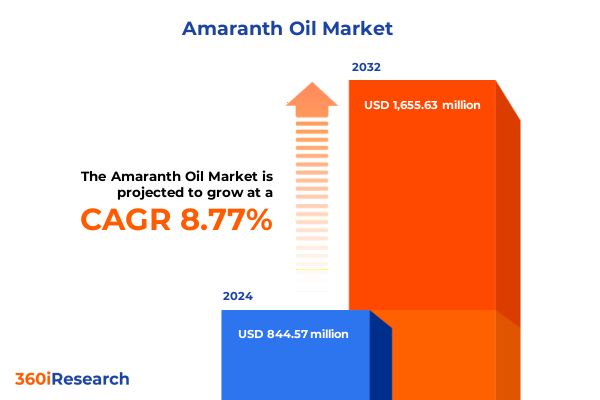

The Amaranth Oil Market size was estimated at USD 910.61 million in 2025 and expected to reach USD 987.59 million in 2026, at a CAGR of 8.91% to reach USD 1,655.63 million by 2032.

Exploring the multifaceted emergence and strategic value of amaranth oil across nutritional cosmetic and pharmaceutical applications

Amaranth oil emerges as a versatile botanical extract derived from the seeds of Amaranthus species, celebrated for its exceptional composition rich in squalene, tocopherols, and phytosterols. The high concentration of squalene-reaching up to eight percent-distinguishes it as a plant-based alternative to shark-derived squalene, meeting the growing consumer demand for sustainable, cruelty-free ingredients while offering notable antioxidant properties that support skin health and cardiovascular function. Moreover, amaranth oil’s unique profile of polyunsaturated fatty acids and phospholipids aids in enhancing skin barrier function and delivery of active compounds in cosmetic formulations, positioning it at the intersection of nutritional, personal care, and therapeutic applications.

Navigating the intersection of cutting-edge extraction methods sustainable sourcing and digital traceability reshaping the amaranth oil landscape

The amaranth oil sector is undergoing a series of transformative shifts driven by technological, regulatory, and consumer imperatives. Advanced extraction methodologies, such as supercritical carbon dioxide and green solvent techniques, have expanded producers’ ability to yield high-purity oil while preserving delicate bioactives, catalyzing broader adoption in premium skincare and nutraceutical formulations. Simultaneously, blockchain and Internet of Things platforms are being piloted to ensure end-to-end traceability across amaranth supply chains, mirroring innovations demonstrated in olive oil provenance systems where decentralized ledgers and smart contracts guarantee tamper-proof records and quality verification. Additionally, the acceleration of the clean-label movement compels suppliers to adopt sustainable sourcing, recyclable packaging, and transparent certification schemes, aligning with consumer expectations for environmental stewardship and ingredient integrity. As a result, market participants are forging cross-border partnerships, deploying digital traceability proofs, and integrating regenerative agriculture principles to reinforce product authenticity and resilience.

Assessing the cascading effects of new 2025 US vegetable oil tariffs on supply chain costs and domestic processing incentives

In 2025, the United States implemented sweeping tariff revisions impacting the importation of vegetable oil feedstocks, encompassing a universal ten-percent levy on select commodities and targeted duties exceeding thirty percent on products from key supplying nations. These measures have elevated costs for imported oils and incentivized domestic processing expansion, particularly within the biodiesel and green fuel sectors, where traders and manufacturers seek to mitigate price volatility. Concurrently, higher duties on palm, sunflower, and certain specialty seed oils have spurred strategic realignment of supply chains, with major distributors forging alliances with North American growers to secure consistent volumes and stabilize margins. As tariff uncertainties persist, businesses are adapting by enhancing inventory flexibility, recalibrating pricing models, and lobbying for favorable trade concessions ahead of looming court rulings and renegotiated agreements.

Uncovering segmentation-driven demand patterns across applications product forms distribution channels and botanical sources

Diverse applications drive the segmentation dynamics of the amaranth oil market, with cosmetic formulators increasingly turning to its antioxidant-rich profile for premium skin and hair care lines, while food and nutraceutical brands leverage its health-promoting attributes to enrich functional beverages and dietary supplements. The product’s physical form also influences positioning: refined oil appeals to cosmetic and pharmaceutical industries due to its neutral scent and heightened purity, whereas unrefined oil commands the food and nutraceutical segments where nutrient retention and flavor complexity matter most. Distribution channels further shape market behavior, as corporate clients in business-to-business networks utilize direct sales relationships and specialized distributors to secure bulk volumes, while business-to‐consumer brands amplify reach through hypermarkets, supermarkets, digital storefronts, and niche specialty stores that cater to discerning shoppers. Additionally, the botanical origin of the oil introduces distinct value propositions: Amaranthus caudatus delivers premium squalene content suited for high-end cosmetics, Amaranthus cruentus is prized in nutraceutical applications for its balanced fatty acid composition, and Amaranthus hypochondriacus finds favor in pharmaceutical research for its phytosterol complexity.

This comprehensive research report categorizes the Amaranth Oil market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Form

- Source

- Application

- Distribution Channel

Mapping regional drivers and regulatory catalysts behind amaranth oil adoption in the Americas EMEA and Asia-Pacific

Regional landscapes reveal nuanced drivers of amaranth oil adoption and growth. Within the Americas, North American producers have bolstered processing capacity to capitalize on tariff-driven import cost increases, while Latin American cultivators in Mexico and Peru benefit from proximity to seeds cultivated by subsistence farmers, enabling supply partnerships focused on traceability and fair-trade practices. In Europe, stringent cosmetic and food safety regulations, coupled with the continent’s robust personal care industry, foster demand for oils verified as organic and cruelty-free, prompting investments in certification and R&D to meet EU standards. The Middle East and Africa show emerging interest in amaranth as a functional ingredient within high-value food sectors and wellness markets, driven by government initiatives to diversify agricultural exports. Meanwhile, the Asia-Pacific region remains the largest raw material source, particularly in India and China where traditional knowledge integrates amaranth oil into herbal remedies and dietary supplements, supporting rapid commercialization through local nutraceutical and pharmaceutical channels.

This comprehensive research report examines key regions that drive the evolution of the Amaranth Oil market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading innovators and alliances advancing extraction efficiency product purity and sustainability commitments in amaranth oil

Leading industry participants are advancing the amaranth oil sector through targeted R&D, strategic collaborations, and portfolio diversification. Europe’s Flavex Naturextrakte GmbH has expanded its supercritical extraction facilities, enabling consistent squalene yields for cosmetic clients, while AMR Amaranth a.s. in the Czech Republic secures raw material supply with integrated farms and storage systems that reduce price exposure. In North America, Mountain Rose Herbs and Nature’s Brands, Inc. pursue certified organic and fair-trade oil lines, reinforcing trust among health-conscious consumers. From India to Ukraine, Proderna Biotech and Amaranth Bio Company are pioneering novel fermentation processes and standardized assays to enhance extract purity and efficacy. Additionally, entities such as Nans Products and RusOliva have formed alliances with research institutes to validate health claims and support regulatory filings, ensuring their products meet emerging guidelines governing natural squalene sources.

This comprehensive research report delivers an in-depth overview of the principal market players in the Amaranth Oil market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akay Natural Ingredients (P) Limited

- BioHarvest Biotech LLC

- Brothers Energy Ingredients Private Limited

- Connoils India Private Limited

- Hunan Anbang Pharmaceutical Co., Ltd.

- Lotus Garden Botanicals

- M Plus Group Ltd.

- Naturalin Bio-Resources Co., Ltd.

- NHR Organic Oils

- NOREVO GmbH

- Organiczing

- Planeteers (UK) Limited

- Praan Naturals by Natural Sourcing, LLC

- Proderna Biotech Pvt. Ltd.

- Rising Sun Botanicals

- Ruiteng (Beijing) Biotechnology Co., Ltd.

- Sabinsa Corporation

- SanaBio GmbH

- Siberian Green Australia by Persimmon LLC

- The Sun LLC

- W. ULRICH GmbH

Strategically harness cutting-edge extraction traceability and regulatory collaboration to capture premium market segments

Industry leaders should prioritize integrating advanced extraction technologies to maximize yield and bioactive retention while minimizing environmental footprint, thereby meeting premium market demands. Simultaneously, deploying blockchain-enabled traceability solutions will strengthen provenance claims, safeguard quality standards, and respond to escalating consumer scrutiny of supply chain integrity. To navigate evolving trade policies, businesses must diversify sourcing strategies by forging strategic partnerships with regional cultivators and investing in domestic processing capabilities. Furthermore, aligning product development with clean-label and sustainability frameworks can unlock new distribution channels, including eco-conscious specialty retailers and e-commerce platforms. Finally, engaging proactively with regulatory bodies to shape emerging guidelines on natural squalene and botanical oil standards will ensure compliance, reduce time-to-market for new formulations, and secure a competitive edge.

Leveraging integrated secondary and primary research methodologies with data triangulation for comprehensive market intelligence

This report deploys a comprehensive research methodology combining secondary and primary approaches. Secondary research entailed an extensive review of scientific literature, government publications, trade press coverage, and patent filings to establish foundational knowledge on amaranth oil composition, applications, and regulatory frameworks. Primary research involved structured interviews with industry stakeholders, including botanists, extraction specialists, supply chain managers, and R&D heads, to validate insights and gather forward-looking perspectives. Data triangulation was performed by cross-referencing financial reports, import-export statistics, and production datasets to ensure accuracy and consistency. Finally, qualitative insights were synthesized with quantitative analyses to derive actionable market segmentation and regional intelligence, underpinning robust strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Amaranth Oil market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Amaranth Oil Market, by Product Form

- Amaranth Oil Market, by Source

- Amaranth Oil Market, by Application

- Amaranth Oil Market, by Distribution Channel

- Amaranth Oil Market, by Region

- Amaranth Oil Market, by Group

- Amaranth Oil Market, by Country

- United States Amaranth Oil Market

- China Amaranth Oil Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing convergence of consumer demand technology innovation and policy dynamics to define the growth blueprint for amaranth oil

The amaranth oil industry stands at a pivotal juncture as evolving consumer preferences, technological breakthroughs, and trade policy realignments converge to shape its trajectory. With heightened interest in natural squalene alternatives and stringent sustainability imperatives, companies that invest in refined extraction processes, secure traceable supply chains, and align with clean-label imperatives will capture premium positioning. Concurrently, proactive engagement with evolving regulations and strategic diversification of sourcing and processing capacities will mitigate tariff uncertainties and foster resilience. By leveraging detailed segmentation insights and regional intelligence, stakeholders can tailor offerings to distinct customer cohorts, driving innovation and market share. Ultimately, those who blend scientific rigor with agile commercial strategies will lead the transformation of amaranth oil from a niche botanical extract into a cornerstone of health, beauty, and wellness industries worldwide.

Unlock unparalleled market insights and drive growth by consulting our Associate Director for comprehensive purchase guidance

Elevate your strategic positioning in the amaranth oil market by securing our in-depth report today. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, for a personalized discussion on how this comprehensive analysis can inform your next growth milestone and competitive advantage. Discover tailored insights, actionable data, and expert guidance designed to empower your decision-making in this rapidly evolving sector. Let our expertise drive your success-connect with Ketan Rohom to access the full market research report and embark on a journey of informed growth.

- How big is the Amaranth Oil Market?

- What is the Amaranth Oil Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?