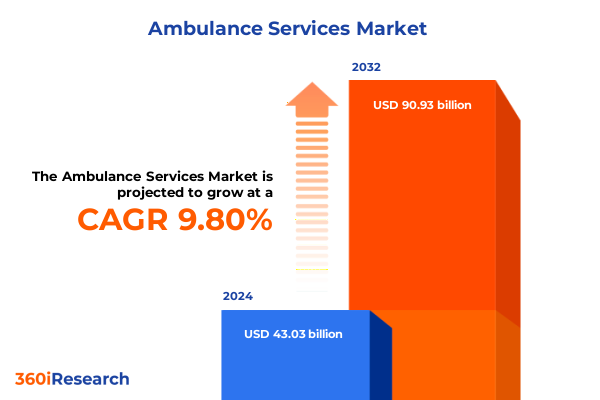

The Ambulance Services Market size was estimated at USD 47.18 billion in 2025 and expected to reach USD 51.73 billion in 2026, at a CAGR of 9.82% to reach USD 90.93 billion by 2032.

Understanding the Expanding Scope of Ambulance Services as Frontline Responders Balance Urgent Patient Needs with Evolving Healthcare Delivery Models

Ambulance services have emerged as a cornerstone of modern emergency and non-emergency healthcare delivery, serving as the vital link between patients in critical need and definitive care facilities. As healthcare systems become more patient-centric, expectations for rapid response times, integrated communication platforms, and seamless transitions of care have intensified. This convergence of rising demand and technological progress has propelled ambulance operators to innovate across clinical protocols, vehicle design, and digital workflows, ensuring that each dispatch not only transports patients but also delivers pre-hospital interventions that can be lifesaving.

The role of ambulance services extends beyond mere transportation; these frontline responders are now focal points for early diagnosis, remote monitoring, and triage decision-making. Integration with emergency operations centers and hospital information systems allows paramedics and medical technicians to transmit vital signs, electrocardiogram readings, and trauma images in real time, shaping treatment plans before arrival on scene. Consequently, ambulance providers are reimagining staff training programs, investing in mobile health technologies, and forging partnerships with telemedicine platforms. This strategic evolution underscores a broader shift toward value-based care, wherein ambulance engagements are measured not by miles traveled but by patient outcomes and clinical efficacy.

Looking ahead, the sector is poised to further expand its scope by incorporating machine learning algorithms for predictive dispatch, leveraging drones for rapid delivery of medical supplies to austere environments, and piloting autonomous vehicle prototypes. These advancements, in concert with robust data analytics, will empower service providers to optimize routing, anticipate peak demand cycles, and allocate resources with unprecedented precision. As the confluence of patient expectations and healthcare delivery priorities continues to reshape the industry, ambulance services will remain at the forefront of innovation, driving both clinical excellence and operational efficiency.

Tracing the Paradigm Shifts Transforming Ambulance Service Delivery through Integration of Advanced Technologies and Data-Driven Operational Strategies

The ambulance services landscape is undergoing transformative shifts driven by breakthroughs in medical technology, digital connectivity, and care coordination. Advanced on-board life support systems, once limited to specialized critical care transports, are increasingly standard features across fleets, enabling paramedics to stabilize patients with cardiac support devices and portable ventilators. This technological convergence has elevated pre-hospital care from transport-focused operations to mobile critical care units, blurring the lines between field interventions and in-hospital treatment.

Simultaneously, the proliferation of data-driven operational strategies is reshaping workforce management and dispatch protocols. Real-time analytics platforms capture telemetry from each vehicle, monitor traffic conditions, and leverage historical incident data to forecast demand surges. By integrating these insights with predictive staffing models, operators can ensure advanced life support teams are strategically positioned during mass gatherings, natural disasters, or public health emergencies. Furthermore, collaboration with local health authorities has deepened, as ambulance providers contribute anonymized usage data to regional emergency preparedness plans, enhancing community resilience.

Interoperability initiatives also signify a paradigm shift in ecosystem partnerships. As ambulance services link with electronic health records and public safety networks, paramedics are granted access to patient histories, allergy profiles, and medication lists, mitigating risks associated with information silos. In urban centers, pilot programs employing unmanned aerial vehicles have demonstrated the feasibility of drone-delivered defibrillators to remote or traffic-congested locations. These innovations reflect a broader industry commitment to transforming every mile traveled into an opportunity for proactive, intelligent care delivery, reshaping the very concept of emergency response.

Assessing the Ripple Effects of New United States Tariffs Announced for 2025 on Ambulance Equipment Sourcing and Supply Chain Resilience

The introduction of new United States tariffs for 2025 has injected renewed scrutiny into the procurement strategies of ambulance service providers and equipment manufacturers alike. With duties restructured across a spectrum of imported medical devices and vehicle components, stakeholders are re-evaluating supply chain dependencies to mitigate potential cost escalations. Major suppliers of emergency medical equipment, including defibrillators, patient monitoring systems, and stretcher assemblies, have begun diversifying their manufacturing footprints, securing alternative sourcing agreements in jurisdictions unaffected by the latest tariff measures.

In response, several leading ambulance operators have accelerated partnerships with domestic assemblers and aftermarket suppliers to localize critical equipment inventories. This pivot not only fortifies supply chains against external trade winds but also reduces lead times for replacement parts, a vital factor in minimizing fleet downtime. Financial officers across public and private service providers are collaborating with procurement specialists to renegotiate terms and explore dynamic hedging strategies that insulate budgets from raw material price volatility.

As a direct consequence, service providers are turning to lean inventory methodologies and just-in-time delivery models to curtail warehousing expenditures. Distribution centers located proximal to high-volume service clusters are being reconfigured to serve as regional hubs, ensuring that specialized emergency transport vehicles remain equipped and ready. By proactively addressing the cumulative impact of these 2025 tariffs, industry participants are reinforcing operational resilience and preserving the continuity of critical patient transport services.

Revealing Critical Segmentation Insights Highlighting How Diverse Service Types Vehicle Configurations and Care Levels Shape Ambulance Market Dynamics

Diving deep into the structural makeup of the ambulance services ecosystem, an array of service types shapes the patient care continuum. Emergency transport operations, which include both advanced life support and basic life support, serve as the vanguard of critical response, while event transport teams manage non-acute movements during large public gatherings. Non-emergency transport specialists facilitate patient repatriation, stretcher transfers, and wheelchair-accessible journeys for individuals requiring medical oversight during transit. Parallel to these road-based functions, specialty transport units deliver targeted clinical services, ranging from neonatal critical care to cardiac stabilization.

The physical platforms that bear these services are equally diverse. Road ambulances, optimized for urban and suburban deployment, coexist alongside fixed-wing and rotary-wing air ambulances, which are mobilized for rapid long-distance transfers or responses to remote incidents. Water ambulances, though less ubiquitous, play a pivotal role in island communities and coastal regions, providing swift evacuation capabilities where land routes are impeded. Each vehicle type demands bespoke maintenance regimes, crew certifications, and operational protocols, underscoring the importance of tailored service strategies.

Overlaying these dimensions, the continuum of care levels-from basic life support through advanced life support to critical care transport-demands configurable medical equipment and specialized clinician training. Critical care transports, segmented into cardiac critical care and neonatal critical care, reflect the apex of pre-hospital clinical complexity. These missions frequently involve integrated ventilatory support, invasive monitoring, and in-flight or in-transit telemedicine consultations. Finally, the funding matrix-encompassing government grants, Medicaid, Medicare, private insurance, and out-of-pocket models-exerts a significant influence on service design, reimbursement frameworks, and patient access, compelling providers to adopt flexible billing and credentialing infrastructures.

This comprehensive research report categorizes the Ambulance Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Vehicle Type

- Level Of Care

- Service Provider

- Payment Method

Uncovering Key Regional Variations in Ambulance Service Adoption Infrastructure Development and Regulatory Frameworks across Global Markets

Geographical distinctions in ambulance service delivery reveal a tapestry of regulatory, infrastructural, and demographic influences. In the Americas, high urban density and well-established emergency networks coexist with rural regions that depend heavily on air and water ambulance solutions to bridge vast distances. Here, community paramedicine programs have emerged to augment traditional dispatch models, enabling proactive home visits for chronic disease management and reducing hospital readmissions.

Across Europe, the Middle East, and Africa, service frameworks vary from state-run public operators in Western Europe to hybrid public-private partnerships in the Gulf Cooperation Council states. Regulatory mandates governing crew certifications and equipment standards tend to converge around international consensus guidelines, while economic development levels dictate the penetration of advanced life support capabilities. In remote regions of Africa, innovative micro-finance models and NGO partnerships have underpinned the emergence of essential non-emergency transport corridors.

In Asia-Pacific, the rapid expansion of urban centers has spurred investment in both air ambulance fleets and high-throughput ground corridors. Countries with sprawling archipelagos leverage water ambulances and hovercraft for interisland transfers, whereas mainland megacities increasingly deploy motorcycle paramedic units to circumvent congested streets. Collaboration between private for-profit providers and government healthcare bodies is catalyzing the standardization of clinical protocols, improving interoperability, and driving quality benchmarks across the region.

This comprehensive research report examines key regions that drive the evolution of the Ambulance Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Ambulance Service Providers and Equipment Manufacturers Steering Innovation and Competitive Strategies in a Challenging Environment

A cadre of established and emerging players has defined the competitive landscape of ambulance services, each leveraging unique strengths to capture distinct market segments. Large private for-profit organizations continue to expand their footprints through hospital-based joint ventures and stand-alone divisions that cater to high-acuity patient populations, offering turnkey transport solutions bolstered by proprietary fleet management platforms. These incumbents invest significantly in research collaborations to pilot next-generation patient monitoring systems and in-vehicle telehealth integrations.

Simultaneously, private non-profit entities deepen community ties through fundraising and grant-supported initiatives, securing government contracts for specialty transport services and community paramedicine programs. Their emphasis on cost transparency and patient advocacy positions them favorably within Medicaid and Medicare reimbursement frameworks. Public sector operators, often subsidized by municipal or state budgets, balance statutory response obligations with performance targets, adhering to rigorous service-level agreements that mandate response times and staffing ratios.

Equipment manufacturers and service enablers play a pivotal supporting role. Leading vendors of advanced life support products, critical care modules, and aircraft conversions form strategic alliances with transport operators to co-develop custom vehicle upfits. These partnerships accelerate the certification of innovative medical devices and streamline the integration of next-generation telecommunication networks. Meanwhile, technology firms specializing in dispatch optimization, predictive analytics, and mobile health applications are reshaping end-to-end workflows, enabling service providers to enhance both clinical outcomes and operational throughput.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ambulance Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acadian Ambulance Service, Inc.

- Air Charter Services Ltd.

- Air Methods Corporation

- American Medical Response, Inc.

- Avincis Aviation Group, S.A.U.

- BVG India Ltd.

- Coastal Medical Transportation Systems, Inc.

- Falck A/S

- Global Medical Response, Inc.

- Guardian Ambulance Service, Inc.

- GVK Emergency Management & Research Institute Ltd.

- Helijet International Inc.

- Life Flight Network, Inc.

- London Ambulance Service NHS Trust

- Medivic Aviation Pvt. Ltd.

- Medulance Healthcare Pvt. Ltd.

- Med‑Trans Corporation

- National Ambulance LLC (UAE)

- Ornge (Ontario Air Ambulance)

- ProTransport‑1, LLC

- REVA Inc.

- SA Ambulance Service

- Scandinavian AirAmbulance Ltd.

- Tebita Ambulance Pre‑Hospital Emergency Medical Service PLC

- Ziqitza Health Care Ltd.

Translating Market Intelligence into Actionable Strategies for Ambulance Service Leaders to Enhance Operational Efficiency and Service Quality

Ambulance service leaders seeking to fortify their market position should prioritize investments in interoperable digital platforms that seamlessly connect dispatch centers, field crews, and receiving hospitals. By adopting unified communication standards and cloud-based patient record systems, organizations can minimize information frictions and expedite clinical decision-making. Concurrently, operational leaders should leverage predictive analytics to dynamically adjust staffing levels and vehicle deployments in response to demand fluctuations, ensuring resource availability during peak incident periods.

Building resilience against supply chain disruptions requires the establishment of multi-tiered supplier networks and the strategic localization of critical spare parts. Procurement teams must engage in scenario planning that accounts for potential tariff shifts and regulatory evolutions, maintaining alternative sourcing pathways to uphold service continuity. In parallel, the development of lean inventory models-underpinned by real-time tracking of component usage-can optimize capital allocation and reduce holding costs without compromising readiness.

Finally, cultivating a culture of continuous clinical innovation will differentiate high-performing providers. Organizations should partner with academic institutions and technology firms to pilot emerging solutions such as unmanned aerial medical delivery, artificial intelligence-driven triage tools, and portable diagnostic imaging units. Investing in multidisciplinary training programs that blend simulation-based mastery with cross-sector secondments will equip crews to deliver advanced pre-hospital interventions, ultimately driving both patient satisfaction and operational excellence.

Explaining the Rigorous Research Methodology Underpinning Comprehensive Insights into Ambulance Services Incorporating Qualitative and Quantitative Approaches

This report synthesizes both qualitative and quantitative research methodologies to deliver robust insights into the ambulance services sector. Primary research was conducted through in-depth interviews with C-suite executives, clinical directors, and operational managers across public, private for-profit, and private non-profit transport providers. These discussions yielded firsthand accounts of emerging clinical protocols, service integration challenges, and strategic investment priorities. Complementing this, field observations were undertaken at urban, rural, and remote dispatch centers to map workflow intricacies and equipment utilization patterns.

On the quantitative side, comprehensive data collection encompassed global incident response volumes, vehicle fleet compositions, and funding model distributions. Statistical analyses were performed to identify correlation trends between response times, service types, and patient outcomes. Supply chain assessments incorporated tariff schedules, sourcing geographies, and inventory turnover metrics. Additionally, a cross-sectional survey of frontline paramedics and emergency medical technicians captured sentiment on technology adoption, training efficacy, and operational pain points.

Finally, a rigorous validation phase involved peer reviews by industry consultants and a Delphi panel of subject-matter experts. This iterative process ensured the accuracy of segmentation frameworks, confirmed regional insights, and vetted recommendations for strategic applicability. Altogether, this triangulated approach underpins the credibility and practical relevance of the findings presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ambulance Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ambulance Services Market, by Service Type

- Ambulance Services Market, by Vehicle Type

- Ambulance Services Market, by Level Of Care

- Ambulance Services Market, by Service Provider

- Ambulance Services Market, by Payment Method

- Ambulance Services Market, by Region

- Ambulance Services Market, by Group

- Ambulance Services Market, by Country

- United States Ambulance Services Market

- China Ambulance Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Summarizing Core Findings and Strategic Considerations to Inform Future Decision-Making in the Evolving Ambulance Services Landscape

In synthesizing the multifaceted dimensions of ambulance services-from frontline clinical advancements and supply chain dynamics to regional disparities and competitive positioning-this report highlights the sector’s rapid evolution and the strategic inflection points that lie ahead. Robust segmentation analysis has illuminated how service type variations, vehicle modalities, care levels, and payment frameworks collectively shape operational priorities and clinical outcomes. Simultaneously, the examination of tariffs and regional regulatory landscapes underscores the importance of adaptive supply chain strategies and localized service models.

Key findings reveal that providers capable of integrating advanced life support technologies, leveraging predictive analytics, and fostering interoperable communication networks are best positioned to enhance patient survival rates and reduce total care costs. Moreover, the rise of community paramedicine and event-based transport solutions reflects a growing emphasis on preventive care and risk mitigation. As global markets diverge in resource availability and regulatory rigor, customized approaches-whether through public-private collaborations in EMEA or agile motorcycle paramedic units in Asia-Pacific megacities-will define the next wave of innovation.

This conclusion distills the critical strategic imperatives that ambulance service stakeholders must embrace to thrive: prioritizing technology integration, reinforcing supply chain resilience, and fostering collaborative ecosystems. By aligning operational frameworks with emergent patient care paradigms and regulatory expectations, the industry can secure its role as an indispensable component of comprehensive healthcare delivery systems.

Engaging Industry Stakeholders with an Invitation from Ketan Rohom to Leverage Expert Insights and Secure the Definitive Ambulance Services Market Research Report

To explore the full breadth of insights contained within this comprehensive analysis of ambulance services, reach out to Ketan Rohom, Associate Director of Sales & Marketing. He brings a wealth of expertise in guiding healthcare organizations toward data-driven strategic decisions and can tailor a customized package that aligns with your organization’s unique needs. Engage directly to discuss licensing options, enterprise dashboards, or custom consulting engagements that leverage the depth of research presented here. Unlock unparalleled market intelligence and propel your ambulance service delivery strategies to the forefront of industry innovation by securing access to the complete report today.

- How big is the Ambulance Services Market?

- What is the Ambulance Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?