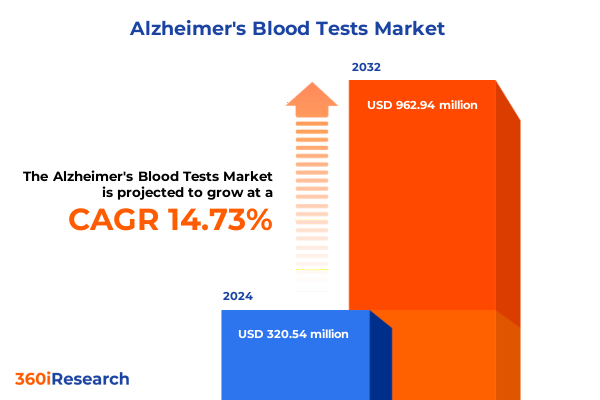

The Alzheimer's Blood Tests Market size was estimated at USD 366.70 million in 2025 and expected to reach USD 422.60 million in 2026, at a CAGR of 14.78% to reach USD 962.94 million by 2032.

Unveiling the Critical Role of Blood-Based Diagnostics in Revolutionizing Early Detection and Management of Alzheimer’s Disease

The pursuit of reliable blood-based diagnostics represents a transformative shift in the detection and management of Alzheimer’s disease, transcending traditional cognitive assessments and invasive procedures. Early detection through minimally invasive assays not only reduces patient burden but also opens new horizons for intervention and disease monitoring. As the prevalence of Alzheimer’s continues to climb, compounded by aging demographics, the imperative to innovate has never been stronger. Breakthroughs in assay sensitivity and specificity have ushered in a new era where subtle biomarker fluctuations can signal disease onset years before clinical symptoms emerge.

This introduction underscores the nexus between clinical need and technological innovation that shapes the Alzheimer’s blood test landscape. Advances in immunoassay platforms, mass spectrometry modalities, and nucleic acid amplification techniques now converge to deliver diagnostic accuracy that rivals cerebrospinal fluid analysis. Moreover, the integration of data analytics and machine learning augments the interpretive power of these assays, translating complex molecular signatures into actionable insights. As stakeholders across research, clinical, and commercial spheres align their efforts, the potential to democratize Alzheimer’s diagnostics and improve patient outcomes comes sharply into focus.

Exploring Pivotal Technological and Clinical Milestones Redefining Alzheimer’s Blood Testing Research and Commercial Strategies

In recent years, Alzheimer’s blood testing has undergone a radical metamorphosis spurred by converging technological, regulatory, and clinical imperatives. Cutting-edge immunoassays leveraging chemiluminescence and electrochemiluminescence detection have achieved unprecedented limits of detection for amyloid beta and tau proteins. Simultaneously, innovations in mass spectrometry-particularly liquid chromatography tandem mass spectrometry and matrix-assisted laser desorption ionization time-of-flight-have unlocked multiplexed quantification capabilities, enabling simultaneous profiling of multiple biomarkers with exceptional precision.

Crucially, the advent of next generation sequencing methodologies, including targeted sequencing panels and whole genome approaches, has expanded the diagnostic palette to encompass genetic risk factors and transcriptomic indicators. Digital and quantitative PCR techniques further enhance analytic throughput and robustness, facilitating large-scale screening initiatives. These transformative shifts not only refine diagnostic performance but also influence commercial strategies, as assay developers pursue integrated platforms that combine biomarker measurement with genetic and epigenetic analyses. Consequently, stakeholders must navigate an evolving ecosystem where product differentiation and data integration determine market leadership.

Assessing the Far-Reaching Consequences of Recent United States Trade Policies on Alzheimer’s Blood Test Supply and Innovation

In 2025, the United States implemented a series of tariffs targeting the importation of specialized reagents, instruments, and consumables essential for Alzheimer’s blood test development. These measures have reverberated throughout the supply chain, elevating procurement costs for immunoassay kits, mass spectrometry components, and sequencing reagents. Consequently, assay manufacturers and research institutions have been compelled to reevaluate sourcing strategies, with some accelerating partnerships with domestic suppliers while others have pursued regional redistribution agreements to maintain continuity of operations.

At the same time, increased input costs have compelled diagnostic developers to optimize assay protocols and explore alternative materials, driving innovation in reagent recycling and microfluidic miniaturization. Although the full impact on pricing structures and reimbursement frameworks remains under assessment, the cumulative effect of these trade policies has reinforced the need for resilient supply chains and diversified manufacturing footprints. As an immediate outcome, several leading labs have initiated dual sourcing plans and localized assembly hubs, thereby reducing exposure to cross-border disruptions and aligning product roadmaps with evolving regulatory landscapes.

Decoding Market Nuances Through In-Depth Analysis of Test Types Biomarkers Platforms Applications Distribution Channels and End Users

A nuanced understanding of Alzheimer’s blood testing demands dissection along multiple axes, each offering unique perspectives on market dynamics. Test type differentiation reveals a spectrum of analytical approaches: immunoassay formats that encompass chemiluminescence, electrochemiluminescence, enzyme-linked immunosorbent assay, and point-of-care lateral flow devices target classic protein biomarkers. Mass spectrometry innovations spanning gas chromatography tandem spectrometry, liquid chromatography tandem spectrometry, and matrix-assisted laser desorption ionization techniques enable multiplexed detection of low-abundance peptides. Parallel advances in nucleic acid methods, including both quantitative and digital PCR, facilitate targeted amplification of markers, while next generation sequencing leverages focused targeted panels and comprehensive whole genome analysis to furnish genetic and epigenetic context.

Biomarker classification further refines this landscape: amyloid beta variants, notably the forty- and forty-two-residue peptides, serve as earliest proxies for plaque deposition, complemented by phosphorylated and total tau measurements that illuminate neurofibrillary pathology. The neurofilament light chain has emerged as a pan-stroke indicator of neuronal damage, offering prognostic value across disease stages. Meanwhile, technological platforms such as electrochemical sensors, label-free biosensors, microfluidic systems, and optical transducers underpin assay miniaturization and integration, catalyzing point-of-care applicability. Application segments span disease progression monitoring, therapeutic development support, and preclinical or prodromal diagnosis. End-user diversity ranges from clinical diagnostic laboratories and hospital networks to at-home testing environments and academic research institutes. Finally, distribution strategies blend direct contractual sales with distributor partnerships and burgeoning online channels, ensuring that these diagnostic innovations reach clinicians and patients with both speed and reliability.

This comprehensive research report categorizes the Alzheimer's Blood Tests market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Test Type

- Biomarker Class

- Technology Platform

- Application

- End User

- Distribution Channel

Discerning Regional Dynamics and Growth Opportunities Across Americas Europe Middle East Africa and Asia Pacific in Alzheimer’s Diagnostics

Regional dynamics in Alzheimer’s blood diagnostics reflect a confluence of healthcare infrastructure, regulatory environment, and investment ecosystems. The Americas, led by the United States, exhibit robust R&D funding, well-established reimbursement pathways, and a growing appetite for early detection tools within integrated healthcare models. Regulatory agencies have signaled a willingness to expedite review processes for novel assays, fueling partnerships between biotech firms and academic medical centers. Cross-border collaborations with Canadian and Latin American laboratories further extend trial networks and post-market surveillance.

Conversely, the Europe, Middle East, and Africa corridor presents heterogeneous adoption patterns. Western European nations leverage centralized health systems to deploy pilot screening programs, while emerging markets in Eastern Europe, the Gulf, and North Africa navigate resource constraints through public–private consortia and philanthropic initiatives. Harmonization efforts by pan-regional regulatory bodies aim to streamline assay approval standards and accelerate patient access. In parallel, Asia-Pacific economies, notably China, Japan, and South Korea, invest heavily in precision medicine platforms, harnessing local manufacturing prowess to scale production of immunoassay reagents and microfluidic devices. Collaborative frameworks with Australian and Southeast Asian research institutes buttress validation studies, positioning the region as a dynamic testbed for commercial rollout.

This comprehensive research report examines key regions that drive the evolution of the Alzheimer's Blood Tests market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborations Driving Competitive Advantage in Alzheimer’s Blood Testing

Leading corporations continue to shape Alzheimer’s blood test innovation through strategic alliances, product diversification, and platform consolidation. Global diagnostics firms have expanded their portfolios by acquiring specialized immunoassay developers, integrating novel tau and amyloid beta assays into comprehensive testing suites. Simultaneously, mass spectrometry and next generation sequencing pioneers have forged co-development agreements to marry high-throughput analytics with proprietary biomarker panels.

Collaboration between biotechnology start-ups and established clinical lab networks has accelerated clinical validation efforts, enabling real-world data generation at scale. Moreover, sensor-focused enterprises have partnered with digital health innovators to embed wireless connectivity and analytics into point-of-care devices, facilitating remote patient monitoring. Through these strategic maneuvers, companies are not only enhancing their competitive positioning but also driving down per-test costs and expanding assay accessibility. The resulting ecosystem fosters continual iteration, as performance feedback loops from end-users inform subsequent assay refinements and technology upgrades.

This comprehensive research report delivers an in-depth overview of the principal market players in the Alzheimer's Blood Tests market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- ALZpath Inc

- Araclon Biotech

- Bio-Rad Laboratories Inc

- BioArctic AB

- C2N Diagnostics LLC

- Diadem srl

- Eli Lilly and Company

- F. Hoffmann-La Roche AG

- Fujirebio Holdings Inc

- Grifols S.A.

- Labcorp

- Quanterix Corporation

- Quest Diagnostics Incorporated

- Siemens Healthineers AG

- Sysmex Corporation

- Thermo Fisher Scientific Inc

Strategic Imperatives for Industry Leaders to Capitalize on Emerging Trends and Strengthen Market Position in Alzheimer’s Diagnostics

Industry leaders must align their strategic priorities with emerging technological imperatives and supply chain vulnerabilities to maintain market relevance. First, prioritizing the integration of multiomics data streams-combining protein, genetic, and metabolomic indicators-will differentiate assay platforms and enhance diagnostic granularity. Establishing consortia with data analytics and artificial intelligence providers can expedite this integration while ensuring compliance with patient privacy regulations.

Second, diversifying supplier networks is essential in light of trade policy fluctuations. Executives should cultivate relationships with alternative reagent vendors and invest in modular manufacturing capabilities that can pivot production based on tariff-driven cost variances. Third, forging partnerships with payers and health systems to demonstrate clinical utility and economic value will be critical for securing sustainable reimbursement. Finally, adopting adaptive go-to-market models that blend direct sales with digital distribution will enhance market reach, particularly in emerging regions where online procurement is rapidly gaining acceptance. By pursuing these strategic imperatives, organizations can fortify their competitive edge and drive accelerated adoption of Alzheimer’s blood diagnostics.

Comprehensive Methodological Framework Ensuring Rigorous and Transparent Analysis of Alzheimer’s Blood Testing Market Trends and Data

This analysis is grounded in a multilayered research methodology designed to ensure rigor, transparency, and validity. Primary insights were garnered through in-depth interviews with key opinion leaders, including neurologists, clinical laboratory directors, and regulatory agency representatives. Complementing these qualitative inputs, data from peer-reviewed scientific journals, conference proceedings, and patent filings were systematically reviewed to map technological advancements and regulatory shifts.

Secondary research encompassed comprehensive scans of company disclosures, financial presentations, and public policy documents to contextualize strategic initiatives and supply chain adaptations. To validate findings, triangulation techniques were applied, cross-referencing proprietary data with third-party scientific databases and observational studies. Throughout the process, a structured framework assessed innovation maturity, clinical adoption readiness, and regional deployment trajectories. This robust approach ensures that the insights presented reflect current realities and anticipate near-term inflection points in Alzheimer’s blood testing.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Alzheimer's Blood Tests market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Alzheimer's Blood Tests Market, by Test Type

- Alzheimer's Blood Tests Market, by Biomarker Class

- Alzheimer's Blood Tests Market, by Technology Platform

- Alzheimer's Blood Tests Market, by Application

- Alzheimer's Blood Tests Market, by End User

- Alzheimer's Blood Tests Market, by Distribution Channel

- Alzheimer's Blood Tests Market, by Region

- Alzheimer's Blood Tests Market, by Group

- Alzheimer's Blood Tests Market, by Country

- United States Alzheimer's Blood Tests Market

- China Alzheimer's Blood Tests Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Synthesis of Critical Findings and Strategic Perspectives Shaping the Future Trajectory of Alzheimer’s Blood Diagnostics

The convergence of technological breakthroughs, evolving trade environments, and strategic corporate maneuvers has positioned Alzheimer’s blood diagnostics at a critical juncture. Immunoassays and mass spectrometry platforms now deliver levels of sensitivity once deemed unattainable, while genetic and protein biomarkers coalesce to form multidimensional clinical signatures. Concurrently, tariff-driven supply challenges have underscored the importance of agile sourcing and localized manufacturing, prompting industry players to rethink traditional distribution models.

As regional landscapes mature and data-driven healthcare gains momentum, diagnostic innovators are presented with unprecedented opportunities to reshape early detection paradigms. However, realizing this potential demands concerted collaboration between assay developers, regulatory bodies, payers, and clinical practitioners. The insights outlined herein illuminate the pathways by which stakeholders can navigate complexity, harness emerging assets, and ultimately deliver transformative value to patients grappling with Alzheimer’s disease.

Partner with Ketan Rohom to Unlock In-Depth Alzheimer’s Blood Testing Insights and Propel Strategic Growth with Advanced Market Intelligence

Engaging directly with Ketan Rohom offers a strategic gateway to tailored insights and bespoke advisory for navigating the complexities of Alzheimer’s blood testing. As Associate Director of Sales and Marketing, he brings a nuanced understanding of market dynamics and customer needs, ensuring that every stakeholder gains a competitive edge through actionable intelligence. By partnering with him, decision-makers can access exclusive briefings, customized research deliverables, and high-impact presentations designed to inform critical launch and investment decisions.

Beyond standard purchase processes, collaborating with this seasoned professional streamlines engagements, reduces time to insight, and guarantees alignment with organizational objectives. His expertise in translating intricate data into clear, compelling narratives empowers clients to articulate value propositions effectively, form strategic alliances, and accelerate product commercialization. Don’t miss the opportunity to elevate your Alzheimer’s diagnostics strategy: reach out to Ketan Rohom today to secure your comprehensive market research report and transform your strategic roadmap into tangible success.

- How big is the Alzheimer's Blood Tests Market?

- What is the Alzheimer's Blood Tests Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?