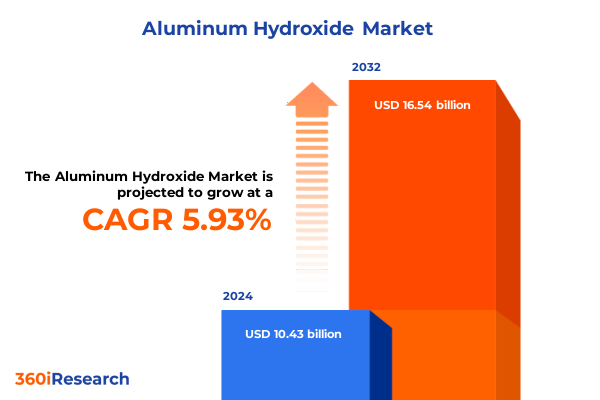

The Aluminum Hydroxide Market size was estimated at USD 11.02 billion in 2025 and expected to reach USD 11.65 billion in 2026, at a CAGR of 5.97% to reach USD 16.54 billion by 2032.

Exploring Aluminum Hydroxide’s Multifaceted Role in Modern Industrial and Pharmaceutical Applications and Its Strategic Importance Across Key Markets

Aluminum hydroxide has emerged as a pivotal compound both in industrial applications and pharmaceutical formulations, demonstrating a versatility that transcends traditional boundaries. In industrial settings, its properties as an adsorbent and flame retardant are increasingly harnessed to meet stringent safety and environmental regulations, while in pharmaceuticals its antacid efficacy continues to support gastrointestinal health for millions of patients worldwide. As supply chains evolve and end users demand higher standards of purity and performance, understanding the nuanced roles of aluminum hydroxide has never been more critical.

Against the backdrop of shifting regulatory landscapes and technological advancements, the aluminum hydroxide market is witnessing a convergence of innovation and strategic reinvention. From gel-based grades designed for precision in catalyst systems to granular and powdered forms optimized for large-scale manufacturing, stakeholders must navigate a complex array of factors influencing demand and supply. This introduction lays the foundation for a comprehensive exploration of market dynamics, shedding light on the driving forces, emerging trends, and strategic imperatives that define the current aluminum hydroxide ecosystem.

Unveiling the Recent Technological Advances and Sustainability Imperatives That Are Reshaping the Aluminum Hydroxide Industry Landscape

In recent years, the aluminum hydroxide industry has experienced a wave of transformative shifts driven by technological innovation and a heightened focus on sustainability. Advanced synthesis techniques have enabled manufacturers to tailor particle size distribution and surface area properties with unprecedented precision, enhancing performance in applications ranging from flocculation in water treatment to filler functionality in plastics and polymers. Concurrently, the adoption of green production processes that minimize energy consumption and waste streams is reshaping competitive dynamics, compelling legacy producers and entrants alike to redefine operational excellence.

Moreover, the intersection of digitalization and process analytics is unlocking new levels of supply chain visibility and efficiency. Real-time monitoring of key performance indicators across manufacturing units allows for proactive maintenance, reduced downtimes, and optimized throughput-all crucial in a market where margins can hinge on subtle variations in product quality. These paradigm shifts underscore the industry’s trajectory towards smarter, more sustainable practices, setting the stage for accelerated growth and resilience in the aluminum hydroxide landscape.

Assessing the Far-Reaching Consequences of 2025 United States Tariffs on Aluminum Hydroxide Supply Chains and Competitive Dynamics

The introduction of new U.S. tariffs on aluminum hydroxide imports in early 2025 has introduced significant headwinds for both domestic manufacturers and downstream consumers. By increasing the landed cost of bulk gel and powdered grades, these measures have reverberated across supply chains, prompting buyers to reassess sourcing strategies and consider alternative raw material portfolios. While tariff mitigation programs and duty drawback schemes have provided partial relief, the net effect has been a reevaluation of inventory management practices and contractual terms across key verticals such as chemicals and paper.

In response, several industry players have accelerated investments in local production capabilities to reduce exposure to import levies and logistical bottlenecks. Strategic partnerships between port terminals and regional storage facilities have emerged to streamline import flows and consolidate volumes, thereby leveraging economies of scale. These adaptations reflect a broader recalibration of supply chain resilience, highlighting how fiscal policy interventions can catalyze structural realignments and long-term competitive differentiation within the aluminum hydroxide market.

Unpacking Critical Segmentation Insights Revealing How Grade, Form, Application, End Users, and Distribution Channels Drive Aluminum Hydroxide Demand

Deconstructing the aluminum hydroxide market through multiple segmentation lenses reveals distinct patterns of demand and performance across end users. When evaluating industrial grade versus pharmaceutical grade, it becomes evident that quality certifications and purity thresholds drive procurement cycles differently, with pharmaceutical grade commanding a premium based on stringent regulatory compliance. Examining product forms-including gel formulations optimized for precise catalyst activation, granules favored for bulk handling, and powders suited to high-shear mixing-highlights how process requirements and equipment compatibility dictate formulation choices and purchase frequency.

Application-based differentiation underscores the multifunctionality of aluminum hydroxide. As an adsorbent in water treatment, its surface chemistry dictates efficacy under varying pH conditions, whereas in antacid formulations, bioavailability and neutralization capacity are paramount. Catalyst supports benefit from tailored surface area and pore distribution, while filler properties in polymers and plastics hinge on particle morphology and dispersion characteristics. Evaluating end-user industries such as chemicals, cosmetics and personal care, paper and printing inks, pharmaceuticals, plastics and polymers, textiles, and wastewater treatment further illustrates how end-product performance criteria and regulatory mandates shape demand trajectories. Distribution channels also play a critical role: traditional offline sales networks continue to dominate industrial procurement, while online platforms gain traction in niche pharmaceutical and specialty chemical segments due to streamlined ordering and small-batch delivery capabilities.

This comprehensive research report categorizes the Aluminum Hydroxide market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Grade

- Form

- Application

- End User

- Distribution Channel

Analyzing Regional Dynamics Across Americas, Europe Middle East and Africa, and Asia Pacific to Illuminate Aluminum Hydroxide Market Opportunities

Regional dynamics in the aluminum hydroxide market reflect a diverse array of growth drivers and operational challenges. In the Americas, robust demand from chemical manufacturing and wastewater treatment sectors in the United States and Brazil is coupled with a push for localized production to mitigate recent import duties. Investment in port infrastructure and inland logistics is streamlining regional flows, as key stakeholders prioritize supply chain visibility and risk management amid volatile trade policies.

Conversely, Europe, Middle East & Africa presents a heterogeneous landscape where regulatory frameworks governing environmental emissions and product safety exert considerable influence. Germany and France lead on sustainable production initiatives, while the Middle East is emerging as a critical export hub thanks to abundant alumina feedstock and strategic port access. In Africa, nascent manufacturing capacity is gradually expanding to meet growing consumption in water treatment and personal care applications.

In the Asia-Pacific region, China and India are prominent growth engines, driven by rapid industrialization and rising pharmaceutical output. However, tightening environmental regulations in China have spurred producers to adopt cleaner technologies, impacting cost structures and encouraging vertical integration. Southeast Asian markets are also gaining prominence as downstream industries diversify sourcing away from traditional hubs, creating new export corridors and competitive benchmarks.

This comprehensive research report examines key regions that drive the evolution of the Aluminum Hydroxide market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies and Strategic Collaborations that Define Competitive Advantage and Innovation within the Aluminum Hydroxide Sector

Leading companies in the aluminum hydroxide landscape are distinguished by their integrated supply chains, advanced R&D capabilities, and strategic partnerships. Major petrochemical and mining conglomerates continue to leverage upstream control of alumina sources to optimize feedstock supply and cost efficiency. Collaborative research agreements with academic institutions and technology providers are accelerating the development of next-generation low-carbon production methods and high-purity grades tailored for specialized applications.

At the same time, mid-tier specialty chemical firms are capturing niche opportunities by focusing on customized formulations and technical support services. These companies differentiate through agile manufacturing frameworks that can accommodate small-batch and rapid-turnaround orders, which is particularly valued in pharmaceutical and cosmetics industries. Additionally, digital platforms offering predictive maintenance and real-time quality assurance are becoming a hallmark of forward-looking companies seeking to cement customer relationships and unlock new revenue streams.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aluminum Hydroxide market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akrochem Corporation

- Albemarle Corporation

- Alcoa Corporation

- Alteo

- Alumina Chemicals & Castables

- American Elements

- CHALCO Shandong Co.,Ltd

- Clariant AG

- Daejoo·KC Group.

- Ecolab Inc.

- Hindalco Industries Ltd. by Aditya Birla Group

- J.M. HUBER Group

- LKAB Minerals AB.

- LobaChemie Pvt. Ltd.

- Merck KGaA

- Nabaltec AG

- Niknam Chemicals Private Limited

- Nippon Light Metal Holdings Company, Ltd.

- Resonac Group Companies

- Rio Tinto Group of Companies

- RusAL

- SCR-Sibelco NV

- Sika AG

- Sumitomo Chemical Co., Ltd.

- Thermo Fisher Scientific Inc.

- TOR Minerals International, Inc..

- Zibo Pengfeng New Material Technology Co., Ltd.

- ZIBO TON YEAR CHEMICAL TECHNOLOGY CO., LTD

Strategic Recommendations for Industry Leaders to Navigate Disruption, Capitalize on Sustainability Trends, and Enhance Value Chains in Aluminum Hydroxide

Industry leaders must take decisive action to capitalize on evolving market conditions and cement their competitive positions. First, investing in sustainable production technologies is critical to align with tightening environmental regulations and customer expectations for low-carbon supply chains. By integrating renewable energy sources and waste valorization processes, companies can both reduce operational costs and enhance brand reputation. Next, diversifying raw material sourcing through regional partnerships and backward integration will help mitigate the impact of tariff fluctuations and logistical disruptions.

Furthermore, capturing value from digital transformation initiatives can yield significant returns. Deploying advanced analytics for process optimization, demand forecasting, and quality control will streamline production while minimizing wastage. Equally important is the strengthening of customer engagement models through tailored technical support and co-development programs, which can foster long-term loyalty in high-value segments such as pharmaceuticals and specialty chemicals. Collectively, these strategies will enable industry players to navigate uncertainty, seize emerging opportunities, and create resilient growth trajectories.

Outlining Rigorous Research Methodology Combining Primary Interviews and Secondary Data Sources to Deliver Insightful Aluminum Hydroxide Market Analysis

This research employed a multi-tiered methodology combining primary and secondary data sources to ensure comprehensive market coverage and analytical rigor. Primary insights were garnered through in-depth interviews with industry executives, technical experts, and end users across key regions. These conversations provided firsthand perspectives on supply chain challenges, application-specific requirements, and investment priorities. Secondary research included a review of industry journals, regulatory filings, patent databases, and company disclosures to contextualize quantitative findings and validate market trends.

Data triangulation was conducted by cross-referencing import-export statistics, regional trade data, and production capacity reports to establish a robust baseline. Each segmentation axis was analyzed using a layered approach that first considered macroeconomic indicators before drilling down into application- and end-user-specific parameters. Quality assurance protocols were applied throughout the research process to verify data integrity and ensure consistency. The combination of qualitative expert opinion and quantitative analysis underpins the credibility of the insights presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aluminum Hydroxide market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aluminum Hydroxide Market, by Product Type

- Aluminum Hydroxide Market, by Grade

- Aluminum Hydroxide Market, by Form

- Aluminum Hydroxide Market, by Application

- Aluminum Hydroxide Market, by End User

- Aluminum Hydroxide Market, by Distribution Channel

- Aluminum Hydroxide Market, by Region

- Aluminum Hydroxide Market, by Group

- Aluminum Hydroxide Market, by Country

- United States Aluminum Hydroxide Market

- China Aluminum Hydroxide Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing Core Findings and Strategic Implications to Highlight the Future Trajectory of the Aluminum Hydroxide Market

The aluminum hydroxide market stands at a pivotal juncture, where innovation, regulation, and trade policy converge to shape its trajectory. Core findings reveal that sustainability-driven process enhancements, along with digital supply chain solutions, are redefining competitive benchmarks. At the same time, the imposition of U.S. tariffs in 2025 has catalyzed a strategic shift towards localized manufacturing and enhanced inventory management, illustrating how fiscal measures can influence long-term industry structure.

Looking ahead, companies that can skillfully navigate segmentation nuances-ranging from grade-specific quality standards to end-user performance criteria-will be best positioned to unlock growth. Regional dynamics underscore the need for adaptive strategies, as stakeholders must reconcile global market access with evolving local requirements. Ultimately, a proactive approach that embraces technological innovation, fosters supply chain resilience, and prioritizes customer-centric solutions will determine market leadership in the years to come.

Connect with Ketan Rohom to Acquire the Comprehensive Aluminum Hydroxide Market Research Report and Drive Strategic Decision-Making

To purchase the comprehensive market research report on aluminum hydroxide and gain unparalleled insights into market dynamics, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at our research firm. Ketan’s expertise in strategic product positioning and market intelligence will guide you through a tailored research package that aligns with your specific needs. Engage with Ketan to explore detailed analysis on transactional price trends, competitive benchmarking, and actionable growth strategies that can empower your organization’s decision-making.

By connecting with Ketan Rohom, you will secure access to exclusive proprietary data, in-depth segmentation analyses, and expert consultations that will position you at the forefront of the aluminum hydroxide market. Contact him today to unlock the full potential of this report and translate insights into a competitive edge in your industry.

- How big is the Aluminum Hydroxide Market?

- What is the Aluminum Hydroxide Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?