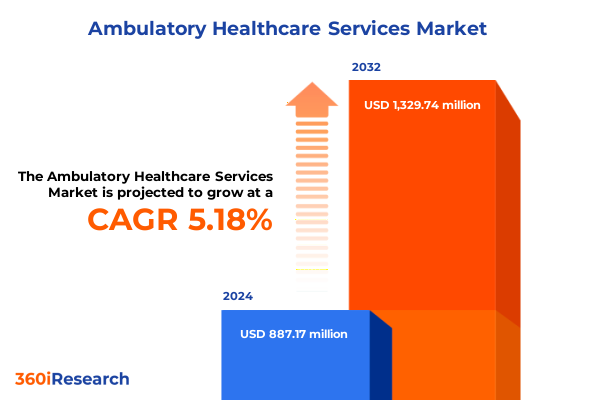

The Ambulatory Healthcare Services Market size was estimated at USD 922.42 million in 2025 and expected to reach USD 960.24 million in 2026, at a CAGR of 5.36% to reach USD 1,329.74 million by 2032.

Overview of the Ambulatory Healthcare Services Market Landscape and Key Drivers Shaping the Future of Outpatient Care Delivery

The ambulatory healthcare sector has evolved into a pivotal component of modern healthcare delivery characterized by its emphasis on outpatient convenience and cost effectiveness. In recent years the convergence of demographic shifts and technological progress has spurred fundamental changes in how patients access diagnostic preventive surgical and therapeutic services outside traditional hospital environments. This report sets out to illuminate the overarching landscape and principal forces driving this dynamic market.

Increased patient preference for care settings that offer reduced wait times personalized attention and lower out-of-pocket expenses has generated sustained demand for ambulatory solutions. Simultaneously regulatory reforms and incentivization programs have accelerated the adoption of preventive screenings and vaccinations while streamlining pathways for advanced imaging and laboratory diagnostics. Against this backdrop innovation in minimally invasive procedures and the integration of telehealth have further redefined expectations around surgical and therapeutic interventions.

By unpacking these multifaceted drivers and their interplay across diverse service modalities this introduction establishes the foundation for a deeper exploration of transformative trends segmentation nuances regional differentiators and actionable strategies. The following pages offer decision makers a clear lens through which to view evolving patient behaviors policy landscapes and competitive benchmarks essential for charting a path to resilient growth in the ambulatory care domain.

Sweeping Technological, Regulatory and Patient-Driven Innovations Redefining Ambulatory Care Delivery Models and Operational Paradigms

The ambulatory healthcare ecosystem is undergoing seismic shifts driven by advances in digital health interoperability regulatory overhaul and heightened consumerism. From artificial intelligence-powered imaging algorithms that boost diagnostic accuracy to remote monitoring platforms that extend post-procedural care beyond clinic walls innovation is reshaping core service delivery models. These technologies not only improve clinical outcomes but also unlock efficiency gains that enable providers to reallocate resources toward higher-value preventive and therapeutic offerings.

Concurrently policy initiatives aimed at curbing hospital readmissions and lowering total cost of care have placed ambulatory centers at the vanguard of value-based reimbursement frameworks. This has prompted organizations to invest in outcome tracking systems and multidisciplinary care teams capable of handling complex case management in outpatient settings. Adoption of bundled payment models for certain minor surgeries and rehabilitation services is fostering greater collaboration among surgeons therapists and support staff to optimize clinical pathways and patient satisfaction.

Moreover demographic trends such as an aging population and rising prevalence of chronic conditions are fueling demand for tailored therapeutic interventions that can be administered in ambulatory surgical centers and outpatient rehabilitation facilities. As patients increasingly prioritize convenience and continuity of care the sector is witnessing a convergence of traditional brick-and-mortar centers with home-based and virtual touchpoints. This fusion of physical and digital modalities is catalyzing a patient-centric transformation that redefines efficiency quality and engagement across the ambulatory care continuum.

Comprehensive Exploration of the Effects of 2025 United States Trade Tariffs on Supply Chains, Cost Structures and Service Accessibility in Ambulatory Care

In 2025 a series of escalated tariffs imposed on medical equipment components and pharmaceutical imports by the United States government has introduced new complexities to the ambulatory healthcare supply chain. Providers reliant on imported imaging devices or laboratory reagents have encountered higher capital expenditures and operating costs. To mitigate these pressures many centers have sought alternative suppliers or passed incremental price adjustments onto patients and payers reflecting an evolving cost structure formed by trade policy.

These tariff measures have also influenced the availability of specialized surgical instruments and chemotherapy agents manufactured abroad prompting some ambulatory surgical centers and infusion clinics to diversify their procurement strategies. Negotiations with domestic manufacturers and bulk purchasing arrangements have become more common as organizations strive to maintain service levels without eroding margins. Furthermore the regulatory environment governing medical device certification and import compliance has become more intricate as scrutiny on origin labeling and safety standards intensifies.

The compound impact of these tariff shifts extends beyond equipment costs into staffing patterns and service mix decisions. Centers are reevaluating the balance between major and minor procedures to offset rising expenses while exploring outsourcing models for laboratory and pathology services to leverage economies of scale. As providers navigate this evolving terrain enhanced data analytics and supply chain visibility tools are proving indispensable for forecasting procurement needs and sustaining uninterrupted patient care in the face of trade-driven supply fluctuations.

Deep Dive into Service Type, Provider, End User and Payment-Based Market Segmentation Driving Precision in Ambulatory Healthcare Strategies

A nuanced understanding of market segmentation reveals how service offerings provider archetypes patient demographics and reimbursement mechanisms converge to shape ambulatory healthcare strategies. Diagnostic Services encompass imaging laboratory and pathology capabilities that are increasingly integrated with digital reporting platforms to accelerate clinical decisionmaking. Preventive Services oriented around screenings and vaccinations are being prioritized by payers and health systems seeking to identify risk factors early and reduce long term costs. Major and minor surgeries performed at specialized outpatient surgical centers now leverage minimally invasive techniques that shorten recovery timelines and enhance patient throughput. Within Therapeutic Services chemotherapy sessions are complemented by precision monitoring tools while physical and radiation therapies adopt real time feedback systems to track treatment efficacy.

Provider Type segmentation highlights how ambulatory surgical centers diagnostic imaging centers outpatient rehabilitation facilities and physician offices each occupy distinct niches. Imaging sites offering CT scans MRI and ultrasound are investing in mobile units and expanded hours to accommodate urgent referrals. Rehabilitation centers specializing in occupational physical and speech therapies are embedding telehealth modules to support remote exercise regimens and caregiver coaching. Meanwhile physician offices integrate preventive and diagnostic functions to serve as one stop points of care for routine consultations and follow up visits.

End User categories adult pediatric and geriatric patient groups exhibit unique utilization patterns with seniors driving demand for chronic care management services and young families seeking consolidated preventive protocols. Payment structures spanning private insurance including HMO and PPO contracts public carriers such as Medicaid and Medicare and direct self pay arrangements influence both service adoption rates and pricing models. Within public insurance expansions to Medicare coverage have spurred growth in outpatient rehabilitation referrals whereas private payors incentivize providers through valuebased contracts rewarding quality metrics.

This comprehensive research report categorizes the Ambulatory Healthcare Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Provider Type

- Payment Type

- End User

Panoramic View of Regional Dynamics Shaping Ambulatory Healthcare Growth Across Americas Europe Middle East Africa and AsiaPacific

Regional dynamics significantly mediate growth trajectories in ambulatory healthcare as each geography presents distinct policy frameworks patient demographics and infrastructural capabilities. In the Americas market maturity is highest in North America where consolidated healthcare networks and robust reimbursement infrastructures support widespread adoption of advanced imaging and same day surgical models. Latin American nations are progressively modernizing outpatient facilities to expand access for underserved populations and curb hospital congestion through public private partnerships.

Europe Middle East and Africa exhibit a wide spectrum of developmental stages. Western Europe’s integrated health systems leverage centralized digital health records to streamline cross border referrals and preventive screening campaigns. The Middle East is witnessing substantial investments in specialized surgical centers designed to attract medical tourism seekers from neighboring regions. SubSaharan Africa prioritizes scalable vaccination programs and mobile diagnostic units to reach remote communities while exploring innovative financing mechanisms to offset limited public budgets.

AsiaPacific nations are dynamically reshaping their ambulatory landscapes in response to ageing populations urbanization and rising lifestyle disease prevalence. East Asian economies focus on integrating telehealth with brick and mortar clinics to manage chronic conditions efficiently. Southeast Asian markets are expanding outpatient rehabilitation services through partnerships between public hospitals and private rehabilitation chains. Australia and New Zealand maintain stringent accreditation standards that ensure high quality benchmarks for imaging pathology and ambulatory surgery while continually evolving their public insurance schemes to enhance outpatient service coverage.

This comprehensive research report examines key regions that drive the evolution of the Ambulatory Healthcare Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Competitive Landscape and Strategic Moves of Leading Ambulatory Healthcare Service Providers Influencing Market Evolution

Major industry participants are deploying differentiated strategies to secure market leadership in ambulatory healthcare. Leading provider networks are forging alliances with technology firms to co develop AIenabled diagnostic solutions that optimize imaging throughput and reduce interpretation variability. Key equipment manufacturers are strengthening their after sales support and instrument servicing capabilities to address tariffdriven procurement challenges and ensure minimal downtime for surgical suites and laboratories.

Ambulatory surgical center operators and outpatient rehabilitation chains are investing in facility expansions and digital front end platforms to enhance patient experience and referral integration. Several large health systems are launching proprietary imaging centers and specialized outpatient clinics to capture a greater share of elective procedure volumes from hospitalbased settings. Meanwhile innovative startups focused on remote monitoring and home based therapy are securing partnerships with established rehabilitation providers to pilot hybrid care models that blend inperson and virtual touchpoints.

Payment and insurance companies are collaborating with ambulatory providers to introduce valuebased reimbursement pilots that tie compensation to quality metrics and patient satisfaction scores. These initiatives are fostering the co creation of standardized care pathways for minor surgeries and chronic disease management. As competitive pressures intensify, organizations that adeptly align technology adoption provider networks and payer collaborations are poised to redefine the ambulatory care competitive frontier.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ambulatory Healthcare Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amwell Corporation

- DaVita Inc.

- Encompass Health Corporation

- Fresenius Medical Care AG & Co. KGaA

- Medical Facilities Corporation

- Oak Street Health, Inc.

- One Medical, Inc.

- Option Care Health, Inc.

- Pediatrix Medical Group

- PYA, P.C.

- Select Medical Corporation

- Sonic Healthcare Limited

- Surgery Partners, Inc.

- Symbion Pty Ltd.

- Teladoc Health, Inc.

- Tenet Healthcare Corporation

- Terveystalo Healthcare

- Universal Health Services, Inc.

Targeted Strategic Imperatives for Industry Leaders to Navigate Disruptive Trends and Optimize Operational Excellence in Outpatient Care

Ambulatory healthcare leaders should prioritize the deployment of integrated digital ecosystems that unify diagnostics scheduling and patient engagement tools to reduce administrative friction and enhance clinical coordination. By establishing interoperable data pipelines between imaging laboratories rehabilitation centers and physician offices organizations can accelerate referrals and improve transparency of patient progress across care episodes.

Investment in outcome measurement frameworks tied to valuebased payment models will enable providers to negotiate more favorable reimbursement terms and demonstrate tangible efficiency gains. Cultivating multidisciplinary care teams that collaborate across surgeons therapists and care coordinators fosters comprehensive treatment plans and mitigates the risk of readmissions. Emphasizing minimally invasive and same day procedures supported by robust patient education initiatives can optimize facility utilization and patient satisfaction concurrently.

Finally forging strategic partnerships with domestic device suppliers and innovative telehealth platforms can insulate operations from supply chain volatility and tariffs while expanding service reach into remote or underserved areas. Organizations that adopt agile governance structures and cultivate a culture of continuous improvement will be best positioned to anticipate regulatory shifts adapt their service portfolios and sustain competitive advantage in a rapidly evolving outpatient care environment.

Rigorous Multimodal Research Methodology Integrating Quantitative Analysis Qualitative Insights and Robust Data Validation for Ambulatory Care Study

The foundation of this analysis rests on a triangulated research framework combining exhaustive secondary data review primary stakeholder interviews and quantitative validation. Secondary sources comprised peer reviewed journals regulatory filings policy white papers and proprietary financial disclosures focused on ambulatory care developments. This provided a historical baseline of service evolution regulatory impacts and innovation milestones.

Complementing desk research over 50 in depth interviews were conducted with C suite executives clinical directors supply chain managers and payer representatives. These discussions surfaced nuanced perspectives on technological adoption challenges reimbursement negotiation tactics and patient engagement strategies. Qualitative insights from frontline practitioners informed the identification of emergent operating models and best practice benchmarks.

To ensure empirical rigor a proprietary dataset of service volumes procedural mix and referral patterns was analyzed using statistical techniques to detect significant correlations between segmentation variables and performance outcomes. Data validation involved cross referencing survey responses with publicly available metrics to enhance reliability. This multimodal methodology ensures that the insights presented in this report reflect a balanced synthesis of strategic context operational realities and quantifiable evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ambulatory Healthcare Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ambulatory Healthcare Services Market, by Service Type

- Ambulatory Healthcare Services Market, by Provider Type

- Ambulatory Healthcare Services Market, by Payment Type

- Ambulatory Healthcare Services Market, by End User

- Ambulatory Healthcare Services Market, by Region

- Ambulatory Healthcare Services Market, by Group

- Ambulatory Healthcare Services Market, by Country

- United States Ambulatory Healthcare Services Market

- China Ambulatory Healthcare Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Strategic Synopsis Emphasizing Future Opportunities Challenges and the Critical Role of Adaptive Strategies in the Ambulatory Healthcare Ecosystem

Bringing together the threads of technological innovation policy shifts tariff impacts segmentation dynamics and regional nuances this analysis underscores the imperative for agile and data-driven strategy in ambulatory healthcare. Facilities that invest in digital integration across diagnostic preventive surgical and therapeutic services will distinguish themselves through enhanced efficiency and patient loyalty. Equally vital is the development of flexible procurement and partnership models that mitigate trade disruptions and optimize resource allocation.

A deep comprehension of end user demographics and payment mechanisms empowers providers to tailor service portfolios promoting preventive care among younger segments while addressing chronic condition management needs of aging populations. Regional adaptability remains crucial as market maturity and regulatory frameworks vary widely across the Americas Europe Middle East Africa and AsiaPacific. Industry leaders must calibrate their approaches to align with local policy incentives digital infrastructure readiness and competitive dynamics.

Ultimately, success in the ambulatory care landscape will hinge on an organization’s ability to integrate strategic foresight with operational excellence and collaborative alliances. By embedding continuous performance measurement and fostering multidisciplinary coordination, providers can navigate uncertainty and capitalize on emerging opportunities. The insights offered herein serve as a strategic compass guiding stakeholders toward informed decision making and sustainable growth trajectories.

Engage with Associate Director Sales and Marketing to Unlock Comprehensive Ambulatory Healthcare Insights and Drive Informed Strategic Decisions Today

To secure tailored insights and elevate your strategic initiatives within the ambulatory healthcare sector connect directly with Ketan Rohom Associate Director Sales and Marketing to explore how our comprehensive study can inform your next move. He will guide you through the depth of analysis on service models provider dynamics regional trends and tariff impacts ensuring you capitalize on market opportunities and preempt emerging disruptions. By engaging with Ketan you will access exclusive executive summaries sample findings and bespoke consultation designed to align with your organizational priorities and operational goals. Reach out today to arrange a personalized briefing and receive a demonstration of the actionable intelligence embedded in this report. Partnering with Ketan ensures that your leadership team benefits from timely expert interpretation of evolving regulatory landscapes reimbursement shifts and technological breakthroughs. Take the first step towards data-driven decisions that drive efficiency optimize care delivery and foster sustainable growth in the ambulatory care environment

- How big is the Ambulatory Healthcare Services Market?

- What is the Ambulatory Healthcare Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?