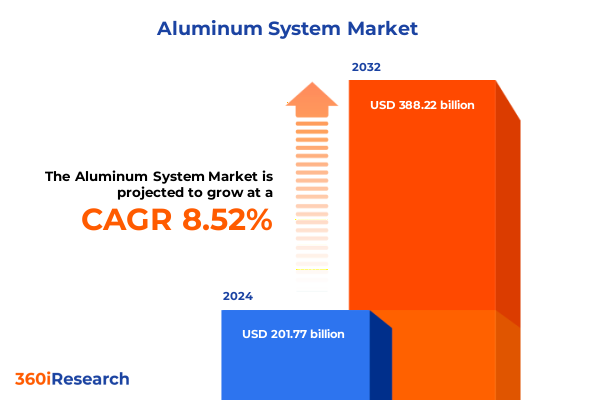

The Aluminum System Market size was estimated at USD 216.77 billion in 2025 and expected to reach USD 232.90 billion in 2026, at a CAGR of 8.68% to reach USD 388.22 billion by 2032.

Exploring the foundational dynamics and emerging drivers shaping the modern aluminum system market to frame strategic opportunities and challenges

The aluminum system market represents a complex ecosystem where raw material properties, production processes, and end-use requirements converge to drive innovation and competitive differentiation. As demand patterns evolve in response to global infrastructure initiatives, environmental imperatives, and technological advancements, stakeholders across the value chain are seeking a holistic understanding of the forces shaping supply dynamics, cost structures, and performance benchmarks. This executive summary aims to frame the landscape by identifying the foundational drivers of growth and the critical challenges that industry leaders must navigate in a rapidly shifting environment.

Within this context, it is essential to recognize how sustainability objectives, digital transformation, and geopolitical developments converge to influence capital allocation, operational efficiency, and product development strategies. By situating the aluminum system market within broader macroeconomic and regulatory frameworks, this introduction outlines the scope of our analysis and sets the stage for a deeper exploration of transformative shifts, tariff impacts, segmentation insights, regional nuances, and company-level dynamics. Through this lens, decision-makers will be equipped with a comprehensive perspective that balances near-term tactical considerations with long-term strategic imperatives.

Examining the pivotal transformative shifts revolutionizing aluminum system production processes sustainability integration and supply chain resilience

Over the past decade, the aluminum system landscape has undergone transformative shifts driven by the relentless pursuit of greater sustainability, enhanced supply chain resilience, and advanced manufacturing capabilities. Firms have embraced circular economy principles, investing in state-of-the-art recycling facilities that reduce energy consumption and minimize carbon footprints. Concurrently, digital technologies such as advanced analytics, the Industrial Internet of Things (IIoT), and artificial intelligence have fostered real-time monitoring and predictive maintenance, optimizing throughput and minimizing unplanned downtime across smelting, casting, extrusion, and rolling processes.

Moreover, regulatory pressures aimed at decarbonization have prompted technology providers and producers to collaborate on innovative low-carbon aluminum solutions. From inert anode development to electrified melt furnaces, these breakthroughs have redefined performance expectations and enabled more sustainable alloys. In parallel, supply chain agility has become paramount, with players diversifying sourcing portfolios and leveraging blockchain-based traceability platforms to ensure material provenance and compliance. Such strategic imperatives underscore the market’s evolution from a commodity-centric model toward an integrated ecosystem where technology adoption and environmental stewardship are intrinsically linked to competitive advantage.

Analyzing the cumulative implications of the United States 2025 tariff adjustments on aluminum system cost structures supply chain strategies and competitive positioning

The implementation of United States tariffs in 2025 has introduced significant implications for aluminum system market economics. As import duties on key intermediate forms and finished components rose, manufacturers faced escalating input costs that reverberated downstream. In response, established producers accelerated investments in domestic smelting and rolling assets to mitigate exposure, while OEMs recalibrated procurement strategies, balancing local sourcing with alternative trade lanes to preserve margin profiles.

Beyond cost considerations, the tariff landscape has catalyzed a reevaluation of supply chain partnerships. International suppliers formed joint ventures with domestic fabricators, transferring technology and capacity to navigate regulatory barriers. Meanwhile, downstream converters and end customers adjusted price negotiation frameworks to reflect the new cost baseline, prompting a dynamic rebalancing of value capture across tiers. These cumulative adaptations underscore how policy levers have reshaped competitiveness, driving an industry-wide shift toward localized value creation and strategic collaboration to secure continuity of supply under evolving trade conditions.

Uncovering critical segmentation insights across application alloy type manufacturing process form and product type to guide targeted market strategies

A nuanced segmentation analysis provides valuable vantage points for tailoring product development, marketing, and investment priorities within the aluminum system market. Based on application, the market spans critical end-use sectors such as construction-encompassing commercial high-rise frameworks, robust industrial facilities, and energy-efficient residential builds-as well as consumer goods, electrical and electronics domains covering consumer electronics devices, industrial electronics assemblies, and power transmission infrastructure. The packaging sector incorporates consumer goods packaging, food and beverage containers designed for safety and shelf stability, and pharmaceutical enclosures that meet stringent regulatory standards. Transportation applications extend to aerospace components engineered for weight reduction, automotive parts optimized for crash performance, marine structures requiring corrosion resistance, and railway vehicle assemblies demanding both strength and durability.

Alloy types further diversify market requirements, from the high-conductivity 1xxx series to the corrosion-resistant 3xxx grades, the versatile 5xxx family, the structural excellence of 6xxx alloys, and the high-strength 7xxx formulations. Manufacturing processes delineate distinct value propositions, with casting routes-including continuous casting for billet and slab, die casting for complex geometries, investment casting for high-precision parts, and sand casting for large volumes-alongside extrusion techniques characterized by direct, impact, and indirect methods to produce uniform cross-sections, and rolling lines segmented into cold and hot rolling practices that yield sheet, foil, plate, and specialist gauge formats. Form factors such as cast products, extruded products, foil, sheet and plate, and wire cater to diverse design and performance demands, while the choice between aluminum alloys and pure aluminum grades ultimately determines mechanical properties, machinability, and corrosion resistance. By interlinking these dimensions, market participants can pinpoint high-value segments, optimize product pipelines, and align capacity with evolving customer specifications.

This comprehensive research report categorizes the Aluminum System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Manufacturing Process

- Form

- Product Type

- Application

Highlighting essential regional insights across Americas Europe Middle East Africa and Asia-Pacific to reveal geographic growth patterns and market nuances

Geographic perspectives reveal distinct drivers and challenges across the Americas, Europe Middle East and Africa, and Asia-Pacific regions that shape the global aluminum system market. In the Americas, expansive infrastructure investments and a strong push toward domestic content requirements have fueled modernization of smelting capacity and downstream finishing lines. Stakeholders have aligned with policy incentives aimed at bolstering energy efficiency and reducing import dependence, leading to collaborations between state authorities and private capital to expand recycling infrastructures and retrofit legacy plants.

Across Europe, the Middle East, and Africa, sustainability mandates and regional integration efforts have been pivotal. European Union carbon border adjustment mechanisms have redirected sourcing toward low-carbon aluminum producers, while emerging markets in the Middle East leverage abundant energy resources to invest in greenfield primary and secondary production. In Africa, nascent bauxite mining projects and localized rolling facilities are spurring new value chains. Meanwhile, Asia-Pacific remains a hotbed of growth, with major capacity expansion in China, India, and Southeast Asia driven by both domestic consumption and export ambitions. Competitive dynamics here are informed by access to low-cost energy, proximity to large automotive and consumer electronics supply bases, and government-led manufacturing modernization initiatives. These regional variances underscore the imperative for companies to adapt go-to-market approaches and technology investments in alignment with localized conditions.

This comprehensive research report examines key regions that drive the evolution of the Aluminum System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading companies driving innovation and competitive dynamics in the aluminum system sector through strategic investments partnerships and technological advancements

Industry leaders, original equipment manufacturers, and specialty alloy suppliers are continuously reshaping the competitive dynamics of the aluminum system sector. Established global players are investing in advanced smelting technologies to enhance energy efficiency and reduce greenhouse gas emissions, while also forging alliances with technology providers to accelerate developments in inert anode materials and carbon-neutral electricity sources. Meanwhile, downstream fabricators are differentiating through high-precision extrusion capabilities, surface treatment innovations, and integrated supply chain services that deliver turnkey component solutions.

Simultaneously, emerging specialists are leveraging digital twins, process automation, and real-time quality analytics to optimize yield and throughput, positioning themselves as agile, niche alternatives to larger conglomerates. Strategic partnerships between recycling companies and electronics dismantlers have unlocked new feedstock streams, enhancing circularity and cost competitiveness. These company-level initiatives collectively drive a dynamic ecosystem in which scale efficiencies, technological prowess, and sustainability credentials determine market leadership and the ability to capture high-growth segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aluminum System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alcoa Corporation

- Aluminium Corporation of China Limited

- China Hongqiao Group Limited

- Emirates Global Aluminium PJSC

- Hindalco Industries Limited

- Norsk Hydro ASA

- Rio Tinto plc

- Shandong Weiqiao Aluminium Power Co., Ltd.

- UACJ Corporation

- United Company RUSAL PLC

- Xinfa Group Co., Ltd.

Presenting actionable recommendations for industry leaders to harness emerging trends optimize operations and strengthen market positioning in the aluminum system landscape

To capitalize on evolving market conditions and maintain a leadership position, industry participants should prioritize a multi-pronged approach that integrates sustainability, digitalization, and supply chain diversification. First, accelerating the deployment of low-carbon smelting variants and post-consumer recycling processes can fortify environmental credentials and align with tightening regulatory regimes. By embedding recycled content tracking via digital platforms, producers can enhance transparency and meet the exacting demands of downstream customers and investors alike.

Second, adopting IIoT frameworks, machine learning-based process optimization, and remote monitoring solutions can elevate operational resilience, reduce maintenance costs, and increase throughput consistency. Partnerships with technology vendors and research institutions will enable rapid prototyping of next-generation alloys and processing techniques. Third, in a landscape shaped by tariff fluctuations and trade policy shifts, proactive engagement with upstream and downstream partners to establish flexible sourcing agreements and localized production hubs will mitigate risk and ensure continuity. By executing these recommendations in a coordinated manner, companies can not only navigate immediate headwinds but also lay the groundwork for sustained innovation and market expansion.

Detailing the comprehensive research methodology encompassing primary interviews secondary data analysis and validation protocols to ensure authoritative aluminum system insights

Our research methodology was designed to ensure rigor, accuracy, and comprehensiveness in capturing the multifaceted nature of the aluminum system market. We conducted in-depth interviews with senior executives across smelters, fabricators, technology providers, and end-users to gather firsthand perspectives on operational challenges, investment priorities, and innovation roadmaps. These qualitative insights were triangulated with a broad spectrum of secondary sources, including industry reports, regulatory filings, and trade association data, to validate emerging trends and quantify key variables shaping market dynamics.

In addition, a systematic data validation process was employed, combining supply-side intelligence-such as capacity utilization rates, production volumes, and technology adoption metrics-with demand-side feedback from OEMs in construction, automotive, aerospace, and packaging sectors. Advanced analytical models were utilized to assess scenario impacts, evaluate tariff sensitivities, and map competitive positioning across regional and global landscapes. The methodology culminated in a peer review by subject-matter experts to ensure coherence, integrity, and relevance of findings, thereby equipping decision-makers with reliable, actionable insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aluminum System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aluminum System Market, by Manufacturing Process

- Aluminum System Market, by Form

- Aluminum System Market, by Product Type

- Aluminum System Market, by Application

- Aluminum System Market, by Region

- Aluminum System Market, by Group

- Aluminum System Market, by Country

- United States Aluminum System Market

- China Aluminum System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Summarizing key takeaways and strategic imperatives derived from the aluminum system market analysis to inform decision making and future research directions

The aluminum system market stands at a pivotal juncture where sustainability imperatives, technological innovation, and shifting trade policies converge to shape future trajectories. Key drivers include the transition toward low-carbon production practices, the integration of digital monitoring and optimization tools, and the strategic localization of supply chains in response to policy interventions. These factors collectively influence cost structures, competitive dynamics, and investment patterns across diverse application segments and geographic regions.

As the industry evolves, collaboration across the value chain-from smelters to end-users-will be critical to unlocking efficiency gains, accelerating product innovation, and enhancing circularity. By synthesizing segmentation insights, regional nuances, and company-level strategies, decision-makers can identify high-impact opportunities and mitigate risks associated with tariff volatility and resource constraints. Ultimately, a proactive, data-driven approach will enable organizations to fortify their market positions and drive long-term growth in an increasingly complex and interconnected aluminum ecosystem.

Engaging with the Associate Director of Sales & Marketing to unlock tailored aluminum system market insights and support strategic decision making

To explore the comprehensive aluminum system market research findings and obtain tailored insights that can inform your strategic planning and investment decisions, we invite you to engage with Ketan Rohom, the Associate Director of Sales & Marketing. His expertise in translating in-depth market intelligence into actionable growth strategies ensures that organizations can leverage the full breadth of our analysis to optimize operations, manage risk, and identify new opportunities. By speaking directly with Ketan Rohom, you will gain clarity on how macroeconomic trends, tariff dynamics, and evolving technology frontiers intersect to shape competitive landscapes. Contacting him will provide you with a bespoke walkthrough of the report’s key takeaways and a roadmap for integrating insights into your business priorities, helping to catalyze innovation and drive sustained performance in the aluminum system sector

- How big is the Aluminum System Market?

- What is the Aluminum System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?