision making, enabling organizations to transcend the limitations of conventional datasets. From credit and debit card transactions and email receipts to geolocation records capturing foot traffic patterns, these diverse streams of information create a more nuanced and timely view of market dynamics. This expanded data universe empowers professionals to anticipate consumer behavior, optimize supply chain logistics, and refine competitive strategies.

As the variety of available alternative data scales, so too does its relevance. Satellite and weather data deliver critical insights for agriculture, energy, and logistics, while mobile application usage and social sentiment analysis unveil real-time shifts in consumer preferences. Simultaneously, web-scraped data provides up-to-the-minute intelligence on pricing, product launches, and competitor movements. By integrating structured and unstructured data-whether from cloud-based repositories or on-premise systems-businesses gain a comprehensive panorama of operating conditions.

This report offers a holistic overview of the alternative data market, revealing how leading enterprises are embedding these insights into their analytics frameworks. It unpacks transformational trends, regulatory considerations, and emerging opportunities, furnishing leaders with the context needed to harness alternative data as a true strategic asset. Ultimately, this introduction sets the stage for an in-depth exploration of how alternative data is reshaping decision making across industries.

Uncovering How Technological Innovations and Regulatory Changes are Redefining the Alternative Data Landscape and Empowering Forward-Thinking Businesses

In recent years, technological breakthroughs and shifting regulatory landscapes have fundamentally redefined the alternative data market. Advancements in machine learning and natural language processing have enabled organizations to extract meaningful signals from unstructured text, images, and social feeds at unprecedented scale. Concurrently, the proliferation of 5G connectivity and edge computing has accelerated the collection of high-frequency geolocation and mobile usage data, delivering richer insights with lower latency.

At the same time, regulatory bodies around the world are implementing enhanced data privacy and security frameworks that fundamentally alter how alternative data can be acquired, stored, and processed. In response, data providers and end users are investing in advanced encryption techniques, differential privacy, and anonymization protocols to ensure compliance while preserving analytical value. These shifts are driving a wave of innovation in data governance platforms and secure data-sharing ecosystems.

Taken together, these technological and regulatory dynamics are empowering forward-thinking businesses to integrate alternative data more seamlessly into decision pipelines. Rather than treating nontraditional data as a one-off experiment, leading organizations are now embedding it into core workflows, using it to inform risk management, revenue forecasting, and marketing optimization. As a result, the alternative data landscape is evolving from a niche advisory function to a central pillar of enterprise intelligence.

Analyzing the Ripple Effects of United States Trade Tariffs Implemented in 2025 on Alternative Data Acquisition Costs and Strategic Planning Dynamics

In 2025, the imposition of additional trade tariffs by the United States has had a cascading effect on the cost and availability of alternative data. Import duties levied on hardware components, such as sensors, communication equipment, and satellite imagery services, have increased operational expenses for data aggregation firms. At the same time, tariffs on cloud infrastructure and data center hardware have driven up pricing for scalable compute resources, prompting some providers to reevaluate on-premise alternatives or seek regional cloud partnerships to mitigate exposure.

Beyond the direct impact on infrastructure, rising import taxes have influenced the broader economic environment, contributing to higher inflation expectations and supply chain disruptions. These factors have, in turn, affected the cadence of data acquisition projects, with organizations pacing new deployments more cautiously and emphasizing cost optimization. In sectors such as retail and manufacturing, businesses have had to adjust their budgeting for foot traffic analytics and sensor-based monitoring platforms to account for increased capital expenditure.

Despite these headwinds, the market has responded with creative solutions. Data providers are negotiating tiered contracts, establishing localized data hubs to bypass cross-border costs, and forging strategic alliances to share infrastructure. Meanwhile, end users are leveraging hybrid deployment architectures, combining cloud and on-premise systems to optimize cost-efficiency. This adaptive approach has not only cushioned the tariff impact but also highlighted the resilience and ingenuity of the alternative data ecosystem.

Illuminating Critical Segmentation Insights to Optimize Alternative Data Strategies Across Diverse Data Types, Deployment Models, and End-User Verticals

A nuanced understanding of market segmentation is critical for organizations seeking to capitalize on alternative data strategies. By examining how data types such as credit and debit card transactions, email receipts, geolocation foot traffic records, mobile application usage, satellite and weather observations, social sentiment metrics, and web-scraped intelligence align with structured and unstructured formats, businesses can determine the optimal integration approach. Cloud-based deployments often offer scalability and agility for handling high-frequency data streams, whereas on-premise models may provide tighter control and specialized customization for sensitive datasets.

The choice of deployment model inherently influences cost structures, security postures, and performance parameters. Cloud environments enable rapid provisioning of compute and storage, supporting advanced analytics and real-time dashboards without substantial capital outlay. On the other hand, on-premise infrastructure appeals to organizations with stringent compliance requirements or those seeking to consolidate data within existing enterprise architecture.

Industry verticals shape both data requirements and value realization. Energy and utilities companies, for example, draw on satellite imagery and weather feeds to optimize grid performance and resource allocation. Manufacturing firms rely on sensor data and transactional records to streamline production and anticipate maintenance needs. In retail and e-commerce, consumer behavior insights derived from payment and mobile usage patterns inform personalization strategies, while transportation and logistics entities leverage geolocation analytics to enhance route planning and delivery efficiency. Recognizing these delineations ensures that alternative data investments yield targeted outcomes and sustained competitive advantage.

This comprehensive research report categorizes the Alternative Data market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Data Type

- Category

- Deployment Model

- End User Industry

Revealing Key Regional Dynamics and Growth Drivers in the Americas, Europe Middle East Africa, and Asia Pacific Shaping Alternative Data Adoption

Regional dynamics play a pivotal role in shaping the adoption and maturation of alternative data strategies. In the Americas, mature financial markets and robust digital infrastructure have fostered an environment where credit and debit transaction analytics and social sentiment insights thrive. North American enterprises have pioneered advanced integration of consumer purchase datasets, setting benchmarks for market intelligence applications.

Across Europe, the Middle East, and Africa, a complex mosaic of regulatory regimes and market maturities has led to diverse adoption patterns. Stringent data privacy regulations in certain European jurisdictions have catalyzed innovation in privacy-preserving analytics, whereas emerging markets in the Middle East and Africa are accelerating data-driven modernization in sectors such as energy and logistics. Collaborative frameworks among regional data providers are facilitating a more seamless flow of satellite and geospatial insights.

The Asia-Pacific region is characterized by high-velocity digital transformation initiatives and large-scale mobile-first populations. Rapid expansion of e-commerce and smart city projects has driven demand for real-time geolocation, mobile usage data, and web-scraped intelligence. In concert with government-led smart infrastructure programs, enterprises in the region are leveraging alternative data to enhance urban planning, supply chain resilience, and consumer engagement strategies.

This comprehensive research report examines key regions that drive the evolution of the Alternative Data market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Innovations, Partnerships, and Competitive Differentiators Among Leading Alternative Data Providers Driving Market Excellence

Leading providers in the alternative data space are differentiating themselves through strategic innovation, targeted partnerships, and specialized vertical offerings. Some firms have invested heavily in proprietary data collection networks, deploying sensor arrays and collaborating with satellite operators to deliver high-resolution imagery and environmental monitoring services tailored to agriculture and energy sectors. Others have focused on building synthetic datasets by combining transactional and sentiment data, enabling more accurate short-term consumer trend forecasting.

In parallel, several data organizations have forged alliances with technology platforms and consulting firms to integrate advanced analytics capabilities directly into enterprise resource planning and customer relationship management systems. These partnerships accelerate time-to-insight by embedding alternative data feeds into familiar workflows, reducing the friction associated with new tool adoption.

Competitive differentiation also stems from the depth of data enrichment and speed of delivery. Providers offering managed analytics pipelines, complete with data cleansing, normalization, and feature engineering, help end users overcome internal resource constraints. Meanwhile, on-demand data marketplaces with self-service discovery interfaces empower analysts to experiment with novel datasets rapidly, fostering a culture of continuous innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Alternative Data market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 1010data, Inc. by SymphonyAI Inc.

- Advan Research Corporation

- Affinity Solutions, Inc.

- AlphaSense, Inc.

- BattleFin Group, LLC

- Bloomberg Finance L.P.

- Consumer Edge Holdings, LLC

- Dataminr, Inc.

- Eagle Alpha Limited

- Exabel AS

- ExtractAlpha Ltd.

- Facteus, Inc.

- Geotab Inc.

- InfoTrie Group

- Institutional Capital Network, Inc.

- M Science Holdings LLC

- Nasdaq, Inc.

- Preqin Holding Limited

- RavenPack International S.L.U.

- S&P Global Inc.

- THE EARNEST ANALYTICS COMPANY, INC

- Thinknum, Inc.

- UBS Evidence Lab

- Yipit, LLC

Crafting Targeted, Actionable Recommendations to Empower Industry Leaders in Harnessing Alternative Data for Competitive Advantage and Strategic Growth

To harness the full potential of alternative data, industry leaders should first establish a robust data governance framework that balances regulatory compliance with analytical agility. By implementing standardized processes for data acquisition, quality assurance, and security, organizations can safeguard sensitive information while accelerating integration into decision-making workflows. Collaborative engagements with legal, IT, and analytics teams will ensure cohesive governance and minimize operational risks.

Next, enterprises should prioritize building modular, scalable architectures that accommodate both cloud-hosted and on-premise deployments. This hybrid approach enables them to dynamically allocate resources based on workload intensity, data sensitivity, and cost considerations. Investing in middleware solutions that abstract underlying infrastructures will simplify data ingestion and foster interoperability among diverse analytics tools.

Finally, decision makers must cultivate cross-functional teams with interdisciplinary expertise in data engineering, domain knowledge, and advanced analytics. Embedding subject-matter experts alongside data scientists encourages the translation of raw signals into actionable insights. By fostering a culture of experimentation and continuous feedback, organizations can refine their analytical models, adapt to emerging data sources, and sustain a competitive edge in an increasingly data-driven business environment.

Describing Comprehensive Research Methodology and Rigorous Analytical Frameworks Employed to Validate Insights and Ensure Data Integrity and Reliability

The research underpinning this analysis leverages a multi-stage methodology designed to ensure the integrity, reliability, and applicability of the insights presented. The process began with a comprehensive mapping of the alternative data supplier landscape, identifying key providers across credit and debit card transactions, email receipts, geolocation records, mobile application metrics, satellite and weather feeds, social sentiment analytics, and web-scraped data sources. Primary research involved in-depth interviews with industry stakeholders, including data strategists, technology executives, and compliance officers, to capture qualitative perspectives on challenges and opportunities.

Quantitative data triangulation was achieved through the collection of market intelligence from proprietary databases, supplemented by regulatory filings and public disclosures. Structured and unstructured datasets were subjected to rigorous validation protocols, encompassing statistical anomaly detection, outlier analysis, and cross-referencing with benchmark indices. Data integrity audits were performed to verify accuracy across cloud and on-premise environments, and to assess compliance with global privacy regulations.

Finally, a layered analytical framework was applied, combining descriptive, diagnostic, predictive, and prescriptive lenses. Advanced modeling techniques, including machine learning clustering algorithms and scenario-based simulations, were utilized to test the resilience of key findings under varying macroeconomic and tariff environments. This holistic methodology ensures that the insights within this report are both empirically grounded and directly actionable.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Alternative Data market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Alternative Data Market, by Data Type

- Alternative Data Market, by Category

- Alternative Data Market, by Deployment Model

- Alternative Data Market, by End User Industry

- Alternative Data Market, by Region

- Alternative Data Market, by Group

- Alternative Data Market, by Country

- United States Alternative Data Market

- China Alternative Data Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Driving Home the Strategic Imperatives of Alternative Data Adoption and Charting Future Pathways for Sustained Innovation and Resilient Decision Making

The strategic imperatives emerging from this analysis underscore the transformative power of alternative data in modern decision making. By integrating diverse streams-from transactional and behavioral datasets to geospatial and sentiment-derived intelligence-organizations can construct a 360-degree view of market and operational conditions. This enriched perspective enables more precise forecasting, agile risk management, and targeted customer engagement strategies.

Adoption of alternative data demands a concerted approach to governance, technology architecture, and talent development. Firms that successfully align these elements will cultivate a sustainable advantage, capable of adapting to tariff shocks, regulatory shifts, and evolving competitive landscapes. Moreover, regional nuances and segmentation considerations illustrate that a one-size-fits-all strategy is insufficient; localized deployment models and sector-specific analytics are key to maximizing value.

Looking forward, continued innovation in data collection technologies, privacy-preserving analytics, and collaborative ecosystems will further expand the possibilities of alternative data. Organizations that remain at the forefront of these developments will be well positioned to chart resilient and growth-oriented pathways, transforming raw signals into strategic assets that drive measurable business outcomes.

Empowering Informed Decision Makers to Secure the Market Research Report Through Direct Engagement with the Associate Director for Strategic Insights

To secure the market research report offering deep, actionable insights into the alternative data ecosystem, decision makers are invited to connect directly with Ketan Rohom, the Associate Director of Sales & Marketing. His expertise in aligning strategic business objectives with cutting-edge research makes him uniquely qualified to guide stakeholders through the report’s comprehensive findings. By engaging with Ketan, organizations can tailor the report’s insights to their specific operational needs, ensuring they harness the full potential of alternative data to drive innovation, improve forecasting reliability, and sharpen competitive positioning.

We encourage you to reach out and arrange a personalized briefing to explore how the report’s extensive analysis of data types, deployment models, industry verticals, and regional dynamics can empower your strategic initiatives. This direct engagement will facilitate a deeper understanding of the methodologies employed, highlight the most relevant trends for your business, and unlock recommendations that can be operationalized quickly. Don’t miss the opportunity to transform your data strategy-contact Ketan Rohom today to acquire the definitive guide on leveraging alternative data for sustainable growth and strategic differentiation.

- How big is the Alternative Data Market?

- What is the Alternative Data Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?