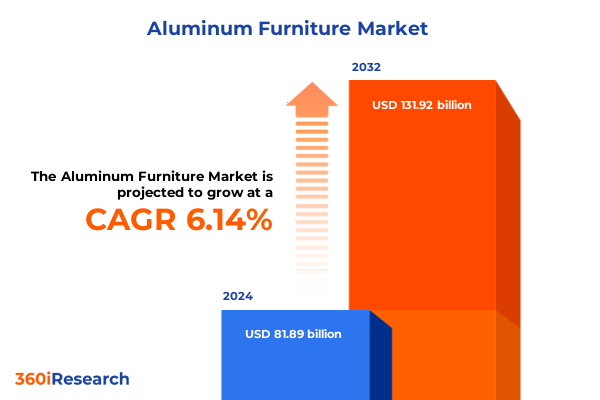

The Aluminum Furniture Market size was estimated at USD 86.73 billion in 2025 and expected to reach USD 91.85 billion in 2026, at a CAGR of 6.17% to reach USD 131.92 billion by 2032.

Navigating the Evolving Aluminum Furniture Market Amid Material Innovations, Consumer Preferences, and Regulatory Dynamics

In recent years, aluminum furniture has emerged as a versatile solution across residential, commercial, and institutional environments, valued for its inherent corrosion resistance and lightweight properties, which are further enhanced by powder-coated finishes that protect against UV exposure and moisture.

Designers are increasingly drawing inspiration from indoor living trends to create outdoor arrangements that mirror the comfort and style of interior spaces, redefining patios and terraces as extensions of the home.

Advanced manufacturing techniques, including precision casting and extrusion technologies, have expanded the design vocabulary available to producers, enabling intricate geometries and modular configurations previously unattainable in traditional furniture production.

As consumer expectations shift toward customizable, durable furnishings that balance form with function, the aluminum furniture market has entered a new phase of rapid innovation and strategic repositioning. This executive summary synthesizes the transformative forces at play, offering decision-makers a cohesive narrative of current dynamics and strategic imperatives that will shape competitive positioning throughout the remainder of 2025 and beyond. It lays the foundation for understanding the regulatory, segmentation, and regional considerations that define this evolving landscape.

How Durability-Driven Consumer Preferences, Sustainability Demands, and Smart Technologies are Reshaping Aluminum Furniture Production and Design Paradigms

Consumer demand has shifted decisively toward products that offer both sustainability and resilience, driving manufacturers to prioritize recycled content and circular design principles. Aluminum’s intrinsic recyclability positions it favorably, as brands integrate post-consumer and industrial scrap into their powder-coating processes to minimize environmental impact and appeal to eco-conscious buyers.

Modular and multifunctional furniture has risen to prominence, reflecting the need for flexible solutions in both urban apartments and expansive outdoor venues. Convertible loungers, nesting tables, and stackable seating now enable consumers to reconfigure living spaces with minimal effort, reinforcing the material’s reputation for lightweight durability in motion.

Smart technologies are increasingly embedded within aluminum furnishings, with integrated solar lighting, wireless charging docks, and temperature-regulating elements becoming hallmarks of premium collections. These functional enhancements underscore the material’s adaptability to electronic integrations and align product offerings with the expectations of tech-savvy end users.

Together, these forces are reshaping production methodologies and supply chains, encouraging partnerships between material scientists, design firms, and technology providers. The result is a collaborative ecosystem in which innovations in coatings, alloys, and embedded electronics converge to set new benchmarks for performance and aesthetic value.

Assessing the Comprehensive Impact of 2025 U.S. Aluminum Tariff Increases on Material Costs, Supply Chains, and Competitive Dynamics

On March 12, 2025, the administration terminated alternative trade agreements covering key partners and imposed a uniform 25 percent ad valorem tariff on all imported aluminum articles and derivative products. This directive applies to shipments from Argentina, Australia, Canada, Mexico, the EU, and the UK, marking a significant policy shift aimed at bolstering domestic producers.

The tariff adjustment has had direct repercussions for the furniture sector, with metal furniture and related components-valued at approximately $15 billion in imports last year-experiencing a notable escalation in landed costs. Categories spanning beds, chairs, stools, and tables now face heightened material expenditures that ripple through manufacturing and distribution channels.

Domestic producers have responded by optimizing inventory strategies, pre-stocking key components ahead of duty implementation and negotiating extended lead times with overseas suppliers to mitigate supply chain disruptions. Companies reliant on imported aluminum tubing and castings are concurrently evaluating the feasibility of nearshoring certain operations to reduce exposure to punitive tariffs and logistical uncertainties.

These dynamics underscore the importance of strategic procurement and supplier diversification. As tariff policies evolve, manufacturers and distributors must maintain agility in contract management, explore alternative material grades, and consider value-engineering approaches to preserve margin integrity and sustain competitive positioning.

Illuminating the Multifaceted Segments of the Aluminum Furniture Market Through Utility, Design, Material, and Distribution Lenses

The aluminum furniture market diverges sharply between indoor and outdoor applications, as indoor segments prioritize ergonomic comfort and aesthetic versatility while outdoor lines emphasize weather resistance and UV-stable finishes. This utility-driven divergence compels manufacturers to tailor surface treatments, frame thicknesses, and fastening systems to distinct environmental exposures.

Within the product spectrum, aluminum furniture spans from beds and benches to chairs, sofas, stools, and tables. Each category demands unique engineering considerations: beds require robust support mechanisms, while tables balance structural rigidity with visual lightness. Sofas and chairs occupy the nexus of comfort and design, often integrating weatherproof textiles or modular frames to enhance user adaptability.

Design aesthetics further differentiate offerings, ranging from the clean lines of contemporary styles to the raw textures of industrial pieces, the minimalism of modern forms, the reclaimed charm of rustic finishes, and the ornate profiles characteristic of traditional craftsmanship. These aesthetic nuances inform material selection, fabrication methods, and finishing options, driving portfolio diversification across brands.

Functionality features such as convertibility, foldability, modularity, and stackability define consumer perceptions of convenience and space efficiency. Convertible sofas and folding chairs cater to multiuse environments, while modular units enable dynamic spatial configurations. Stackable stools and chairs optimize storage and facilitate event-based deployments.

Material types bifurcate into cast and wrought aluminum, with wrought variants further explored through extrusions, plates, and sheets. Cast aluminum supports sculptural forms and intricate detailing, whereas extruded profiles deliver consistent cross-sections for frames and structural elements. Plate and sheet components are integral to panel-based assemblies and surface treatments.

End users span residential, commercial, and institutional sectors. Hospitality, office, and retail spaces drive commercial demand, while educational institutions and government buildings represent institutional adoption. Residential consumption encapsulates single-family homes, multifamily developments, and outdoor living trends.

Distribution channels balance between traditional offline outlets-furniture and specialty stores-and digital platforms, including direct brand websites and third-party e-commerce marketplaces. Each channel necessitates tailored merchandising strategies, logistics frameworks, and digital engagement tactics to capture target audiences.

This comprehensive research report categorizes the Aluminum Furniture market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Utility

- Product Type

- Design Aesthetic

- Functionality Features

- Material Type

- End User

- Distribution Channel

Exploring the Regional Dynamics of Aluminum Furniture Demand Across the Americas, EMEA, and Asia-Pacific Regions

The Americas exhibit strong demand driven by high disposable incomes, suburban expansion, and an entrenched culture of outdoor living. North American markets lead with robust commercial projects in hospitality and real estate developments, while Latin America shows growing interest in urban outdoor installations.

Europe, the Middle East, and Africa collectively display diverse regional characteristics. Western and Northern Europe emphasize sustainability credentials and design pedigree, favoring powder-coated and anodized finishes. Southern Europe’s balmy climates reinforce demand for all-weather pieces, whereas Middle Eastern and African markets leverage aluminum’s corrosion resistance amid challenging environmental conditions.

Asia-Pacific dynamics vary significantly across markets. Mature economies like Japan and Australia emphasize premium design and smart integrations, while rapidly urbanizing hubs in China and India present scale opportunities for modular and entry-level offerings. Government investment in public infrastructure and hospitality projects further amplifies regional demand.

This comprehensive research report examines key regions that drive the evolution of the Aluminum Furniture market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Leading Innovators and Market Drivers in the Aluminum Furniture Industry to Illuminate Competitive Strengths

Leading producers distinguish themselves through advanced alloy formulations, proprietary coating systems, and integrated design services. Companies with established extrusion and casting capabilities leverage economies of scale to serve both bespoke contract segments and volume-oriented retail channels. Conversely, agile newcomers prioritize niche collaborations with designers and architects to introduce limited-edition collections that command premium positioning.

Retailers and distributors also shape competitive landscapes. Online marketplaces rapidly expand access to direct-to-consumer aluminum furniture brands, forcing traditional brick-and-mortar operators to elevate in-store experiences and omnichannel fulfillment models. Collaborative showrooms and pop-up activations have emerged as tactics to reinforce tactile engagement and accelerate purchase decisions.

Innovation extends beyond product lines to encompass supply chain efficiencies. Industry players invest in digital tools for inventory optimization, demand forecasting, and supplier performance management, minimizing stockouts and expediting response to seasonality shifts. Strategic partnerships with logistics providers enhance last-mile delivery capabilities, catering to consumer expectations for rapid fulfillment and transparent tracking.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aluminum Furniture market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A & K Enterprise of Manatee, Inc.

- ALUMINAKS METAL SANAYİ LİMİTED

- Aluminium Seating Specialists

- BAB Aluminium Pty Ltd

- Brown Jordan Inc.

- Clinton Aluminum, Inc.

- Felton International Group Pty Ltd

- Haverty Furniture Companies, Inc.

- Haworth, Inc.

- Herman Miller Inc.

- Higold Group Co., Ltd.

- Hindalco Industries Limited

- Hooker Furniture

- IKEA Group

- JYSK A/S

- Kimball International, Inc.

- Kunakij Furniture Industry Co., Ltd.

- La-Z-Boy Incorporated

- Manufacturas Ruiz, S.A.

- Metro Plus Life Style

- MillerKnoll, Inc.

- Miri Piri Sheds & Structures

- Nitori Holdings Co., Ltd.

- NMF Metal

- Patio Palace

- Paul B. Zimmerman, Inc.

- Ryohin Keikaku Co., Ltd.

- Steelcase Inc.

- Sturdybilt Agencies Pty Ltd.

- The Home Depot, Inc.

Strategic Playbook for Industry Leaders to Capitalize on Material Trends, Supply Chain Resilience, and Customer-Centric Innovations

Industry leaders should prioritize diversified sourcing strategies, blending domestic production with nearshore options to mitigate tariff exposures and logistical bottlenecks. Cultivating strategic supplier alliances early in the design process can unlock co-development opportunities and secure preferential material allocations during peak demand cycles.

Investments in research and development are essential to differentiate through material science and functional integration. Collaborations with coating specialists and electronics integrators will accelerate the introduction of weatherproof smart features, setting new benchmarks for performance and consumer appeal.

Omnichannel distribution merits focused attention, with seamless transitions between digital platforms and physical showrooms becoming critical to capturing evolving consumer journeys. Leveraging data analytics to personalize recommendations, anticipate replenishment needs, and optimize pricing can deepen engagement and bolster loyalty.

Finally, sustainability initiatives must permeate corporate strategies, from life-cycle assessments and reclamation programs to transparent reporting. Emphasizing circularity not only aligns with regulatory trajectories but also resonates with end users who increasingly view environmental stewardship as a proxy for brand integrity.

Transparency in Research Approach Integrating Primary Interviews, Secondary Data Verification, and Qualitative Analysis for Market Credibility

This analysis employs a hybrid research framework that integrates primary interviews with executives across manufacturing, distribution, and design firms to capture firsthand perspectives on emerging challenges and opportunities. Complementary secondary research leverages trade publications, regulatory notices, and patent filings to validate market drivers and technological advancements.

Supplier databases and procurement records inform material cost trajectories and sourcing patterns, while qualitative assessments of brand strategies and consumer feedback platforms reveal sentiment shifts and unmet needs. Triangulation across data sources ensures robustness and mitigates bias.

Key assumptions are documented transparently, including tariff scenarios, production lead times, and regional adoption curves. Continuous refinement through peer review and stakeholder consultations underpins the credibility of insights and strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aluminum Furniture market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aluminum Furniture Market, by Utility

- Aluminum Furniture Market, by Product Type

- Aluminum Furniture Market, by Design Aesthetic

- Aluminum Furniture Market, by Functionality Features

- Aluminum Furniture Market, by Material Type

- Aluminum Furniture Market, by End User

- Aluminum Furniture Market, by Distribution Channel

- Aluminum Furniture Market, by Region

- Aluminum Furniture Market, by Group

- Aluminum Furniture Market, by Country

- United States Aluminum Furniture Market

- China Aluminum Furniture Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2544 ]

Synthesizing Insights on Market Evolution, Regulatory Influences, and Innovation Trajectories to Guide Future Strategic Directions

The aluminum furniture industry stands at the intersection of material innovation, regulatory realignment, and evolving consumer expectations. As tariffs reshape cost structures, manufacturers are prompted to reengineer supply chains and explore alternative sourcing models. Simultaneously, durability, sustainability, and smart integration emerge as distinguishing pillars for product differentiation.

Segmentation analysis underscores the need for tailored strategies across utility, product, style, and functionality cohorts, each presenting unique value propositions and operational imperatives. Regional insights reveal heterogeneous demand drivers, from North America’s outdoor living ethos to Asia-Pacific’s scale opportunities and EMEA’s premium positioning.

Competitive profiling highlights the imperative for agility, as both established players and challengers deploy advanced manufacturing capabilities and omnichannel distribution to secure market share. Ultimately, success will hinge on the ability to harmonize cost efficiency with innovation, sustainability, and customer-centric execution.

Secure Expert Analysis and Actionable Insights by Contacting Associate Director of Sales & Marketing to Acquire the Full Aluminum Furniture Market Report Today

Ready to gain a competitive edge and unlock comprehensive market insights? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to acquire the full aluminum furniture market research report and equip your organization with the data and analysis needed to drive informed decisions and strategic growth

- How big is the Aluminum Furniture Market?

- What is the Aluminum Furniture Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?