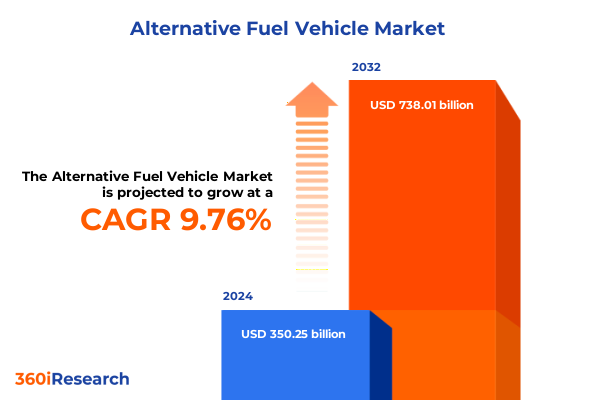

The Alternative Fuel Vehicle Market size was estimated at USD 383.17 billion in 2025 and expected to reach USD 419.18 billion in 2026, at a CAGR of 9.81% to reach USD 738.01 billion by 2032.

Unveiling the dynamic evolution of alternative fuel vehicles and the imperative for industry innovation and strategic stakeholder collaboration

In recent years, the accelerated uptake of electric and hybrid vehicles has signaled a profound transformation in global transportation dynamics. By the end of 2023, the international electric vehicle fleet numbered under 45 million units and consumed roughly 130 terawatt-hours of electricity, underscoring the rapid scale-up of charging infrastructure and grid integration measures worldwide. This surge reflects not only growing environmental consciousness among consumers but also the maturation of electrification technologies and the strengthening of value chains across regions.

Building on these foundations, 2024 witnessed sustained momentum, with global electric vehicle sales exceeding 17 million units and China alone contributing approximately 11 million deliveries, highlighting its preeminent role in manufacturing and domestic adoption. Cost trajectories have also improved markedly. Key battery components experienced significant price declines, with lithium-ion battery pack prices falling nearly 14% year-on-year in 2023, driven by material cost efficiencies and economies of scale in production. These downward cost pressures have enhanced affordability and expanded the addressable market, paving the way for broader demographic engagement.

Despite these advances, the sector now faces a complex interplay of policy adjustments, geopolitical recalibrations, and supply chain realignments. While ambitious decarbonization targets set by national and sub-national governments continue to anchor long-term strategy, short-term uncertainties have emerged. Notably, forecasts for U.S. vehicle electrification expectations have been halved as regulatory incentives were recalibrated under the new administration, generating debate among automakers, investors, and policy-makers on the speed and scale of the transition. Against this backdrop, industry participants must navigate a landscape defined by evolving technology standards, shifting public incentives, and increasingly sophisticated consumer preferences, all of which will shape the next phase of alternative fuel vehicle evolution.

Identifying transformative shifts reshaping the alternative fuel vehicle sector through breakthroughs in propulsion technology and policy support frameworks

Technological breakthroughs are propelling the alternative fuel vehicle ecosystem into new frontiers. In 2023, lithium-iron-phosphate battery chemistries accounted for over 40% of global electric vehicle capacity and supported nearly a 14% drop in average pack prices, reflecting intensified research-and-development activity and the scaling of cost-effective manufacturing processes. Concurrently, ultrafast charging systems and advanced thermal management solutions have reduced charging times to competitive levels, while solid-state battery prototypes promise next-generation energy densities and safety enhancements.

Parallel to battery innovation, fuel cell electric vehicles are gaining momentum in segments where extended range and rapid refueling are critical. Major OEMs are conducting pilot deployments of hydrogen-powered heavy-duty trucks and commercial fleets, leveraging modular fuel cell stacks to achieve operational viability in long-haul logistics, port drayage, and public transit applications. These initiatives underscore a growing consensus that a diversified propulsion portfolio will be essential for decarbonizing all vehicle weight classes and use cases.

Supportive policies continue to shape technology adoption pathways. At the federal level, recent adjustments to the Inflation Reduction Act have reallocated subsidies and redefined qualifying criteria for zero-emission vehicles, intensifying competition among OEMs and incentivizing novel assembly footprints. Simultaneously, California’s Advanced Clean Cars II regulations have been amended to mandate 100% zero-emission light-duty vehicle sales by 2035, reinforcing the state’s role as a policy lighthouse and sending clear demand signals to the market. These developments illustrate how legislative frameworks and regulatory mandates are catalyzing investment and shaping product roadmaps, even as legal challenges and political debates introduce elements of uncertainty.

Looking beyond North America, regions such as the European Union and East Asia are advancing stringent tailpipe emission standards and offering targeted incentives for next-generation powertrains. Combined with ongoing advances in digitalization, connectivity, and smart grid integration, these transformative shifts are redefining competitive benchmarks and setting the stage for a new era of sustainable mobility.

Examining the cumulative impact of newly imposed United States tariffs in 2025 on the manufacturing costs and global supply chains of alternative fuel vehicles

The cumulative impact of United States tariffs implemented in early 2025 has reverberated across manufacturing lines and supply chains within the alternative fuel vehicle industry. Comprehensive tariff schedules introduced duties ranging from 25% on battery components and rare earth minerals to 35% on steel and aluminum inputs, prompting immediate cost pressures. According to industry analyses, these measures elevated acquisition costs for critical raw materials by up to 50%, while average per-vehicle production costs rose between 7% and 12%, compelling assembly facilities to reassess supplier contracts and sourcing strategies.

Supply chain operations encountered significant disruptions amid these tariff adjustments. Container dwell times at major West Coast ports extended by as much as 18 days, semiconductor chip prices fluctuated by 20 to 40%, and manufacturers responded by stockpiling inventory to mitigate delivery risks. This confluence of delays and volatility increased working capital requirements sharply and underscored vulnerabilities in lean manufacturing models that rely on just-in-time deliveries.

In response, leading automakers have accelerated domestic investment to sidestep import levies. For instance, General Motors announced a $4 billion capital allocation across three U.S. plants, while Hyundai unveiled a $21 billion package that includes development of a new steel production facility. Mercedes-Benz is likewise expanding capacity at its Alabama SUV plant, reflecting a broader pivot toward regionalization under the USMCA umbrella and an emphasis on near-shoring to maintain competitive cost structures.

While producers have largely absorbed these tariff-driven cost increments, consumer pricing pressures have begun to surface. Industry forecasts suggest that automakers will incrementally pass on portions of the additional duties to end users to preserve margin integrity, resulting in average transaction prices trending upward by several thousand dollars. This gradual cost transfer is likely to shape purchasing behaviors and may decelerate adoption rates in price-sensitive segments, posing new strategic considerations for OEMs and financiers alike.

Uncovering segmentation insights across propulsion types, driving ranges, vehicle classifications, and end use applications within the alternative fuel vehicle market

Alternative fuel vehicle offerings exhibit distinct variations when analyzed by propulsion type. Battery electric vehicles are configured around battery capacity thresholds of less than 50 kilowatt-hours for urban runabouts, 50 to 100 kilowatt-hours for balanced performance and range, and greater than 100 kilowatt-hours for extended travel requirements. Fuel cell electric vehicles, by contrast, continue to gain traction in niche markets where swift hydrogen refueling and sustained range performance are prerequisites, particularly within heavy transport and specialist fleet applications. Hybrid electric vehicles, blending internal combustion engines with electric drive assistance, retain relevance by offering a pragmatic bridge for consumers transitioning from conventional powertrains while benefiting from established fueling infrastructure.

Driving range segmentation further differentiates product positioning. Vehicles designed for journeys under 200 miles primarily address urban and short-haul use cases, enabling compact designs and lower battery costs. Offerings that deliver 200 to 300 miles of range occupy the mainstream bracket, appealing to daily commuters and regional travelers seeking a balance of cost and flexibility. Models engineered for ranges exceeding 300 miles target long-distance commuters and cross-country travel, commanding premium specifications in battery density and thermal management systems.

Vehicle classification adds another dimension, encompassing heavy commercial vehicles engineered for bulk freight and logistics operations, light commercial vehicles optimized for last-mile deliveries and service trades, and passenger vehicles tailored to occupant comfort and lifestyle requirements. These distinctions inform chassis architecture, payload considerations, and total cost of ownership analyses, driving specialized feature sets such as enhanced towing capacity or customizable cabin layouts.

End use segmentation of commercial versus personal applications shapes value propositions and financing structures. Commercial fleets prioritize operational uptime, charging infrastructure availability, and total cost of service ownership, often leveraging leasing and subscription models to manage residual value risk. Personal use cases emphasize user experience, connectivity, and design aesthetics, with consumers favoring models that align with brand identity and deliver effortless daily usability.

This comprehensive research report categorizes the Alternative Fuel Vehicle market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Propulsion Type

- Driving Range

- Vehicle Type

- End Use

Highlighting regional dynamics and growth trajectories across the Americas, Europe Middle East and Africa, and Asia Pacific markets shaping alternative fuel vehicle adoption strategies

Within the Americas, North American production and adoption trends display contrasting patterns. United States manufacturing output experienced a modest decline in 2024, whereas Mexico’s electric vehicle assembly doubled its volume, supported by competitive labor costs and integration within USMCA-compliant supply chains. Canada continues to enhance its ZEV mandate, targeting significant emissions reductions and incentivizing local assembly of light-duty and commercial models. In California, zero-emission vehicles comprised one in four new registrations in the fourth quarter of 2024, reflecting robust state policies and a $1.4 billion commitment to charging infrastructure expansion.

Europe, the Middle East and Africa illustrate a heterogeneous landscape. Western European nations initially led global adoption with substantial subsidy programs, but growth plateaued in 2024 as incentives tapered and supply chain constraints emerged. Production within the European Union stabilized at approximately 2.4 million electric car units, with regulatory frameworks such as the EU’s 2035 CO₂ targets sustaining long-term demand despite near-term market stagnation. Emerging markets in the Gulf Cooperation Council are piloting incentive schemes and public charging networks, signaling nascent interest in alternative propulsion options amidst energy diversification strategies.

Asia-Pacific underscores the centrality of China, which accounted for leading global EV production and domestic consumption in 2024. Beyond China, assembly capacity in Southeast Asian hubs grew by 15%, driven by investments from major Japanese and Korean manufacturers aiming to optimize cost structures and access regional markets. Australia and New Zealand have begun reshaping incentive policies to bolster electric uptake, while technology partnerships are expanding across the Indo-Pacific corridor, underscoring the strategic importance of this region to future supply chain resilience and market diversification.

This comprehensive research report examines key regions that drive the evolution of the Alternative Fuel Vehicle market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing critical company-level insights from leading manufacturers and emerging newcomers driving the alternative fuel vehicle ecosystem’s competitive landscape

Leading battery manufacturers are recalibrating strategies to manage evolving demand and cost structures. LG Energy Solution reported a notable deceleration in electric vehicle battery orders due to the combined effect of new U.S. tariffs and the phase‐out of federal purchase subsidies at the end of September 2025. Despite strong second‐quarter results bolstered by customer stockpiling, the company anticipates a short‐term contraction in EV battery demand and plans to repurpose production lines toward energy storage system deployments to mitigate revenue volatility.

Within the automotive OEM landscape, Volkswagen has disclosed preliminary discussions to shift Audi production to the United States in response to a recent $1.5 billion tariff exposure. This initiative forms part of a broader proposal to exchange domestic manufacturing commitments for tariff concessions, leveraging existing investments in South Carolina and aligning with reciprocal trade incentives. The approach reflects a growing industry trend of localization and tariff mitigation efforts, as OEMs seek to preserve price competitiveness and operational flexibility.

Meanwhile, Chinese manufacturers are consolidating global leadership. BYD surpassed longstanding incumbents to capture approximately 16% of global electric vehicle sales in 2024, overtaking competitors whose market shares have waned despite aggressive pricing strategies. This ascendancy underscores the strategic significance of scale, integrated supply chains, and diversified product portfolios that span passenger, commercial, and emerging mobility segments across international markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Alternative Fuel Vehicle market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADM Archer Daniels Midland Company

- Aemetis Inc.

- Alto Ingredients Inc.

- BP p.l.c.

- Chevron Corporation

- Cosan S.A.

- CropEnergies AG

- Darling Ingredients Inc.

- Diamond Green Diesel LLC

- Gevo Inc.

- Green Plains Inc.

- Henan Tianguan Enterprise Co., Ltd.

- INEOS Enterprises Ltd.

- Jilin Fuel Ethanol Co., Ltd.

- Neste Oyj

- POET LLC

- Renewable Energy Group, Inc.

- Shell plc

- TotalEnergies SE

- UPM Kymmene Corporation

- Valero Energy Corporation

- Varo Energy Group SA

- VERBIO Vereinigte BioEnergie AG

- Vivergo Fuels Limited

Offering actionable recommendations for industry leaders to leverage innovations, regulatory changes and shifting consumer demands within the alternative fuel sector

Industry leaders should accelerate collaborative research and development partnerships to sustain momentum in battery chemistry and fuel cell innovation. By pooling resources and co-investing in cross-sector technology demonstrations, stakeholders can de-risk nascent solutions and expedite time-to-market for game-changing advances. This collaborative approach will also strengthen intellectual property frameworks and facilitate rapid scalability across multiple vehicle applications.

As regulatory environments evolve, companies must adopt agile compliance strategies that anticipate policy shifts and legal challenges. Proactive engagement with regulators, participation in standards-setting forums, and scenario planning for potential waiver reversals will enable organizations to shape favorable outcomes and avoid costly operational disruptions. Equally, developing flexible manufacturing footprints capable of dynamic production allocation across global sites will mitigate tariff exposure and supply chain volatility.

Leveraging customer data analytics and direct-to-consumer engagement models can enhance value propositions in both commercial and personal use cases. Advanced telematics, over-the-air software updates, and integrated mobility services offer opportunities to differentiate offerings, optimize total cost of ownership, and build enduring brand loyalty. Executing pilot deployments of service-oriented solutions, such as subscription-based charging and predictive maintenance, will refine revenue streams and reinforce long-term engagement.

Finally, industry participants should elevate workforce development and stakeholder education initiatives. Cultivating a talent pipeline with expertise in electrification, hydrogen technologies, and digital systems is critical for sustaining growth. Concurrently, transparent communication and training programs will ensure seamless adoption of new vehicle types among fleet operators, service providers and end-users alike, laying the groundwork for holistic ecosystem expansion.

Detailing the research methodology that integrates stakeholder interviews, data validation and analytical frameworks for robust industry insights

This study employs a multifaceted research methodology designed to deliver robust and actionable insights. Primary data was collected through in-depth interviews with executives from leading OEMs, battery manufacturers, infrastructure providers and government agencies, ensuring a comprehensive understanding of strategic priorities and operational challenges across the value chain.

Secondary research encompassed a rigorous review of public filings, regulatory documents, proprietary databases and peer-reviewed literature. Trade association reports, policy notices and patent filings were systematically analyzed to track legislative developments, technology trends and competitive intelligence, enabling triangulation of qualitative and quantitative findings.

Data validation protocols included cross-referencing primary interview inputs with market activity indicators such as production volumes, sales registrations and infrastructure deployments. Advanced analytical frameworks, including scenario analysis, sensitivity testing and supply chain network modeling, were applied to assess risk exposures and evaluate strategic levers under varying market conditions.

The combination of stakeholder insights, authoritative secondary sources and quantitative modeling has yielded an integrated perspective. This approach facilitates the identification of emerging opportunities, potential disruptions and priority actions that align with the strategic objectives of decision-makers across the alternative fuel vehicle ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Alternative Fuel Vehicle market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Alternative Fuel Vehicle Market, by Propulsion Type

- Alternative Fuel Vehicle Market, by Driving Range

- Alternative Fuel Vehicle Market, by Vehicle Type

- Alternative Fuel Vehicle Market, by End Use

- Alternative Fuel Vehicle Market, by Region

- Alternative Fuel Vehicle Market, by Group

- Alternative Fuel Vehicle Market, by Country

- United States Alternative Fuel Vehicle Market

- China Alternative Fuel Vehicle Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing key findings and future outlook to underscore the strategic importance and investment potential of the alternative fuel vehicle market

The insights presented underscore a pivotal moment in the alternative fuel vehicle journey, where technological breakthroughs, evolving policy frameworks and real-world operational lessons converge. As battery technologies continue to mature and hydrogen pathways gain credibility, the market is poised for further segmentation and specialization, with new niches emerging across propulsion types, driving ranges and end-use applications.

Regional dynamics reveal differentiated trajectories, shaped by policy incentives, manufacturing footprints and consumer sentiments. In North America, tariff considerations and supply chain localization call for strategic agility, while Europe and Asia Pacific leverage regulatory clarity and scale economies to foster resilient growth. Now, more than ever, companies must embrace collaborative innovation, flexible production strategies and data-driven customer engagement to secure their positions.

Ultimately, the road ahead will demand an integrated approach that balances risk management with bold investment in next-generation powertrains, charging infrastructure and digital services. Organizations that navigate this complex environment with foresight, adaptability and a relentless focus on value creation will define the future contours of sustainable mobility and drive the global transition to cleaner transportation.

Encouraging engagement with Associate Director of Sales and Marketing to acquire the full alternative fuel vehicle market research report for strategic advantage

Interested stakeholders are invited to reach out to Ketan Rohom, Associate Director of Sales & Marketing, to explore comprehensive insights and bespoke analyses tailored to strategic objectives. Engage directly with Ketan to discuss how this in-depth study can inform your roadmap, mitigate emerging risks, and position your organization for sustained leadership in the rapidly evolving alternative fuel vehicle domain. Secure your access to the full report today to gain a definitive competitive edge, leveraging expert guidance and actionable data that will drive informed decision-making and long-term value creation.

- How big is the Alternative Fuel Vehicle Market?

- What is the Alternative Fuel Vehicle Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?