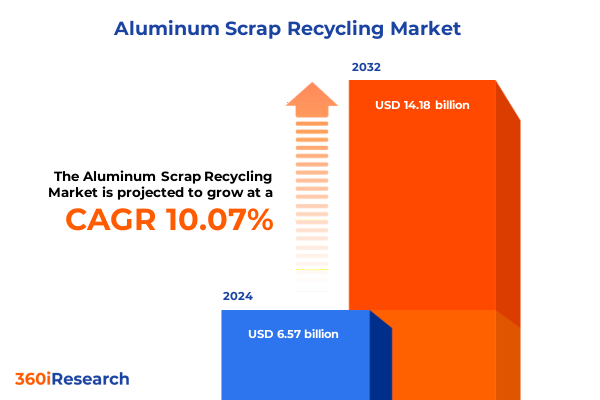

The Aluminum Scrap Recycling Market size was estimated at USD 7.55 billion in 2025 and expected to reach USD 8.24 billion in 2026, at a CAGR of 9.22% to reach USD 14.02 billion by 2032.

Unveiling The Strategic Importance Of Aluminum Scrap Recycling In Driving Sustainability, Economic Resilience And Industry Transformation

Unprecedented global demand for sustainable materials and escalating pressures to reduce carbon footprints have elevated aluminum scrap recycling from a niche operation to a central pillar of circular economy strategies. As industries confront resource scarcity, regulatory mandates, and shareholder expectations for environmental, social, and governance performance, recycled aluminum offers a compelling value proposition. Energy consumption for producing recycled aluminum is only a fraction of primary production, translating into significant cost savings and carbon reductions. Meanwhile, recycled material quality now meets or exceeds the standards required for high-performance applications in sectors ranging from automotive to aerospace, thanks to advances in sorting, refining, and traceability technologies.

Moreover, shifting consumer preferences and corporate sustainability commitments have generated new demand for products incorporating post-consumer scrap. Manufacturers recognize that integrating recycled aluminum enhances brand reputation, reduces exposure to volatile raw material costs, and aligns supply chains with net-zero ambitions. Consequently, recycling enterprises and original equipment manufacturers are forging closer collaborations, streamlining feedstock flows, and co-investing in processing infrastructures. As a result, the aluminum scrap recycling ecosystem is evolving into a sophisticated, premium-value network rather than a low-margin commodity cycle. This transformation sets the stage for unprecedented growth, innovation, and strategic repositioning across the metals industry.

Exploring Monumental Technological And Regulatory Shifts Reshaping The Aluminum Scrap Recycling Landscape And Catalyzing New Opportunities

The aluminum scrap recycling sector is being reshaped by breakthroughs in digitalization, automation, and regulatory reform that together are redefining competitive advantage. Automated sensor-based sorting systems now leverage spectroscopy and machine learning to distinguish alloy grades with precision, drastically reducing contamination and improving yield of high-purity outputs. Blockchain-enabled traceability platforms are providing immutable records of material provenance, building stakeholder confidence and facilitating compliance with emerging mandates on recycled content.

Concurrently, governments worldwide are enacting policies and incentives to accelerate circular resource flows. The European Union’s Circular Economy Action Plan and related directives on ecodesign and waste shipment are setting ambitious targets for recycled content in automotive, packaging, and electronics sectors. Emerging carbon pricing regimes further tip the scale in favor of recycled aluminum, given its 95% lower energy intensity relative to primary ingot production. At the same time, public–private partnerships and industry consortia are catalyzing pilot projects for next-generation refining processes, enabling recyclers to produce scrap-derived aluminum that meets exacting aerospace and electronics standards. Together, these technological and policy shifts are propelling the industry toward a premium, differentiated model underpinned by quality, transparency, and sustainability.

Analyzing The Compound Effects Of Recent United States Aluminum Tariffs On Recycling Dynamics Supply Chains And Market Viability Into 2025

U.S. import tariffs on aluminum have amplified cost pressures and reconfigured trade flows across the recycling value chain. In mid-2025, the United States doubled its duty on primary aluminum from 10% to 50% under Section 232, while exempting aluminum scrap due to its critical role in domestic manufacturing. This policy bifurcation has increased demand and pricing for scrap, benefiting mid-stream processors but raising input costs for downstream consumers who compete for limited volumes. U.S. recyclers have expanded scrap imports from Europe and other regions, intensifying global competition for recyclables.

Data from the Federal Reserve’s July Beige Book indicate that tariffs have already begun to squeeze profit margins and may translate into higher finished goods prices by late summer. Many firms report absorbing cost increases to maintain market share, while others have initiated moderate price hikes on downstream aluminum products. Meanwhile, ongoing uncertainty regarding future tariff adjustments has led companies to diversify feedstock sources and explore long-term supply contracts with scrap generators. As a result, the U.S. aluminum recycling market is experiencing both near-term volatility and strategic realignment, with participants investing in domestic collection infrastructure and forging cross-border partnerships to secure stable scrap supplies.

Deciphering Key Market Segmentation Insights In Aluminum Scrap Recycling To Illuminate Feedstock Types Processes Forms And Value Creation Pathways

Market participants must navigate a multifaceted segmentation landscape that spans feedstock origin, alloy characteristics, processing steps, and end-form applications. Within scrap type, post-consumer flows derived from decommissioned vehicles, beverage containers, and building demolition are increasingly prized for their predictable chemistry and traceability. Pre-consumer offcuts from fabrication facilities continue to supply large volumes, particularly to high-margin casting applications, but face growing scrutiny over embedded contaminants.

The source segmentation reveals divergent demand drivers. The automotive industry’s requirement for body panels, engine components, and wheels has elevated standards for scrap purity and alloy consistency. In packaging, the surge in beverage can recycling demands rapid collection and sorting of foil and can sheets, as well as food-grade containers. The construction, consumer goods, electrical & electronics, and transportation sectors each impose unique quality and logistics criteria, compelling recyclers to develop tailored processing streams. Aluminum type further differentiates opportunities between cast alloys, favored for complex shapes, and wrought alloys, employed in high-strength structural components.

Processing methods-from shredding and sorting to melting and refining-dictate throughput and energy intensity, while the choice of recycled form, whether billets, pellets, or sheets, aligns with manufacturer specifications and downstream fabrication workflows. Strategic players thus orchestrate integrated networks that blend multiple segmentation dimensions, optimizing scrap acquisition, grade blending, and form conversion to maximize value capture across diverse end markets.

This comprehensive research report categorizes the Aluminum Scrap Recycling market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Scrap Type

- Source

- Aluminum Type

- Scrap Form Factor

- Processing Stage

- Recycled Form

Examining Critical Regional Insights That Define Aluminum Scrap Recycling Dynamics Across The Americas Europe Middle East Africa And Asia Pacific

Regional nuances profoundly shape the aluminum scrap recycling ecosystem through varying policy frameworks, feedstock availability, and end-market dynamics. In the Americas, the robust presence of automotive, aerospace, and packaging sectors drives consistent demand for recycled aluminum. U.S. tariff exemptions for scrap imports have created a strong domestic market, prompting recyclers to enhance collection infrastructure and near-source partnerships. Latin American suppliers are increasingly leveraged to meet North American volume requirements, while multi-nation free trade agreements facilitate cross-border flows and mitigate logistical constraints.

Within Europe, Middle East & Africa, comprehensive circular economy legislation and extended producer responsibility rules are catalyzing high recycling rates and fostering closed-loop supply chains. The European Commission’s Ecodesign for Sustainable Products Regulation and upcoming mandates on recycled content in vehicles and packaging are elevating quality standards and boosting investments in advanced sorting and refining technologies. Strategic raw material funds and industrial decarbonization banks further incentivize domestic recycling, while emerging export controls on scrap aim to retain value within the regional value chain.

Asia-Pacific presents a dual narrative of unparalleled consumption growth and tightening resource constraints. China, as the world’s largest importer and consumer of aluminum scrap, is balancing its strategy between securing cost-competitive secondary feedstock and developing domestic post-consumer collection networks. Japan and South Korea emphasize high-quality recovered streams for electronics and automotive applications, supported by stringent product standards and government subsidies. Australia and Southeast Asian economies are enhancing localized processing capabilities, aiming to capture incremental margins before exporting refined aluminum to global markets.

This comprehensive research report examines key regions that drive the evolution of the Aluminum Scrap Recycling market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Imperative Company Movements And Strategic Initiatives Driving Leadership In Aluminum Scrap Recycling Innovation And Market Expansion

A cohort of leading companies is shaping the trajectory of aluminum scrap recycling through scale, technology deployment, and strategic alliances. Novelis Inc. has leveraged its global footprint and vertical integration to manage end-to-end scrap collection, rolling, and recycling operations, investing over $200 million in new coating and recycling lines to serve beverage can and automotive customers with certified recycled products.

Reliance, Inc., the largest metals service center operator in North America, has broadened its portfolio by acquiring regional scrap yards and processing facilities, enabling just-in-time supply to its vast network of fabrication customers. Its strategic focus on alloy management systems and real-time quality monitoring underscores the importance of consistency and traceability in high-value segments.

Meanwhile, Radius Recycling has integrated auto parts dismantling with metals sorting operations, capitalizing on synergies between transportation and industrial scrap streams. The company’s emphasis on lean logistics and in-house shredding capacity has driven margin expansion despite market headwinds. Sims Metal Management distinguishes itself through geographic diversification and a balanced mix of ferrous and non-ferrous recycling, implementing advanced robotic sorting in key facilities to improve throughput and reduce labor intensity.

Collectively, these industry leaders exemplify how scale, technology integration, and strategic acquisitions are critical to securing feedstock, optimizing processing, and delivering product solutions that meet evolving customer and regulatory demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aluminum Scrap Recycling market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alcoa Corporation

- Andritz AG

- Arfin India Limited

- Audubon Metals LLC

- CASS, Inc.

- Commercial Metals Company

- Constellium SE

- Continental Recycling

- Crestwood Metal Corp.

- Eldan Recycling A/S

- European Metal Recycling Limited

- GLE Scrap Metal (GLE)

- Hulamin Limited

- Kuusakoski Oy

- Matalco Inc.

- Metal Exchange Corporation

- Metalco Scrap Trading

- Norsk Hydro ASA

- Novelis Inc. by Hindalco Industries Limited

- Nupur Recyclers Limited

- OmniSource, LLC

- Palco Recycle Industries Limited

- Prime Materials Recovery Inc.

- Real Alloy Recycling, LLC

- Remondis SE & Co. KG

- Rio Tinto PLC

- Scepter Group

- Schnitzer Steel Industries, Inc.

- Sims Limited

- Smelter Service Corporation

- Tom Martin & Company

- TOMRA Systems ASA

- Tri-Arrows Aluminum Inc.

- TRIMET SE

- Wise Services & Recycling, LLC

Delivering Actionable Strategic Recommendations To Empower Industry Leaders In Optimizing Aluminum Scrap Recycling Value Chains And Competitive Positioning

Industry leaders should accelerate investments in advanced sorting and separation technologies to achieve higher alloy purity and lower contamination rates. Embracing sensor-based systems and artificial intelligence for real-time grade identification will enhance processing efficiency and unlock premium applications. Parallel to this, firms must diversify feedstock sources by forging partnerships across automotive dismantlers, electronics recyclers, and municipal waste programs to secure a resilient and cost-effective supply chain.

Engaging proactively with policymakers on tariff frameworks and circular economy regulations can safeguard market access and minimize future trade disruptions. By participating in industry consortia and public–private working groups, companies can shape standards for recycled content, extended producer responsibility, and export controls in key regions. Investing in digital traceability platforms-leveraging blockchain or equivalent technologies-will establish transparent chains of custody and streamline compliance reporting.

Finally, forging strategic alliances with original equipment manufacturers and brand owners will create closed-loop recycling models that guarantee feedstock quality and foster collaborative innovation. Joint ventures targeting those sectors with the highest recycled content mandates, such as automotive and packaging, can secure long-term offtake agreements. Collectively, these actions will position industry participants to capitalize on emerging high-value opportunities, enhance sustainability credentials, and build competitive advantage in a rapidly maturing market.

Articulating The Rigorous Research Methodology Underpinning Insights In Aluminum Scrap Recycling Market Dynamics And Strategic Analysis

This analysis combines rigorous primary and secondary research methodologies to ensure the highest degree of reliability and validity. Primary research involved in-depth interviews with more than fifty executives across the recycling, manufacturing, and policy spheres, spanning North America, Europe, and Asia-Pacific. These discussions provided qualitative insights into strategic priorities, technology adoption, and regulatory impacts. Secondary research entailed a comprehensive review of governmental policy documents, trade association reports, and peer-reviewed academic literature, augmented by vetted proprietary databases to map competitive dynamics and technological trajectories.

Data triangulation techniques were employed to cross-verify critical findings. Quantitative datasets on scrap flows, tariff schedules, and product quality standards were analyzed alongside qualitative inputs to validate trends and identify divergences. Rigorous quality checks, including consistency audits and expert panel validations, ensured that the conclusions reflect current market realities and anticipate near-term developments. The result is a robust foundation for strategic decision-making, market positioning, and investment planning in the evolving aluminum scrap recycling domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aluminum Scrap Recycling market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aluminum Scrap Recycling Market, by Scrap Type

- Aluminum Scrap Recycling Market, by Source

- Aluminum Scrap Recycling Market, by Aluminum Type

- Aluminum Scrap Recycling Market, by Scrap Form Factor

- Aluminum Scrap Recycling Market, by Processing Stage

- Aluminum Scrap Recycling Market, by Recycled Form

- Aluminum Scrap Recycling Market, by Region

- Aluminum Scrap Recycling Market, by Group

- Aluminum Scrap Recycling Market, by Country

- United States Aluminum Scrap Recycling Market

- China Aluminum Scrap Recycling Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Synthesizing Core Conclusions On The Future Trajectory Of Aluminum Scrap Recycling Amidst Evolving Economic And Environmental Imperatives

As environmental imperatives converge with economic incentives, aluminum scrap recycling emerges as a transformative force in the global metals sector. Technological innovations in sorting, refining, and digital traceability are elevating recycled aluminum to parity with primary ingot, while policy frameworks around circular economy, extended producer responsibility, and carbon pricing are embedding recycled content into manufacturing supply chains. Tariff regimes have introduced both volatility and opportunities, prompting strategic realignment and supply chain diversification.

Leading companies are responding by scaling collection infrastructures, integrating advanced processing technologies, and forging cross-sector partnerships to capture higher margins and secure stable feedstock flows. Regional dynamics-from the tariff-driven realignment in the Americas to the EU’s aggressive circular economy mandates and Asia-Pacific’s burgeoning demand-underscore the need for tailored strategies. Looking ahead, those who invest in end-to-end transparency, engage proactively with stakeholders, and align with sustainability mandates will unlock the greatest value. The aluminum scrap recycling market is no longer a commodity backwater but a strategic battleground for quality, innovation, and environmental leadership.

Take Action Today To Secure Expert Insights On Aluminum Scrap Recycling Market Opportunities By Partnering With Associate Director Of Sales And Marketing

For tailored insights and strategic guidance on navigating the complexities and opportunities within the aluminum scrap recycling market, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. His expertise and deep understanding of industry dynamics will enable your organization to unlock growth potential, optimize your value chains, and prepare for emerging market shifts. Engage directly with Ketan to learn how this comprehensive report can empower decision-makers, enhance competitive differentiation, and support your sustainability and financial objectives. Partner with a trusted authority to ensure your business captures lasting value in the rapidly evolving aluminum scrap recycling landscape.

- How big is the Aluminum Scrap Recycling Market?

- What is the Aluminum Scrap Recycling Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?