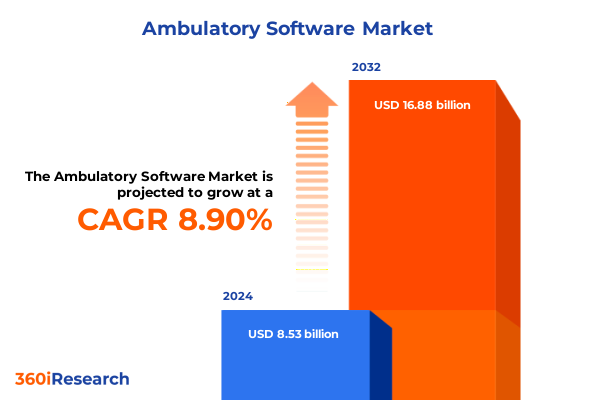

The Ambulatory Software Market size was estimated at USD 9.28 billion in 2025 and expected to reach USD 10.06 billion in 2026, at a CAGR of 8.92% to reach USD 16.88 billion by 2032.

Establishing the Foundation for Next-Generation Outpatient Care Through Seamless and Intelligent Ambulatory Software Integration

In today’s competitive healthcare environment, ambulatory software serves as the backbone of efficient patient management and streamlined clinical operations. From the initial point of care in physician offices to the specialized workflows of ambulatory surgery centers, software solutions are redefining how providers deliver services. The convergence of electronic health records, practice management capabilities, and integrated billing functionalities empowers care teams to navigate complex regulatory requirements while enhancing patient interactions.

As the demand for continuity of care and patient engagement intensifies, ambulatory software platforms are evolving into unified ecosystems. These solutions are not merely transaction engines; they’re intelligent hubs that aggregate data, automate routine tasks, and enable real-time clinical decision support. By bridging the gap between front-end patient experiences and back-end administrative processes, modern ambulatory software fosters a holistic approach to outpatient care that drives performance metrics, from patient satisfaction scores to operational efficiency.

Embracing Cloud-Native Platforms, AI-Enabled Analytics, and Integrated Telehealth to Redefine Outpatient Service Delivery

The ambulatory software sector is undergoing a profound metamorphosis driven by advances in cloud architectures, artificial intelligence, and patient-centered digital tools. Over the last few years, providers have shifted from deploying on-premise applications to embracing cloud-native platforms that offer scalable infrastructure and continuous feature innovation. Within this cloud paradigm, hybrid and private cloud models are gaining traction as organizations balance data sovereignty requirements with the need for flexible, cost-effective environments.

Concurrently, AI-powered clinical decision support and revenue cycle analytics are coming to the forefront. Machine learning algorithms are optimizing coding accuracy, predicting patient no-shows, and identifying high-risk populations for proactive interventions. Telehealth has transitioned from a niche service to a core module, integrating remote patient monitoring and virtual consultations into comprehensive outpatient workflows. These transformative shifts underscore a larger industry trend toward interoperability, where secure data exchange across disparate systems has become non-negotiable. In this evolving landscape, regulatory compliance frameworks such as updated interoperability rules and data privacy mandates are shaping solution roadmaps and driving innovation cycles.

Navigating the Cost Pressures and Strategic Realignments Triggered by 2025 U.S. Tariffs on Technology and Software Imports

In 2025, escalating tariffs imposed by the United States government on imported technology components and software licensing have created a ripple effect across the ambulatory software value chain. Hardware costs for on-premise servers and network equipment surged, compelling many providers to accelerate cloud migrations to mitigate upfront capital expenditures. At the same time, service providers faced elevated operational costs due to increased import duties on specialized diagnostic accessories and connectivity modules that interface with telehealth ecosystems.

The cumulative impact of these tariffs has been most pronounced for mid-sized and smaller practices that lack the purchasing power of large hospital systems. The increased cost of software subscriptions, integration services, and ongoing support has necessitated a strategic reallocation of IT budgets. Many organizations are renegotiating vendor contracts and exploring composite deployment models-where core clinical functions remain on premise while ancillary services migrate to cloud environments. Over the long term, this tariff-driven recalibration is fostering a new equilibrium, with vendors innovating localized development and support operations to insulate clients from future trade-policy volatility.

Revealing the Interplay of Cloud Versatility, Telehealth Expansion, Practice Demographics, Service Enhancements, and Specialty Clinic Needs

The ambulatory software landscape can be understood through various dimensions of delivery mode, product type, business size, component structure, and end-user specialization. Delivery mode dynamics reveal that pure public cloud deployments command significant interest for their minimal infrastructure management overhead, while hybrid and private cloud options appeal to organizations requiring data residency controls and tailored security profiles. In the product realm, electronic health records continue to anchor clinical workflows, yet the rapid expansion of telehealth modules-both remote patient monitoring and video-based consultations-is reshaping outpatient care paradigms alongside billing and practice management systems.

When considering business size, large practices leverage integrated enterprise suites to align multisite operations, whereas medium-sized clinics often prioritize modular additions that can be scaled without disrupting existing processes. Small practices are gravitating toward plug-and-play solutions that offer turnkey implementation and flexible subscription models. Component analysis shows that software licensing constitutes the core deliverable, but services such as implementation and integration, ongoing support and maintenance, and provider training are increasingly viewed as critical value drivers. Among end users, ambulatory surgery centers and diagnostic centers depend on streamlined clinical and financial modules for high-volume workflows, physician offices emphasize patient engagement and scheduling, and specialty clinics-spanning cardiology, dermatology, and orthopedics-demand tailored functionality to address niche procedural and documentation requirements.

This comprehensive research report categorizes the Ambulatory Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Product Type

- End User

- Delivery Mode

Comparing the Distinct Adoption Drivers and Growth Accelerators Across the Americas, EMEA, and Asia-Pacific Regions

Regional dynamics in the ambulatory software market illustrate diverse adoption patterns and growth catalysts across the Americas, Europe, Middle East & Africa, and Asia-Pacific zones. In the Americas, the United States remains the largest adopter, driven by robust healthcare spending, value-based care initiatives, and mature reimbursement frameworks. Canada is following suit, with a focus on digital health interoperability and public-private partnerships that accelerate solution deployment in ambulatory care.

Across Europe, Middle East & Africa, regulatory harmonization efforts such as GDPR in Europe and evolving data protection laws in the Middle East are guiding software enhancements toward stricter privacy and consent management. Market education and infrastructure development are spurring uptake in emerging EMEA economies. Meanwhile, Asia-Pacific presents the highest growth trajectory, fueled by rapid healthcare digitization in China, India, Australia, and Southeast Asian nations. Government incentives, expanding private healthcare networks, and the push toward universal health coverage are amplifying demand for scalable cloud offerings, next-generation telehealth modules, and analytics platforms to optimize outpatient services in high-volume environments.

This comprehensive research report examines key regions that drive the evolution of the Ambulatory Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Market Leaders and Innovators Shaping Cloud-Native, AI-Enhanced, and Interoperable Ambulatory Software Ecosystems

Several leading vendors have solidified their positions in the ambulatory software market through differentiated value propositions and strategic expansions. One global incumbent offers an end-to-end cloud ecosystem that integrates revenue cycle management with advanced clinical analytics, catering to health systems seeking unified digital infrastructures. Another prominent player focuses on modular, API-driven platforms that enable rapid telehealth integration, meeting the evolving demands of specialty clinics and remote care initiatives.

Emerging disruptors are carving out niches by embedding AI-powered decision support within electronic health record workflows, while midsize vendors are consolidating regional footprints through targeted partnerships and acquisitions. Service-heavy competitors are distinguishing themselves through comprehensive implementation, training, and maintenance engagements, ensuring that clients can leverage complex solutions without overburdening internal IT teams. Across the board, these companies share a common emphasis on interoperability, cybersecurity hardening, and continuous product innovation to address the dynamic requirements of ambulatory care providers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ambulatory Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AdvancedMD, Inc.

- athenahealth, Inc.

- Azalea Health Innovations, Inc.

- ChartLogic, Inc.

- Computer Programs and Systems, Inc.

- CureMD Healthcare, Inc.

- eClinicalWorks, LLC

- Elation Health, Inc.

- Epic Systems Corporation

- Greenway Health, LLC

- Medical Information Technology, Inc.

- Modernizing Medicine, Inc.

- Nextech Systems, LLC

- NextGen Healthcare, Inc.

- Oracle Corporation

- Practice Fusion, Inc.

- RXNT, Inc.

- Tebra Technologies, Inc.

- Veradigm LLC

- WebPT, Inc.

Outlining a Multi-Layered Growth Blueprint Emphasizing Cloud Evolution, AI Integration, Strategic Partnerships, and Cybersecurity

Industry leaders must adopt a multi-pronged strategy to maintain competitive advantage and sow the seeds for long-term growth. First, they should accelerate cloud-based migrations and hybrid deployments that reduce total cost of ownership while providing the agility to launch new modules rapidly. Second, embedding AI-driven analytics into both clinical decision support and revenue cycle workflows will unlock operational efficiencies and improve patient outcomes through predictive insights.

Third, forging partnerships with payers, device manufacturers, and telehealth integrators will create end-to-end care pathways that strengthen competitive moats. Fourth, prioritizing user experience by simplifying interfaces, providing role-based dashboards, and delivering context-aware alerts will drive higher adoption rates among busy clinicians. Fifth, expanding cybersecurity measures through proactive threat monitoring, encryption standards, and compliance certifications will safeguard data integrity as digital footprints expand. Finally, diversifying supply chains and localizing support capabilities can mitigate the cost and operational uncertainties introduced by evolving trade policies.

Detailing the Comprehensive Blend of Primary Interviews, Secondary Analysis, and Data Triangulation Underpinning the Research

Our research methodology combines rigorous primary and secondary data collection techniques to ensure the highest levels of accuracy and impartiality. Primary insights were obtained through in-depth interviews with senior executives, IT directors, and clinical leaders across a representative cross-section of ambulatory care settings. These conversations provided nuanced perspectives on deployment challenges, satisfaction drivers, and future roadmap priorities.

Secondary research encompassed the analysis of industry white papers, regulatory filings, technical specifications, and peer-reviewed journals to validate market trends and technology benchmarks. Data triangulation was achieved by cross-referencing vendor disclosures, procurement documents, and end-user surveys. Quantitative inputs were segmented by delivery mode, product type, practice size, service component, and end-user category to generate a granular understanding of market dynamics. This holistic approach ensures that our findings reflect both the evolving strategic objectives of solution providers and the operational realities of ambulatory care practitioners.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ambulatory Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ambulatory Software Market, by Component

- Ambulatory Software Market, by Product Type

- Ambulatory Software Market, by End User

- Ambulatory Software Market, by Delivery Mode

- Ambulatory Software Market, by Region

- Ambulatory Software Market, by Group

- Ambulatory Software Market, by Country

- United States Ambulatory Software Market

- China Ambulatory Software Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesizing Technological Innovations, Strategic Imperatives, and Regional Variations to Chart the Path Forward for Ambulatory Care Software

Ambulatory software has transcended its role as a back-office tool and emerged as a strategic enabler for outpatient care excellence. From cloud migrations and AI-powered modules to tariff-influenced cost realignments, the market is being reshaped by technological breakthroughs and policy shifts. Segmentation insights reveal that cloud architectures, telehealth expansion, and service-oriented delivery are central to meeting the distinct requirements of diverse practice settings and specialty clinics.

Regional analysis underscores the importance of tailored deployment strategies that reflect local regulatory frameworks and digital maturity levels. Leading vendors are navigating these complexities through modular design, API-first approaches, and robust cybersecurity measures. For industry stakeholders, the imperative is clear: embrace interoperability, invest in advanced analytics, and fortify digital infrastructures to deliver seamless, patient-centric care. The next chapter of ambulatory software evolution will be defined by those who can synthesize innovation with operational excellence across every dimension of the outpatient continuum.

Unlock the Definitive Ambulatory Software Market Intelligence by Engaging with the Associate Director of Sales & Marketing

To gain comprehensive insights into the evolving ambulatory software landscape and unlock strategic advantages for your organization, secure your copy of this definitive market research report today. Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to explore tailored service packages, discuss volume licensing options, and arrange a personalized briefing. Don’t miss this opportunity to leverage industry-leading intelligence that will empower your decision-making and drive future growth.

- How big is the Ambulatory Software Market?

- What is the Ambulatory Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?