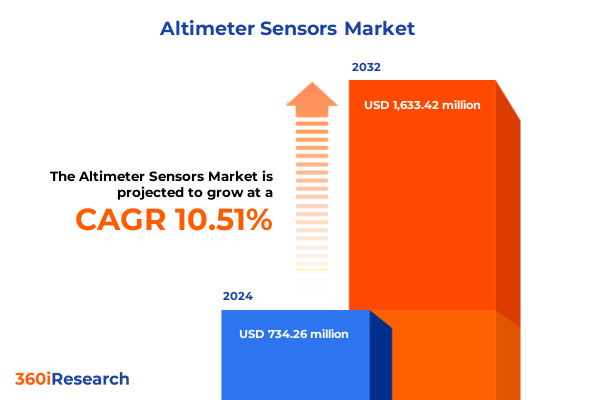

The Altimeter Sensors Market size was estimated at USD 812.38 million in 2025 and expected to reach USD 904.08 million in 2026, at a CAGR of 12.33% to reach USD 1,833.42 million by 2032.

Pioneering precision altimeter sensor solutions are reshaping navigation, automation, and monitoring applications across a wide range of industries

Precision altimeter sensors are specialized instruments designed to accurately determine an object’s height relative to a specified reference point, harnessing various physical principles such as barometric pressure, radio wave reflection, and laser pulse travel time. These instruments range from barometric or pressure altimeters that infer altitude from atmospheric pressure variations, to radar altimeters that measure the time taken for radio waves to bounce back from the surface beneath an aircraft. By converting physical phenomena into reliable altitude data, these sensors underpin critical functions in navigation, safety systems, and automation across an array of sectors

Rapid technological convergence and regulatory challenges are driving fundamental transformation across altimeter sensor design and application landscapes

In recent years, the altimeter sensor landscape has undergone transformative technological shifts driven by miniaturization, enhanced integration, and regulatory scrutiny. Advancements in Micro-Electro-Mechanical Systems (MEMS) have enabled barometric sensors to achieve unprecedented accuracy while consuming minimal power, facilitating deployment in compact consumer wearables and medical devices. Bosch Sensortec’s BMP581 exemplifies this trend, delivering centimeter-level altitude resolution and deep standby current reductions that extend battery life in downstream applications Transitioning from hardware innovation to system-wide integration, manufacturers are embedding AI-ready functionalities and network connectivity directly into sensor modules, allowing real-time data fusion with GPS, inertial measurement units, and cloud-based analytics platforms. Moreover, ultrafast LiDAR-based altimeters increasingly capture high-resolution atmospheric profiles, ushering in new capabilities for aerospace weather sensing and advanced navigation systems.

Evolving trade policies and US 2025 tariff measures have profoundly reshaped altimeter sensor supply chains and cost structures

The United States’ 2025 tariff regime targeting semiconductors, precision sensor modules, and key materials has had a profound cumulative impact on altimeter sensor supply chains and cost structures. By imposing higher duties on components sourced from specific regions, original equipment manufacturers and aftermarket suppliers have faced elevated procurement expenses and extended lead times, compelling many to reassess sourcing strategies and production footprints. Concurrently, components subject to new tariff brackets have spurred accelerated feasibility studies into vertical integration, with leading players evaluating in-house manufacturing of critical subassemblies to mitigate duty exposure. In parallel, companies have deepened collaboration between supply and design teams to qualify duty-exempt alternatives and redesign product architectures for tariff efficiency. From a financial standpoint, organizations have adjusted cost models to accommodate incremental duty expenses while preserving margin targets. Looking forward, dynamic sourcing strategies, diversified supplier networks, and agile manufacturing processes will be essential for navigating the evolving trade environment and safeguarding operational resilience

Nuanced market segmentation reveals distinct value chains and application-specific dynamics in distribution, usage, and technology preferences

Market segmentation in the altimeter sensor domain reveals nuanced dynamics across distribution channels, application verticals, end-user industries, and enabling technologies. In terms of distribution, original equipment manufacturers and aftermarket suppliers operate distinct value chains, with OEMs focusing on integrated system deployments and aftermarket channels prioritizing retrofit and replacement solutions. Applications span from automotive advanced driver-assistance systems and parking assistance platforms to consumer electronics like smartphones and wearables, where barometric altimeters deliver fitness and indoor localization functionalities. In healthcare settings, altimeter sensors play critical roles in diagnostic instrumentation and patient monitoring systems, while industrial automation leverages factory automation and process control implementations. End users mirror these application spheres-automotive OEMs, consumer device manufacturers, healthcare providers, and industrial operators-each imposing unique performance, reliability, and compliance requirements. Technology segmentation highlights the continued relevance of radar altimeters for low-altitude aviation landing aids, LiDAR for atmospheric sensing and high-precision mapping, and ultrasonic sensors for short-range altitude detection in robotics and industrial platforms.

This comprehensive research report categorizes the Altimeter Sensors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Distribution Channel

- Application

- End User

Regional market dynamics reflect divergent regulatory frameworks, technology adoption rates, and supply chain strengths across Americas, EMEA, and Asia-Pacific

Regional insights underscore how divergent regulatory frameworks, technology adoption rates, and supply-chain strengths shape altimeter sensor markets across the Americas, Europe, Middle East & Africa (EMEA), and Asia-Pacific. In the Americas, robust defense and aerospace investment underpins demand for radar altimeters, exemplified by Honeywell’s Next-Generation APN-209 contract awarded by the U.S. Army to enhance operational readiness in challenging environments Transitioning to EMEA, the deployment of 5G telecommunications has prompted regulatory bodies such as Eurocontrol to assess and mitigate potential radar altimeter interference, with continent-wide guidelines balancing spectrum allocation and flight safety considerations Meanwhile, the Asia-Pacific region has emerged as a high-growth hub for altimeter sensor integration, driven by rapidly expanding automotive electronics, consumer devices, and industrial IoT deployments, positioning APAC at the forefront of adoption and innovation

This comprehensive research report examines key regions that drive the evolution of the Altimeter Sensors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading innovators are advancing altimeter sensor performance, reliability, and integration through strategic partnerships and cutting-edge technology breakthroughs

Key industry incumbents are advancing altimeter sensor performance, reliability, and integration through strategic technology development and partnerships. Bosch Sensortec’s BMP581 barometric pressure sensor establishes a new benchmark for accuracy and ultra-low power consumption in mobile and IoT devices, enabling centimeter-level altitude detection for fitness tracking, indoor localization, and drone stability applications Honeywell continues to broaden its aerospace footprint with the Next-Generation APN-209 radar altimeter system, replacing legacy units on Army aircraft and delivering enhanced environmental resilience and supply-chain risk mitigation through a common-core architecture Recognizing the strategic importance of MEMS technologies, STMicroelectronics has embarked on a transformative acquisition of NXP’s MEMS sensor business, reinforcing its position across automotive safety and industrial applications and unlocking synergies in scalable IDM-based sensor manufacturing

This comprehensive research report delivers an in-depth overview of the principal market players in the Altimeter Sensors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ametek, Inc.

- Amphenol Corporation

- Baumer Group

- Bosch Sensortec GmbH

- Honeywell International, Inc.

- Infineon Technologies AG

- Meggitt PLC

- Murata Manufacturing Co., Ltd.

- Murata Manufacturing Co., Ltd.

- NXP Semiconductors N.V.

- Paroscientific

- Safran SA

- SICK AG

- STMicroelectronics N.V.

- TE Connectivity Ltd.

- Texas Instruments Incorporated

Strategic imperatives for industry leaders include investing in innovation, optimizing supply networks, and strengthening regulatory collaboration to secure competitive advantage

To maintain a competitive edge in the evolving altimeter sensor landscape, industry leaders should prioritize targeted investments in sensor innovation while concurrently optimizing supply chain resilience. Establishing dedicated R&D programs focused on MEMS miniaturization and AI-enabled signal processing will drive the next wave of performance breakthroughs, as demonstrated by Bosch’s BMP581 achievements Furthermore, cultivating dynamic sourcing strategies that diversify supplier networks and incorporate duty-exempt alternatives will mitigate the cost volatility introduced by recent tariff policies, aligning with the adaptive approaches outlined in leading supply-chain analyses In parallel, proactive engagement with regulatory bodies and participation in standards committees will help shape spectrum management and interference mitigation frameworks, ensuring compliance and safeguarding operational continuity. Finally, adopting modular design principles and open-architecture platforms will enable seamless integration across applications and geographies, maximizing return on technical investments and accelerating time to market for differentiated sensor solutions.

A robust research framework combining primary stakeholder engagement, secondary data analysis, and empirical validation ensures rigorous market intelligence

This analysis is grounded in a rigorous research framework combining primary and secondary data collection with empirical validation. Primary insights were obtained through in-depth interviews and consultations with senior executives, design engineers, and supply-chain managers across leading sensor manufacturers, avionics integrators, and end-user organizations. Secondary research encompassed a comprehensive review of technical whitepapers, regulatory publications, and industry periodicals, supplemented by a systematic evaluation of patent filings and acquisition announcements. Data triangulation and cross-verification techniques were applied to reconcile discrepancies, while trend analysis and scenario modeling informed the assessment of tariff impacts and regional adoption patterns. Quality control was maintained through iterative review cycles and peer corroboration, ensuring the integrity and reliability of the strategic insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Altimeter Sensors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Altimeter Sensors Market, by Technology

- Altimeter Sensors Market, by Distribution Channel

- Altimeter Sensors Market, by Application

- Altimeter Sensors Market, by End User

- Altimeter Sensors Market, by Region

- Altimeter Sensors Market, by Group

- Altimeter Sensors Market, by Country

- United States Altimeter Sensors Market

- China Altimeter Sensors Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Comprehensive insights converge to highlight the critical role of advanced altimeter sensors in empowering future-ready navigation, automation, and monitoring systems

In conclusion, the convergence of advanced MEMS technologies, AI-driven integration strategies, and evolving regulatory landscapes is redefining the altimeter sensor market. From the precision enhancements embodied by cutting-edge barometric sensors to the system-level reliability delivered by next-generation radar altimeters, stakeholders across automotive, aerospace, consumer electronics, healthcare, and industrial automation stand to benefit from tailored sensor innovations. Navigating the cumulative effects of tariffs and spectrum management challenges requires agile sourcing, collaborative policy engagement, and modular design approaches. By synthesizing segmentation and regional insights with actionable recommendations, this analysis equips decision makers with the knowledge needed to harness emerging opportunities and mitigate risks in a rapidly transforming market environment.

Unlock deep strategic advantage by engaging with our Associate Director of Sales & Marketing to secure your comprehensive altimeter sensors market intelligence report

To explore how this comprehensive analysis can inform strategic decision making and provide actionable insights tailored to your organization’s needs, please reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the full altimeter sensors market research report. Engage with Ketan to discuss customized solutions, schedule a briefing, and ensure your team has the intelligence required to navigate evolving technology landscapes and competitive pressures.

- How big is the Altimeter Sensors Market?

- What is the Altimeter Sensors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?