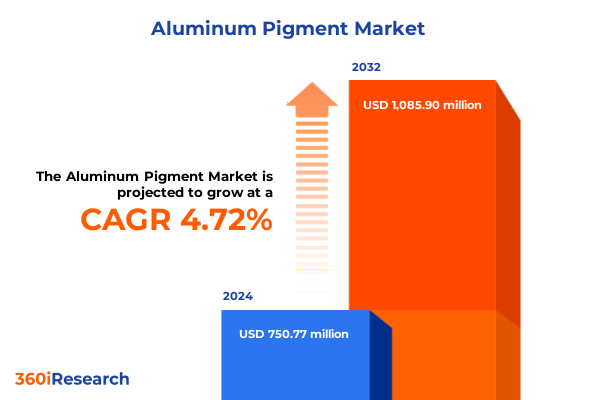

The Aluminum Pigment Market size was estimated at USD 781.62 million in 2025 and expected to reach USD 817.18 million in 2026, at a CAGR of 4.80% to reach USD 1,085.89 million by 2032.

Exploring How Aluminum Pigments Are Revolutionizing Coatings, Cosmetics, Plastics, and Printing Inks Through Cutting-Edge Technologies and Sustainability

The evolution of aluminum pigments has transformed the visual and functional performance of coatings, cosmetics, plastics, and printing inks, establishing these metallic additives as indispensable components in modern manufacturing. Recent advancements in flake morphology and surface treatments have elevated the reflectivity, dispersibility, and durability of pigment pastes and powders, enabling brands to deliver striking metallic effects while meeting rigorous performance standards. As sustainability and regulatory pressures intensify, manufacturers are innovating with water atomized powders and dispersion-based systems to reduce volatile organic compound emissions and enhance process efficiencies.

Moreover, the increasing prevalence of direct-to-end-user digital platforms alongside established distributor and online sales networks is reshaping how customers access specialized pigment formulations. This seamless integration of distribution channels ensures that product developers and formulators can source atomized, flake, or water-atomized grades with precision-tailored particle sizes ranging from sub-5-micron to above 25-micron classifications. Together with growing demand from original equipment manufacturer coatings and refinish coatings in the automotive sector, as well as liquid and powder industrial coating applications, the aluminum pigment market stands at the nexus of aesthetic appeal, regulatory compliance, and sustainable innovation.

Transformational Forces Shaping the Aluminum Pigment Industry Through Technological Innovations, Sustainability Imperatives, and Regulatory Milestones

The aluminum pigment landscape is undergoing transformative shifts driven by breakthroughs in nanotechnology, green chemistry, and digital manufacturing. Innovations in surface functionalization now enable powder and dispersion grades to deliver unprecedented adhesion and corrosion resistance on metal and plastic substrates, addressing end-user demands for long-lasting finishes. Concurrently, the emergence of high-shear dispersion techniques has streamlined paste production, reducing energy consumption while improving flake alignment and color consistency.

In parallel, regulatory frameworks across key markets are enforcing stricter emissions limits and end-of-life recyclability standards, compelling pigment producers to phase out solvent-based formulations in favor of aqueous and low-VOC alternatives. This regulatory impetus has accelerated collaborations between raw material suppliers and downstream coaters, fostering co-development platforms that integrate sustainability metrics into product design. Furthermore, the digitalization of customer engagement-leveraging e-commerce portals and interactive application guides-has enabled faster product sampling cycles and real-time performance feedback, effectively collapsing the traditional R&D-to-market timeline.

Assessing the Consequential Effects of 2025 U.S. Section 232 Tariff Adjustments on Aluminum Pigment Supply Chains, Costs, and Competitive Dynamics

The implementation of revised Section 232 tariffs on aluminum articles and derivative products has reshaped procurement strategies and cost structures for pigment manufacturers and formulators. Effective March 12, 2025, the ad valorem rate on aluminum pigment inputs rose from 10 percent to 25 percent for all countries except Russia, ending product exemption processes and tariff-rate quotas established under earlier proclamations. These changes prompted supply chain realignments as firms sought new sources of raw materials, including domestic smelters and alternative international suppliers, to mitigate the tariff burden while maintaining product quality and consistency.

Building on this, the June 4, 2025 proclamation further elevated tariffs to a 50 percent rate on both steel and aluminum imports, with specific carve-outs for the United Kingdom under the U.S.-UK Economic Prosperity Deal. This second adjustment intensified cost pressures across the value chain, leading many producers to prioritize downstream value-added services such as surface treatment and custom dispersion to preserve margins. Simultaneously, the heightened duties spurred strategic stockpiling ahead of enforcement deadlines and catalyzed dialogue with policymakers on securing new national exemptions or pursuing bilateral agreements to alleviate long-term trade risks.

Deep-Dive into Market Segmentation Revealing Distribution Channels, Formulation Types, Particle Geometries, and Application Verticals Driving Demand Patterns

Insight into market segmentation reveals how distribution channels, form factors, material types, particle geometries, and application verticals collectively drive product positioning and innovation. Manufacturers have tailored their go-to-market strategies across direct sales, distributor networks, and emerging online portals to optimize customer reach and service levels. Meanwhile, R&D investments in dispersion, paste, and powder technologies continue to expand the performance envelope, enabling formulators to select the optimal consistency and effect intensity for each project.

Turning to material typology, atomized, water atomized, and flake pigments each offer unique trade-offs in terms of metallic luster, handling characteristics, and cost efficiency, with particle size distributions spanning sub-5-micron fines to flakes exceeding 25 microns. This spectrum of particle geometries facilitates precise control over opacity, sparkle, and surface coverage. Application-driven differentiation is equally pronounced, as OEM coatings and refinish coatings in the automotive sector demand high durability and gloss retention; cosmetics require skin-safe, uniform shimmer; industrial coatings-from liquid formulations to powder-based systems-prioritize corrosion resistance and process compatibility; and plastics and printing inks exploit metallic pigments for decorative and functional purposes.

This comprehensive research report categorizes the Aluminum Pigment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Distribution Channel

- Form

- Type

- Particle Size

- Application

Evaluating Regional Demand Drivers and Supply Chain Dynamics Across the Americas, Europe Middle East & Africa, and Asia-Pacific Markets for Aluminum Pigments

Regional dynamics underscore divergent growth catalysts and supply chain complexities across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, robust automotive production hubs and an expanding plastics manufacturing base continue to generate demand for high-performance aluminum pigments, even as localized tariff regimes incentivize greater domestic sourcing and strategic partnerships with North American smelters. The region’s mature e-commerce infrastructure further accelerates sample turnaround times and small-batch deployments for specialty coatings.

Conversely, Europe, Middle East & Africa presents a mosaic of regulatory frameworks, where stringent EU emissions standards coexist with emerging growth in Middle Eastern construction and African consumer goods sectors. This duality compels pigment providers to harmonize global product lines with region-specific certifications and logistical models. Meanwhile, the Asia-Pacific market remains the largest global consumption center, driven by electronics manufacturing, automotive assembly, and a burgeoning personal care industry. Producers in this region have capitalized on local raw material availability and cost-effective manufacturing to achieve economies of scale, while simultaneously adapting offerings to meet evolving environmental and safety regulations.

This comprehensive research report examines key regions that drive the evolution of the Aluminum Pigment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Aluminum Pigment Manufacturers on R&D Investments, Strategic Partnerships, and Portfolio Diversification Strategies

Industry leaders in aluminum pigment production are strengthening their positions through targeted mergers, acquisitions, and innovation investments. Global chemical conglomerates have expanded their portfolios to include advanced flake and dispersion systems, integrating end-to-end capabilities from raw metal processing to high-performance pigment coatings. At the same time, specialized pigment houses are forging strategic alliances with OEMs and applicators to co-develop bespoke solutions, leveraging their agile R&D infrastructures to respond swiftly to emerging aesthetic and functional requirements.

In parallel, companies focusing on water-atomized and nano-enabled pigment technologies are differentiating on sustainability credentials and process efficiency. These market players are increasingly proactive in securing cross-industry partnerships-particularly within the automotive, cosmetics, and electronics segments-to pilot next-generation coatings that deliver both enhanced performance and reduced environmental footprint. Such collaborative ventures, coupled with ramped-up investments in digital customer engagement and simulation tools, are reshaping competitive dynamics by privileging responsiveness and technical service.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aluminum Pigment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alpavit GmbH

- ALTANA AG

- Aluchem Inc.

- Arasan Aluminium Industries (P) Ltd.

- Asahi Kasei Corporation

- AVL Metal Powders n.v.

- BASF SE

- Carlfors Bruk AB

- Carl Schlenk AG

- DIC Corporation

- FX Pigments Pvt Ltd.

- GEOTECH International B.V.

- Hefei Sunrise Aluminium Pigments Co., Ltd.

- Kolortek Co., Ltd.

- MEPCO – The Metal Powder Company Ltd.

- Metaflake Ltd.

- Nippon Light Metal Holdings Co., Ltd.

- ShanDong Jie Han Metal Material Co., Ltd.

- Silberline Asia Pacific Pte Ltd.

- Silberline Manufacturing Co., Inc.

- SMC Minerals and Chemicals

- Toyal America, Inc.

- Toyo Aluminium K.K.

- Zhangqiu Metallic Pigment Co., Ltd.

- Zuxing New Materials Co., Ltd.

Strategic Imperatives for Industry Stakeholders to Navigate Tariff Pressures, Sustainability Mandates, and Technological Disruptions in Aluminum Pigments

To navigate evolving tariff environments and intensifying sustainability mandates, industry stakeholders should fortify supply resilience by diversifying raw material sourcing across domestic smelters and allied international partners. Integrating eco-friendly dispersion and water-based formulation platforms can unlock new market segments, particularly among brands seeking low-VOC alternatives. Additionally, enterprises must enhance their downstream value proposition through customized technical service offerings, digital color simulation tools, and rapid prototyping capabilities that shorten development cycles.

Moreover, forging pre-competitive consortia to advocate for balanced trade policies and pursue tariff exemptions can mitigate cost volatility. Leaders should also prioritize investments in circularity initiatives, leveraging recycled aluminum streams to align with corporate sustainability goals and regulatory requirements. Finally, embracing omni-channel distribution strategies-combining direct sales, distributor engagement, and sophisticated online portals-will optimize customer accessibility and build enduring formulator relationships in an increasingly digital marketplace.

Employing Rigorous Mixed-Methods Research, Expert Interviews, and Data Triangulation to Deliver Robust Aluminum Pigment Market Insights

This report’s findings are grounded in a robust mixed-methods approach combining primary and secondary research. Expert interviews with senior R&D directors, procurement leads, and technology partners provided real-world perspectives on formulation challenges and supply chain adaptations. Simultaneously, a comprehensive review of regulatory documents, industry publications, and material safety data sheets ensured factual alignment with current standards and product specifications.

Quantitative data was cross-verified against multiple sources, including trade association statistics, customs records, and public financial disclosures, while qualitative insights were triangulated through Delphi panels and focus group discussions. Rigorous data validation protocols, including consistency checks and outlier analysis, guaranteed the reliability of conclusions. This methodological rigor ensures that the strategic recommendations and market intelligence presented here are both actionable and defensible.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aluminum Pigment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aluminum Pigment Market, by Distribution Channel

- Aluminum Pigment Market, by Form

- Aluminum Pigment Market, by Type

- Aluminum Pigment Market, by Particle Size

- Aluminum Pigment Market, by Application

- Aluminum Pigment Market, by Region

- Aluminum Pigment Market, by Group

- Aluminum Pigment Market, by Country

- United States Aluminum Pigment Market

- China Aluminum Pigment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Connecting the Dots How Aluminum Pigment Market Dynamics Will Shape Competitive Advantages and Innovation Trajectories

The aluminum pigment market is poised to evolve through a confluence of technological innovation, sustainability acceleration, and trade policy realignment. As producers refine dispersion and powder technologies to satisfy stricter environmental standards, the competitive landscape will favor those with agile R&D frameworks and diversified sourcing models. Moreover, the interplay between regional regulatory variations and global application trends will continue to drive specialized product portfolios and collaborative partnerships.

Ultimately, stakeholders who proactively engage with emerging digital sales channels, advocate for equitable trade practices, and champion circularity initiatives will secure enduring competitive advantages. By integrating the segmentation, regional, and tactical insights herein, decision-makers can craft robust strategies that not only mitigate risks associated with tariff volatility but also capitalize on the aesthetic and functional potential of next-generation aluminum pigment solutions.

Unlock Comprehensive Aluminum Pigment Market Insights and Propel Your Strategy Forward with Expert Guidance from Our Associate Director of Sales & Marketing

Elevate your competitive edge by securing full access to our in-depth market research report covering the latest developments and strategic imperatives shaping the aluminum pigment landscape in 2025. Connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to discuss tailored licensing options that empower your organization with actionable intelligence and proprietary insights. Reach out today to transform these findings into decisive market leadership.

- How big is the Aluminum Pigment Market?

- What is the Aluminum Pigment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?