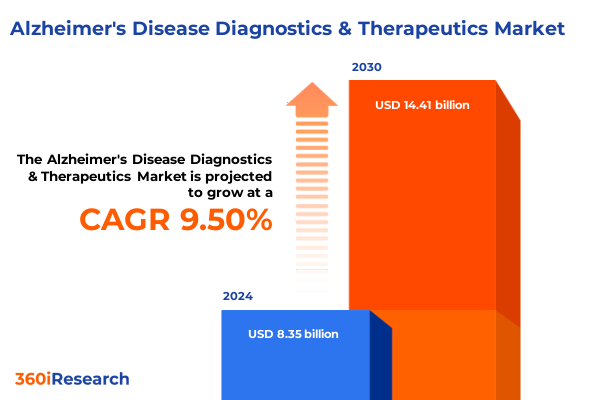

The Alzheimer's Disease Diagnostics & Therapeutics Market size was estimated at USD 8.35 billion in 2024 and expected to reach USD 9.12 billion in 2025, at a CAGR of 9.50% to reach USD 14.41 billion by 2030.

Unraveling the Intricacies of Alzheimer’s Disease Diagnostics and Therapeutics to Empower Stakeholders with Strategic Decision Making

The complexities of Alzheimer’s disease pose a formidable challenge to healthcare systems worldwide, demanding a cohesive understanding of diagnostic breakthroughs and therapeutic advancements alike. In recent years, the convergence of novel biomarker discoveries and imaging modalities has propelled early detection to the forefront, transforming what was once a reactive clinical approach into a proactive journey. Meanwhile, therapeutic strategies have evolved from symptomatic care to targeted interventions that address underlying pathophysiology and slow disease progression. This dual focus on precision diagnostics and mechanism-based treatments underpins the dynamic landscape of Alzheimer’s care, compelling stakeholders to reassess traditional pathways and invest in multidisciplinary collaboration.

Against this backdrop, healthcare providers, payers, and policy-makers must navigate a rapidly shifting environment marked by regulatory reform, reimbursement debates, and emerging digital health technologies. The imperative to integrate genetic testing with advanced imaging and digital cognitive assessments highlights a shift toward personalized medicine, ensuring each patient’s therapeutic regimen aligns with their molecular and clinical profile. As diagnostic accuracy improves and therapeutic pipelines diversify, industry leaders are poised to capitalize on unmet needs, fostering innovations that promise better quality of life for millions.

This introduction sets the stage for a deep dive into the transformative shifts reshaping Alzheimer’s disease diagnostics and therapeutics, outlining the challenges and opportunities that lie ahead.

Harnessing Breakthrough Innovations and Disruptive Technologies That Are Reshaping Alzheimer’s Disease Diagnosis and Treatment Paradigms

The Alzheimer’s disease landscape is undergoing a technological renaissance, where state-of-the-art biomarker assays and digital health platforms converge to redefine clinical practice. Blood-based biomarker panels capable of detecting amyloid and tau signatures are complementing traditional cerebrospinal fluid analyses, reducing procedural barriers and facilitating broader screening initiatives. Simultaneously, the integration of magnetic resonance imaging with cutting-edge positron emission tomography tracers is enabling clinicians to visualize neurodegenerative processes with unprecedented clarity, paving the way for timely therapeutic intervention.

Parallel to diagnostic innovations, therapeutic modalities are advancing through targeted monoclonal antibodies and combination therapies that act on multiple pathological mechanisms. The regulatory endorsements of aducanumab and lecanemab have sparked debate over efficacy and pricing, yet they underscore a paradigm shift toward disease-modifying treatments. Moreover, non-drug interventions such as cognitive stimulation therapy and behavioral interventions are being embedded within care frameworks, offering holistic management and mitigating caregiver burden.

Underpinning these advances is an accelerated adoption of artificial intelligence and machine learning, which harness large datasets to predict disease trajectories and personalize treatment plans. The synergy between digital health solutions and traditional diagnostic and therapeutic approaches is creating an ecosystem where deep phenotyping and adaptive trial designs become the norm. As a result, Alzheimer’s disease care is transitioning from a one-size-fits-all model to a precision medicine era, where data-driven insights catalyze next-generation innovation.

Assessing the Far-Reaching Consequences of the 2025 United States Tariff Policies on Alzheimer’s Disease Diagnostic Tools and Therapeutic Supply Chains

In 2025, the introduction of targeted United States tariff measures on imported diagnostic reagents and therapeutic components has reverberated through Alzheimer’s disease supply chains. These tariffs have increased the cost of key raw materials, including specialized antibodies and radiotracers, prompting manufacturers to reassess sourcing strategies. The resulting upward pressure on production expenses has challenged diagnostic laboratories and pharmaceutical developers to absorb costs or pass them on to end users, intensifying debates around affordability and access.

Moreover, therapeutic developers reliant on global contract manufacturing organizations have faced logistical delays as tariff classification disputes and customs inspections extended lead times. In response, industry players are exploring repatriation of certain production processes to mitigate future disruptions and capitalize on domestic incentives. While this shift promises increased supply chain resilience, it also necessitates substantial capital investment and workforce training in specialized manufacturing techniques.

The tariffs have also spurred strategic collaborations between diagnostic and therapeutic entities to co-develop integrated solutions that distribute cost and risk. Through joint ventures and risk-sharing agreements, companies are exploring bundled offerings that encompass biomarker testing and treatment plans, aiming to streamline value-based care models. As the tariff environment evolves, stakeholders will need to monitor policy adjustments closely and implement agile supply chain strategies to ensure uninterrupted patient access.

Unveiling Key Segmentation Insights That Illuminate Differentiated Pathways in Alzheimer’s Disease Diagnostics and Therapeutics Offering Strategic Clarity

A nuanced examination of Alzheimer’s disease market segmentation reveals distinct pathways for innovation and commercialization. When considering diagnostics versus therapeutics as primary divisions, it becomes evident that biomarker analysis-encompassing both blood-based assays and cerebrospinal fluid evaluations-offers scalable screening solutions, while imaging techniques such as computed tomography, magnetic resonance imaging, electroencephalograms, and positron emission tomography address both structural and molecular diagnostic needs. Neuropsychological instruments like the Ascertain Dementia 8 and Mini-Mental State Exam complement these modalities by assessing cognitive function and behavioral symptoms in a cost-efficient manner.

Within therapeutics, drug-based treatments range from cholinesterase inhibitors like donepezil galantamine, and rivastigmine to NMDA receptor antagonists, each offering symptomatic relief, while monoclonal antibodies aducanumab, donanemab, and lecanemab target amyloid load directly. Combination therapies further seek synergistic effects by merging mechanisms of action, and non-drug interventions-such as behavioral interventions and cognitive stimulation therapy-provide essential support paradigms that enhance patient engagement.

Patient demographics segmentation underscores that individuals aged 65 to 74 years often present with early-stage Alzheimer’s, whereas those above 85 years tend to require more comprehensive late-stage care. Middle-stage populations between 75 and 84 years demand tailored management strategies balancing disease moderation and quality-of-life interventions. End users range from academic and research institutes pioneering next-generation diagnostics to homecare settings focused on real-world therapy adherence, while distribution channels span hospital pharmacies, retail outlets, and increasingly, online pharmacies that offer convenient access for caregivers.

This comprehensive research report categorizes the Alzheimer's Disease Diagnostics & Therapeutics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Drug Class

- Patient Demographics

- Disease Stage

- End User

- Distribution Channel

Exploring Key Regional Dynamics in the Americas Europe Middle East Africa and Asia-Pacific That Shape the Future of Alzheimer’s Disease Solutions

Regional dynamics play a pivotal role in shaping the development, adoption, and reimbursement of Alzheimer’s disease solutions across the Americas, Europe, the Middle East and Africa, and Asia-Pacific. In North America, robust funding for research and well-established reimbursement frameworks have accelerated the commercialization of biomarker assays and disease-modifying treatments. Meanwhile, Latin American markets are expanding their diagnostic infrastructure, increasingly integrating imaging centers and genetic screening into national memory care protocols, albeit with variability in payer coverage and resource allocation.

Across Europe, harmonized regulatory pathways such as the European Medicines Agency’s centralized process have facilitated cross-border access to innovative therapies, yet differential health technology assessment outcomes in individual member states influence pricing negotiations and inclusion lists. In the Middle East and Africa, emerging public-private partnerships are driving pilot programs for early detection, leveraging mobile health units and telemedicine to address geographic and socioeconomic disparities. These initiatives often rely on tailored genetic testing panels that account for region-specific population variants.

The Asia-Pacific region represents a landscape of dual extremes: established markets in Japan and Australia embrace digital cognitive assessment platforms and government-sponsored dementia registries, while South and Southeast Asian nations are investing in capacity building for imaging and laboratory diagnostics. The convergence of government initiatives and private sector engagement is enabling scalable models for mass screening, positioning Asia-Pacific as a critical growth frontier.

Shared across regions is the recognition that localized reimbursement strategies, culturally adapted care frameworks, and cross-sector collaborations will be essential to ensure equitable patient access and sustainable innovation.

This comprehensive research report examines key regions that drive the evolution of the Alzheimer's Disease Diagnostics & Therapeutics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Biopharma and Diagnostics Companies Pioneering Breakthrough Innovations and Strategic Collaborations in Alzheimer’s Disease Space

The Alzheimer’s disease ecosystem is anchored by pioneering stakeholders that span large biopharma, specialized biotechnology firms, and diagnostic leaders. Major pharmaceutical companies have leveraged their global reach to advance monoclonal antibody therapies through late-stage clinical trials, securing regulatory endorsements for treatments that target amyloid pathology. Concurrently, diagnostics companies have diversified product portfolios, expanding blood-based biomarker offerings and forging partnerships with imaging technology providers to create end-to-end diagnostic solutions.

Innovative biotech firms have distinguished themselves by focusing on niche mechanisms-ranging from tau aggregation inhibitors to neuroinflammation modulators-while academic spin-offs are translating genome-wide association study findings into precision medicine platforms. These companies often engage in strategic alliances with contract research organizations and contract manufacturing organizations to streamline the development and scale-up of complex biologics. Moreover, collaborations between therapeutic developers and digital health pioneers are giving rise to companion diagnostics and remote monitoring tools designed for seamless integration into clinical workflows.

Investors and industry observers note that mergers and acquisitions remain a favored strategy for acquiring cutting-edge technology and expanding geographic footprints. This consolidation trend underscores the importance of combining deep scientific expertise with commercial execution capabilities. As partnerships evolve, companies that demonstrate adaptive business models and cross-disciplinary innovation will be best positioned to drive the next wave of breakthroughs in Alzheimer’s disease care.

This comprehensive research report delivers an in-depth overview of the principal market players in the Alzheimer's Disease Diagnostics & Therapeutics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbvie Inc.

- AC Immune SA

- Alector, Inc.

- Alzheon, Inc.

- Amylyx Pharmaceuticals, Inc.

- AstraZeneca PLC

- Aurobindo Pharma Limited

- Biogen Inc.

- BioXcel Therapeutics Inc.

- Bristol-Myers Squibb Company

- Cognoptix Inc.

- Corium Inc.

- Danaher Corporation

- Denali Therapeutics Inc.

- Eisai Co., Ltd.

- Eli Lilly and Company

- F. Hoffmann-La Roche AG

- GE Healthcare

- Grifols, S.A.

- H. Lundbeck A/S

- Johnson & Johnson Services, Inc.

- Lupin Limited

- Luye Pharma Group Ltd.

- Merck & Co. Inc.

- Muna Therapeutics

- Novartis AG

- Quest Diagnostics Incorporated

- Sanofi S.A.

- Siemens Healthineers AG

- Takeda Pharmaceutical Company Limited

- TauRx Therapeutics Ltd.

- Teva Pharmaceutical Industries Ltd.

- Thermo Fisher Scientific Inc.

- Voyager Therapeutics, Inc.

- Zydus Lifesciences Limited

Delivering Actionable Recommendations to Empower Industry Leaders to Accelerate Innovation and Enhance Collaboration in Alzheimer’s Disease Research

To navigate the evolving Alzheimer’s disease market, industry leaders should prioritize strategic investments in blood-based biomarker assay development to enable scalable population screening and early detection initiatives. Strengthening public-private collaborations will accelerate the translation of genomic and proteomic discoveries into clinical diagnostics and companion therapeutics. Organizations are advised to diversify their manufacturing base to counteract tariff-driven supply chain disruptions, leveraging both domestic production facilities and near-shoring partnerships to ensure resilience and cost stability.

Embracing digital therapeutics and AI-enabled decision support systems can provide real-time insights into patient progression, enabling personalized care pathways and adaptive trial designs. Expanding access through online pharmacy channels and remote cognitive assessment platforms will meet the growing demand for home-based care models, especially among aging populations in underserved regions. Additionally, cultivating cross-sector alliances with payers and health technology assessment agencies will facilitate value-based reimbursement frameworks that reward improved patient outcomes rather than volume of services.

Ultimately, companies that align research and development priorities with patient-centric value propositions, while maintaining operational flexibility in response to regulatory and trade policy shifts, will be best equipped to lead the next generation of Alzheimer’s disease diagnostics and therapeutics.

Describing Rigorous Research Methodologies Employed to Deliver Comprehensive Insights on Alzheimer’s Disease Diagnostics and Therapeutics

This comprehensive market research report is grounded in a rigorous methodology that integrates primary and secondary research techniques. Primary data collection involved in-depth interviews with key opinion leaders, including neurologists, clinical trial investigators, and reimbursement specialists, to capture insights on diagnostic adoption, therapeutic efficacy, and policy trends. Secondary research drew upon peer-reviewed journals, official regulatory guidance documents, clinical trial registries, and public financial disclosures to validate emerging technologies and strategic initiatives.

Data triangulation was employed to reconcile quantitative findings with qualitative perspectives, ensuring high data fidelity and contextual relevance. Market segmentation was conducted across product categories, drug classes, patient demographics, disease stages, end user types, and distribution channels, enabling a multidimensional analysis of growth drivers and adoption barriers. Regional deep dives leveraged local market intelligence from public health authorities and regional industry associations to map competitive landscapes and reimbursement frameworks.

The analytical framework combined SWOT and Porter’s Five Forces models to assess competitive intensity and strategic positioning, while scenario analysis explored potential impacts of tariff shifts and policy reforms. This methodological approach ensures that the resulting insights are both comprehensive and actionable, offering stakeholders a robust foundation for strategic planning and investment decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Alzheimer's Disease Diagnostics & Therapeutics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Alzheimer's Disease Diagnostics & Therapeutics Market, by Product

- Alzheimer's Disease Diagnostics & Therapeutics Market, by Drug Class

- Alzheimer's Disease Diagnostics & Therapeutics Market, by Patient Demographics

- Alzheimer's Disease Diagnostics & Therapeutics Market, by Disease Stage

- Alzheimer's Disease Diagnostics & Therapeutics Market, by End User

- Alzheimer's Disease Diagnostics & Therapeutics Market, by Distribution Channel

- Alzheimer's Disease Diagnostics & Therapeutics Market, by Region

- Alzheimer's Disease Diagnostics & Therapeutics Market, by Group

- Alzheimer's Disease Diagnostics & Therapeutics Market, by Country

- United States Alzheimer's Disease Diagnostics & Therapeutics Market

- China Alzheimer's Disease Diagnostics & Therapeutics Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Drawing Comprehensive Conclusions That Synthesize Critical Insights and Chart the Path Forward for Alzheimer’s Disease Diagnostics and Therapeutics

The collective insights presented throughout this executive summary underscore a critical juncture in Alzheimer’s disease care, where diagnostic precision and therapeutic innovation converge to redefine patient outcomes. Breakthrough blood-based biomarker assays and advanced imaging modalities are enabling earlier detection, while novel monoclonal antibodies and combination treatments signal a departure from purely symptomatic management.

Trade policy developments, particularly United States tariff adjustments in 2025, have illuminated the importance of resilient supply chains and strategic alliances that balance cost efficiencies with uninterrupted access. Deep segmentation analysis reveals that targeted approaches-whether by patient age cohort, disease stage, or distribution channel-unlock opportunities for tailored interventions and optimized care delivery.

Regionally, the interplay of regulatory harmonization, reimbursement strategies, and infrastructure capabilities continues to shape market dynamics, with the Americas and Europe leading adoption curves, the Middle East and Africa addressing access disparities, and the Asia-Pacific region poised for rapid expansion. Companies that demonstrate agility in research partnerships, digital integration, and value-based collaboration will emerge as leaders in this evolving ecosystem.

As stakeholders chart their strategic roadmaps, the need for patient-centric design, data-driven decision making, and cross-sector collaboration remains paramount. By synthesizing these critical insights, this report offers a clear path forward for advancing Alzheimer’s disease diagnostics and therapeutics to meet the growing global imperative.

Connect with Ketan Rohom Associate Director Sales and Marketing to Secure Essential Alzheimer’s Disease Diagnostics and Therapeutics Market Insights Today

To explore the full breadth of Alzheimer’s disease diagnostics and therapeutics insights and gain a competitive edge, connect directly with Ketan Rohom Associate Director Sales and Marketing to secure essential market research today

- How big is the Alzheimer's Disease Diagnostics & Therapeutics Market?

- What is the Alzheimer's Disease Diagnostics & Therapeutics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?