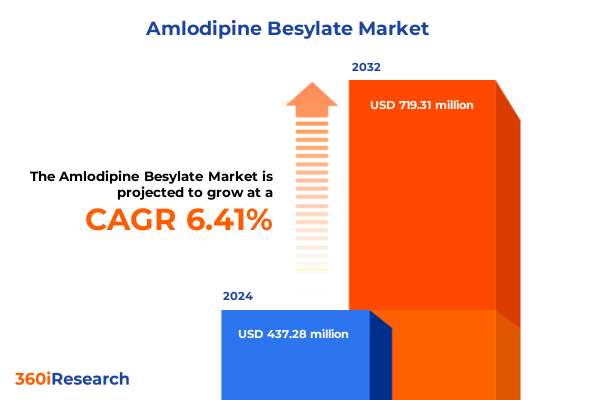

The Amlodipine Besylate Market size was estimated at USD 464.88 million in 2025 and expected to reach USD 490.06 million in 2026, at a CAGR of 6.43% to reach USD 719.31 million by 2032.

Revealing the Critical Role of Amlodipine Besylate in Addressing Global Hypertension and Angina Through a Comprehensive Market Introduction

Amlodipine Besylate stands as a cornerstone therapy in the management of both hypertension and angina, leveraging its long-acting dihydropyridine calcium channel blockade to deliver sustained vasodilation and improved cardiovascular outcomes. Since its introduction, the molecule’s proven efficacy, coupled with a favorable safety profile, has established it as a first-line choice among clinicians worldwide. This introduction sets the stage by highlighting the pivotal role Amlodipine Besylate occupies in contemporary pharmacotherapy and introduces the key themes explored in the report.

Against a backdrop of escalating global hypertension prevalence driven by aging populations, urbanization, and lifestyle factors, the Amlodipine Besylate market has witnessed notable shifts in demand patterns. As chronic disease management paradigms evolve toward value-based care, stakeholders are increasingly focused on optimizing cost-effectiveness, patient adherence, and therapeutic differentiation. This section introduces the market’s current dynamics, underscoring how clinical requirements intersect with regulatory, economic, and competitive forces.

Transitioning from foundational context, subsequent chapters delve into transformative shifts reshaping the landscape, the cumulative impact of newly enacted tariffs, nuanced segmentation analyses, regional intricacies, company profiles, and actionable guidance. By framing these elements upfront, readers gain clarity on the report’s structured approach to delivering strategic insights and supporting data-driven decision-making across the Amlodipine Besylate value chain.

Uncovering the Transformative Trends Redefining the Amlodipine Besylate Landscape in Response to Innovation Regulation and Patient-Centric Care

Over the past decade, rapid advancements in drug formulation technology and patient-centric care models have fundamentally altered the Amlodipine Besylate landscape. Novel extended-release delivery platforms have emerged, enabling more precise pharmacokinetic profiles that enhance adherence and minimize peak-related side effects. At the same time, digital health solutions-including mobile adherence apps and telemedicine platforms-have begun to integrate seamlessly with therapeutic regimens, offering real-time monitoring and personalized dose-management support.

Simultaneously, heightened regulatory scrutiny around bioequivalence standards has elevated the bar for generic manufacturers, prompting investment in sophisticated analytical techniques to demonstrate interchangeability. This regulatory tightening has fostered a dual environment in which branded innovator companies fortify their portfolios with value-added formulations while generics firms pursue targeted differentiation through controlled-release technologies and patient support programs.

Moreover, shifting reimbursement frameworks in key markets have accelerated the transition toward outcome-based contracting, compelling stakeholders to align pricing strategies with demonstrable clinical benefits. These transformative trends collectively signal a market in flux, where innovation, regulatory rigour, and evolving patient expectations converge to redefine competitive parameters and set the stage for strategic repositioning.

Exploring the Cumulative Consequences of United States Tariffs Imposed in 2025 on Amlodipine Besylate Importation and Cost Structures

In 2025, the United States government implemented revised tariff schedules targeting active pharmaceutical ingredients, including Amlodipine Besylate, with the stated aim of reshoring critical manufacturing capabilities. Though intended to bolster domestic supply resilience, these measures have introduced a series of cost pressures across the value chain. Import duties on key intermediates have elevated upstream production expenses, particularly for manufacturers lacking fully integrated chemical synthesis capabilities.

As a result, contract manufacturers and formulators have faced margin compression, which in turn has influenced pricing negotiations with wholesalers and payers. While some larger players have absorbed the additional levies through scale efficiencies and diversified sourcing, smaller firms have experienced tighter cash flows, leading to a consolidation wave among regional suppliers. Pharmacy benefit managers have responded by intensifying rebate negotiations and revisiting formulary tiers, seeking to offset the tariffs’ impact on health plan budgets.

Despite short-term cost upticks, the long-term consequence is a reconfigured supply landscape where domestic API production gains prominence and strategic partnerships become essential to navigate tariff volatility. Companies that proactively realign their procurement strategies and invest in domestic capacity stand to mitigate risk and capitalize on incentive programs designed to support onshore manufacturing initiatives.

Deriving Deep Insights from Application Type Dosage Distribution and End User Segmentation That Influence Amlodipine Besylate Adoption Patterns

Analyzing the Amlodipine Besylate market through the lens of application reveals distinct uptake trajectories in angina compared to broader hypertension management. While hypertensive patients represent the bulk of consumption due to high prevalence rates, the angina segment commands premium positioning of extended-release formulations, driving targeted R&D investments. This differentiation underscores the importance of tailoring portfolio strategies to distinct therapeutic contexts.

In parallel, the dichotomy between branded and generic offerings has sharpened. Branded entities leverage formulation patents and patient support services to preserve margin stability, whereas generic producers focus on cost leadership and rapid market entry post-patent expiry. The resulting competitive dynamics require strategic agility, as companies calibrate their product mix to balance volume-driven generic sales with higher-margin proprietary formulations.

Distribution channel analysis highlights a growing shift toward digital and retail pharmacy outlets at the expense of traditional hospital pharmacy procurement. Hospital pharmacies remain critical for acute care and inpatient settings, yet online pharmacy platforms are capturing share through home delivery and telepharmacy services. Retail pharmacies, benefiting from walk-in convenience and integrated clinical services, continue to serve as a central touchpoint for maintenance therapy in chronic patients.

Considering dosage, the prevalence of mid-range strengths such as 5 mg and 10 mg reflects physician preference for flexible titration, whereas lower-strength options cater to sensitive populations. End-user segmentation further distinguishes purchasing patterns: clinics value fast access and sample programs; homecare services prioritize cost-efficient bulk packaging; and hospitals emphasize compliance with stringent procurement protocols.

This comprehensive research report categorizes the Amlodipine Besylate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Dosage

- Application

- Distribution Channel

- End User

Analyzing Regional Dynamics Across Americas Europe Middle East Africa and Asia-Pacific to Illuminate Amlodipine Besylate Market Variations

Regional analysis of the Amlodipine Besylate market exposes nuanced drivers across the Americas, EMEA, and Asia-Pacific. In the Americas, robust health infrastructure, widespread insurance coverage, and established generic pathways underpin steady volume growth. Market participants face reimbursement pressures, yet benefit from clear regulatory frameworks and incentives for domestic API production bolstered by the 2025 tariff measures.

Within Europe, the Middle East, and Africa, heterogeneity in healthcare systems generates both challenges and opportunities. Western Europe’s cost-containment policies and tender-based procurement favor high-volume generics, while emerging markets in the Middle East and North Africa seek branded differentiation to meet expanding insurance coverage. Sub-Saharan Africa relies heavily on donor-supported programs and generic imports, driving price sensitivity and potential for public-private partnerships to enhance access.

Asia-Pacific stands out for its dual market structure: in developed economies such as Japan and Australia, premium pricing for innovator drugs coexists with stringent regulatory barriers to market entry, whereas in high-growth markets like China and India, rapid urbanization, rising middle-class incomes, and local manufacturing capacity fuel generic expansion. Authorities in the region are also promoting bioequivalence standards aligned with global benchmarks, further intensifying competition among biosimilar and generic manufacturers.

This comprehensive research report examines key regions that drive the evolution of the Amlodipine Besylate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Stakeholders Shaping the Amlodipine Besylate Market Through Strategic Collaborations and Competitive Differentiation

Within the Amlodipine Besylate competitive arena, leading players demonstrate diverse approaches to secure market leadership. Global innovators maintain their foothold through pipeline expansion, patent litigation strategies, and lifecycle management of existing formulations. By contrast, multinational generic firms leverage economies of scale, robust supply chain networks, and aggressive pricing models to capture broad patient segments.

Strategic collaborations and joint ventures have emerged as critical mechanisms for combining R&D expertise with manufacturing efficiency. Partnerships between originator companies and contract development organizations streamline the launch of value-added formulations, while alliances among generics producers enhance capacity utilization and geographic reach. In addition, several mid-sized companies are investing in specialty dosage forms and fixed-dose combinations to carve out high-growth niches.

Innovation in digital patient support and adherence monitoring tools represents another frontier where competitive differentiation is taking shape. Companies offering integrated digital platforms alongside traditional pharmaceutical products are better positioned to demonstrate real-world evidence of improved outcomes, thereby strengthening negotiations with payers and formulary committees.

This comprehensive research report delivers an in-depth overview of the principal market players in the Amlodipine Besylate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accord Healthcare Inc.

- Alembic Pharmaceuticals Limited

- Amneal Pharmaceuticals LLC

- Apotex Inc.

- Aurobindo Pharma Limited

- Cipla Limited

- Dr. Reddy's Laboratories Ltd.

- Glenmark Pharmaceuticals Ltd.

- Hetero Labs Limited

- Hikma Pharmaceuticals PLC

- Jubilant Generics Limited

- Lupin Limited

- Macleods Pharmaceuticals Ltd.

- Mylan N.V.

- Northstar Rx LLC

- Pfizer Inc.

- Prinston Pharmaceutical Inc.

- Sun Pharmaceutical Industries Ltd.

- Torrent Pharmaceuticals Ltd.

- Wockhardt Limited

- Zydus Lifesciences Limited

Implementing Actionable Strategies for Pharmaceutical Leaders to Enhance Amlodipine Besylate Portfolio Value and Navigate Future Market Disruptions

Industry leaders must prioritize resilience in sourcing and manufacturing to mitigate ongoing tariff and supply chain fluctuations. By diversifying API procurement across domestic and international suppliers, companies can safeguard production continuity and leverage incentive programs aimed at onshore capacity expansion. Concurrently, adopting predictive analytics for demand forecasting will optimize inventory levels and minimize stock-outs.

To enhance therapeutic value, stakeholders should invest in patient-centric formulation innovations such as once-daily extended-release and combination therapies. Embedding digital adherence tools within these offerings will not only improve clinical outcomes but also yield compelling evidence to support value-based contracts with payers. Furthermore, executing targeted educational initiatives for prescribers and pharmacists can drive greater awareness of formulation advantages and reinforce brand preference.

Collaboration with healthcare systems to implement outcome-linked reimbursement models will be pivotal. By co-designing pilot programs that tie pricing to measurable endpoints-such as blood pressure reduction and hospitalization avoidance-manufacturers can align incentives with payers’ cost-containment goals. Such collaborative approaches will amplify stakeholder buy-in and underpin sustainable market access.

Outlining a Robust Multi-Methodological Approach to Gather Quantitative and Qualitative Data Underpinning the Amlodipine Besylate Market Intelligence

This report employs a multi-pronged research methodology combining extensive secondary research with primary data collection to ensure robust analysis of the Amlodipine Besylate market. Secondary sources include regulatory filings, peer-reviewed journals, clinical trial registries, and industry publications to establish a foundational understanding of therapeutic, regulatory, and competitive landscapes.

Primary research encompasses structured interviews with key opinion leaders, formulary decision-makers, and procurement heads across major geographies. These interviews provide qualitative insights into pricing strategies, formulary placement, and patient adherence drivers. Additionally, quantitative surveys of pharmacists, physicians, and payers were conducted to validate market trends and forecast adoption patterns.

Data triangulation techniques were applied to reconcile findings from disparate sources, ensuring internal consistency and minimizing bias. Statistical tools were used to analyze sales data, pricing trajectories, and patient demographics. Finally, the compiled insights were peer-reviewed by an expert advisory board to enhance accuracy and relevance, providing decision-makers with a reliable, evidence-based market intelligence resource.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Amlodipine Besylate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Amlodipine Besylate Market, by Type

- Amlodipine Besylate Market, by Dosage

- Amlodipine Besylate Market, by Application

- Amlodipine Besylate Market, by Distribution Channel

- Amlodipine Besylate Market, by End User

- Amlodipine Besylate Market, by Region

- Amlodipine Besylate Market, by Group

- Amlodipine Besylate Market, by Country

- United States Amlodipine Besylate Market

- China Amlodipine Besylate Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concluding Insights Synthesizing Amlodipine Besylate Market Trends Tariff Impacts and Strategic Pathways Toward Sustainable Growth

In summary, the Amlodipine Besylate market is characterized by evolving therapeutic needs, regulatory recalibration, and competitive innovation. The introduction of 2025 tariffs has reshaped supply chain economics, driving a shift toward domestic API production and strategic sourcing diversification. Concurrently, segmentation insights reveal nuanced adoption patterns across angina and hypertension use cases, branded versus generic channels, and emerging digital distribution platforms.

Regional dynamics further underscore the need for tailored strategies: cost-driven growth in the Americas; heterogenous procurement frameworks across EMEA; and rapid generic expansion alongside premium innovator markets in Asia-Pacific. Leading companies are responding with differentiated formulations, strategic alliances, and digital patient support solutions that reinforce their market positioning.

Looking ahead, success will hinge on the ability to integrate patient-centric innovation with resilient supply chains and outcome-based contracting. By leveraging the insights detailed in this report, stakeholders can chart a clear path toward sustainable growth, competitive advantage, and improved patient outcomes in the Amlodipine Besylate arena.

Engaging with Ketan Rohom to Unlock Full-Spectrum Amlodipine Besylate Market Intelligence and Drive Informed Decision-Making Through a Premier Research Report

To gain comprehensive insights into the competitive landscape and pivotal trends driving the Amlodipine Besylate market, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Engaging directly with Ketan will provide you with personalized guidance on how this meticulously crafted report can support your strategic planning, portfolio optimization, and stakeholder presentations. By partnering with an expert who understands the nuances of antihypertensive therapeutics and global market dynamics, you’ll secure timely access to data-driven recommendations and actionable intelligence. Contact Ketan Rohom today to explore tailored solutions, arrange a demonstration of key findings, and ensure your organization remains at the forefront of competitive advantage in the Amlodipine Besylate domain.

- How big is the Amlodipine Besylate Market?

- What is the Amlodipine Besylate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?