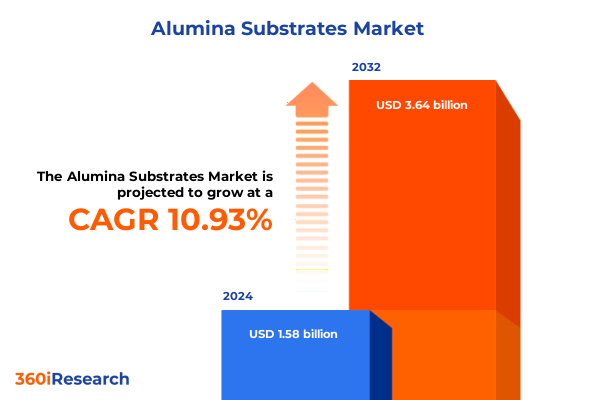

The Alumina Substrates Market size was estimated at USD 1.75 billion in 2025 and expected to reach USD 1.94 billion in 2026, at a CAGR of 10.99% to reach USD 3.64 billion by 2032.

Exploring the critical role of alumina substrates in modern electronics innovation and how this material underpins performance and reliability

Alumina substrates have emerged as a foundational element in the advancement of electronic systems, bridging the gap between material science innovation and the rigorous performance demands of modern devices In recent years, heightened miniaturization requirements, coupled with the relentless pursuit of improved thermal management, have propelled these ceramic platforms to the forefront of engineering discussions From high-frequency telecom modules to ruggedized aerospace circuits, alumina substrates play an indispensable role in ensuring signal integrity, mechanical robustness, and thermal stability As end-use industries continue to push the boundaries of speed and power density, the inherent insulating properties and superior thermal conductivity of alumina ceramics offer a robust solution that addresses critical design challenges

At the same time, global supply chains have undergone profound shifts, underscoring the strategic value of reliable raw material sourcing and manufacturing agility Strategic stakeholders are now tasked with balancing cost pressures against the imperative to maintain strict quality standards and uninterrupted production flows Consequently, understanding the evolving landscape of alumina substrate applications and supply dynamics is more crucial than ever This introduction sets the stage for a detailed exploration of transformative market shifts, policy impacts, segmentation perspectives, and region-specific trends that collectively shape the future trajectory of this vital materials sector

Revealing the transformative shifts in market dynamics for alumina substrates driven by technological breakthroughs and evolving end-use applications

The alumina substrates market has witnessed a series of transformative shifts, driven by breakthroughs in fabrication techniques and the growing complexity of electronic architectures Historically, traditional planar components dominated design philosophies, yet today's advanced systems demand three-dimensional interposers and multi-layer configurations enabled by high temperature co fired ceramics These manufacturing innovations have not only enhanced thermal performance but also reduced interconnect parasitics, enabling higher frequency operation without sacrificing signal clarity

Moreover, the proliferation of electric vehicles and renewable energy systems has ushered in new thermal management imperatives, prompting engineers to favor substrates with enhanced thermal conductivity. Concurrently, the integration of embedded passive components and heterogeneous integration approaches has accelerated the adoption of low temperature co fired ceramics for sensitive sensor applications and compact module designs. As consumer electronics continue to shrink while packing greater functionality, standard substrates are now being supplemented by ultra-thin variants to accommodate space-constrained platforms. These shifts underscore a sector in flux, where material attributes are being continuously optimized to meet evolving performance benchmarks

Assessing the cumulative impact of the 2025 United States tariffs on alumina substrates across supply chains, production costs, and strategic sourcing decisions

The introduction of new United States tariffs in 2025 has exerted a material influence on the economics of alumina substrate production and sourcing While intended to bolster domestic manufacturing, these measures have also prompted importers to reevaluate their global procurement strategies At the outset, incremental duties on ceramic substrates sourced from key exporting nations led to a noticeable uptick in landed costs, compelling downstream manufacturers to absorb higher input expenses or seek alternative suppliers with more favorable trade terms

In response, certain industry participants have pursued nearshoring initiatives, forging partnerships with regional producers to mitigate tariff exposure and compress lead times. However, the limited capacity of domestic facilities, particularly for high temperature co fired ceramics and ultra-thin substrate formats, has introduced new supply constraints. These dynamics have, in turn, heightened the importance of strategic inventory management and collaborative supply chain planning. Looking ahead, the cumulative impact of these tariffs will continue to reverberate across production roadmaps and investment decisions, underscoring the need for proactive risk assessments and agile sourcing frameworks

Deriving key segmentation insights across product types, end-use industries, applications, thicknesses, product forms, and sales channels to guide strategic positioning

A nuanced understanding of the alumina substrates landscape requires a deep dive into the distinct characteristics that define each product segment. Based on type, the market encompasses high temperature co fired ceramics, which excel in applications demanding superior heat resistance, contrasted with low temperature co fired ceramics that enable the integration of embedded passive elements integral to miniaturized electronics. High thermal conductivity variants address escalating power density challenges, while standard substrates provide a cost-effective solution for legacy module architectures. By aligning material properties with thermal, mechanical, and electrical performance criteria, OEMs can tailor substrate selections to the precise demands of their device designs

Delving into end-use industry segmentation, aerospace and defense sectors prioritize reliability under extreme conditions, whereas consumer electronics emphasize form factor and cost efficiencies. Automotive electronics demand components that withstand thermal cycling and mechanical stress, and industrial electronics require substrates capable of long-term stability in harsh environments. Medical electronics focus on biocompatibility and high purity, while telecommunications applications necessitate substrates with stable dielectric constants for signal integrity. Similarly, application-based distinctions reveal diverse substrate requirements, from heat sinks that leverage high thermal conductivity to PCB substrates optimized for mass-production reliability. Medium, thick, thin, and ultra-thin thickness categories each carry unique fabrication considerations that impact thermal performance and assembly processes. Product form variations in disc, plate, and sheet configurations further influence handling and processing efficiencies. Finally, sales channels split between direct sales, which foster deeper client collaboration, and distributor sales, which offer broader market reach and inventory convenience. By synthesizing these segmentation layers, stakeholders can identify white space opportunities and refine their value propositions

This comprehensive research report categorizes the Alumina Substrates market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Category

- Material Purity

- Shape

- Manufacturing Process

- Application

- End-Use Industry

- End User

- Sales Channel

Examining the distinctive regional trends, regulatory environments, and growth drivers shaping the alumina substrates market across the Americas, EMEA, and Asia-Pacific markets

Regional markets for alumina substrates exhibit distinct growth trajectories shaped by localized demand drivers and regulatory landscapes In the Americas, a robust shift toward domestic semiconductor and power electronics manufacturing has elevated the strategic priority of regional supply resilience. This trend is intensifying investments in North American production capabilities, particularly for critical substrate types that support electric vehicles and renewable energy inverters. Conversely, EMEA markets are negotiating a dual imperative of regulatory compliance and competitive cost structures, with significant deployment of high temperature co fired ceramics in aerospace and defense projects across the European Union

Asia-Pacific continues to dominate both supply and consumption, driven by the concentration of consumer electronics manufacturing hubs and rapidly expanding 5G infrastructure deployments. China, Japan, South Korea, and Taiwan are at the forefront of substrate innovation, investing heavily in advanced manufacturing platforms that optimize throughput and yield. Meanwhile, Southeast Asian nations are emerging as alternative sourcing destinations, capitalizing on lower labor costs and burgeoning industrial ecosystems. Each region’s unique regulatory environment, investment incentives, and market maturity levels will dictate the speed and scale of future capacity expansions, underscoring the importance of region-specific go-to-market strategies

This comprehensive research report examines key regions that drive the evolution of the Alumina Substrates market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the strategic initiatives, portfolio expansions, and competitive positioning of leading players in the global alumina substrates industry for competitive intelligence

Leading participants in the alumina substrates sector are deploying strategic initiatives to enhance their competitive positioning and capture emerging market opportunities Several global ceramic substrate manufacturers have expanded their product portfolios to include high thermal conductivity and ultra-thin variants, responding directly to customer demand for enhanced thermal management in high power density applications. Others have established joint ventures or acquired regional specialists to bolster their presence in key geographies and reduce tariff-related risks. Collaborative engagements with electronics OEMs are increasingly common, enabling co-development of tailored substrate materials that meet stringent application requirements

Operational excellence programs remain a priority, with companies investing in next-generation production equipment to increase yield and reduce cycle times. Quality assurance frameworks are being fortified through ISO certifications and rigorous material characterization protocols, addressing end-use industry requirements for traceability and reliability. Simultaneously, supply chain digitization efforts are gaining traction, as real-time visibility tools allow stakeholders to monitor inventory levels, shipment statuses, and demand signals across dispersed networks. These collective moves illustrate how top-tier vendors are leveraging technological, geographic, and process innovations to maintain market leadership and unlock new streams of revenue

This comprehensive research report delivers an in-depth overview of the principal market players in the Alumina Substrates market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Substrate Microtechnology Corporation

- ANTS Ceramics Pvt Ltd

- Aremco Products, Inc.

- Asahi Glass Co., Ltd.

- Carborundum Universal Limited

- CeramTec GmbH

- Chaozhou Three-Circle (Group) Co., Ltd.

- CoorsTek, Inc.

- Corning Incorporated

- Dowa Power Device Co., Ltd.

- Du-Co Ceramics Company

- ICP Technology Co., Ltd.

- JAPAN FINE CERAMICS CO.,LTD.

- KOA Corporation

- Kyocera Corporation

- LEATEC Fine Ceramics Co., Ltd

- Maruwa Co., Ltd.

- Merck KGaA

- MTI Corporation

- Murata Manufacturing Co., Ltd.

- NEO Technology Solutions

- NGK INSULATORS, LTD.

- Nikko Company

- Nippon Carbide Industries Co., Inc.

- Niterra Co., Ltd.

- Ortech Advanced Ceramics

- Rogers Corporation

- TDK Corporation

- Toshiba Materials Co., Ltd.

- TTM Technologies Inc.

- XIAMEN MASCERA TECHNOLOGY CO.,LTD.

- Yokowo Co., Ltd.

Outlining actionable recommendations for industry leaders to optimize supply chain resilience, capitalize on emerging applications, and navigate tariff challenges

Industry leaders must adopt a multifaceted approach to thrive in the evolving alumina substrates landscape First, building flexible supply chain architectures will be critical; this involves diversifying supplier bases across regions, investing in nearshoring partnerships, and implementing advanced inventory optimization systems to cushion against tariff volatility. Second, collaborative product development with end-users can accelerate time-to-market for novel substrate formulations, ensuring that R&D investments are closely aligned with the thermal, electrical, and mechanical requirements of emerging applications. Third, integrating sustainability considerations into manufacturing processes-such as sourcing eco-friendly alumina powders and reducing energy consumption in sintering operations-will resonate with corporate responsibility goals and regulatory mandates

Furthermore, organizations should invest in digital transformation initiatives, including predictive analytics and real-time production monitoring, to drive continuous improvement in yield and throughput. Cultivating strategic alliances with equipment vendors and research institutions can foster innovation ecosystems that deliver incremental performance gains. Finally, maintaining a vigilant stance on geopolitical developments and trade policies will help executives anticipate and respond to external risks, ensuring that strategic planning remains both proactive and resilient

Detailing the rigorous research methodology employed to analyze secondary sources, conduct expert interviews, and validate key findings in the alumina substrates sector

The research methodology underpinning this report integrates a robust combination of secondary research, expert interviews, and data triangulation to ensure accuracy and comprehensive coverage Initial insights were gathered through in-depth analysis of publicly available technical papers, patent databases, and regulatory filings to map the current state of alumina substrate technologies. This was complemented by targeted interviews with materials scientists, purchasing managers at leading electronic manufacturers, and senior executives from prominent substrate producers to validate emerging trends and strategic priorities

Quantitative data points were cross-verified through multiple sources to mitigate bias and reconcile discrepancies, while qualitative perspectives were synthesized to illuminate the strategic rationale behind key market moves. Regional market sizing and segmentation frameworks were constructed by correlating end-use electronics demand forecasts with substrate consumption patterns. Finally, all findings were subjected to a rigorous internal peer review process, ensuring that insights are credible, actionable, and aligned with the needs of decision-makers seeking to navigate the dynamic alumina substrates sector

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Alumina Substrates market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Alumina Substrates Market, by Type

- Alumina Substrates Market, by Category

- Alumina Substrates Market, by Material Purity

- Alumina Substrates Market, by Shape

- Alumina Substrates Market, by Manufacturing Process

- Alumina Substrates Market, by Application

- Alumina Substrates Market, by End-Use Industry

- Alumina Substrates Market, by End User

- Alumina Substrates Market, by Sales Channel

- Alumina Substrates Market, by Region

- Alumina Substrates Market, by Group

- Alumina Substrates Market, by Country

- United States Alumina Substrates Market

- China Alumina Substrates Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 1749 ]

Concluding insights that reinforce the strategic importance of alumina substrates and the imperative for stakeholders to adapt in a rapidly evolving technology landscape

In summary, alumina substrates stand at the nexus of material science and electronic innovation, offering unparalleled thermal and electrical performance characteristics that are indispensable for advanced device architectures. The market is being reshaped by a confluence of factors, including evolving fabrication technologies, shifting trade policies such as the 2025 United States tariffs, dynamic end-use industry requirements, and region-specific regulatory landscapes As stakeholders chart their strategic roadmaps, a clear focus on segmentation nuances, regional dynamics, and competitive positioning will be essential to unlock sustainable growth and mitigate operational risks

By synthesizing these multifaceted insights, executives and technical leaders can make informed decisions that align production capabilities with application demands, safeguard supply chain integrity in the face of tariff fluctuations, and drive continuous innovation through collaborative ecosystems The conclusion underscores that proactive strategy development-rooted in rigorous research and market intelligence-will be the key differentiator for companies looking to excel in the rapidly advancing alumina substrates arena

Engage with Ketan Rohom for exclusive access to in-depth market intelligence and secure your comprehensive alumina substrates market report today

Are you ready to transform your market approach and gain a competitive edge in the alumina substrates space Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to unlock comprehensive and actionable insights that will guide your strategic decisions Tailored to address the most pressing industry challenges, this detailed report equips you with the intelligence needed to optimize operations, mitigate risks, and capitalize on emerging growth avenues Connect now to secure your copy and begin leveraging critical data for sustainable success

- How big is the Alumina Substrates Market?

- What is the Alumina Substrates Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?