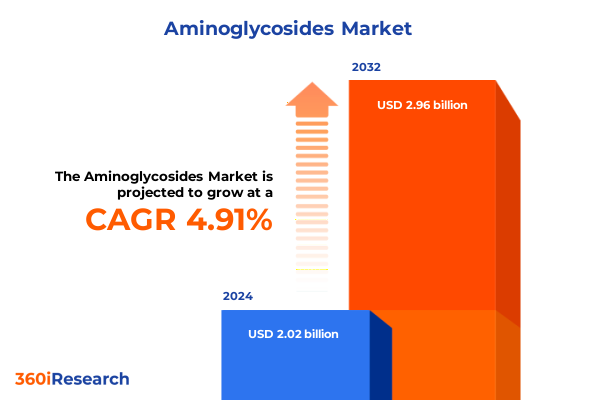

The Aminoglycosides Market size was estimated at USD 2.12 billion in 2025 and expected to reach USD 2.21 billion in 2026, at a CAGR of 4.91% to reach USD 2.96 billion by 2032.

Unveiling the Strategic Significance of Aminoglycosides in Antibacterial Therapy and Emerging Market Dynamics Shaping the Future Landscape

The aminoglycoside class of antibiotics has remained a cornerstone of antimicrobial therapy for over eight decades, demonstrating robust activity against a spectrum of serious Gram-negative infections. As bacterial resistance escalates and treatment paradigms evolve, the enduring efficacy of agents such as amikacin and gentamicin underscores their strategic significance in both acute care and outpatient settings. This analysis provides an executive overview of pivotal trends, strategic developments, and market dynamics shaping the aminoglycoside landscape, equipping stakeholders with a holistic understanding of emerging challenges and opportunities.

Against a backdrop of rising multidrug-resistant pathogens, healthcare providers continue to rely on aminoglycosides for their potent bactericidal properties and ability to synergize with beta-lactams and glycopeptides. Concurrently, regulatory agencies have introduced nuanced guidelines to optimize dosing protocols, mitigate nephrotoxicity risks, and ensure patient safety. This convergence of clinical imperatives and stringent oversight has propelled a new wave of innovation in delivery systems, therapeutic monitoring, and formulation science.

As the industry adapts to accelerated R&D cycles and shifting policy landscapes, decision-makers must navigate a complex interplay of supply-chain constraints, geopolitical influences, and evolving reimbursement frameworks. The following sections delve into transformative shifts across the sector, dissect the impact of recent trade policy changes, highlight segmentation and regional nuances, and offer strategic imperatives for market leadership.

Navigating the Paradigm Shifts Driven by Resistance Trends Regulatory Reforms and Technological Innovations in Aminoglycoside Development

Recent years have witnessed a pronounced shift in the aminoglycoside ecosystem, driven by the accelerating pace of antimicrobial resistance and parallel advancements in drug delivery and diagnostics. Healthcare systems worldwide are recalibrating formularies to address resistant Gram-negative organisms, prompting manufacturers to invest in next-generation derivatives with optimized safety profiles and targeted tissue penetration. In parallel, the integration of rapid pathogen identification technologies has enabled more precise utilization of aminoglycosides, reducing exposure and preserving efficacy.

Regulatory bodies across multiple jurisdictions have responded to these clinical exigencies by streamlining pathways for novel aminoglycoside analogs and supporting adaptive licensing frameworks. As a direct consequence, collaborations between biotech innovators and established pharmaceutical entities have proliferated, fostering co-development agreements that leverage complementary strengths in medicinal chemistry and large-scale manufacturing. These alliances signify a paradigm departure from traditional, siloed R&D models toward more dynamic, partnership-driven approaches.

Moreover, patient-centric delivery platforms-such as long-acting injectable formulations and targeted liposomal carriers-have gained traction, promising to reduce dosing frequency, minimize systemic toxicity, and improve adherence. These advances reflect a broader industry trend toward personalized antibiotic stewardship, whereby tailored regimens are informed by pharmacokinetic monitoring and genomic resistance profiling. Collectively, these transformative shifts are redefining the role of aminoglycosides in modern therapeutic arsenals.

Assessing the Ripple Effects of 2025 United States Import Tariffs on Supply Chains Manufacturing Costs and Access to Aminoglycoside Therapies

In early 2025, the United States implemented a series of import tariffs targeting active pharmaceutical ingredients and finished dosage forms, exerting significant pressure on aminoglycoside supply chains. Raw materials sourced predominantly from Asia faced higher levies, prompting contract manufacturers to reevaluate sourcing strategies and negotiate revised supplier agreements. Consequently, production costs for injectable and topical formulations have risen, with cost inflation transmitted downstream to distributors and, ultimately, healthcare providers.

The imposition of tariffs has also accelerated reshoring initiatives, as domestic producers seek to mitigate exposure to cross-border trade volatility. Companies have initiated capacity expansions in North American facilities, investing in process optimization and quality-control systems to ensure regulatory compliance. While these developments bolster long-term supply security, they require considerable capital deployment and carry lead times that extend beyond current demand cycles.

Furthermore, pricing dynamics have been affected as payers adjust reimbursement models to reflect increased acquisition costs, potentially constraining formulary placement and fueling greater competition among generics. To adapt, manufacturers are exploring value-based contracting frameworks, linking reimbursement to clinical outcomes and fostering partnerships with health systems to establish stewardship programs. In this increasingly complex policy landscape, agility in supply planning and strategic foresight will be essential for sustaining access and preserving market positioning.

Revealing Market Segmentation Insights That Illuminate Diverse Product Types Administration Routes Applications Channels and Formulations in Aminoglycosides

Analyzing the aminoglycoside market through a segmentation lens reveals distinct patterns of demand and utilization that inform strategic priorities. Product-type analysis shows sustained preference for gentamicin and amikacin in critical care settings, while streptomycin retains niche usage in tuberculosis management and tobramycin dominates ocular and pulmonology applications. Meanwhile, neomycin continues to serve as a topical agent for dermatological and otic indications. These product distinctions drive formulation innovation, with ointments, powders, and aqueous solutions each tailored to specific clinical contexts.

Route administration further differentiates market dynamics, as injectable formats-encompassing both intramuscular and intravenous applications-remain central to hospital protocols for severe infections. Oral capsules and tablets offer convenience for outpatient continuity of care, although bioavailability considerations limit their use to select indications. Topical delivery through ear and eye drops, as well as skin creams, addresses localized infections with minimal systemic exposure, reflecting a broader move toward compartmentalized therapeutic approaches.

Application settings underscore diverse procurement channels and purchasing behaviors across ambulatory surgical centers, clinics, and hospitals, each governed by unique formulary committees and budgetary constraints. Distribution pathways amplify this complexity: hospital pharmacies maintain centralized inventory for high-acuity wards, retail outlets cater to outpatient scripts, wholesale distributors support bulk replenishment, and online channels-divided between marketplaces and dedicated pharmacy websites-offer digital convenience and competitive pricing. These multifaceted segmentation insights guide manufacturers in optimizing portfolio allocation, distribution strategies, and patient engagement tactics to meet the heterogeneous needs of end users.

This comprehensive research report categorizes the Aminoglycosides market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Route Administration

- Application

- Distribution Channel

- Formulation

Examining Regional Dynamics Influencing Aminoglycoside Adoption and Market Evolution Across the Americas EMEA and Asia-Pacific Territories

Regional analysis highlights nuanced growth trajectories and adoption patterns across the Americas, EMEA, and Asia-Pacific. In North America, robust clinical data and well-established stewardship programs underpin sustained demand for intravenous aminoglycosides, with outpatient oral formulations gradually gaining traction through community pharmacy channels. Latin American markets are characterized by price sensitivity and generic competition, spurring local manufacturing initiatives and public–private partnerships to bolster access in resource-limited settings.

Within Europe, Middle East, and Africa, regulatory harmonization efforts coupled with pan-regional procurement mechanisms are reshaping access frameworks. While European Union members emphasize strict pharmacovigilance and standardized dosing protocols, emerging markets in the Middle East and Africa are focusing on supply-chain resilience and affordable generics, often supported by international health organizations. These diverging priorities create opportunities for tailored market entry strategies and differentiated value propositions.

The Asia-Pacific region continues to lead in raw-material production and contract manufacturing, leveraging economies of scale to supply global markets. Simultaneously, domestic demand in China, India, and Southeast Asian nations is escalating due to expanding hospital infrastructures and increasing awareness of antimicrobial stewardship. Government incentives for local R&D and production capacity expansion further accelerate innovation in next-generation aminoglycoside analogs and advanced delivery mechanisms.

This comprehensive research report examines key regions that drive the evolution of the Aminoglycosides market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves Competitive Collaborations and Innovation Pipelines Among Leading Companies Shaping the Aminoglycoside Market Landscape

The competitive landscape features a blend of global pharmaceutical leaders, specialized generics manufacturers, and emerging biotech players. Established multinationals have leveraged broad antibiogram datasets and extensive regulatory expertise to maintain portfolio robustness, often supplementing legacy assets with incremental formulation improvements. At the same time, generics specialists have focused on cost leadership and scale efficiencies, driving price competitiveness in mature markets through high-volume production models.

Biotech entrants and contract manufacturing organizations are disrupting traditional value chains by offering toll-manufacturing partnerships and co-development agreements focused on proprietary analogs or targeted delivery platforms. Strategic alliances have emerged as a key mechanism for risk-sharing and accelerating time to market, exemplified by collaborations that pool R&D resources and regulatory experience. Concurrently, M&A activity has consolidated mid-tier players, enhancing geographic reach and expanding therapeutic portfolios through synergistic acquisitions.

Innovation pipelines reflect growing interest in aminoglycoside conjugates and combination therapies that synergize with monoclonal antibodies or adjuvant molecules to overcome resistance mechanisms. Strategic licensing deals and cross-sector alliances with diagnostics firms are also on the rise, underscoring the importance of integrated solutions that align antibiotic therapy with rapid resistance profiling.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aminoglycosides market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- AstraZeneca plc

- Bristol Myers Squibb Company

- Cipla Limited

- GlaxoSmithKline plc

- Hangzhou Uniwise International Co., Ltd.

- HuvePharma

- Insmed Incorporated

- Jiangxi Bolai Pharmacy Co., Ltd.

- Kremoint Pharma Pvt. Ltd

- Medico Remedies Pvt. Ltd.

- Medson Pharmaceuticals

- Novartis AG

- Pfizer Inc.

- Teva Pharmaceutical Industries Ltd

- Vega Pharma Ltd.

- Zoetis Inc.

Delivering Actionable Strategic Recommendations to Drive Growth Enhance Resilience and Foster Competitive Advantage in the Aminoglycosides Sector

Industry leaders must adopt an agile posture to harness emerging opportunities and safeguard market share. First, forging partnerships across the value chain-from API suppliers to specialty distributors-can mitigate supply-chain disruptions and cultivate flexible manufacturing networks. By aligning with strategic collaborators, firms can optimize capacity utilization and secure critical raw materials under long-term supply agreements.

Next, prioritizing R&D investments in advanced formulations and targeted delivery platforms will address evolving clinical needs and differentiate portfolios. Embracing personalized medicine principles through pharmacokinetic monitoring and resistance-guided dosing can enhance therapeutic outcomes while reinforcing stewardship commitments. To further bolster resilience, companies should diversify geographic production footprints, balancing domestic capacity expansions with select offshore alliances to manage cost pressures and regulatory divergence.

Finally, engaging payers and health systems in outcome-based contracting and value-added service models can unlock new reimbursement pathways. By demonstrating real-world evidence of clinical effectiveness and cost savings, manufacturers can secure favorable formulary positioning and cultivate long-term customer loyalty. Integrating digital tools for remote monitoring and patient adherence will also reinforce competitive differentiation and drive broader acceptance.

Unpacking Rigorous Research Methodology Emphasizing Data Triangulation Expert Collaboration and Multidimensional Analytical Frameworks

This analysis synthesizes primary and secondary research conducted through a structured, multi-tiered approach. Initially, comprehensive desk research catalogued regulatory filings, peer-reviewed literature, and corporate disclosures to establish a foundational understanding of the aminoglycoside landscape. Concurrently, proprietary interviews with infectious disease specialists, pharmacy directors, and supply-chain executives provided firsthand perspectives on clinical adoption patterns and procurement challenges.

Quantitative data were triangulated across diverse sources-hospital usage reports, national procurement databases, and external benchmarks-to validate trends and identify regional variances. These insights were supplemented by expert roundtables and advisor workshops, ensuring that nuanced market drivers and technology inflection points were rigorously vetted. Throughout this process, data integrity protocols and methodological standards were strictly enforced to uphold analytical rigor and objectivity.

Finally, scenario planning exercises and sensitivity analyses were employed to explore potential regulatory shifts, supply-chain disruptions, and evolving stewardship guidelines. This holistic methodology ensures that the insights and recommendations presented here are both robust and actionable, providing stakeholders with a reliable compass in a rapidly evolving market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aminoglycosides market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aminoglycosides Market, by Product Type

- Aminoglycosides Market, by Route Administration

- Aminoglycosides Market, by Application

- Aminoglycosides Market, by Distribution Channel

- Aminoglycosides Market, by Formulation

- Aminoglycosides Market, by Region

- Aminoglycosides Market, by Group

- Aminoglycosides Market, by Country

- United States Aminoglycosides Market

- China Aminoglycosides Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesis of Key Insights Underscoring Strategic Imperatives and Forward-Looking Perspectives in the Evolving Aminoglycoside Landscape

In summary, the aminoglycoside sector stands at a critical juncture defined by escalating resistance pressures, regulatory recalibrations, and evolving supply-chain dynamics. The confluence of these forces is reshaping clinical use patterns, spurring innovation in both molecular design and delivery platforms. Segmentation analyses reveal distinct demand drivers across product types, administration routes, application settings, distribution channels, and formulations, underscoring the need for nuanced, evidence-based strategies.

Regional insights highlight divergent adoption curves and procurement frameworks, from the sophisticated stewardship programs of North America and Europe to the cost-focused generics markets of Latin America and the supply-chain hubs of Asia-Pacific. Competitive activities have intensified, with major players pursuing strategic collaborations, targeted M&A, and value-added service offerings to secure market positioning. Meanwhile, the 2025 tariff landscape has injected fresh complexity into sourcing decisions and pricing strategies, emphasizing the importance of supply resilience.

Looking ahead, industry stakeholders must embrace agility through diversified production, partnership-driven R&D, and innovative contracting models to navigate this dynamic environment. By aligning clinical innovation with regulatory foresight and operational flexibility, companies can harness the full potential of aminoglycosides, delivering critical therapeutic value while safeguarding long-term growth.

Empower Your Decision-Making by Engaging with Ketan Rohom for Exclusive Access to the Comprehensive Aminoglycoside Market Research Report

To secure the full breadth of insights and strategic guidance contained within this report, kindly contact Ketan Rohom, Associate Director of Sales & Marketing, who stands ready to facilitate your organization’s access to the in-depth analysis, proprietary data, and tailored recommendations essential for informed decision-making in the aminoglycoside space. By engaging directly with this opportunity, you ensure your team gains exclusive privilege to actionable intelligence that can shape resilient portfolios, optimize supply strategies, and drive competitive differentiation in an evolving global landscape. Reach out to explore customized licensing options, volume packages, and enterprise solutions designed to align seamlessly with your operational requirements and long-term growth objectives

- How big is the Aminoglycosides Market?

- What is the Aminoglycosides Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?