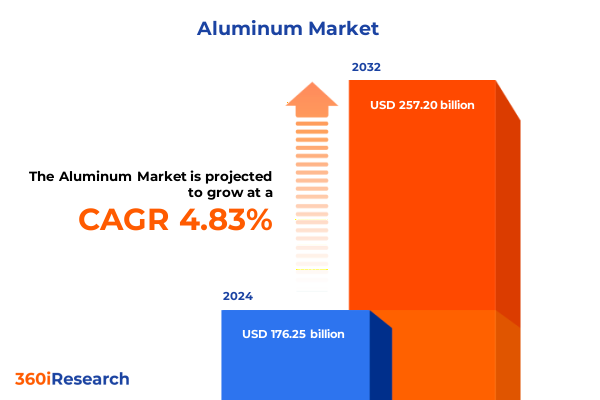

The Aluminum Market size was estimated at USD 184.43 billion in 2025 and expected to reach USD 193.06 billion in 2026, at a CAGR of 4.86% to reach USD 257.20 billion by 2032.

Unveiling the Dynamic Forces Shaping the Global Aluminum Market and Its Strategic Significance for Industry Stakeholders in an Era of Transition

Aluminum has emerged as a cornerstone material in modern industrial applications, owing to its unique combination of strength, malleability, and low density. Its lightweight characteristics have made it indispensable in automotive and aerospace sectors striving to improve fuel efficiency and reduce emissions. In particular, the shift toward electric vehicles has heightened the demand for aluminum components to offset the weight of battery systems and enhance driving range. Meanwhile, high-strength aluminum alloys continue to replace heavier materials in aircraft structures, contributing to both cost savings and environmental targets. These developments underscore aluminum’s critical role as an enabler of industry transformation.

Unlocking Key Transformational Trends and Technological Innovations Driving Unprecedented Evolution Across the Aluminum Industry Ecosystem

The aluminum industry is undergoing profound transformation driven by emerging low-carbon technologies and evolving regulatory mandates. Primary producers are investing in inert-anode and renewable-powered smelting, aiming to slash greenhouse gas emissions associated with traditional Hall-Héroult processes. Concurrently, recycling initiatives are scaling up, with global secondary production capacity expected to exceed 15 million tons annually by 2027, emphasizing circularity and resource efficiency. This pivot toward greener production is creating new competitive dynamics, positioning low-carbon aluminum as a premium product in decarbonizing supply chains.

Advancements in digitalization and automation are further reshaping operational paradigms across the value chain. The adoption of IIoT sensors, cloud-based analytics, and digital twins is enabling real-time monitoring of potlines and extrusion presses, optimizing energy consumption and predicting maintenance needs before failures occur. Industry 4.0 deployments have demonstrated up to 30% reductions in downtime and waste, while improving quality assurance. As producers harness big data and AI-driven insights, they are better equipped to meet fluctuating demand, navigate supply chain disruptions, and maintain stringent quality standards.

Analyzing the Far-Reaching Cumulative Consequences of Recent United States Tariff Actions on Aluminum Trade Dynamics and Market Structures

In March 2025, the United States terminated longstanding tariff exclusions and imposed a 25% ad valorem tariff on aluminum imports from major trading partners, including Canada, Mexico, the EU, and the UK. This policy shift marked the first substantial expansion of tariffs under the 2018 Section 232 framework, intended to protect domestic producers by making imported metal less price-competitive. The abrupt reinstatement of duties on previously exempt allies introduced uncertainty for downstream industries reliant on cross-border supply chains.

Barely three months later, in June 2025, the administration further escalated the duty rate from 25% to 50% ad valorem across most sources, while granting specific allowances under a new U.S.–UK Economic Prosperity Deal. The move aimed to reinforce national security arguments and bolster domestic output, yet it also intensified cost pressures for manufacturers using unwrought and semi-finished aluminum. The heightened tariff burden reshaped price benchmarks, raising the Midwest premium to record levels.

These layered tariffs have had a cascading effect on domestic pricing and labor markets. U.S. producers like Century Aluminum and recyclers such as Matalco have benefited from elevated premiums, with scrap imports surging over 30% in early 2025 as recyclers compete for feedstock. However, many downstream users-from automotive parts suppliers to packaging firms-report higher input costs and supply instability. Industry leaders warn of potential job losses, estimating tens of thousands of positions at risk across primary and secondary sectors, as companies recalibrate sourcing strategies or relocate operations.

On the international front, the EU and Canada enacted retaliatory tariffs within days of the U.S. measures, targeting approximately $57 billion in American exports. The EU’s two-phase countermeasure rollout began on April 1 and Canada’s actions took effect on March 13, directly impacting industries from agriculture to machinery. These tit-for-tat duties have complicated diplomatic relations and prompted calls for renewed multilateral engagement to stabilize trade flows.

Illuminating Critical Market Segmentation Perspectives That Reveal Nuanced Demand Patterns and Strategic Growth Opportunities in Aluminum

The aluminum market’s complexity is underscored by multiple lenses through which demand and supply must be examined. Based on type, the industry spans both cast aluminum, favored for its fluidity and intricate shapes, and wrought aluminum, prized for its mechanical strength and workability in extrusion and rolling operations. This dichotomy reflects distinct production pathways and value chains, shaping how raw material procurement and processing investments are prioritized.

Viewed through the lens of form, the material takes on diverse downstream shapes-from bars and wires essential for electrical and structural uses to cans and foils dominating the packaging realm, ingots serving as standardized trading units, and expansive sheets employed in cladding and automotive panels. Each form factor carries unique fabrication demands, inventory practices, and end-user requirements, influencing capital allocation and supply chain resilience.

Source segmentation further differentiates the market between aluminum scrap, which supports the burgeoning circular economy through secondary smelting, and bauxite-derived primary metal, which remains critical for meeting scale requirements despite higher energy inputs. This balance between primary and secondary feedstock underpins strategic decisions around facility upgrades and raw material security.

Grades of aluminum bifurcate into alloyed compositions-engineered to deliver enhanced strength, corrosion resistance, or conductivity for applications from aerospace to electrical grids-and high-purity variants, which command premium pricing in semiconductor, medical, and vacuum-forming applications. Processing methods add another layer of distinction, encompassing die-casting for precision parts, extrusion for tubular and profile geometries, forging for structural components, and rolling for flat products.

Finally, application segmentation reveals that aluminum’s versatility spans critical end markets: aerospace and defense, where performance and weight savings are paramount; building and construction, capitalizing on durability and recyclability; electronics, leveraging thermal and electrical conductivity; healthcare, relying on biocompatibility and sterilization; packaging, benefiting from barrier properties and infinite recyclability; and transportation, where lightweighting contributes to energy efficiency. Together, these segmentation dimensions illuminate the multifaceted nature of the aluminum landscape and guide targeted strategies for market participants.

This comprehensive research report categorizes the Aluminum market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Source

- Grade

- Processing Method

- Application

Deciphering Regional Variations and Growth Drivers Across the Americas Europe Middle East & Africa and Asia Pacific Aluminum Markets

Regional dynamics in the aluminum market exhibit distinct characteristics and growth drivers. In the Americas, the production landscape is anchored by the United States and Canada, which collectively supply a significant portion of North America’s demand. U.S. domestic smelting capacity, although constrained by high energy costs and environmental regulations, has seen a modest resurgence courtesy of tariff protections and investments in recycling infrastructure. Canada’s aluminum corridor benefits from abundant hydroelectric power, enabling cost-competitive primary production that remains vital for the region’s downstream industries.

Across Europe, the Middle East, and Africa, the aluminum sector is shaped by a blend of mature Western European producers and emerging Middle Eastern smelters, many of which leverage low-cost energy sources. European end users grapple with stringent decarbonization mandates, driving adoption of recycled aluminum and low-carbon production methods, while regional trade barriers and logistic networks influence import flows. In Africa, nascent bauxite mining projects are expanding, setting the stage for vertical integration opportunities that could reshape supply chains by the decade’s end.

In the Asia-Pacific, China’s role is emblematic of scale and transition. Having approached its government-imposed production cap of 45 million tons, Chinese producers are redirecting focus toward modernizing facilities, shifting capacity to renewables-rich provinces, and expanding recycling operations. Meanwhile, Southeast Asian nations and India are ramping up both primary and secondary capacities to meet burgeoning domestic demand, supported by favorable energy policies and foreign investment. This regional growth hub continues to dictate pricing benchmarks and innovation trajectories worldwide.

This comprehensive research report examines key regions that drive the evolution of the Aluminum market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Global Aluminum Producers and Emerging Innovators Shaping Competitive Dynamics and Strategic Alliances in the Sector

The competitive landscape is dominated by a handful of global producers complemented by agile regional players. Leading the pack is Aluminum Corporation of China Limited, better known as Chalco, which has leveraged state support and local resource integration to secure its position at the top of global output rankings. China Hongqiao Group follows closely, distinguished by its scale-driven expansion and strategic shift toward hydropower-based smelting. Russia’s Rusal and India’s Vedanta contribute substantial volumes, each navigating evolving geopolitical and environmental headwinds.

Exporters such as Rio Tinto and Norsk Hydro bring a differentiated portfolio, with Hydro’s recent decision to trim capital spending in response to trade uncertainties reflecting the heightened emphasis on operational flexibility. These companies have also prioritized low-carbon and value-added product lines to counter the commodity price cycle’s volatility and align with end-user decarbonization targets. European integrated majors like Alcoa’s global divisions continue to benefit from tariff-induced premium pricing in North America, while simultaneously exploring joint ventures focused on green aluminum production.

In parallel, a growing contingent of specialized recyclers and smelter-operators is carving out niches in secondary aluminum, capitalizing on the surge in scrap imports driven by tighter primary metal supply. These agile players have demonstrated resilience amid fluctuating feedstock costs, leveraging digitalized sorting and advanced melt-shop processes to produce certified low-carbon grades. Together, this mosaic of incumbents and newcomers shapes a dynamic competitive arena where scale, sustainability credentials, and innovation capacity define market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aluminum market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alcoa Corporation

- Aluminium Bahrain B.S.C.

- Aluminum Corporation of China Limited

- American Elements

- Arconic Corporation

- Bharat Aluminium Company Ltd.

- Century Aluminum Company Ltd.

- China Hongqiao Group Co., Ltd.

- Constellium SE

- East Hope Group

- Emirates Global Aluminium PJSC

- Hindalco Industries Ltd.

- Jindal Aluminium Limited

- JW Aluminum Holding Corp.

- Kaiser Aluminum Corporation

- Logan Aluminum Inc.

- Norsk Hydro ASA

- Rio Tinto PLC

- Tomago Aluminium

- Tredegar Corporation

- UACJ Corporation

- Vedanta Limited

Empowering Industry Leaders with Strategic Roadmap Recommendations to Navigate Challenges and Capitalize on Aluminum Market Opportunities

Industry leaders must prioritize decarbonization by investing in technologies such as inert anodes, renewable energy integration, and closed-loop recycling systems to meet tightening environmental regulations and capture emerging premium markets. Strategic partnerships with energy providers and technology firms can accelerate these initiatives and distribute capital requirements across broader ecosystems.

Strengthening supply chain resilience is also critical. Organizations should diversify feedstock sourcing by balancing primary bauxite procurement with expanded scrap acquisition, while deploying advanced traceability platforms to monitor origin, grade, and carbon intensity across multiple suppliers. This dual approach mitigates risks linked to geopolitical volatility and tariff shifts.

Digital transformation must be embedded across operational processes, from furnace and potline optimization using predictive analytics to real-time quality control in extrusion and rolling facilities. By harnessing IIoT and AI insights, companies can reduce downtime, minimize energy consumption, and enhance yield. Allocating resources toward workforce training will ensure seamless adoption of these technologies.

Finally, maintaining proactive engagement with policymakers and industry associations will help firms navigate evolving trade landscapes and shape frameworks that support sustainable growth. Transparent reporting of environmental and social metrics will bolster stakeholder trust and strengthen competitive positioning in markets where customers increasingly weigh ESG performance in procurement decisions.

Outlining Rigorous Research Methodology and Analytical Frameworks That Ensure Robust Insights into the Evolving Aluminum Market

This research integrates both qualitative and quantitative approaches to ensure comprehensive coverage of the aluminum value chain. Primary data were gathered through in-depth interviews with executives and technical leaders across upstream and downstream segments, complemented by structured surveys capturing operational metrics and forward-looking perspectives.

Secondary sources included trade association reports, regulatory filings, and press releases, triangulated with proprietary databases tracking production capacity, energy consumption, and trade flows. Geopolitical and policy developments were monitored continuously to assess their implications for tariff structures, supply security, and investment incentives.

Analytical frameworks such as SWOT, PESTEL, and Porter’s Five Forces were employed to evaluate market dynamics, while scenario modeling assessed potential impacts of regulatory changes and technological adoption. Rigorous data validation protocols, including cross-referencing multiple sources and expert peer reviews, underpinned the study’s credibility.

Finally, findings were synthesized into actionable insights, with strategic implications delineated for different stakeholder groups. This methodology ensures that the conclusions and recommendations presented here are robust, relevant, and directly applicable to decision-makers seeking to navigate the complexities of the evolving aluminum market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aluminum market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aluminum Market, by Type

- Aluminum Market, by Form

- Aluminum Market, by Source

- Aluminum Market, by Grade

- Aluminum Market, by Processing Method

- Aluminum Market, by Application

- Aluminum Market, by Region

- Aluminum Market, by Group

- Aluminum Market, by Country

- United States Aluminum Market

- China Aluminum Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing Strategic Conclusions and Forward-Looking Outlook to Inform Decision-Making in the Rapidly Changing Aluminum Industry

The aluminum industry stands at a pivotal juncture, navigating the dual imperatives of sustainability and economic resilience. Contemporary challenges-ranging from escalating tariffs and supply chain disruptions to decarbonization pressures-are reshaping value chains and redefining competitive advantage.

Yet these very dynamics also present opportunities for innovation, collaboration, and strategic realignment. Producers that successfully integrate low-carbon technologies, digitalize operations, and adapt to segmentation nuances will be poised to serve a diverse set of high-growth end markets.

By understanding regional distinctions, leveraging competitive insights, and implementing the recommendations outlined herein, stakeholders can chart a clear path forward. In an environment marked by rapid transformation, the ability to anticipate shifts and respond intentionally will determine which organizations thrive.

This study provides the foundational knowledge and strategic guidance needed to navigate the complex aluminum landscape and to capitalize on emerging opportunities in a world increasingly focused on resource efficiency and environmental stewardship.

Engage with Our Associate Director to Secure Exclusive Access to the Comprehensive Aluminum Market Research Report and Propel Strategic Decisions

For personalized guidance on leveraging these insights and to secure your full copy of this in-depth aluminum market research report, reach out to Ketan Rohom, Associate Director, Sales & Marketing. His expertise will help tailor the report’s findings to your strategic objectives and ensure you have the data you need to drive your initiatives forward.

- How big is the Aluminum Market?

- What is the Aluminum Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?