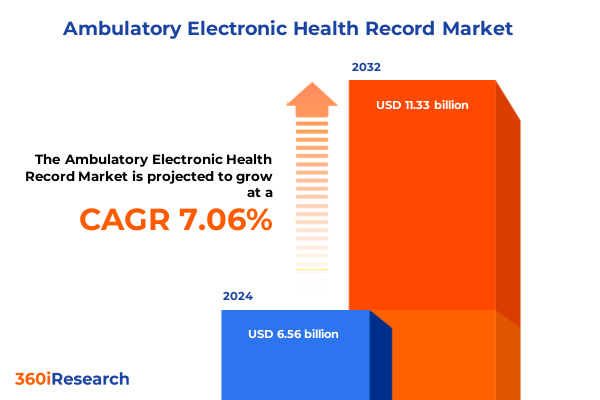

The Ambulatory Electronic Health Record Market size was estimated at USD 7.03 billion in 2025 and expected to reach USD 7.54 billion in 2026, at a CAGR of 8.35% to reach USD 12.33 billion by 2032.

Transforming Patient Care Through Ambulatory Electronic Health Records With Innovative Technologies, Regulatory Drivers, and Strategic Imperatives for Growth

The rapid evolution of healthcare delivery outside hospital walls has accelerated the adoption of electronic health record systems designed specifically for ambulatory care environments, where efficiency, interoperability, and patient engagement converge to redefine clinical excellence. These platforms have become integral to the daily workflows of physicians and care teams, streamlining documentation, appointment scheduling, and billing processes while providing robust decision support. As clinicians migrate from paper-based charting to digital interfaces, the promise of real-time data capture and analytics has ushered in a new era of proactive care coordination and outcome tracking.

In recent years, policy reforms and quality-based reimbursement models have underscored the importance of data-driven decision making and population health management, driving ambulatory practices to invest in advanced EHR capabilities. The proliferation of patient portals has empowered individuals to access their health information and interact with care providers digitally, fostering transparency and adherence. Meanwhile, the integration of telehealth modalities has extended the reach of ambulatory services, catalyzing hybrid care models that blend in-person visits with remote monitoring and virtual consultations for more personalized treatment pathways.

This executive summary offers a concise yet comprehensive overview of the ambulatory EHR landscape, highlighting transformative trends, market dynamics, and strategic segmentation insights. It is intended to guide executives and decision makers through an informed decision-making process by presenting critical analyses of regulatory impacts, regional differentiators, and actionable recommendations. By synthesizing key findings and outlining the research methodology, this summary lays the groundwork for deeper exploration and investment in ambulatory record-keeping solutions.

Recognizing the Pivotal Technological and Regulatory Inflection Points Redefining Ambulatory EHR Deployments and Clinical Workflows Nationwide

The ambulatory health IT domain is undergoing a profound transformation as cloud-native architectures and application programming interfaces gain traction among providers seeking scalable, secure, and cost-effective record management solutions. Organizations are embracing hybrid deployment models that balance on-premises control with cloud-based flexibility, allowing care teams to access patient data across multiple sites. At the same time, the integration of artificial intelligence and machine learning algorithms into electronic records is elevating diagnostic accuracy, risk stratification, and care coordination, enabling predictive insights that support proactive interventions.

Regulatory inflection points are compounding this technological momentum, with recent mandates promoting standardized data exchange formats and patient access to personal health information. The rollout of interoperability guidelines has compelled EHR vendors to enhance system compatibility and open-platform capabilities, reducing data silos and improving care continuity. Compliance with privacy and security regulations remains a top priority, prompting the adoption of advanced encryption, multi-factor authentication, and audit logging features to safeguard sensitive health records in alignment with national standards.

Concurrently, remote care delivery models have gained unprecedented importance, integrating telemedicine modules and mobile health applications with core EHR platforms. This convergence is reshaping patient engagement paradigms, offering real-time virtual visits and remote monitoring functionalities that support chronic disease management and postoperative follow-up. As consumer expectations evolve, ambulatory practices must harness these transformative shifts to streamline workflows, enhance patient satisfaction, and position themselves for sustained competitive advantage in an increasingly digital care ecosystem.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Adjustments on Ambulatory EHR Supply Chains, Costs, and Vendor Strategies

In 2025, adjustments to United States import tariffs on hardware components and software modules critical to ambulatory electronic record systems have introduced new cost considerations for providers and technology vendors. These measures have targeted a range of server infrastructure, networking equipment, and specialized medical devices imported from key international markets, catalyzing a reevaluation of procurement strategies. As the regulatory landscape for trade evolves, ambulatory care organizations must account for potential price fluctuations that can influence capital expenditures and operating budgets.

The imposition of higher duties on certain technology inputs has had ripple effects throughout the ambulatory EHR ecosystem. Hardware manufacturers are navigating increased production expenses, which have translated into elevated equipment leasing fees and maintenance costs. At the same time, software vendors are reassessing licensing models to offset added financial burdens, carefully balancing the impact on subscription fees against the need to sustain research and development investments. These dynamics have underscored the importance of transparent cost structures and proactive supplier negotiations.

In response, leading vendors are diversifying their supply chains by nearshoring production facilities and forging partnerships with domestic component suppliers to mitigate tariff exposure. Ambulatory practices are exploring bundled service agreements and flexible fee arrangements to preserve budgetary predictability. The current environment highlights the strategic imperative of adaptive procurement policies and collaborative vendor relationships, ensuring that ambulatory care providers can continue to leverage advanced EHR functionalities without compromising financial sustainability or patient service levels.

Unveiling Critical End User, Deployment Mode, Product Type, Specialty, and Component Perspectives Driving Adoption Trends in Ambulatory EHR Solutions

Ambulatory care providers exhibit distinct preferences based on organizational structure and service offerings, shaping the adoption and configuration of electronic record systems. Surgical centers prioritize streamlined perioperative documentation and integration with anesthesia modules, while multi-specialty clinics seek comprehensive platforms that accommodate diverse workflows across departments. Independent physician practices often balance functionality with cost efficiency, favoring modular solutions that can scale with practice consolidation. Single specialty practices, particularly in cardiology, dermatology, obstetrics and gynecology, oncology, and orthopaedics, demand tailored interfaces and decision-support tools optimized for their clinical scope. Meanwhile, urgent care centers focus on rapid registration and treatment documentation to maintain patient throughput and satisfy episodic care demands.

The deployment landscape further influences acquisition strategies, as cloud offerings gain ground with their rapid provisioning and remote accessibility. Within cloud implementations, organizations are weighing hybrid architectures to retain sensitive data on-site while leveraging public or private cloud environments for scalable compute resources. Pure on-premises configurations remain relevant for practices with stringent data residency requirements or limited connectivity, underscoring the need for flexible infrastructure choices that align with organizational risk tolerance and IT capabilities.

Differentiation between integrated and standalone electronic record products reflects provider priorities for interoperability and feature breadth. Specialists across cardiology, dermatology, general practice, obstetrics and gynecology, oncology, and orthopaedics assess solutions not only on core documentation and order-entry functions but also on advanced modules such as computerized physician order entry, clinical decision support, and electronic prescribing. Patient portal and telemedicine capabilities, including remote monitoring and virtual visits, are increasingly regarded as essential components that extend care beyond the clinic and foster sustained patient engagement.

This comprehensive research report categorizes the Ambulatory Electronic Health Record market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Specialty

- Component

- End User

- Deployment Mode

Analyzing Regional Nuances in Ambulatory EHR Adoption Across the Americas, Europe Middle East Africa, and Asia Pacific to Guide Strategic Market Entry

The Americas represent one of the most mature markets for ambulatory electronic record adoption, characterized by widespread implementation among physician practices and specialty clinics. In the United States, comprehensive policy frameworks and incentive programs have spurred high penetration rates, driving continuous enhancement of interoperability and patient engagement features. Regional variations in Canada reflect provincial healthcare system integration efforts, with cloud-based platforms growing rapidly where national digital health strategies prioritize cross-jurisdictional data exchange. Latin American markets exhibit emerging demand, as outsourcing of ambulatory services and private-sector investments trigger a gradual shift from manual to electronic recordkeeping.

Across Europe, the Middle East, and Africa, adoption patterns are shaped by regulatory complexity and infrastructure diversity. European Union member states have advanced interoperability initiatives under the Digital Single Market, but disparate healthcare funding models create uneven uptake among primary care providers. In the Middle East, affluent healthcare systems are accelerating the deployment of modern ambulatory platforms as part of broader eHealth visions, whereas in parts of Africa, connectivity constraints and budgetary pressures necessitate lightweight, mobile-first solutions that can operate in low-resource settings. Collaborative partnerships between regional health ministries and technology vendors are essential to drive scalable adoption in these varied environments.

The Asia-Pacific region offers a spectrum of opportunities driven by government-led digital transformation roadmaps and rapidly expanding private healthcare networks. Highly developed markets such as Japan and Australia are enhancing their ambulatory systems with advanced analytics and AI integration, while emerging economies in Southeast Asia prioritize fundamental electronic record functionality to replace paper logs. Localization of language, compliance with national privacy regulations, and adaptability to hybrid cloud deployments are key factors for vendors seeking to capture share in this dynamic and heterogeneous landscape.

This comprehensive research report examines key regions that drive the evolution of the Ambulatory Electronic Health Record market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Ambulatory EHR Vendors and Technology Innovators Shaping Competitive Dynamics Through Differentiation, Partnerships, and Value-Added Services

Leading providers of ambulatory electronic health record platforms have differentiated themselves through targeted feature enhancements and strategic alliances. Established vendors offer robust ecosystems that integrate revenue cycle management, patient engagement modules, and analytics dashboards, catering to practices seeking end-to-end digital solutions. A number of specialized software companies have carved out niche positions by delivering vertical-specific interfaces that streamline documentation and clinical decision support for cardiology, dermatology, and obstetrics and gynecology practices.

In pursuit of comprehensive care pathways, many vendors are forging collaborative partnerships with telemedicine providers, remote monitoring firms, and population health technology specialists. These alliances augment core recordkeeping capabilities with virtual visit infrastructure and advanced patient outreach tools, enabling care teams to extend service offerings beyond the physical clinic. Additionally, select market participants have pursued M&A transactions to expand their global footprints and integrate complementary software assets, positioning themselves to address the evolving needs of multi-location ambulatory networks.

Innovation roadmaps emphasize interoperability and predictive analytics as critical differentiators. Vendors are investing in open APIs that adhere to industry standards, empowering third-party application integration and streamlined data exchange with hospital information systems. Concurrently, machine learning models embedded in clinical decision support modules are enabling early warnings for high-risk patients, optimizing treatment protocols and reducing readmission likelihood. By aligning product development with emerging care delivery models, these companies are setting the stage for the next generation of ambulatory record systems that prioritize data-driven efficiency and patient-centric engagement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ambulatory Electronic Health Record market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AdvancedMD, Inc.

- athenahealth, Inc.

- CareCloud, Inc.

- Cerner Corporation

- CureMD.com, Inc.

- eClinicalWorks, LLC

- Epic Systems Corporation

- GE HealthCare Technologies Inc.

- Greenway Health, LLC

- Kareo, Inc.

- Medical Information Technology, Inc.

- Modernizing Medicine, Inc.

- NextGen Healthcare, Inc.

- Practice Fusion, Inc.

- Veradigm Inc.

Strategic Imperatives and Actionable Recommendations for Health IT Leaders to Leverage Ambulatory EHR Advances and Drive Operational and Clinical Excellence

In light of the evolving ambulatory EHR landscape, health IT executives must prioritize interoperability initiatives that facilitate seamless data flow across care settings. By adopting open-standards frameworks and integrating application programming interfaces, organizations can unlock cross-platform synergies, minimize manual data entry, and support collaborative care models. Aligning technical roadmaps with regulatory priorities will also ensure compliance and position provider organizations to capitalize on emerging incentive programs and value-based payment structures.

Simultaneously, a strategic cloud migration plan is essential to achieve scalability and resilience. Health IT leaders should evaluate hybrid deployment scenarios that balance on-premises security controls with the flexibility of public and private cloud services. Incorporating advanced analytics and artificial intelligence into ambulatory record systems will enable proactive risk identification, drive evidence-based decision making, and support continuous quality improvement initiatives. At the same time, robust cybersecurity measures, including end-to-end encryption and regular vulnerability assessments, will safeguard patient data and maintain stakeholder trust.

Finally, investment in workforce training and change management is critical to maximize technology adoption and realize clinical benefits. Cross-functional governance teams comprising IT specialists, clinical leadership, and administrative stakeholders can streamline implementation, prioritize feature enhancements, and measure performance against key success criteria. Establishing strategic partnerships with technology vendors, professional associations, and academic centers will further accelerate innovation and ensure that ambulatory practices remain at the forefront of digital health transformation.

Methodological Framework Outlining Rigorous Qualitative and Quantitative Research Techniques Underpinning the Ambulatory EHR Market Analysis Process

The research underpinning this ambulatory record analysis is grounded in a robust methodological framework that combines qualitative insights with quantitative rigor. Primary research efforts encompassed in-depth interviews with C-suite executives, IT directors, and practice managers across diverse ambulatory settings, including surgical centers, specialty clinics, and urgent care facilities. These conversations provided nuanced perspectives on technology adoption drivers, implementation challenges, and future investment priorities. Concurrently, structured surveys captured statistically significant data on deployment preferences, feature utilization, and budget allocation trends across end-user segments.

Secondary research included a comprehensive review of industry publications, regulatory filings, and peer-reviewed studies to contextualize market dynamics within broader healthcare transformation initiatives. Publicly available documentation and vendor white papers were analyzed to map product capabilities against segmentation criteria such as deployment mode, product type, and specialty focus. Data triangulation techniques were applied to reconcile discrepancies between primary feedback and secondary findings, ensuring a cohesive and accurate representation of the marketplace.

Analytical processes involved categorizing vendors, components, and geographic regions to establish meaningful insights that resonate with decision makers. Market segmentation was validated through cross-analysis of functional requirements and purchase behavior, while emerging trends were benchmarked against global best practices. Peer review and expert panel sessions were conducted to challenge assumptions and refine conclusions, resulting in an executive summary that delivers reliable, actionable intelligence for stakeholders navigating the ambulatory electronic record landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ambulatory Electronic Health Record market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ambulatory Electronic Health Record Market, by Product Type

- Ambulatory Electronic Health Record Market, by Specialty

- Ambulatory Electronic Health Record Market, by Component

- Ambulatory Electronic Health Record Market, by End User

- Ambulatory Electronic Health Record Market, by Deployment Mode

- Ambulatory Electronic Health Record Market, by Region

- Ambulatory Electronic Health Record Market, by Group

- Ambulatory Electronic Health Record Market, by Country

- United States Ambulatory Electronic Health Record Market

- China Ambulatory Electronic Health Record Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Consolidating Core Findings and Forward-Looking Perspectives to Illuminate the Strategic Trajectory of Ambulatory Electronic Health Records

This analysis has highlighted the salient factors reshaping the ambulatory electronic record environment, including the ascendancy of cloud-based deployment models, the integration of artificial intelligence into clinical workflows, and evolving regulatory mandates that prioritize interoperability and patient access. The 2025 tariff adjustments have underscored the critical importance of adaptive supply chain strategies and transparent cost management, while segmentation analyses have revealed distinct adoption patterns across surgical centers, specialty clinics, and urgent care facilities. Regional deep dives have further emphasized the need for localized approaches in the Americas, Europe Middle East Africa, and Asia Pacific markets, each presenting unique regulatory and infrastructure conditions.

Looking ahead, the convergence of predictive analytics, telemedicine, and patient-facing technologies promises to further transform ambulatory care delivery. Vendors that excel in open-standards integration and personalized patient engagement will be well positioned to capture market share and drive sustained outcomes improvement. As industry leaders implement the strategic imperatives outlined in this report, they will unlock new efficiencies, strengthen compliance postures, and enhance the patient experience. In an era defined by rapid digital innovation, a forward-looking mindset and agile operational execution will be essential for realizing the full potential of ambulatory electronic health record systems.

By focusing on continual refinement of user interfaces and embedding evidence-based decision support into everyday practice, healthcare organizations can reduce clinician burden and accelerate adoption. Furthermore, ongoing investment in workforce training, change management, and security protocols will safeguard digital transformations against implementation risks. The collective insights and methodologies presented herein provide a foundation for strategic decision making, enabling stakeholders to navigate complexities and seize emerging opportunities within the ambulatory record domain.

Engage with Associate Director Ketan Rohom for Exclusive Access to In-Depth Ambulatory EHR Market Intelligence and Drive Your Strategic Decisions

To gain a comprehensive understanding of the ambulatory electronic health record market and capitalize on emerging opportunities, decision makers are encouraged to connect with Associate Director Ketan Rohom. With extensive experience in healthcare IT research and strategic advisory services, Ketan Rohom can provide tailored insights and guidance that align with your organization’s unique operational objectives and growth priorities.

By engaging directly with the research team, executives will benefit from a deep dive into the methodologies, segmentation analyses, and regional assessments that underpin this executive summary. This collaboration offers an opportunity to explore customized data sets, address specific challenges, and refine implementation strategies for successful EHR integration. Whether you seek to optimize procurement decisions, evaluate vendor roadmaps, or assess the financial implications of regulatory changes, personalized consultation will deliver targeted recommendations and actionable roadmaps.

To initiate this strategic partnership, reach out to schedule a consultation and secure access to the full ambulatory EHR market research report. Empower your organization with the expertise needed to navigate the complexities of digital health transformation and drive clinical and operational excellence through informed decision making.

Unlock value for stakeholders by leveraging in-depth analyses that are not readily available in public domains. A direct engagement with Ketan Rohom will ensure your team gains clarity on critical trends, competitive positioning, and the tactical steps required to achieve measurable outcomes in ambulatory care settings.

- How big is the Ambulatory Electronic Health Record Market?

- What is the Ambulatory Electronic Health Record Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?