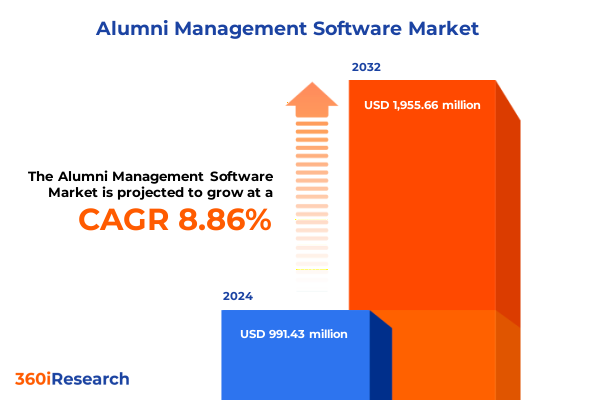

The Alumni Management Software Market size was estimated at USD 1.07 billion in 2025 and expected to reach USD 1.16 billion in 2026, at a CAGR of 8.96% to reach USD 1.95 billion by 2032.

Envisioning the Future of Alumni Engagement through Cutting-Edge Management Software Solutions that Drive Institutional Growth and Community Bonds

Alumni management software has rapidly emerged as a cornerstone for institutions aiming to cultivate enduring relationships with their graduates. By consolidating historical data, enabling personalized communication streams, and facilitating community-building events, these platforms empower organizations to transform passive alumni lists into active stakeholders. Institutions that harness the power of sophisticated engagement tools can tap into enhanced fundraising potential, drive mentorship initiatives, and bolster career services for their graduates.

As technology continues to redefine stakeholder expectations, modern alumni networks demand seamless, omnichannel experiences. The evolution from manual alumni outreach to integrated digital suites marks a pivotal shift in how institutions sustain long-term connections. With rising investments in cloud infrastructures and artificial intelligence, alumni management software is becoming ever more scalable and intuitive. This trend reflects a broader shift toward data-driven decision making, emphasizing the importance of actionable insights and predictive analytics to inform strategic planning and foster meaningful interactions.

Embracing Data-Driven Transformation and AI-Powered Workflows to Elevate Alumni Relations and Strengthen Institutional Engagement Strategies Across Channels

The alumni management landscape is undergoing transformative shifts driven by the convergence of digitalization, artificial intelligence, and mobile engagement. Institutions are increasingly adopting AI-powered analytics to segment alumni based on interests, giving capacity, and professional trajectories. This enables highly targeted communications that resonate with distinct alumni cohorts, fostering deeper engagement and more robust loyalty.

Simultaneously, the proliferation of mobile-first designs has redefined accessibility, allowing alumni to interact with their alma mater through user-friendly applications on smartphones and tablets. Integration with social media channels further amplifies reach, with real-time event updates and community forums enhancing peer-to-peer interactions. As organizations move toward unified platforms that blend customer relationship management, donor engagement, event coordination, and learning modules, the boundaries between departmental silos are dissolving. This holistic approach ensures that alumni receive cohesive experiences while institutions gain comprehensive visibility into every aspect of alumni relations.

Analyzing the Far-Reaching Consequences of United States Tariff Policies on Alumni Management Platforms and Institutional Technology Investments

United States tariff policies implemented in 2025 have introduced new layers of complexity for providers and adopters of alumni management platforms. Import duties on server hardware, networking equipment, and certain software components have increased capital expenditures for on premise deployments. Institutions relying on domestic data centers have seen costs rise as maintenance budgets absorb higher hardware replacement expenses.

Cloud-based vendors have also felt these ripple effects, as multinational service providers often source equipment globally and must adapt to shifting trade regulations. Subscription fees have adjusted to accommodate higher operational costs, leading organizations to reassess their procurement strategies. In response, some vendors are exploring localized hosting partnerships and edge computing solutions to bypass cross-border tariffs. Meanwhile, institutions are balancing the benefits of software-as-a-service against the financial impacts of tariff-inflated licensing agreements, prompting renewed interest in open-source frameworks that mitigate exposure to import duties.

Uncovering Key Insights from Market Segmentation across Deployment Models, Application Verticals, End Users, and Organizational Frameworks

Delving into deployment modes reveals that the cloud model is gaining significant traction, driven by its scalability and reduced upfront expenditure, while on premise solutions continue to hold appeal for organizations prioritizing complete control over their infrastructure. When considering application functionality, alumni management platforms are expanding beyond basic customer relationship modules to encompass specialized donor management capabilities, robust event management workflows, and integrated learning management components that support continuing education and professional development.

Examining end users uncovers distinct priorities: corporate entities leverage alumni networks to amplify brand advocacy and recruit talent, educational institutions focus on building lifelong learner communities and bolstering fundraising campaigns, and non profit organizations depend on alumni engagement to sustain volunteer networks and drive mission-based giving. Organizational size further nuances platform selection; large enterprises demand comprehensive customization and advanced analytics, whereas small and medium enterprises often favor turnkey deployments that allow for rapid implementation and ease of use.

User type segmentation highlights divergent needs as well. Administrators seek granular dashboards, compliance tracking, and detailed reporting tools to manage data governance and stakeholder outreach. Established alumni look for networking opportunities, mentorship programs, and exclusive event invitations that recognize their long-term commitment, while new alumni prioritize career placement resources, skill-building workshops, and introductory community forums that facilitate their initial integration into the alumni ecosystem.

This comprehensive research report categorizes the Alumni Management Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Deployment Mode

- User Type

- Application

- End User

Mapping Regional Dynamics and Adoption Trends for Alumni Management Software in the Americas, Europe Middle East Africa, and Asia Pacific Markets

In the Americas, the maturity of alumni management software adoption is evident in the prevalence of end-to-end suites that blend customer relationship management with advanced fundraising modules. Institutions in this region are emphasizing compliance with data privacy regulations at the state and federal levels, while harnessing analytics to optimize donor engagement and event turnout.

Europe, Middle East & Africa presents a mosaic of regulatory environments and language requirements, compelling vendors to offer highly configurable platforms capable of supporting multi-currency transactions and multilingual interfaces. Organizations in EMEA are prioritizing GDPR alignment and regional data residency, leading to a surge in demand for localized hosting options and customizable consent management tools.

Across the Asia-Pacific region, rapid digital transformation and mobile-first consumer preferences are driving accelerated adoption of alumni engagement solutions. Educational and corporate institutions are partnering with technology firms to deploy applications that leverage social messaging platforms and mobile payment integrations. This dynamic environment is fostering innovative feature sets such as microlearning modules, virtual networking lounges, and real-time event streaming to meet the expectations of tech-savvy graduates.

This comprehensive research report examines key regions that drive the evolution of the Alumni Management Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Established Players Shaping the Alumni Management Software Ecosystem with Differentiated Strategies and Technological Leadership

Leading players in the alumni management software arena are distinguishing themselves through strategic investments in artificial intelligence, intuitive user interfaces, and seamless third-party integrations. Several innovators are embedding machine learning algorithms to generate predictive giving scores and to recommend personalized outreach paths. Established vendors continue to expand their ecosystems via open APIs, enabling institutions to connect alumni data with finance systems, marketing automation platforms, and enterprise resource planning solutions.

Emerging challengers are carving out niches by focusing on vertical-specific use cases, such as higher education alumni associations and corporate alumni networks. These newcomers differentiate through rapid feature deployment cycles and modular architectures, allowing organizations to adopt functionality in stages. Strategic partnerships with event technology providers and professional development platforms are further enhancing value propositions, cementing the role of alumni management software as a central hub for lifelong learning, career services, and networking.

This comprehensive research report delivers an in-depth overview of the principal market players in the Alumni Management Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 360Alumni

- Almabase, Inc.

- AlmaBay Networks Private Limited

- Almashines Technologies Pvt. Ltd.

- AlumnForce

- Anthology Inc. by Blackboard Inc.

- Classter

- Creatrix Campus

- Ellucian Company L.P.

- EverTrue Inc. by ThankView

- Firsthand

- Graduway by Gravyty

- Hivebrite

- Insala Inc.

- MemberPlanet, LLC

- OmniMagnet, LLC

- PeopleGrove Inc.

- PeoplePath GmbH

- Raklet Inc.

- Regpack Inc.

- SAP SE

- Saviance Technologies

- VeryConnect Limited

- WildApricot Inc.

Adopting Forward-Thinking Strategies to Enhance Alumni Management Capabilities and Drive Sustainable Growth through Innovation and Collaborative Partnerships

Industry leaders should prioritize the integration of AI-driven personalization engines to tailor communications and engagement pathways for diverse alumni segments. Strengthening data governance frameworks will ensure compliance with evolving privacy regulations while fostering trust among graduates. Adopting modular system architectures allows institutions to deploy core capabilities quickly and scale additional features, such as event management and learning modules, in response to changing stakeholder needs.

Collaborative partnerships with fintech and edtech vendors can accelerate innovation and unlock new revenue streams through co-branded offerings. Embedding real-time analytics dashboards empowers decision-makers to monitor campaign performance and derive actionable insights. Equally important is investing in talent development to upskill administrators on data literacy and platform customization, ensuring that organizations can fully leverage the potential of their alumni management software.

Detailing the Robust Research Approach Integrating Primary Stakeholder Interviews Secondary Data Analysis and Rigorous Validation Processes for Reliability

The research methodology underpinning this analysis combines qualitative and quantitative techniques to ensure the integrity and applicability of findings. Primary interviews were conducted with senior alumni relations officers, software architects, and technology procurement leaders across corporate, educational, and nonprofit sectors. These conversations provided firsthand perspectives on deployment challenges, feature priorities, and emerging engagement trends.

Secondary data sources included publicly available regulatory filings, vendor white papers, and industry conference proceedings, which were rigorously cross-referenced to validate insights. Data triangulation techniques were applied to reconcile discrepancies and reinforce the reliability of conclusions. Additionally, validation workshops with domain experts were held to refine interpretations and align strategic recommendations with real-world operational considerations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Alumni Management Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Alumni Management Software Market, by Deployment Mode

- Alumni Management Software Market, by User Type

- Alumni Management Software Market, by Application

- Alumni Management Software Market, by End User

- Alumni Management Software Market, by Region

- Alumni Management Software Market, by Group

- Alumni Management Software Market, by Country

- United States Alumni Management Software Market

- China Alumni Management Software Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Key Findings to Illuminate Strategic Imperatives and Future Outlook for Stakeholders in the Evolving Alumni Management Software Domain

This executive summary synthesizes critical findings on the evolving alumni management software market, highlighting the transformative impact of AI-driven personalization, cloud migration, and mobile-first engagement. The analysis underscores how tariff policies are influencing deployment strategies and cost structures, while segmentation and regional insights reveal nuanced adoption patterns among different institution types and geographies.

As alumni networks become increasingly central to institutional advancement, stakeholders must embrace strategic imperatives such as modular platform architectures, robust data governance, and collaborative partnerships. The future outlook points toward further integration of emerging technologies-augmented reality networking, blockchain credentials, and hyper-targeted learning pathways-that will redefine alumni engagement. Institutions and vendors prepared to adapt to these trends are well positioned to foster stronger lifelong relationships with graduates and achieve sustainable growth.

Engage with Ketan Rohom to Unlock In-Depth Insights and Secure Your Comprehensive Alumni Management Software Market Research Report Today

To delve deeper into these strategic insights and gain a competitive edge, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan brings extensive expertise in alumni engagement solutions and can guide you through the comprehensive findings of this report. By partnering with him, you’ll unlock detailed analyses, best practices, and tailored recommendations designed to accelerate your adoption and optimization of alumni management software.

Connect with Ketan to secure your copy of the full market research report and elevate your alumni engagement strategy to the next level today.

- How big is the Alumni Management Software Market?

- What is the Alumni Management Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?