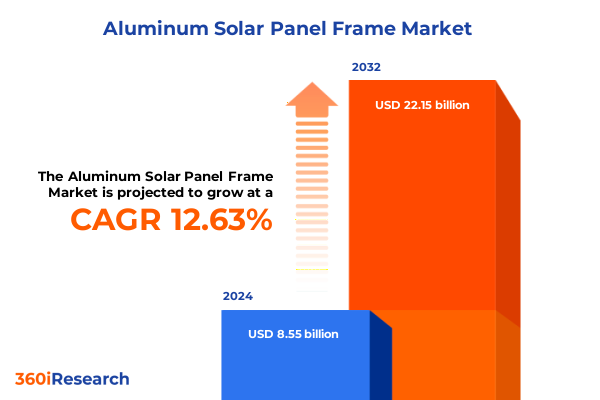

The Aluminum Solar Panel Frame Market size was estimated at USD 9.45 billion in 2025 and expected to reach USD 10.72 billion in 2026, at a CAGR of 12.93% to reach USD 22.15 billion by 2032.

Unlocking Sustainable Solar Momentum Through Advanced Aluminum Frame Designs Enhancing Durability Efficiency and Lifecycle Performance

The global surge in photovoltaic deployment underscores an urgent need to refine every component of solar energy systems, and aluminum frames stand at the forefront of this evolution. As the clean energy sector readies to meet the Net Zero Emissions by 2050 Scenario, aluminum’s innate combination of high strength-to-weight ratio, corrosion resistance, and full recyclability positions it as an indispensable material in both distributed and utility-scale installations. Moreover, industry leaders are rapidly integrating lifecycle considerations into design, recognizing that aluminum frames not only deliver long-term structural integrity but also support circular economy objectives by enabling closed-loop recycling systems that consume up to 95% less energy than primary production.

Transitioning from traditional mounting components to aluminum frame solutions that adhere to third-party sustainability standards has become a critical differentiator. As policy frameworks such as the EU Carbon Border Adjustment Mechanism drive explicit carbon reporting and product environmental footprints, solar developers and module producers increasingly demand proof of recycled content and low-emission processing methods. This convergence of regulatory pressure and corporate net-zero commitments highlights the pivotal role of advanced aluminum frames in enhancing the technical performance and environmental credibility of solar arrays.

Embracing Cutting-Edge Innovations and Digital Transformations to Revolutionize Solar Panel Frame Manufacturing and Deployment Efficiencies

Innovations in manufacturing processes and material science are rapidly redefining how aluminum solar frames are designed, produced, and deployed. Additive manufacturing and robotic extrusion systems now offer unprecedented precision, enabling intricate cross-sections that optimize load distribution while minimizing raw material usage. Such automation not only accelerates production throughput but also drives down defect rates, reinforcing quality control protocols that ensure uniformity in critical structural tolerances.

Simultaneously, next-generation aluminum alloys and composite hybrids are emerging to address the unique demands of challenging environments. Alloy formulations refined for elevated tensile strength and enhanced corrosion resistance support installations in coastal and high-humidity zones, while polymer-reinforced composite frames deliver superior weight reduction and thermal insulation benefits. These material breakthroughs, coupled with digital twin simulations for real-time structural health monitoring, allow stakeholders to forecast maintenance needs and extend module lifespans-all without compromising sustainability metrics. Together, these transformative shifts are ushering in a new era of integrated lifecycle solutions that fuse performance, resilience, and ecological stewardship.

Navigating the Complex Trade Terrain Shaped by Stacked Tariffs That Reshape Solar Frame Supply Chains and Cost Structures in the United States

The United States has progressively layered import duties on aluminum and related solar components, creating a multifaceted tariff environment that now shapes sourcing strategies and cost structures. In early 2025, modifications to Section 232 duties reinstated a universal 10% levy on all aluminum articles, while country-specific reciprocal tariffs were paused only briefly amid diplomatic negotiations. Those measures built upon extended Section 301 provisions, which subject Chinese-origin solar cells and modules to up to 60% combined duties, alongside anti-dumping and countervailing duties that can stack up to 30% on top of existing tariffs.

This cumulative tariff structure has translated into tangible pricing impacts and supply chain realignments across the solar frame sector. Material costs have risen as manufacturers redirect sourcing to domestic smelters or partner with non-Chinese suppliers, while lead times have extended due to capacity constraints at alternate production hubs. For utility-scale developers, these elevated equipment expenses have prompted renegotiations of power purchase agreements, driving project deferrals in tight-margin scenarios. Likewise, distributed solar installers report that escalating frame prices have compressed project budgets, reinforcing the need for strategic inventory management and proactive tariff-mitigation policies.

Decoding Market Segmentation to Reveal End User Panel Types Installations and Channel Dynamics Driving Aluminum Solar Frame Demand Patterns

Analyzing the market through an end-user lens reveals that commercial applications-spanning industrial, office, and retail settings-prioritize high-load frames capable of supporting large surface areas and enhanced wind-load ratings, while the residential segment, divided between single-family rooftops and multi-family installations, demands slimmer, aesthetically integrated profiles. Utility-scale deployments, whether in vast ground-mounted fields or smaller community solar arrays, require robust, modular connectors that facilitate rapid assembly and withstand high-temperature fluctuations.

When examining panel types, monocrystalline modules, particularly PERC-enhanced variants, often pair with premium anodized frames for maximum structural integrity, whereas polycrystalline panels, both PERC and non-PERC, leverage cost-efficient extrusions optimized for quick installation. Thin-film technologies, including cadmium telluride and CIGS, benefit from corrosion-resistant alloy frames that complement their lightweight form factor and unique mounting requirements.

Installation mode further differentiates demand: ground-mount systems call for heavier gauge extrusions with integrated foundations to manage soil-related stresses, whereas rooftop projects utilize streamlined, low-profile rails designed for minimal roof penetration. Distribution channels also influence purchasing strategies, with OEM partnerships providing custom-engineered solutions, aftermarket suppliers focusing on retrofit and repair segments, and tiered third-party distributors delivering both standard and premium frames through established network agreements.

This comprehensive research report categorizes the Aluminum Solar Panel Frame market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Panel Type

- Installation

- End User

- Channel

Assessing Regional Dynamics from Americas Policy Incentives to EMEA Sustainability Mandates and Asia-Pacific Market Expansion Influencing Frame Strategies

In the Americas, federal incentives such as the Inflation Reduction Act have catalyzed domestic manufacturing expansions, encouraging frame producers to invest in low-carbon smelting facilities and regional recycling centers. Corporate renewable procurement and state-level net-zero mandates further drive adoption of high-performance aluminum frames, particularly in states with elevated electricity prices and robust sustainability targets.

Across Europe, the Middle East, and Africa, stringent sustainability regulations like the EU’s Carbon Border Adjustment Mechanism necessitate transparent supply chains and carbon footprint disclosures for imported aluminum products. Solar developers in the EU and UAE emphasize suppliers offering certified recycled content, while North African markets pursue hybrid frame solutions to balance cost efficiencies with climate resilience in arid environments.

In the Asia-Pacific region, rapid capacity build-outs in China and India spotlight both traditional aluminum and emerging composite frames. India’s domestic manufacturing incentives and PLI schemes have accelerated adoption of polymer-reinforced alternatives that address high-salinity coastal zones, while China’s integrated supply networks continue to supply low-cost, high-volume extrusions to global markets.

This comprehensive research report examines key regions that drive the evolution of the Aluminum Solar Panel Frame market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Aluminum Frame Manufacturers and Strategic Alliances Harnessing Technology and Sustainability Credentials to Define Competitive Edge

Market leadership in aluminum frame manufacturing is consolidated among companies that combine deep technical capabilities with strategic sustainability credentials. Hydro Extrusions has emerged as a frontrunner by leveraging its CIRCAL recycled aluminum technology to supply frames containing 75% post-consumer content, meeting European low-carbon project requirements while offering corrosion resistance that surpasses competitors by 30%. Hydro’s collaboration with leading module integrators in the U.S. Southwest underscores its ability to optimize standardized high-volume frame designs for automated assembly lines.

Norsk Hydro’s hydro extrusion division and Constellium SE further distinguish themselves through advanced alloy formulations and customizable anodization finishes that appeal to both utility and distributed solar applications. On the other hand, China’s Xingfa Aluminium and Jinli Group command significant shares of the high-performance segment, deploying patented thermal barrier alloys and anti-corrosion coatings to address extreme temperature and humidity challenges in global utility markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aluminum Solar Panel Frame market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adani Solar

- Bimal Aluminiums Pvt. Ltd.

- Canadian Solar Inc.

- Gautam Solar Pvt. Ltd.

- Gujarat Aluminium Extrusion Pvt. Ltd.

- Hanwha Q CELLS GmbH

- Jiangyin Haihong Nonferrous Metal Material Co., Ltd.

- Jinko Solar Co., Ltd.

- Presal Extrusion d.o.o.

- PSP Dynamic Limited

- Renusol GmbH

- Shandong Davogen Aluminum Products Co., Ltd.

- SunLink Corporation

- Sunworld Tech Corp.

- Trina Solar Co., Ltd.

- Unicorn Industries

- Vaibhav Laxmi Industries Pvt. Ltd.

- Vasant Industries

- Vikram Solar Limited

- Vishakha Renewables Pvt. Ltd.

Charting Strategic Pathways for Industry Leaders to Optimize Supply Chains Innovate Materials and Advocate Policy for Resilient Solar Frame Growth

To navigate tariff complexities and supply constraints, industry leaders should prioritize multi-source procurement strategies that harness both domestic and allied international suppliers, thereby mitigating cost volatility and ensuring continuity of lead times. Embracing digital traceability platforms will enable end-to-end carbon footprint tracking, satisfying regulatory disclosures and strengthening sustainability claims in tender processes.

Investments in advanced recycling infrastructure and circular design principles can significantly reduce material expenditures and align procurement with emerging policy frameworks such as carbon border adjustments. By collaborating with alloy refiners and module integrators to co-develop optimized frame solutions, manufacturers can differentiate their offerings through lower embodied emissions and enhanced mechanical performance. Simultaneously, active engagement with policymakers to advocate for balanced trade measures will help stabilize the tariff landscape and support sustainable growth across both distributed and utility-scale segments.

Detailing a Robust Methodological Framework Combining Secondary Research Expert Insights Data Triangulation and Rigorous Validation for Credible Analysis

This analysis synthesizes insights from a rigorous, multi-phase research methodology designed to ensure both breadth and depth of coverage. Initially, an extensive review of secondary sources-including policy documents, trade rulings, and technical standards-provided the foundation for identifying key market drivers, regulatory impacts, and competitive dynamics. Complementing this desk research, a series of expert interviews with material scientists, solar developers, and supply chain executives validated emerging trends and uncovered nuanced operational challenges.

Quantitative data was triangulated with proprietary databases and public filings to map industry structure and corroborate company profiles. Segmentation assumptions were stress-tested through scenario analysis to confirm the relevance of end-user categories, panel technologies, installation modes, and distribution channels. Finally, regional insights were refined through comparative policy reviews and market monitoring to reflect the most up-to-date developments across major geographies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aluminum Solar Panel Frame market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aluminum Solar Panel Frame Market, by Panel Type

- Aluminum Solar Panel Frame Market, by Installation

- Aluminum Solar Panel Frame Market, by End User

- Aluminum Solar Panel Frame Market, by Channel

- Aluminum Solar Panel Frame Market, by Region

- Aluminum Solar Panel Frame Market, by Group

- Aluminum Solar Panel Frame Market, by Country

- United States Aluminum Solar Panel Frame Market

- China Aluminum Solar Panel Frame Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Concluding Insights That Synthesize Key Trends Technological Shifts and Policy Impacts Guiding Future Investments in Aluminum Solar Panel Frame Solutions

The aluminum solar panel frame industry stands at a pivotal crossroads, shaped by rapid technological advancements, shifting regulatory landscapes, and evolving customer priorities. Advances in automated manufacturing and next-generation alloy formulations are unlocking new thresholds of performance and durability, while composite alternatives gain traction in climate-sensitive regions. At the same time, the compounding effects of U.S. tariff policies underscore the importance of resilient, diversified supply chains.

Segmentation analyses reveal a complex interplay between end-user demands, panel types, installation preferences, and channel strategies that inform product development and go-to-market approaches. Regional divergences-driven by local incentives, sustainability mandates, and capacity investments-highlight the necessity of tailored strategies that align frame offerings with market-specific requirements. Ultimately, companies that successfully integrate circular economy principles, adopt digital traceability, and engage collaboratively with policymakers will be best positioned to capture the next wave of solar growth while advancing global decarbonization goals.

Seize the Opportunity to Elevate Your Solar Projects by Engaging with Our Expert Analysis Delivered by Ketan Rohom to Secure Competitive Market Intelligence

To explore the full depth of this market research and gain actionable insights that will empower your strategic initiatives, connect with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in guiding industry leaders through tailored intelligence will ensure you have the competitive edge needed to optimize supply chains, anticipate policy shifts, and capitalize on emerging material innovations. Reach out today to secure your copy of the comprehensive report and embark on a data-driven journey that transforms your solar panel framing strategy into a sustainable growth engine.

- How big is the Aluminum Solar Panel Frame Market?

- What is the Aluminum Solar Panel Frame Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?