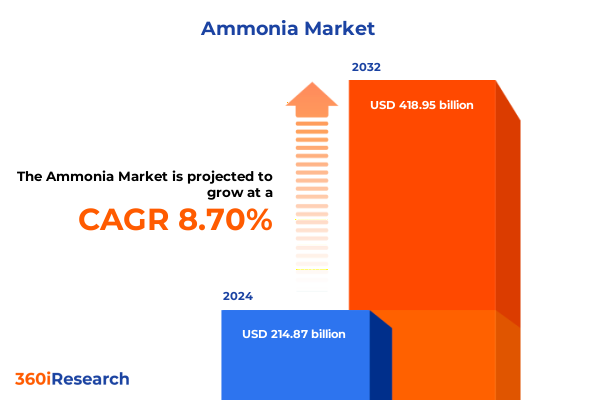

The Ammonia Market size was estimated at USD 232.40 billion in 2025 and expected to reach USD 251.67 billion in 2026, at a CAGR of 8.78% to reach USD 418.95 billion by 2032.

Exploring the Strategic Importance of Ammonia in Driving Sustainable Energy Solutions, Agricultural Productivity and Industrial Processes Amid Global Decarbonization Efforts

Ammonia has long underpinned the global chemical and agricultural industries, serving as the primary feedstock for fertilizer production and a critical building block for industrial processes. Traditional ammonia production, rooted in the Haber-Bosch process, accounts for nearly 2 percent of global carbon emissions yet remains indispensable for supporting food security and manufacturing applications worldwide. The legacy of brown ammonia, derived from natural gas, still dominates capacity globally, while blue ammonia, which integrates carbon capture technologies, offers an intermediate decarbonization step that preserves established infrastructure and supply chains. Against this backdrop, the interplay between established ammonia hubs in North America, the Middle East and Asia and evolving environmental imperatives continues to shape market dynamics.

Unveiling the Pivotal Technological and Regulatory Shifts Reshaping Ammonia Production, Distribution and Market Dynamics Worldwide

Technological breakthroughs are redefining how ammonia moves from concept to market. Electrochemical synthesis and advanced electrolyzer designs are making green ammonia-produced from renewable-powered hydrogen-more technically feasible, even though cost hurdles persist in scaling electrolysis for mass production. Meanwhile, biomass-derived ammonia pathways are emerging as niche alternatives that can leverage agricultural residues and reduce lifecycle emissions.

At the same time, impactful policy decisions are reshaping financial incentives and risk profiles for producers. The U.S. Inflation Reduction Act’s 45V clean hydrogen tax credit, offering up to $3 per kilogram of hydrogen produced below a 0.45 kg CO₂e threshold, has catalyzed investment interest in both green and blue ammonia facilities. Similarly, the recent extension of key federal credits under the “One Big Beautiful Bill Act” provides certainty for project developers through 2032 and bolsters long‐term return expectations for emerging technologies.

Concurrently, applications beyond fertilizer are gaining traction as ammonia’s energy density and carbon‐free combustion profile make it a compelling fuel for decarbonizing maritime and power generation sectors. Innovative efforts to deploy ammonia‐fueled gas turbines and dedicated carriers signal the dawn of new value chains that extend beyond chemical manufacturing.

Analyzing How New United States Tariff Measures in 2025 Have Altered Ammonia Supply Chains, Cost Structures and Trade Flows in the Domestic Market

In 2025, the United States implemented sweeping tariff measures to protect domestic industry, instituting a universal 10 percent duty on all imports, while maintaining elevated reciprocal tariffs for select trading partners, including a 34 percent levy on Chinese goods effective April 9, 2025. These duties immediately increased landed costs for imported ammonia and urea, exerting pressure on fertilizer input prices and prompting buyers to secure domestic supply or source from tariff‐favored regions.

Subsequently, temporary adjustments introduced in mid-May saw a suspension of 24 percentage points of the elevated duties on Chinese origin goods for a 90-day window, restoring a 10 percent rate for covered imports starting May 14, 2025. While this measure provided short-term relief for end users reliant on cost-competitive volumes from Asia, the rapid policy reversals created uncertainty that disrupted long-term contracting and inventory strategies.

As a cumulative effect, supply chain participants accelerated diversification toward low-tariff sources in the Middle East and Latin America, and domestic producers gained relative pricing leverage. In turn, downstream sectors such as agriculture and industrial chemicals faced both cost volatility and the need to adjust operating models to navigate an unpredictable tariff environment.

Dissecting the Essential Segmentation Frameworks That Illuminate Market Opportunities Across Ammonia Types, Processes, Applications and Distribution Channels

Ammonia market insights emerge clearly when examined through type segmentation, contrasting blue ammonia-where carbon capture integration enhances environmental credentials-and green ammonia, rooted in electrochemical processes that harness renewable electricity, against the conventional brown ammonia produced via natural gas feedstocks. Further dimensionality arises from the production process segmentation, which differentiates biomass-derived ammonia leveraging organic waste streams and electrochemical synthesis striving for modular, low-carbon footprints from the century-old Haber-Bosch infrastructure dominating global output.

Water content type segmentation delineates the industrial use of anhydrous ammonia, prized for fertilizer and refrigeration systems, from aqueous ammonia formulations tailored for water treatment and chemical syntheses. Physical state distinctions between gaseous supply chains, which facilitate high-pressure transport, and liquid handling routes optimized for storage density inform logistics and facility design decisions. Purity grade segmentation underscores the divergent quality benchmarks for applications ranging from agricultural grade uses through food grade specifications to stringent industrial grade requirements.

Application segmentation reveals a layered structure: the chemical synthesis domain spans feedstocks for adipic acid, nitric acid, and ammonium derivatives; the fertilizer segment encompasses ammonium nitrate, ammonium sulfate and urea; and emerging energy carrier uses exploit ammonia’s hydrogen content for power generation and maritime propulsion. Complementary end-use segmentation spans agriculture, chemicals and petrochemicals, energy and power, food processing, mining and pharmaceuticals and healthcare. Distribution channels, whether through traditional offline supply networks or burgeoning online procurement platforms, complete the multifaceted view of an increasingly nuanced market landscape.

This comprehensive research report categorizes the Ammonia market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Production Process

- Water Content Type

- Physical State

- Purity Grade

- Application

- End-Use

- Distribution Channel

Illuminating the Distinct Regional Dynamics Shaping Ammonia Demand, Production Capabilities and Trade Patterns Across the Americas, EMEA and Asia-Pacific

The Americas landscape features extensive natural gas reserves that have historically underpinned large-scale brown ammonia production, complemented by recent investments in blue ammonia hubs along the Gulf Coast. U.S. policy incentives and emerging renewable energy projects in regions such as Texas and Louisiana are accelerating pilot green ammonia deployments, while Canada’s integrated fertilizer complexes remain a key export source into Latin America.

In Europe, Middle East and Africa, EMEA regulatory frameworks are balancing decarbonization mandates with energy security concerns. Europe’s Nordics and Netherlands have become testbeds for green hydrogen and ammonia facilities, bolstered by subsidy programs, yet elevated energy costs pose economic headwinds. The Middle East leverages low-cost solar resources to advance green ammonia production projects, with initiatives in the UAE and Saudi Arabia targeting export markets. Across Africa, nascent local production models seek to reduce import dependency but face capital and infrastructure constraints.

Asia-Pacific dynamics reflect robust fertilizer demand in India and China, underpinned by government agricultural support programs, alongside national hydrogen roadmaps in Japan and South Korea catalyzing clean ammonia innovation. Australia’s early green ammonia ventures have encountered economic setbacks, highlighting the challenges of marrying ambitious renewable targets with commercial viability in remote regions.

This comprehensive research report examines key regions that drive the evolution of the Ammonia market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Leading Industry Players and Strategic Initiatives Driving Innovation, Sustainability and Competitive Advantage in the Global Ammonia Sector

Global ammonia production is concentrated among legacy chemical giants. CF Industries and Nutrien leverage vast natural gas feedstock advantages to serve core fertilizer markets, while Yara International is at the forefront of blue ammonia with its operational carbon capture integration in northern Europe. These incumbents are strategically expanding into low-carbon segments to future-proof their portfolios.

Emerging players are pushing technological boundaries. OCI’s Middle East ventures and Abu Dhabi National Oil Company projects explore solar-powered electrolysis at scale, while Hanwha’s ammonia-fueled gas turbine developments illustrate the convergence of maritime decarbonization and chemical supply chains. TalusAg’s localized green ammonia production in sub-Saharan Africa demonstrates the potential of distributed models to enhance food security and reduce import dependence, even as economic challenges temper some early initiatives.

Across the value chain, engineering service providers, electrolyzer OEMs and carbon capture technology firms are forging partnerships with end users to co-develop integrated ammonia ecosystems that address both sustainability targets and operational efficiency.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ammonia market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Achema

- Casale SA

- CF Industries Holdings, Inc.

- Chambal Fertilisers and Chemicals Limited

- CSBP Limited

- EuroChem Group

- Group DF

- Gujarat State Fertilizers & Chemicals Limited (GSFC)

- IFFCO

- Jaysons Chemical Industries

- JSC Togliattiazot

- Kapsom Green Energy Technology Limited

- Koch, Inc.

- Krishak Bharati Cooperative Limited

- Mitsubishi Gas Chemical Company Inc.

- Mitsui Chemicals, Inc.

- Monolith Inc.

- Nissan Chemical Corporation

- Nutrien Ltd.

- OCI N.V.

- PT Pupuk Sriwidjaja Palembang (Pusri)

- Qatar Fertiliser Company

- Saudi Basic Industries Corporation

- Shijiazhuang Enric Gas Equipment Co., Ltd.

- Yara International ASA

Implementing Strategic Roadmaps and Best Practices for Industry Leaders to Capitalize on Emerging Ammonia Trends, Technologies and Regulatory Developments

Industry leaders should prioritize a balanced portfolio approach that spans conventional brown and blue ammonia while strategically investing in green ammonia pilots. By aligning capital allocation with near-term decarbonization goals and long-term sustainability targets, organizations can hedge technical risk across production pathways.

To enhance competitiveness, companies must fortify their supply chains by securing low-cost renewable electricity contracts, optimizing feedstock sourcing and diversifying logistics partnerships. Integrating advanced analytics and digital twins into ammonia synthesis and distribution operations will drive operational excellence, reduce unplanned downtime and improve energy efficiency.

Engagement with policymakers and participation in multi-stakeholder industry consortia will enable firms to influence evolving regulatory frameworks and access critical incentives. Strategic alliances with electrolyzer manufacturers, carbon capture providers and shipping technology developers can accelerate commercialization, establish first-mover advantages and capture emerging opportunities in energy carrier markets.

Detailing the Comprehensive Research Methodology Combining Quantitative Data Analysis, Qualitative Insights and Expert Validation to Deliver Robust Ammonia Market Intelligence

This research integrates a multi-layered methodology, beginning with comprehensive secondary research drawn from industry journals, news outlets and government publications to capture recent policy developments, technology breakthroughs and project announcements. Quantitative data were collected from trade associations, customs records and peer-reviewed studies to map production capacities, trade flows and emission profiles.

Qualitative insights derive from interviews with industry experts, technology providers and end users to contextualize market drivers and validate emerging trends. Our analytical framework employs segmentation matrices aligned to type, production, application and distribution, supplemented by regional analyses that factor in policy, resource endowments and infrastructure maturity.

Rigorous triangulation and peer reviews ensured data accuracy and consistency, while scenario planning workshops with internal stakeholders stress-tested findings against potential policy and technology shifts. The holistic approach delivers actionable market intelligence tailored to strategic decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ammonia market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ammonia Market, by Type

- Ammonia Market, by Production Process

- Ammonia Market, by Water Content Type

- Ammonia Market, by Physical State

- Ammonia Market, by Purity Grade

- Ammonia Market, by Application

- Ammonia Market, by End-Use

- Ammonia Market, by Distribution Channel

- Ammonia Market, by Region

- Ammonia Market, by Group

- Ammonia Market, by Country

- United States Ammonia Market

- China Ammonia Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1749 ]

Synthesizing Key Insights to Frame the Future Outlook for the Ammonia Industry Amid Evolving Energy, Environmental and Economic Imperatives

Understanding the evolving ammonia landscape requires synthesizing technological innovations, policy impacts and market dynamics across multiple dimensions. The interplay of production pathways-ranging from established brown ammonia to emerging green and biomass-derived routes-reflects an industry in transition toward sustainability. Tariff measures in the United States have introduced cost volatility, but strategic policy incentives such as clean hydrogen credits are realigning investment priorities toward low-carbon solutions.

Regional nuances underscore the importance of tailored strategies: incumbents in the Americas and EMEA are leveraging existing infrastructure to pilot decarbonization technologies, while Asia-Pacific markets balance fertilizer demand with nascent clean ammonia initiatives. Leading companies are responding by forging partnerships, optimizing supply chains and diversifying portfolios to capture both traditional and emerging applications.

In this dynamically shifting environment, organizations that proactively integrate segmentation insights, regional intelligence and technological foresight will secure competitive advantage and drive the next wave of ammonia industry transformation.

Engage with Associate Director Ketan Rohom to Secure In-Depth Ammonia Market Intelligence and Strategic Insights to Empower Your Business Decisions

Are you ready to translate deep market insights into competitive advantage and informed strategy? Connect with Ketan Rohom, Associate Director of Sales & Marketing, to gain access to a comprehensive market research report that will equip your team with actionable intelligence on market dynamics, segmentation, regional drivers, technological shifts and policy impacts. Your organization can move confidently through complex market landscapes by leveraging expert analysis and tailored data. Reach out today to secure your copy and ensure your leadership team stays at the forefront of the ammonia sector’s evolution.

- How big is the Ammonia Market?

- What is the Ammonia Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?