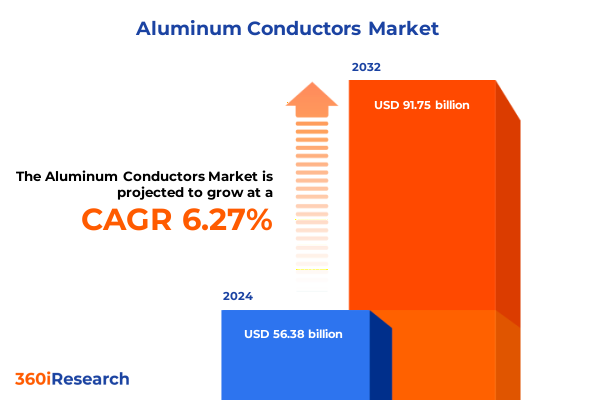

The Aluminum Conductors Market size was estimated at USD 59.41 billion in 2025 and expected to reach USD 62.61 billion in 2026, at a CAGR of 6.40% to reach USD 91.75 billion by 2032.

Exploring the pivotal role of aluminum conductors in modernizing energy infrastructure and fulfilling sustainability objectives across diverse applications

Aluminum conductors have emerged as a foundational component in the ongoing modernization of global energy infrastructure. With a combination of high conductivity, favorable strength-to-weight ratio, and cost efficiencies relative to traditional copper, these conductors are playing a pivotal role in meeting the surging demands of renewable energy integration, grid resilience, and smart grid deployment.

Driven by the imperative to decarbonize power generation and the growing need for reliable transmission over extended distances, utilities and industrial players are increasingly specifying aluminum-based solutions. Innovations in alloy composition and manufacturing processes have enhanced mechanical durability, reduced line sag, and improved thermal performance. As electrification initiatives accelerate across urban, suburban, and rural landscapes, aluminum conductors are underpinning critical projects-from offshore wind interconnectors to next-generation urban megaprojects-while also aligning with sustainability goals through recyclability and lower embedded carbon footprints.

Unveiling transformative shifts reshaping aluminum conductor markets as technological innovation and regulatory evolution redefine industry dynamics

The aluminum conductor market is experiencing a profound transformation as technological breakthroughs and evolving regulatory frameworks intersect. Advanced conductor designs, such as high-temperature low-sag (HTLS) alloys and composite core conductors, are elevating ampacity and reliability, addressing the twin challenges of rising load demands and environmental extremes.

Simultaneously, the policy landscape is shifting to emphasize decarbonization and energy security. Stricter emissions targets and clean energy mandates are stimulating unprecedented investment in grid upgrades and transmission projects. These reforms are complemented by growing interest in smart grid applications, where real-time monitoring and dynamic line rating systems optimize capacity and reduce downtime. Taken together, these dynamics are reshaping competitive positioning and accelerating the adoption of aluminum conductors in mission-critical infrastructure.

Assessing the profound cumulative implications of newly elevated United States aluminum tariffs on supply chains cost structures and competitive positioning

In early 2025, the United States invoked Section 232 of the Trade Expansion Act to increase aluminum tariffs from 10% to 25% ad valorem, while simultaneously terminating alternative agreement exemptions with key trading partners effective March 12, 2025. These measures aim to safeguard domestic capacity utilization and strengthen national security imperatives by curbing import volumes that have eroded downstream production and depressed local demand.

The cumulative impact of these higher tariffs reverberates throughout supply chains and cost structures. Importers face significantly elevated duties, driving a shift toward domestic sourcing and incentivizing investment in local smelting and fabrication facilities. At the same time, regional price differentials may widen, prompting purchasers to reassess sourcing strategies and, where feasible, to adopt alternative alloys or composite solutions. While these adjustments support U.S. production objectives, they also introduce complexities for multinational contractors and utilities that rely on cross-border material flows.

Uncovering deep segmentation insights revealing how conductor type application insulation and voltage rating influences aluminum conductor market trajectories

A granular segmentation of the aluminum conductor market illuminates the diverse technological and application-specific trajectories shaping future growth. Within the conductor type spectrum, overhead variants command significant attention, with All Aluminum Alloy Conductor (AAAC), All Aluminum Conductor (AAC), and Aluminum Conductor Steel Reinforced (ACSR) each tailored to distinct spans and loading scenarios. Submarine conductors, utilizing Cross Linked Polyethylene (XLPE) and Polyvinyl Chloride (PVC) insulation, underpin undersea energy corridors, while underground cables deploy XLPE, PVC, and rubber compounds to balance mechanical protection with electrical performance.

Application segmentation further refines the market narrative: construction deployments span commercial and residential wiring, industrial projects demand customized conductor profiles for process reliability, and utility use cases bifurcate into distribution and long-haul transmission systems. Insulation criteria separate bare conductors from insulated types, the latter relying on XLPE, PVC, or rubber to meet stringent safety and thermal stability requirements. Finally, voltage rating distinctions-from extra-high voltage through high, medium, and low tiers-define grid interconnection standards, emergency resilience capabilities, and compatibility with evolving smart grid architectures.

This comprehensive research report categorizes the Aluminum Conductors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Conductor Type

- Insulation

- Voltage Rating

- Application

Revealing key regional insights that highlight the distinctive drivers challenges and growth patterns across Americas Europe Middle East Africa and Asia Pacific

Regional heterogeneity defines the trajectory of aluminum conductor demand worldwide. In the Americas, abundant primary aluminum resources, federal incentives for grid modernization, and stimulus under clean energy laws underpin robust capital spending on transmission and distribution networks. Shifting policy focus toward domestic manufacturing has also spurred investment in secondary aluminum production and conductor fabrication hubs.

Across Europe, the Middle East, and Africa, decarbonization targets and expansive renewable rollout-particularly in offshore wind and solar-hydrogen projects-drive demand for specialized conductor solutions that can withstand harsh marine and desert environments. Meanwhile, electrification efforts in Sub-Saharan Africa and infrastructure upgrades in the Gulf Cooperation Council align with broader economic diversification goals. In Asia-Pacific markets, rapid urbanization, industrial expansion, and regional interconnect initiatives fuel the fastest growth rates, while large-scale HVDC and UHVDC projects link distant generation centers to consumption hubs.

This comprehensive research report examines key regions that drive the evolution of the Aluminum Conductors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing leading aluminum conductor manufacturers innovation strategies collaborations and market positioning that drive competitive advantage globally

Global cable industry leaders are adopting differentiated strategies to capitalize on aluminum conductor opportunities. Prysmian Group, recognized as the largest cable manufacturer worldwide, has strategically acquired U.S. players to bolster its low and medium voltage portfolio and leverage its high-voltage expertise for offshore wind farm interconnectors. Nexans leverages sustainability-driven innovation, developing EcoDesign aluminum conductors that reduce carbon intensity by embedding recycled alloys and optimizing production energy use, thereby aligning with stringent EU decarbonization mandates.

Southwire Company, with its vertically integrated supply chain, maintains a dominant position in North America by controlling raw material sourcing through to conductor fabrication, enabling cost efficiencies and rapid delivery. LS Cable & System and Sumitomo Electric focus on geographic diversification, tapping APAC demand through localized production while investing in digital monitoring systems. Emerging regional players such as KEI Industries and Midal Cables complement established names by offering agile production timelines and alloy customization for specific market needs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aluminum Conductors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- APAR Industries Limited

- Arfin India Limited

- Group Nirmal

- Heraeus Holding

- Hindusthan Urban Infrastructure Ltd

- JSk Industries Pvt. Ltd

- Kaiser Aluminium Corporation

- Lumino Industries Limited

- MWS Wire Industries, Inc.

- Norsk Hydro ASA

- Norsk Hydro ASA

- Novametal SA

- OBO Bettermann Holding GmbH & Co. KG

- Oswal Cables Pvt Ltd

- RusAL

- Shanghai Metal Corporation

- Southern Cable Group

- Southwire Company, LLC

- Sturdy Industries Ltd.

- Sumitomo Electric Industries, Ltd.

- TOTOKU INC

- Transrail Lighting Limited

- TRIMET Aluminium SE

- TT Cables

- Vimetco NV

Delivering actionable guidelines for industry leaders to capitalize on aluminum conductor advancements and overcome bottlenecks to secure sustainable growth

To navigate the evolving aluminum conductor landscape, industry leaders should prioritize strategic diversification of their supply chains, balancing domestic production initiatives with resilient global procurement frameworks. By investing in alloy and composite innovation-particularly high-temperature low-sag and lightweight HTLS materials-manufacturers can serve critical transmission corridors while mitigating commodity price volatility.

Engaging proactively with regulators and utilities to shape supportive policy environments will also be essential. Companies can partner on pilot projects that demonstrate the performance and reliability advantages of advanced aluminum conductors, thereby accelerating code adoption and project approvals. Finally, embedding circular economy principles through enhanced recycling and alloy reclamation initiatives will not only bolster sustainability credentials but also create cost-effective feedstock streams for future conductor production.

Detailing robust research methodology frameworks employed to ensure data integrity rigorous analysis and actionable intelligence in aluminum conductor market

The research framework underpinning this analysis integrates rigorous primary and secondary data collection to ensure comprehensive market coverage and actionable intelligence. Primary insights derive from in-depth interviews with utility executives, conductor fabricators, and regulatory officials across key geographies. These conversations inform an understanding of procurement criteria, performance challenges, and policy drivers.

Secondary data sources include technical standards, trade association reports, and patent filings related to conductor metallurgy and insulation technologies. Supply chain analyses and trade flow statistics were also synthesized to quantify material movements and tariff impacts. Finally, cross-validation against independent consultancy studies and corporate financial disclosures ensures the robustness and integrity of findings presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aluminum Conductors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aluminum Conductors Market, by Conductor Type

- Aluminum Conductors Market, by Insulation

- Aluminum Conductors Market, by Voltage Rating

- Aluminum Conductors Market, by Application

- Aluminum Conductors Market, by Region

- Aluminum Conductors Market, by Group

- Aluminum Conductors Market, by Country

- United States Aluminum Conductors Market

- China Aluminum Conductors Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesizing key takeaways and future outlook to underscore the strategic importance of aluminum conductors in evolving energy ecosystems

Aluminum conductors stand at the nexus of evolving energy systems, offering a compelling blend of performance, cost-efficiency, and sustainability. The confluence of advanced alloy developments, escalating smart grid requirements, and shifting regulatory landscapes has elevated their strategic importance across transmission, distribution, and specialized subsea applications.

As the industry adapts to heightened U.S. tariffs, nuanced segmentation insights, and diverse regional demands, stakeholders who align innovation pipelines with dynamic policy frameworks and sustainable supply chain practices will secure long-term competitive advantage. The collective imperative remains clear: harness technological progress, foster collaborative partnerships, and cultivate regulatory engagement to shape the next chapter of aluminum conductor deployment.

Connect with Ketan Rohom Associate Director Sales Marketing to access the comprehensive market research report and drive informed decision making

For a deeper understanding of the forces shaping the aluminum conductor sector and to gain access to comprehensive insights encompassing market drivers, segmentation findings, and strategic analyses, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in guiding decision-makers through complex industry dynamics will help you leverage the latest intelligence to inform procurement strategies, partnership opportunities, and long-term planning.

To secure your copy of the full market research report and unlock actionable recommendations, reach out to Ketan Rohom today. Position your organization ahead of the curve by partnering with a seasoned industry expert who can ensure you capitalize on emerging trends and navigate evolving regulatory landscapes with confidence.

- How big is the Aluminum Conductors Market?

- What is the Aluminum Conductors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?