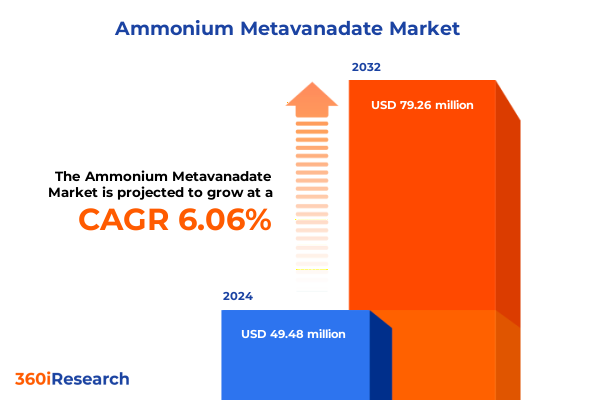

The Ammonium Metavanadate Market size was estimated at USD 52.51 million in 2025 and expected to reach USD 56.82 million in 2026, at a CAGR of 6.62% to reach USD 82.26 million by 2032.

Exploring the Critical Role and Evolving Dynamics of Ammonium Metavanadate as a Pivotal Intermediate in Vanadium Purification and Energy Storage Technologies

The inorganic compound ammonium metavanadate, chemically designated NH₄VO₃, serves as a crucial intermediate in the purification of vanadium and finds diverse applications across industries. With its distinctive polymeric chain structure composed of corner-sharing VO₄ tetrahedra bound by ammonium ions, this white salt precipitates from vanadate-enriched solutions and yields vanadium pentoxide upon roasting, making it indispensable for refining processes in metallurgical and chemical sectors.

Beyond its role in traditional metallurgy, ammonium metavanadate underpins critical advancements in energy storage technologies and chemical synthesis. Recent trends reveal that vanadium redox flow batteries leverage this compound as an electrolyte precursor, offering exceptional cycle life and scalability. Concurrently, its catalytic efficacy is being harnessed in petroleum refining and specialty chemical synthesis, where precise vanadium content is paramount to reaction performance. These multifaceted utilities underscore the compound’s strategic importance as global industries pivot toward cleaner energy solutions and advanced material technologies.

Unveiling the Paradigm Shifts Reshaping the Ammonium Metavanadate Market Through Technological Advances and Sustainability Imperatives

The ammonium metavanadate market is undergoing sweeping transformations driven by the accelerating energy transition and heightened environmental mandates. The growing adoption of vanadium redox flow batteries for grid-scale energy storage has elevated demand for high-purity NH₄VO₃ as a feedstock for electrolytes. Concurrently, the surge in electric vehicle production has intensified interest in lithium-ion and alternative battery chemistries, with battery materials suppliers exploring vanadium-based additives to enhance thermal stability and cycle durability in next generation cells.

Simultaneously, sustainability imperatives are reshaping production and sourcing strategies. Manufacturers are investing in low carbon footprint synthesis routes, including solubilization techniques that reduce energy consumption and emissions. Research collaborations are proliferating to develop closed loop vanadium recovery from spent catalysts and battery materials, reflecting a broader circular economy ethos. As digitalization and advanced analytics refine process control, stakeholders are well positioned to capitalize on these paradigm shifts, driving both innovation and efficiency across the value chain.

Assessing the Far Reaching Effects of United States Trade Policy Shifts on Ammonium Metavanadate Supply Chains and Cost Structures Amid Recent Tariff Updates

U.S. trade policy exerts a significant influence on the ammonium metavanadate landscape, where imports of NH₄VO₃ are currently subject to a 5.5% ad valorem duty under HTS code 2825.30.0050, encompassing inorganic bases and related vanadium compounds. This baseline tariff, while moderate compared to recent steel and aluminum levies, contributes to elevated input costs for domestic battery material and catalyst producers that rely on imported feedstocks.

In April 2025, the administration initiated a Section 232 investigation into processed critical minerals and their derivative products, signaling potential future duties on vanadium compounds to safeguard national security interests in energy storage and advanced manufacturing sectors. Although the probe remains underway, its prospect has prompted supply chain recalibrations, with some firms exploring increased domestic conversion capacity and long term sourcing agreements to mitigate potential disruptions.

Moreover, the U.S. Court of International Trade recently invalidated certain reciprocal IEEPA-based tariffs, clarifying that Section 232 and Section 301 duties will continue despite legal challenges. This judicial outcome underscores the importance of strategic tariff management and proactive engagement with policymakers as industry participants strive to maintain cost competitiveness and supply reliability amid evolving regulatory frameworks.

Revealing Actionable Insights Across Application End Use Industry Grade Purity Form and Distribution Channel Dimensions for Ammonium Metavanadate

Key segmentation analysis reveals that application diversity drives market dynamics for ammonium metavanadate, where the battery materials sector, encompassing both lithium-ion and vanadium redox flow technologies, represents a fast-growing end use. The catalysts segment, spanning chemical synthesis and petroleum refining activities, remains foundational, leveraging NH₄VO₃’s vanadium content to accelerate reaction pathways. Electronics applications for ammonium metavanadate focus on semiconductor manufacturing and sensor fabrication, areas where vanadium compounds contribute to wafer etching and thin film deposition processes. Additionally, the glass and ceramics market segment, including enamels, fiber optics, and structural ceramics, relies on precise vanadium oxide incorporation to enhance mechanical strength and optical performance. Pigments applications continue to utilize the compound for coatings and colorants, capitalizing on its chromatic stability and corrosion resistance.

Examining end use industry distribution, automotive manufacturers leverage ammonium metavanadate in battery packs and catalytic converters, while chemical manufacturing facilities utilize it for both petrochemical production and specialty chemical synthesis. Semiconductor fabs and sensor assemblers in the electronics sector deploy vanadium-based precursors for specialty etchants and thin films. Energy storage players prioritize vanadium redox flow batteries, where consistent electrolyte purity is critical to long term reliability. Market participants also segment by grade, ranging from analytical and lab grade, through battery grade variants for lithium and VRFB applications, to electronics grade for semiconductor processes, and technical grade variants tailored to industrial and commercial uses. Purity considerations differentiate high purity, standard purity, and ultra high purity categories, each addressing distinct performance and regulatory requirements. Form factor analysis spans flakes, pellets, and powder presentations, affecting handling, dissolution rates, and storage logistics. Distribution channels encompass direct sales-servicing aftermarket and OEM clients-distributor networks through retailers and wholesalers, and online sales via company websites and e-commerce marketplaces, reflecting evolving procurement preferences.

This comprehensive research report categorizes the Ammonium Metavanadate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- End Use Industry

- Grade

- Purity

- Form

- Distribution Channel

- Application

Uncovering Regional Dynamics Driving Growth and Demand in the Americas Europe Middle East Africa and Asia Pacific Ammonium Metavanadate Markets

The Americas region demonstrates robust activity, driven by North American energy and aerospace industries. U.S. producers increasingly incorporate ammonium metavanadate into titanium alloys for aircraft components, leveraging its vanadium content to improve strength and reduce weight. Simultaneously, demand in automotive battery manufacturing continues to grow, spurred by electric vehicle incentives and state-level decarbonization targets. Canada and Mexico contribute via mining and refineries, integrating NH₄VO₃ production into broader critical minerals strategies to support regional supply resilience.

In Europe, the Middle East, and Africa, the shift toward renewable energy systems and infrastructure renovation underpins steady uptake of vanadium-based materials. European steel producers are adapting to low carbon mandates by incorporating vanadium microalloys, often precipitated as ammonium metavanadate, to achieve high strength at reduced thickness. The Middle East’s petrochemical complexes rely on vanadium catalysts for sulfuric acid production, while African nations with emerging mining projects offer new sources of vanadium feedstock, enhancing supply diversity.

Asia-Pacific remains the largest consumption hub for ammonium metavanadate, bolstered by China’s dominant vanadium and steel sectors. China’s “14th Five-Year Plan” elevates energy storage deployment, with over 300 MWh of VRFB capacity commissioned in major grid-scale projects, intensifying demand for ultrapure NH₄VO₃ electrolytes. India and Southeast Asia are piloting energy storage systems to balance renewable generation, while Australia’s prospective vanadium ventures signal future export growth, positioning the region as a critical nexus for global AMV supply and demand.

This comprehensive research report examines key regions that drive the evolution of the Ammonium Metavanadate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Strengths and Competitive Advantages of Leading Global Producers and Distributors in the Ammonium Metavanadate Value Chain

Global vanadium resource concentration significantly influences the competitive landscape for ammonium metavanadate, with China hosting approximately 42% of world economic resources, followed by Russia at 23% and South Africa at 16%. These reserves underlie the operations of leading producers such as Panzhihua New Steel & Vanadium Co., which benefits from integrated mining and refining capabilities in Sichuan province. In Russia, EVRAZ’s KGOK facility processes steel slag by-products to yield vanadium oxides and intermediates, leveraging co-generation efficiencies within its steel mills.

Production volumes further underscore regional strengths. China’s primary vanadium output reached an estimated 70,000 metric tons in 2024, supporting downstream NH₄VO₃ manufacturing, while Russia’s annual production stood at approximately 21,000 metric tons. In South Africa, companies such as Bushveld Minerals and Glencore’s operations in the Bushveld Complex contribute over 9,000 metric tons of vanadium, positioning the country as a vital supplier for European and Asian markets.

Among Western suppliers, Brazil’s Largo Resources distinguishes itself as a pure-play vanadium producer, leveraging the high grade of its Maracás Menchen project to produce low impurity feedstock. In North America, Bear Metallurgical Company operates a Pennsylvania toll processing facility specialized in converting imported vanadium pentoxide into ferrovanadium and related derivatives, demonstrating adaptability through contract manufacturing and value-added services amid shifting domestic feedstock availability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ammonium Metavanadate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Elements LLC

- Avantor, Inc.

- BASF SE

- Elementis plc

- Evonik Industries AG

- GfE Gesellschaft für Elektrometallurgie mbH

- Italmatch Chemicals Group S.p.A.

- Johnson Matthey PLC

- Merck KGaA

- MoTiV Metals LLC

- Santa Cruz Biotechnology, Inc.

- Solvay SA

- Thermo Fisher Scientific Inc.

Equipping Industry Stakeholders with Targeted Strategies to Enhance Resilience Agility and Competitiveness in the Ammonium Metavanadate Sector

To navigate the complex ammonium metavanadate landscape, industry leaders should diversify raw material sourcing by establishing relationships with emerging producers in Africa and South America, thereby mitigating concentration risks and enhancing supply security. Simultaneously, vertical integration into vanadium pentoxide processing and electrolyte blending can capture additional value and buffer against tariff fluctuations by internalizing key conversion steps. Collaborative partnerships with battery and catalyst manufacturers can facilitate co-development of tailored AMV grades, unlocking new application opportunities while optimizing margins.

Policy engagement is paramount; companies must actively participate in trade consultations and Section 232 investigations to advocate for balanced import measures that support domestic processing without imposing undue cost burdens. Investment in digital supply chain visibility tools, such as blockchain-enabled tracking and AI-driven demand forecasting, will strengthen resilience to regulatory shifts and logistical disruptions. Finally, advancing R&D initiatives focused on low temperature precipitation routes, closed loop recovery systems, and novel vanadium-based chemistries will position organizations at the forefront of sustainable innovation in high-value end markets.

Outlining Rigorous Research Approaches and Data Triangulation Techniques Applied to Develop a Comprehensive Ammonium Metavanadate Market Analysis

This analysis synthesizes multi-source data, combining publicly available regulatory filings, governmental trade announcements, and industry intelligence to derive comprehensive insights. Secondary research encompassed tariff schedules, Section 232 and Section 301 proclamations, and court rulings to map the evolving trade policy environment. Market structure and regional dynamics were informed by geological assessments, notably United States Geological Survey and Geoscience Australia reports, alongside specialized publications detailing vanadium resource distribution and production statistics.

Qualitative validation involved cross referencing producer capabilities and strategic initiatives through patent filings, corporate press releases, and expert interviews. Segmentation frameworks for application, end use industry, grade, purity, form, and distribution channel were developed using a structured approach to ensure clarity and consistency. Data triangulation techniques merged disparate sources, enabling robust interpretation of shifting demand drivers and supply constraints. The resulting methodology delivers a rigorous, transparent foundation for actionable guidance in the ammonium metavanadate market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ammonium Metavanadate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ammonium Metavanadate Market, by End Use Industry

- Ammonium Metavanadate Market, by Grade

- Ammonium Metavanadate Market, by Purity

- Ammonium Metavanadate Market, by Form

- Ammonium Metavanadate Market, by Distribution Channel

- Ammonium Metavanadate Market, by Application

- Ammonium Metavanadate Market, by Region

- Ammonium Metavanadate Market, by Group

- Ammonium Metavanadate Market, by Country

- United States Ammonium Metavanadate Market

- China Ammonium Metavanadate Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3180 ]

Synthesizing Critical Findings and Industry Implications for Strategic Decision Making in the Evolving Ammonium Metavanadate Landscape

In summary, ammonium metavanadate’s pivotal function as a vanadium intermediate extends far beyond traditional metallurgy, catalyzing innovation in energy storage, chemicals, and advanced materials. Market forces driven by the energy transition, environmental policy, and digitalization are reshaping demand profiles, while trade policy uncertainties underscore the importance of strategic agility. Segmentation insights illuminate the nuanced applications and end use industries shaping market opportunities, and regional analysis reveals evolving hotspots for consumption and production. Leading companies leverage resource access, technological differentiation, and contract processing to secure competitive advantages, offering valuable lessons for peers.

As stakeholders chart future growth trajectories, actionable recommendations emphasize supply diversification, vertical integration, policy engagement, and technology investment. Such proactive measures will be critical to navigating regulatory landscapes, stabilizing cost structures, and capitalizing on emergent value chains. With rigorous research methodologies underpinning these findings, organizations are equipped to make informed decisions, drive sustainable innovation, and maintain leadership in the dynamic ammonium metavanadate ecosystem.

Connect with Ketan Rohom to Unlock Tailored Insights and Secure Your In Depth Ammonium Metavanadate Market Research Report Today

Ready to elevate your strategic approach with unparalleled depth and foresight? Discuss how a bespoke market research report on ammonium metavanadate can equip your organization to seize emerging opportunities and navigate evolving challenges with confidence. Connect directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to explore tailored research packages, secure exclusive insights, and gain a competitive edge in this transformative market landscape. Empower your decision making with data-driven analysis and personalized guidance-reach out today to begin your journey toward sustainable growth and industry leadership.

- How big is the Ammonium Metavanadate Market?

- What is the Ammonium Metavanadate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?