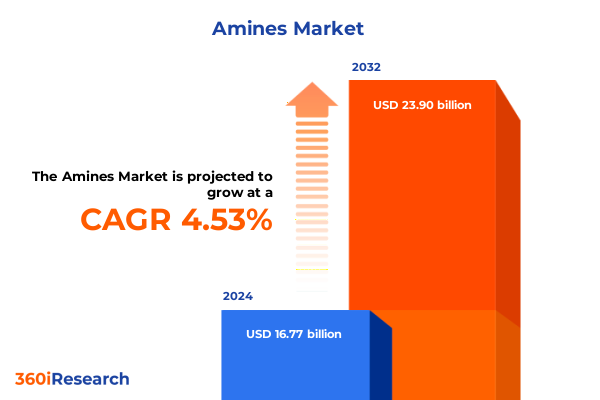

The Amines Market size was estimated at USD 17.51 billion in 2025 and expected to reach USD 18.30 billion in 2026, at a CAGR of 4.54% to reach USD 23.90 billion by 2032.

Comprehensive Exploration of the Amines Market’s Strategic Foundations Emerging Growth Drivers and Key Industry Dynamics Shaping Global Competitiveness Innovation and Resilience Strategies

The global amines market occupies a critical position within the broader chemicals sector, underpinning the production of high-value derivatives, specialty applications, and essential industrial processes. Amines serve as vital intermediates in the manufacture of agrochemicals, playing a fundamental role in herbicide and pesticide formulations, while also enabling the synthesis of active pharmaceutical ingredients, surfactants, and water treatment chemicals. In recent years, the convergence of regulatory tightening, sustainability imperatives, and evolving end-use requirements has intensified the focus on amine innovation and supply chain robustness.

Despite the commodity nature of many amine grades, differentiation through high-purity grades, bio-based feedstocks, and tailored functionalization has opened avenues for producers to capture value and foster long-term partnerships with downstream formulators. Moreover, heightened scrutiny on environmental impact and worker safety has driven the adoption of greener synthesis routes, waste minimization protocols, and advanced monitoring technologies. As the industry navigates complex raw material dynamics and shifting demand patterns, stakeholders are prioritizing agile manufacturing, strategic feedstock sourcing, and digital integration to maintain cost competitiveness and resilience.

Examining Groundbreaking Transformative Forces Driving Technological Innovation Sustainability Integration Regulatory Evolution and Supply Chain Resilience Radically Reshaping the Amines Industry Landscape

The amines landscape has witnessed a cascade of transformative shifts driven by technological breakthroughs and evolving regulatory frameworks. First, the integration of green chemistry principles has accelerated the transition toward bio-based amines derived from renewable feedstocks such as lignocellulosic biomass and waste-derived glycerol. Through enzymatic catalysis and continuous flow reactors, producers are enhancing process yields, reducing energy consumption, and minimizing hazardous byproducts, thereby fortifying their sustainability credentials.

Concurrently, digitalization across the value chain is reshaping operational efficiency and customer engagement. Advanced process analytics utilizing machine learning models enable real-time optimization of reaction conditions and predictive maintenance of critical equipment. At the same time, cloud-based customer portals and blockchain-enabled traceability platforms are instilling greater transparency and responsiveness in supply networks, driving closer collaboration between producers and end-users.

Regulatory evolution is yet another catalyst for change, with emerging jurisdictions imposing stricter controls on volatile amines and designated critical priority substances. This has prompted companies to invest in emission abatement technologies, implement comprehensive hazard assessments, and accelerate adoption of safer alternatives. Taken together, these hallmark shifts are redefining competitive parameters and unlocking new sources of growth.

Assessing the Far-Reaching Cumulative Effects of 2025 United States Tariffs on Market Access Supply Chains and Competitive Landscape

In 2025, the United States introduced a graduated tariff regime affecting a broad spectrum of amines imports, altering the cost structure for buyers and reshaping sourcing strategies. Producers based in Asia and Europe adjusted their export pricing to maintain competitiveness, while importers reevaluated supplier portfolios and engaged in renegotiations to offset incremental duties. The immediate effect was a visible uptick in landed costs for key grades such as ethanolamines and ethylenediamine, compelling downstream processors to explore alternative chemistries or vertically integrate their upstream supply.

Beyond direct price implications, the tariff measures accelerated investment in domestic production assets, particularly in the Gulf Coast and Midwest regions, where ample feedstock availability and infrastructure synergies support scale-up. As capacity expansions came online, the market witnessed improved access to locally sourced amines, partially alleviating the initial supply constraints. However, this realignment also intensified competition among domestic producers, leading to margin compression and prompting strategic alliances to secure feedstock streams and optimize logistics.

Looking ahead, the cumulative impact of the tariff landscape is driving a recalibration of global trade lanes, with customers increasingly favoring suppliers that demonstrate both cost transparency and supply security. This dynamic underscores the need for companies to adopt flexible pricing models, engage in forward procurement agreements, and bolster downstream integration to mitigate exposure to future policy shifts.

Deriving Deep Insights from Type Application and End Use Industry Segmentation to Uncover Critical Market Differentiators and Opportunities

A nuanced appreciation of market segmentation reveals distinct performance vectors and opportunity zones. When parsed by type, diethanolamine emerges as a versatile workhorse in surfactant synthesis and gas sweetening, while ethylenediamine commands value in chelating agents and polymer intermediates. Monoethanolamine continues to dominate acid gas removal applications, and triethanolamine secures a strong foothold in personal care emulsifiers and corrosion inhibitors. Through this lens, each type exhibits unique margin profiles and end-use synergies that guide portfolio prioritization and R&D allocation.

Analyzing the market through application categories further illuminates growth frontiers. In agrochemicals, fertilizers leverage amine-based neutralization steps, herbicides exploit targeted delivery vectors, and pesticides benefit from encapsulation chemistries. Gas treatment leverages acid gas removal, carbon dioxide extraction, and hydrogen sulfide mitigation, each demanding tailored amine formulations with precise thermodynamic properties. The pharmaceuticals domain bifurcates into active pharmaceutical ingredients and intermediates, where stringent purity mandates drive dependence on high-grade ethanolamines. Surfactants span emulsifiers, foaming agents, and wetting agents, underscoring the role of amine structure in interfacial activity. Water treatment surfaces biocide formulation, corrosion inhibition, and scale prevention, with each subsegment requiring distinct functional performance.

Evaluating end use industries adds another dimension of insight. Within agricultural chemicals, crop protection and soil treatment pathways determine the mix and volume of amine utilities. The oil and gas realm segregates upstream exploration, midstream transport, and downstream refining, each segment exhibiting differential sensitivity to feedstock price trends and regulatory constraints. Personal care divides into cosmetics and toiletries, where consumer demand for clean-label ingredients elevates interest in bio-based amines. Pharmaceuticals’ split between formulations and generics underscores the dual engines of innovation and cost competitiveness. Lastly, industrial and municipal water treatment systems reveal regional investment cycles and infrastructure upgrade imperatives that underpin amine demand.

This comprehensive research report categorizes the Amines market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Application

- End Use Industry

Unveiling Core Regional Dynamics and Growth Catalysts Across Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics in the amines market are shaped by diverse factors spanning resource accessibility, regulatory ecosystems, and demand profiles. In the Americas, robust oil and gas infrastructures in North America and expanding agrochemical capacities in South America converge to create a heterogeneous demand base. The United States continues to lead in advanced manufacturing and research investments, while Brazil’s agricultural sector drives demand for specialty amines in fertilizers and crop protection agents.

Across Europe the Middle East and Africa, the interplay of tight environmental standards and petrochemical traditions dictates market behavior. Western Europe prioritizes low-emission production and circular economy practices, leveraging hydrogen and carbon capture technologies. In the Middle East, new downstream integration projects capitalize on abundant natural gas to produce ethanolamines and ethylenediamine at competitive costs. Meanwhile, select African markets are moving toward infrastructure development and water treatment upgrades, gradually unlocking latent demand for biocide and scale inhibition chemistries.

The Asia Pacific region represents a fast-evolving landscape driven by expanding chemical hubs, rapid urbanization, and rising disposable income. China’s aggressive capacity build-out has led to a deep pool of low-cost supply, prompting domestic players to pursue higher-value segments and export strategies. India is scaling up both commodity and specialty amine capacities, underpinned by supportive policies for local manufacturing. Meanwhile, Southeast Asian economies are advancing petrochemical clusters and water infrastructure projects, creating pockets of growth for surfactants and treatment chemicals.

This comprehensive research report examines key regions that drive the evolution of the Amines market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Market Participants Strategic Initiatives Innovations and Competitive Positioning Shaping the Amines Industry

Competitive dynamics in the amines market are defined by a blend of global majors and agile specialty producers. Leading chemical conglomerates leverage integrated asset footprints and proprietary technologies to offer comprehensive product portfolios ranging from commodity ethanolamines to niche functional amines. Their scale advantages enable them to absorb feedstock price volatility and deliver consistent quality assurance to large end users in pharmaceuticals, agrochemicals, and oil and gas.

Conversely, mid-tier and regional players carve out differentiated positions through focused application expertise, faster new product introductions, and customer-centric service models. By concentrating on high-growth subverticals such as bio-based amines, high-purity grades for pharmaceutical intermediates, and tailored gas treatment solutions, these companies are capturing premium margins and fostering collaborative R&D partnerships.

Strategic alliances and joint ventures are increasing in frequency as firms seek to accelerate capacity expansions, share technical know-how, and de-risk capital investments. Mergers and acquisitions are likewise prominent, with acquirers targeting bolt-on specialty amines portfolios or integrated downstream capabilities to enhance cross-sell synergies and broaden addressable markets. Collectively, these competitive strategies illustrate a market in which flexibility, innovation speed, and collaborative ecosystems determine leadership positions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Amines market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akzo Nobel N.V.

- Albemarle Corporation

- Alkyl Amines Chemicals Limited

- Arkema S.A.

- BALAJI AMINES LIMITED

- BASF SE

- Celanese Corporation

- Croda International PLC

- DuPont de Nemours, Inc.

- Eastman Chemical Company

- Evonik Industries AG

- Global Amines Company Pte. Ltd.

- Hexion Inc.

- Huntsman International LLC

- Indo Amines Limited

- INEOS AG

- Kao Corporation

- Lanxess AG

- Merck KGaA

- Mitsubishi Gas Chemical Company Inc.

- NOF CORPORATION

- Nouryon Chemicals Holding B.V.

- OQ Chemicals GmbH

- SABIC

- Solvay SA

- Stepan Company

- Tokyo Chemical Industry Co., Ltd.

Providing Actionable Strategic Recommendations to Propel Industry Leaders Toward Sustainable Growth Operational Resilience and Market Leadership

To navigate the evolving amines landscape and capture emerging opportunities, industry leaders should prioritize a multi-pronged strategic agenda. First, investing in flexible manufacturing platforms capable of handling both petroleum-derived and bio-based feedstocks will enable rapid adaptation to raw material price fluctuations and sustainability demands. Deploying modular reactors and continuous flow technologies can shorten lead times for new product qualifications while reducing capital intensity.

Second, forging deeper collaborations across the value chain-including partnerships with equipment suppliers, research institutes, and key end users-will accelerate co-development of next-generation amine formulations. By aligning innovation roadmaps with customer-specific performance targets, producers can secure long-term supply agreements and create lock-in effects that enhance revenue visibility.

Third, implementing integrated digital frameworks across procurement, production, and commercial operations will unlock efficiency gains and data-driven decision making. Advanced analytics can optimize feedstock utilization, minimize energy consumption, and predict maintenance needs, while customer-facing digital portals can streamline order processing and enhance transparency.

Finally, engaging proactively with policymakers and industry associations on emerging regulations and sustainability standards will help shape feasible compliance pathways. By participating in cross-industry platforms focused on emission reductions, circular economy models, and chemical safety, companies can influence policy outcomes and position themselves as responsible market stewards.

Detailing Rigorous Research Methodology and Analytical Framework Underpinning Comprehensive Market Insights and Data Integrity Assurance Processes

This analysis is grounded in a robust research methodology that synthesizes primary and secondary data sources to ensure comprehensive coverage and data integrity. Primary research involved in-depth interviews with senior executives across the amines value chain-including production, distribution, and end users-to capture firsthand perspectives on market drivers, technology adoption, and regulatory impacts. These qualitative insights were triangulated with survey data collected from procurement and R&D professionals to quantify priority themes and adoption rates of emerging technologies.

Secondary research encompassed a systematic review of industry publications, regulatory filings, patent databases, and trade association reports to map historical trends, capacity developments, and announced capital projects. Advanced data validation techniques, including cross-referencing production estimates with customs data and feedstock price indices, were employed to reconcile discrepancies and enhance forecast reliability.

Quantitative modeling leveraged scenario analysis to evaluate potential outcomes under varying tariff regimes, feedstock price volatility scenarios, and sustainability mandates. Sensitivity analyses were conducted to identify critical inflection points and resilience thresholds. Throughout the process, a peer review framework engaged internal subject matter experts to validate assumptions, refine analytical approaches, and ensure the highest standards of objectivity and rigor.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Amines market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Amines Market, by Type

- Amines Market, by Application

- Amines Market, by End Use Industry

- Amines Market, by Region

- Amines Market, by Group

- Amines Market, by Country

- United States Amines Market

- China Amines Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 2226 ]

Summarizing Key Insights Reinforcing Strategic Imperatives and Forward Looking Considerations for Stakeholders in the Amines Market

The evolving amines market presents a complex interplay of sustainability, technological innovation, and policy dynamics, all of which are reshaping traditional competitive paradigms. Strategic differentiation hinges on the ability to integrate greener production pathways, harness digital analytics, and forge collaborative ecosystems that span the entire value chain. Observing the ripple effects of the 2025 United States tariff measures underscores the importance of supply chain agility and diversified sourcing strategies.

At its core, the market’s segmentation by type, application, and end use industry reveals discrete growth pockets-ranging from high-purity ethanolamines for pharmaceutical intermediates to specialized amine blends for advanced water treatment. Regional nuances further refine these opportunities, as resource endowments, regulatory intensity, and infrastructure priorities vary significantly across the Americas, EMEA, and APAC.

To thrive amid these complexities, stakeholders must adopt an integrated strategic approach that balances innovation investment with operational efficiency, anticipates policy shifts through proactive engagement, and embeds sustainability as a business imperative. Those who succeed will be best positioned to deliver tailored solutions, secure premium partnerships, and sustain long-term competitive advantage in this dynamic market environment.

Connecting Industry Stakeholders with Expert Guidance and Exclusive Opportunities Through Direct Engagement with Ketan Rohom for Comprehensive Insights

To unlock unparalleled insights into the amines market and tailor strategic initiatives to your business objectives, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan’s expertise in chemicals and deep understanding of market nuances ensures that you receive bespoke guidance, whether you’re exploring supply chain optimization, evaluating tariff impacts, or identifying strategic partners globally. By engaging with Ketan, you gain direct access to senior-level analysis, customized data dashboards, and in-depth briefings that address your unique challenges.

Take the next step toward informed investment and expansion decisions by partnering with an industry veteran who can help you interpret findings, contextualize emerging trends, and chart a clear path forward. Contact Ketan to schedule a personalized consultation, request tailored excerpts from the full research report, or discuss volume licensing and enterprise solutions. Empower your organization with the confidence and clarity needed to navigate today’s complex amines landscape and seize growth opportunities ahead.

- How big is the Amines Market?

- What is the Amines Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?