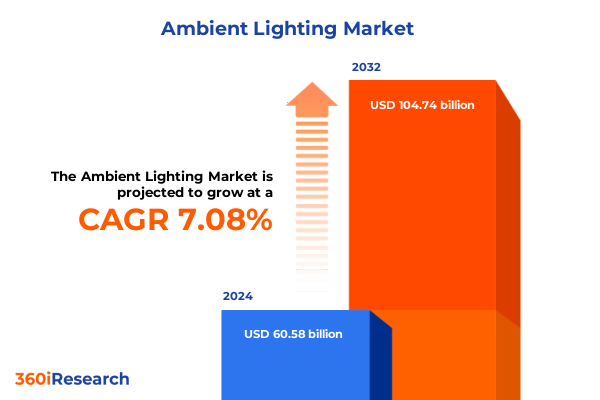

The Ambient Lighting Market size was estimated at USD 64.72 billion in 2025 and expected to reach USD 69.15 billion in 2026, at a CAGR of 7.11% to reach USD 104.74 billion by 2032.

Setting the Stage for Ambient Lighting: Understanding the Market Dynamics Driving Innovation and Adoption Across Diverse Environments

Ambient lighting has transcended its traditional role of mere illumination to become a sophisticated design element and functional necessity in modern environments. From hospitality venues to residential living spaces and industrial facilities, the demand for tailored lighting solutions that enhance mood, comfort, productivity, and safety has grown exponentially. This rise is fueled by a convergence of factors including increasing consumer awareness of wellness-centric design, stringent energy-efficiency regulations, and the seamless integration of digital control technologies. As stakeholders seek the perfect balance between form and function, ambient lighting emerges as both an art and a science, requiring an in-depth understanding of human-centric illumination principles and cutting-edge hardware capabilities.

Moreover, technology advancements have enabled a level of customization previously unattainable. Dynamic color tuning, circadian rhythm support, and sensor-driven adjustments now allow lighting systems to respond automatically to environmental and user-specific variables. Designers and engineers collaborate closely to embed these intelligent features while optimizing for cost, performance, and aesthetic appeal. Consequently, ambient lighting is no longer an afterthought but a critical component of architectural planning, interior design, and facilities management. This introduction underscores the urgency for decision-makers and industry participants to stay abreast of shifting market forces, evolving standards, and emerging best practices shaping the future of ambient illumination.

Identifying Pivotal Transformations in Ambient Lighting Driven by Technological Breakthroughs and Consumer Preferences Shaping Future Trends

The ambient lighting landscape is undergoing transformative shifts as LED technologies supplant legacy sources and intelligent control platforms redefine user interaction. Energy consumption concerns and environmental mandates have accelerated the obsolescence of incandescent, halogen, and fluorescent fixtures, propelling LED solutions to the forefront. These solid-state devices offer unprecedented efficiency, longer operational lifespans, and form factors that enable sleeker, more versatile installations. Simultaneously, the proliferation of IoT-enabled lighting systems has blurred the line between illumination and data analytics, empowering real-time monitoring, predictive maintenance, and occupancy-driven light levels that optimize both comfort and cost.

In parallel, consumer expectations are evolving. Aesthetic considerations such as color rendering index (CRI) and tunable white have become baseline requirements, while wellness-focused features like circadian-supportive lighting gain traction in workplace and healthcare settings. Manufacturers are responding with modular designs and open protocols that simplify integration with building management systems and third-party devices. Across the value chain, partnerships between lighting specialists, software developers, and integrators are creating ecosystems where lighting fixtures serve as sensors, communication nodes, and interactive media surfaces. Together, these shifts signal a departure from static, one-dimensional lighting to responsive, multi-functional ambient environments that adapt dynamically to user needs and broader operational goals.

Analyzing the Ripple Effects of United States Trade Tariffs Imposed in 2025 on Supply Chains Cost Structures and Strategic Sourcing Decisions

In 2025, the imposition of targeted tariffs by the United States on imported lighting components and modules has sent ripples across global supply chains, compelling manufacturers to reassess sourcing and production strategies. These measures, aimed at protecting domestic producers of LED panels and related electronics, have increased landed costs for many original equipment manufacturers. As cost pressures mount, companies are forced to consider absorption versus pass-through pricing models, balancing margin protection with the risk of losing price-sensitive customers.

To mitigate tariff-driven cost hikes, leading producers are diversifying their manufacturing footprints, expanding capacities in tariff-exempt jurisdictions such as Mexico, Vietnam, and select European Union member states. Concurrently, vertical integration efforts are intensifying, with firms acquiring upstream LED chip suppliers to secure supply and control pricing. Strategic alliances also play a pivotal role: joint ventures with regional lighting assemblers enable shared risk and streamlined logistics. Despite these adjustments, the tariff landscape remains fluid, underscoring the importance of agile sourcing strategies and scenario planning to maintain competitiveness and meet contractual obligations in both commercial and residential projects.

Uncovering Deep Segmentation Insights in Ambient Lighting by Interpreting Product Type Installation Technology Application and Distribution Dynamics

A nuanced understanding of market segmentation is indispensable for crafting targeted ambient lighting solutions. When viewed through the lens of product type, LED formats dominate due to superior efficiency and design flexibility, with bulbs remaining a staple for retrofits, tubes widely adopted in commercial ceilings, and panels preferred for uniform, low-glare illumination in office environments. However, legacy fluorescent and halogen sources still retain pockets of demand where cost sensitivities or legacy installations persist. Installation modalities further refine market opportunities, as portable fixtures such as desk and floor lamps enable personalized lighting accents while recessed and suspended systems deliver architectural integration. Surface-mounted options like track lights and wall sconces strike a middle ground, serving environments that require both directional emphasis and aesthetic appeal.

Technological classification differentiates conventional fixtures from smart systems, with Bluetooth, Wi-Fi, and Zigbee communication protocols facilitating remote control, scene setting, and energy management. In automotive, commercial, hospitality, industrial, and residential applications, each segment reveals distinct performance requirements: automotive ambient lighting emphasizes durability and color consistency, while hospitality settings demand dynamic effects. Within the commercial sphere, offices require compliance with workplace standards, and retail environments leverage ambience to influence consumer behavior. Residential applications range from indoor bedroom and living room scenarios to exterior landscape lighting, each with unique luminaire design considerations. Finally, distribution channels span traditional retail and wholesale networks as well as direct sales and e-commerce platforms, each influencing go-to-market strategies and customer engagement models.

This comprehensive research report categorizes the Ambient Lighting market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Installation Type

- Technology

- Application

- Distribution Channel

Examining Regional Variations in Ambient Lighting Demand and Adoption Patterns Across the Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics in ambient lighting reveal distinct growth trajectories and adoption drivers. In the Americas, robust demand stems from North American energy-efficiency incentives and stringent building codes mandating LED retrofits in commercial and public infrastructure projects. Latin American markets demonstrate growing appetite for cost-effective solutions, with emphasis on retrofit kits and integrated controls that address power reliability challenges. Across Europe, Middle East, and Africa, European Union directives such as Ecodesign and Energy Performance Certificates drive manufacturers to comply with rigorous standards on luminous efficacy and recyclability. The Middle Eastern hospitality sector prioritizes immersive guest experiences, investing in dynamic ambient systems, while selected African urban centers focus on sustainable street and public area lighting to enhance safety and reduce municipal expenditure.

In Asia-Pacific, rapid urbanization and industrial expansion underpin significant demand for ambient lighting in smart buildings, automotive assembly plants, and large-scale infrastructure projects. China continues to be both a manufacturing powerhouse and a vast domestic market for advanced LED fixtures, supported by incentives for energy transition. India’s modernization of commercial and residential spaces is fueling growth in both standard and smart lighting segments. Southeast Asian economies, balancing cost sensitivity with aspirations for technological prestige, are investing in hybrid solutions that blend conventional fixtures with basic smart capabilities. These regional insights inform strategic market entry and expansion decisions by highlighting local regulatory imperatives, customer preferences, and competitive landscapes.

This comprehensive research report examines key regions that drive the evolution of the Ambient Lighting market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Competitive Strategies and Innovations Adopted by Leading Ambient Lighting Manufacturers and Technology Providers Globally

Leading players in the ambient lighting industry differentiate through a combination of technological leadership, strategic partnerships, and brand equity. Globally recognized manufacturers leverage extensive R&D investments to refine LED architectures, advance driver electronics, and expand connectivity options. Collaborations with software firms enable seamless integration of lighting control platforms, while alliances with construction and architecture firms ensure early specification of cutting-edge solutions in new builds and renovations. Market entrants and specialized technology providers are challenging incumbents by introducing modular, plug-and-play luminaires and open-source ecosystems that lower barriers to adoption for smaller projects.

In addition to product innovation, companies emphasize sustainability credentials, pursuing third-party certifications and adopting circular economy principles to optimize material use and end-of-life recycling. Marketing strategies increasingly highlight human-centric benefits, positioning lighting as a contributor to occupant well-being and operational efficiency. Meanwhile, targeted M&A activity consolidates supply chains, as firms acquire niche LED suppliers, control system developers, and regional distributors to enhance vertical integration and market reach. These competitive dynamics create a fast-paced environment in which agility, customer focus, and technological foresight are essential to maintaining leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ambient Lighting market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Cooper Lighting Solutions LLC

- Eaton Corporation plc

- General Electric Company

- Hubbell Incorporated

- Hyundai Mobis Co., Ltd.

- Koito Manufacturing Co., Ltd.

- Koninklijke Philips N.V.

- OSRAM GmbH

- Panasonic Corporation

- Signify N.V.

- Stanley Electric Co., Ltd.

Recommending Actionable Strategies for Industry Leaders to Leverage Emerging Opportunities and Mitigate Competitive and Regulatory Challenges Effectively

Industry leaders should prioritize strategic investments in smart lighting platforms to capitalize on growing demand for data-driven building management. Developing open-architecture systems that support multiple wireless protocols will facilitate interoperability with third-party IoT devices and unlock revenue streams through subscription-based analytics services. Simultaneously, adopting a multi-tiered supply chain strategy can mitigate tariff risks by balancing production across domestic and low-tariff regions. Engagement with contract manufacturers in Latin America, Southeast Asia, and EU member states ensures flexibility in response to regulatory shifts and currency fluctuations.

Furthermore, embedding sustainability at the core of product development-from selecting recyclable materials to designing for disassembly-will resonate with increasingly eco-conscious clients and align with global decarbonization targets. Cultivating partnerships with lighting designers, architects, and integrators enables early involvement in project specification, granting competitive advantage and driving higher margins. Finally, investing in targeted digital marketing campaigns and immersive customer experiences, such as virtual reality configuration tools, will accelerate time-to-order and strengthen brand differentiation. By implementing these recommendations, established and emerging players can harness emerging trends, reduce operational vulnerabilities, and secure long-term growth in the ambient lighting sector.

Detailing the Rigorous Multimodal Research Methodology Employed to Analyze Ambient Lighting Market Trends Technologies and Stakeholder Perspectives

The research methodology underpinning this report combines rigorous quantitative and qualitative techniques to deliver comprehensive insights. Secondary data was gathered from publicly available regulatory filings, patent databases, industry white papers, and non-proprietary market analyses provided by governmental energy agencies. Primary research included structured interviews with senior executives from lighting manufacturers, technology integrators, and end-users in commercial, hospitality, and residential segments. These conversations illuminated real-world challenges in specification, installation, and maintenance of ambient lighting systems.

Supplementing expert interviews, an online survey was conducted among facility managers and lighting designers to quantify adoption drivers and identify unmet needs. Case studies spanning major construction projects in North America, Europe, and Asia-Pacific provided context on installation best practices and innovative applications. Data triangulation was achieved by cross-referencing trade statistics, shipping records, and company annual reports to validate supply chain trends and tariff impacts. Analytical techniques included scenario modeling to assess cost-pass-through under various trade policy conditions and technology adoption curves derived from diffusion theory. This multi-modal approach ensures robust findings that are both actionable and reflective of current market realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ambient Lighting market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ambient Lighting Market, by Product Type

- Ambient Lighting Market, by Installation Type

- Ambient Lighting Market, by Technology

- Ambient Lighting Market, by Application

- Ambient Lighting Market, by Distribution Channel

- Ambient Lighting Market, by Region

- Ambient Lighting Market, by Group

- Ambient Lighting Market, by Country

- United States Ambient Lighting Market

- China Ambient Lighting Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Delivering a Comprehensive Conclusion Synthesizing Core Insights Trends and Implications for Stakeholders in the Ambient Lighting Industry

In summary, the ambient lighting sector stands at a pivotal juncture defined by rapid technological evolution, regulatory complexity, and shifting consumer priorities. The dominant ascendancy of LED solutions, coupled with the integration of intelligent control systems, has redefined expectations for both performance and flexibility. The 2025 tariff landscape in the United States has introduced fresh supply chain challenges, prompting companies to diversify manufacturing footprints and forge strategic alliances to maintain cost competitiveness.

A granular segmentation analysis reveals that success hinges on tailoring offerings to distinct product, installation, and application requirements-from residential bedroom fixtures to industrial warehouse illumination-while accommodating varying distribution channel dynamics. Regional insights underscore the importance of aligning strategies with local policy frameworks and consumer preferences, whether in the incentive-driven markets of North America or the rapid urbanization zones of Asia-Pacific. Competitive intelligence highlights that sustained innovation and sustainability initiatives, supported by partnerships and targeted M&A, are critical for market leadership.

Ultimately, industry players that embrace open architectures, invest in circular design principles, and build resilient supply chains will be best positioned to capture emergent opportunities and navigate future uncertainties. This report provides a holistic roadmap for stakeholders seeking to harness the full potential of ambient lighting technologies and establish a differentiated presence in this dynamic market.

Incentivizing Engagement with a Direct Call to Action to Collaborate with Ketan Rohom for In-Depth Ambient Lighting Market Intelligence and Purchase Guidance

To gain unparalleled insights into the rapidly evolving ambient lighting landscape and secure a strategic advantage, reach out to Ketan Rohom, Associate Director, Sales & Marketing. His deep expertise in lighting technology adoption, regulatory implications, and market segmentation will help you navigate complex supply chain dynamics and identify high-potential growth opportunities. Engage with Ketan to discuss how our comprehensive market research report can be customized to address your specific business objectives and inform your investment decisions. By collaborating with him, you’ll receive personalized guidance on interpreting tariff impacts, optimizing distribution strategies, and leveraging regional trends to drive sustainable growth. Don’t miss the opportunity to elevate your understanding of ambient lighting innovations and propel your organization forward. Contact Ketan Rohom today to purchase the full research report and transform insight into action.

- How big is the Ambient Lighting Market?

- What is the Ambient Lighting Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?