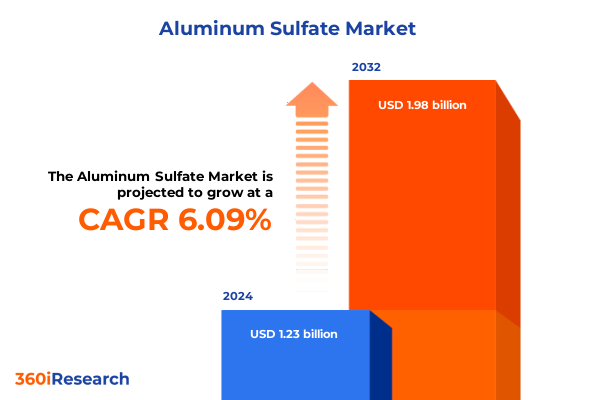

The Aluminum Sulfate Market size was estimated at USD 1.30 billion in 2025 and expected to reach USD 1.37 billion in 2026, at a CAGR of 6.23% to reach USD 1.98 billion by 2032.

Unlocking the Vital Role of Aluminum Sulfate in Modern Industry: A Comprehensive Overview of its Functions, Importance, and Strategic Benefits

Aluminum sulfate is a widely utilized inorganic compound, prized for its versatile role as a coagulant and mordant across multiple industrial sectors. In water and wastewater treatment, it facilitates the removal of suspended solids and impurities, ensuring compliance with stringent environmental regulations. In paper manufacturing, its function as a sizing agent enhances fiber bonding, improving paper strength, brightness, and ink retention. Moreover, in the textile industry, aluminum sulfate acts as a mordant that fixes dyes to fabrics, delivering vivid color fastness and uniformity while minimizing washout. These core applications underscore why aluminum sulfate remains an indispensable chemical intermediate for both municipal and industrial processes

Identifying the Key Transformative Shifts Shaping the Aluminum Sulfate Market Landscape in Response to Sustainability, Technological, and Regulatory Drivers

As global industries respond to mounting environmental imperatives, the aluminum sulfate landscape has shifted dramatically toward sustainability and innovation. Regulatory agencies are imposing more rigorous effluent standards, driving producers to invest in higher-purity grades and advanced product formulations that minimize sludge volume and chemical residues. At the same time, manufacturers are harnessing digitalization and process automation to reduce energy consumption during production, improve consistency, and accelerate batch turnaround times. Furthermore, the trend toward circular economy models has elevated interest in recycling alum-based coagulants and recovering aluminum from spent treatment sludges. These transformative forces are reshaping supply chains, prompting strategic investments in research and development to deliver next-generation coagulants that balance performance with environmental stewardship

Examining the Cumulative Impact of 2025 United States Aluminum Import Tariffs on Domestic Aluminum Sulfate Supply Chains, Cost Structures, and Industry Competitiveness

In early 2025, the U.S. government revoked preferential trade agreements with major allies such as Canada, the European Union, and Mexico, reinstating a uniform 25 percent ad valorem tariff on aluminum articles and derivative aluminum products effective March 12, 2025. This policy adjustment terminated product exclusion processes and eliminated exemptions that had previously shielded qualifying producers, thereby marking a significant elevation in import duties on raw and derivative aluminum imports into the United States The cumulative impact of these measures has been felt acutely by industrial consumers of aluminum sulfate, who have faced steep increases in raw material costs that have translated into higher procurement prices. For example, domestic coagulant suppliers such as USALCO immediately adjusted their pricing structures to reflect the new tariff burdens, leading to notable increases in the Platts Midwest US Transaction Premium and corresponding pass-through effects in downstream water treatment and paper manufacturing operations

Unveiling Key Segmentation Insights Across Applications, Forms, Grades, and Distribution Channels to Illuminate Market Dynamics and End-User Requirements

The aluminum sulfate market can be segmented by application, form, grade, and distribution channel to reveal distinct user requirements and growth potentials. Within the application segment, the demand from leather tanning is dissected between footwear tanning and garments, and upholstery tanning, while paper manufacturing subdivides into packaging, tissue, and writing and printing grades, each with tailored purity and flocculation profiles. Dye fixation in the textile industry underscores the need for specific reactive surface chemistries, and the wastewater segment encompasses both industrial and municipal treatment facilities, where chemical oxygen demand and turbidity removal metrics drive formulation preferences. In parallel, the water treatment segment differentiates between industrial and municipal plants, emphasizing consistent quality and solubility properties. Considering form factors, granular sizes ranging from 2–4 millimeters and 4–6 millimeters support targeted dosing systems, whereas pelletized forms spanning 3–5 and 5–7 millimeters cater to automated feed mechanisms. Powder configurations––both fine and medium grades––address rapid dissolution requirements in high-volume applications. Grade distinctions between food, pharmaceutical, and technical grades further refine product specifications, with pharmaceutical-grade variants subdivided into oral and topical formulations to meet rigorous sterility and toxicity standards. Finally, the distribution network spans direct sales engagements, distributor-mediated channels through retail or wholesale partners, and growing volumes of online procurement platforms, reflecting evolving buyer preferences and logistical efficiencies.

This comprehensive research report categorizes the Aluminum Sulfate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Grade

- Application

- Distribution Channel

Highlighting Critical Regional Insights Across the Americas, Europe Middle East and Africa, and Asia Pacific to Understand Geographic Demand Drivers and Market Nuances

Across the Americas, robust investments in water infrastructure renovation and municipal treatment upgrades sustain high consumption rates of aluminum sulfate, especially in regions with aging networks that require reliable coagulant performance and minimal byproduct generation. Meanwhile, in Europe, the Middle East, and Africa, stringent environmental directives-coupled with a strong focus on industrial effluent quality-have elevated demand for high-purity and eco-certified grades, prompting producers to enhance product traceability and quality assurance frameworks. In the Asia-Pacific region, rapid urbanization and industrial expansion have driven a surge in demand for paper manufacturing and municipal water treatment chemicals, as governments prioritize clean water access and pollution control. The region’s significant manufacturing base further amplifies the need for aluminum sulfate in dye fixation, packaging paper sizing, and wastewater management, making it a central growth hub for suppliers seeking scale and operational flexibility

This comprehensive research report examines key regions that drive the evolution of the Aluminum Sulfate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Strategic Moves and Market Footprints of Leading Aluminum Sulfate Suppliers to Understand Competitive Positioning and Innovation Strategies

Leading chemical manufacturers have taken divergent approaches to capitalize on shifting market dynamics in the aluminum sulfate sector. Finnish specialty chemical firm Kemira announced a €20 million investment to add an aluminum chlorohydrate production line in Tarragona, Spain, signaling its commitment to high-performance coagulants for drinking water treatment and reinforcing its European footprint In North America, Kemira’s acquisition of Thatcher Group’s iron sulfate assets on the U.S. East Coast further illustrates strategic consolidation aimed at broadening product portfolios and optimizing logistics networks Simultaneously, major domestic coagulant supplier USALCO moved swiftly to adjust pricing in response to the 25 percent tariff increase, communicating supply cost implications to its customer base and demonstrating the immediate commercial repercussions of trade policy changes Distribution specialist Univar Solutions continues to serve as a key aggregator, offering both liquid and dry aluminum sulfate configurations through its nationwide network of warehouses, thus providing downstream users with critical flexibility in procurement and inventory management

This comprehensive research report delivers an in-depth overview of the principal market players in the Aluminum Sulfate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- Ecolab Inc.

- Grasim Industries Limited

- Holland Company, Inc.

- Kemira Oyj

- Kishida Chemical Co., Ltd.

- Merck KGaA

- National Aluminium Company Limited

- Nouryon Chemicals Holding B.V.

- PVS Technologies, Inc.

- Shandong Shuangyang Chemical Co., Ltd.

- SNF Floerger SA

- Solvay SA

- Veolia Environnement SA

Actionable Recommendations to Drive Growth and Resilience in the Aluminum Sulfate Industry Through Strategic Investment, Collaboration, and Sustainability Initiatives

Industry leaders should prioritize collaborative ventures to enhance raw material resilience and scale regional production capacity in anticipation of potential trade disruptions. Embracing digital monitoring solutions within manufacturing operations can yield real-time quality control data, reducing variability and lowering waste generation. To address evolving regulatory demands, chemical producers must invest in eco-friendly product lines that deliver superior removal efficiencies while minimizing sludgy byproduct in alignment with circular economy objectives. Engaging directly with key end users-particularly municipal water authorities and major paper producers-will foster product co-development opportunities tailored to specific performance criteria. Furthermore, navigating tariff volatility requires proactive scenario planning and hedging strategies, including geographic diversification of supply sources and strategic inventory positioning. By integrating sustainability benchmarks into corporate roadmaps, industry players can strengthen their market positioning and establish enduring partnerships rooted in shared environmental commitments.

Research Methodology Detailing the Systematic Approach Combining Primary and Secondary Data Sources to Ensure Accurate and Reliable Market Insights

This analysis synthesizes insights derived from a multi-tiered research framework, commencing with primary interviews conducted among chemical manufacturers, end-users, and trade association representatives to capture firsthand perspectives on operational challenges and emerging requirements. Complementary secondary research encompassed a thorough review of regulatory proclamations, Federal Register updates, proprietary company press releases, and technical white papers to contextualize macro-policy impacts such as tariff adjustments. Publicly available datasets and industry catalogs provided verification of segmentation structures and key supplier footprints. Each data point was triangulated against reputable journal publications and market intelligence platforms to validate accuracy. Throughout the process, a structured data validation protocol was applied to ensure consistency and reliability, while insights from domain experts were incorporated to refine strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aluminum Sulfate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aluminum Sulfate Market, by Form

- Aluminum Sulfate Market, by Grade

- Aluminum Sulfate Market, by Application

- Aluminum Sulfate Market, by Distribution Channel

- Aluminum Sulfate Market, by Region

- Aluminum Sulfate Market, by Group

- Aluminum Sulfate Market, by Country

- United States Aluminum Sulfate Market

- China Aluminum Sulfate Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Drawing Conclusive Insights on the Aluminum Sulfate Market’s Evolution, Challenges, and Strategic Imperatives for Future Industry Leadership

The aluminum sulfate market stands at a critical juncture where evolving environmental regulations, heightened sustainability expectations, and geopolitical trade shifts are redefining competitive landscapes. While traditional applications in water treatment, paper manufacturing, and textiles remain robust, new growth vectors are emerging through advanced coagulant technologies and cross-industry collaborations. Tariff-induced cost pressures have underscored the need for agile supply chain strategies and diversified sourcing models. Moreover, segmentation insights reveal nuanced requirements across application sectors, form factors, and distribution routes, illuminating the pathways by which suppliers can tailor offerings to precise user demands. As regional dynamics continue to diverge-driven by infrastructure investment cycles in the Americas, regulatory stringency in EMEA, and capacity expansions in Asia-Pacific-the imperative for targeted, data-driven decision-making becomes ever more paramount. Ultimately, stakeholders who effectively integrate innovation, sustainability, and strategic foresight will secure leadership in this dynamic chemical landscape.

Connect with Ketan Rohom to Secure Your Aluminum Sulfate Market Research Report and Gain the Strategic Insights Needed to Accelerate Growth and Competitiveness

Ready to transform your strategic approach with comprehensive insights and data-driven analysis on the aluminum sulfate market? Reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to secure your copy of the full market research report and gain the actionable intelligence you need to make informed decisions that will drive growth and competitive advantage

- How big is the Aluminum Sulfate Market?

- What is the Aluminum Sulfate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?