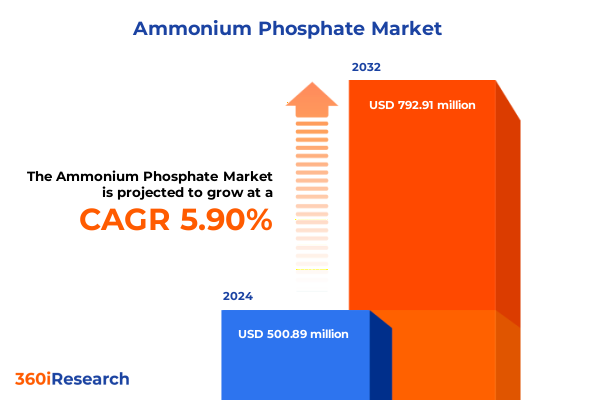

The Ammonium Phosphate Market size was estimated at USD 521.26 million in 2025 and expected to reach USD 544.06 million in 2026, at a CAGR of 6.17% to reach USD 792.91 million by 2032.

Ammonium Phosphate Market Overview Reveals Critical Dual-Nutrient Role Across Agriculture Food Feed and Industrial Applications

Ammonium phosphate stands at the nexus of agricultural productivity and industrial innovation, serving as both a cornerstone nutrient in global farming and a versatile agent in food, feed, and metal treatment applications. With its dual capacity to supply essential nitrogen and phosphorus, this compound plays an integral role in supporting both staple crop yields and specialized industrial processes. As population growth and evolving dietary preferences drive increased demand for high-nutrient diets, farmers and agribusinesses are turning to ammonium phosphate formulations that optimize nutrient release and minimize environmental impact.

Beyond its agricultural significance, ammonium phosphate’s chemical properties are leveraged in food and feed applications to regulate acidity and enhance emulsification, while its performance in corrosion inhibition and metal cleaning underscores its importance in manufacturing and maintenance sectors. This multifaceted compound is consequently subject to an intricate web of influences-including raw material availability, environmental regulations, and technological advancements in fertilizer efficiency. In this context, grasping the full spectrum of market forces is essential for stakeholders aiming to align product portfolios with evolving end-user needs.

Transformation of Ammonium Phosphate Sector Fueled by Environmental Mandates Digital Precision Farming and Breakthrough Agritech Innovations

Recent years have witnessed a profound transformation in the ammonium phosphate landscape, driven by sustainability mandates, digital agriculture, and innovative product formulations. Stricter environmental regulations have compelled producers to invest in eco-friendly manufacturing processes, reducing waste output and enhancing energy efficiency. This shift is mirrored in the rise of enhanced efficiency fertilizers-featuring controlled-release mechanisms-that are gaining traction among large-scale growers focused on both yield maximization and runoff reduction. Industry analysts note that such formulations have accounted for nearly a quarter of all new ammonium phosphate products introduced in 2024, underscoring their rapidly growing significance.

Concurrently, the integration of digital tools and precision farming technologies has reshaped application strategies. Farms employing GPS-driven variable-rate application are reporting substantial decreases in phosphate waste, while cloud-based farm management systems enable real-time nutrient monitoring and decision support. These advancements are complemented by a surge in R&D collaborations between agritech firms and academic institutions, resulting in more than 200 patents filed since 2023 for advanced granulation and blending techniques. Together, these trends highlight a market pivot toward data-driven efficiency and sustainability, fundamentally redefining how ammonium phosphate is produced, distributed, and applied.

Shifting US Tariff Framework in 2025 Intensifies Cost Pressures on Ammonium Phosphate Imports and Domestic Supply Chains

The United States’ evolving tariff environment in 2025 has exerted cumulative pressure on ammonium phosphate supply chains and pricing dynamics. In March, the Department of Commerce increased countervailing duties on Moroccan phosphate fertilizers-key inputs for domestic blending operations-raising the rate from a preliminary 14.21% to 16.81% and retroactively applying it to imports dating back to 2022. This adjustment follows the original petition by a major U.S. phosphate producer, which alleged substantial government subsidies granted to Moroccan exporters, prompting ongoing legal challenges that may extend the tariff measures until at least 2026.

Simultaneously, a broader reciprocal tariff policy announced in early April imposed a baseline 10% duty on fertilizer imports from non-USMCA partners, affecting every country outside North America with the exception of certain critical minerals. Although potash and other potassium-based fertilizers were explicitly exempted, nitrogenous and phosphatic products-including key diammonium phosphate and monoammonium phosphate inputs-have seen heightened import costs. Seasonal supply chain disruptions have been exacerbated by these measures, with distributors reporting tightening inventories as forward cover strategies shift in response to tariff unpredictability. With mid-year negotiations still underway, stakeholders face ongoing uncertainty regarding duration and scope of these duties.

Detailed Breakdown of Ammonium Phosphate Demand Illuminates Influences of Application Grade Type and Physical Form on Buyer Preferences

A nuanced understanding of market segmentation reveals how application, grade, type, and form collectively shape ammonium phosphate demand. Across agricultural and feed additive applications, farmers gravitate toward direct fertilizers and acidifiers that balance rapid nutrient availability with soil health considerations. Food processors rely on acidulants and emulsifiers to achieve precise pH control and textural stability, while metal treatment facilities prioritize corrosion inhibition blends and cleaning solutions that deliver consistent performance under rigorous conditions.

Grade distinctions further delineate product positioning, with agricultural grade dominating broadacre fertilizer programs, food grade ensuring purity compliance in consumables, and technical grade meeting industrial performance specifications. The two principal chemical types-monoammonium phosphate and diammonium phosphate-offer complementary profiles of solubility and nutrient density, allowing suppliers to tailor blends for starter applications or sustained-release scenarios. Moreover, the choice between granular, liquid, and powder forms enables end users to optimize handling logistics, application efficiency, and storage economics. Collectively, these segmentation criteria empower manufacturers and distributors to align product strategies with targeted end-use requirements.

This comprehensive research report categorizes the Ammonium Phosphate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Grade

- Form

- Application

Regional Ammonium Phosphate Dynamics Highlight Americas Trade Sensitivities EMEA Sustainability Drives and Asia-Pacific Growth Initiatives

Regional dynamics underscore stark contrasts in ammonium phosphate adoption and regulatory environments. In the Americas, North America’s reliance on imports-particularly from Canada-has rendered farmers sensitive to cross-border tariffs and supply disruptions. Midwestern grain producers are increasingly exploring direct fertilizer alternatives and on-farm blending to hedge against import duty volatility. Across Latin America, government subsidy programs continue to drive fertilizer uptake, even as infrastructure constraints and logistical bottlenecks pose distribution challenges.

In Europe, Middle East, and Africa, environmental directives in the European Union have catalyzed shifts toward low-cadmium and heavy-metal-free phosphate products, while North African phosphate exporters face intensifying scrutiny over subsidy structures and quality standards. The contentious duties levied on Moroccan exports exemplify the delicate balance between trade defense actions and the imperative for supply chain stability. Regulatory frameworks in the Gulf Cooperation Council and South Africa further illustrate a dual push for diversified sourcing and domestic capacity expansion.

Asia-Pacific presents the most dynamic growth profile, underpinned by vast government-supported farming initiatives in China and India where large-scale agricultural operations demand high-efficiency nutrient solutions. Robust investments in rural infrastructure and fertilizer blending facilities have fueled regional capacity, which now accounts for over a third of global consumption. Meanwhile, Southeast Asian and Oceanic markets are integrating precision agriculture tools to optimize application rates and reduce environmental impact, reinforcing the region’s leadership in adopting advanced agronomic practices.

This comprehensive research report examines key regions that drive the evolution of the Ammonium Phosphate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Enterprise Strategies Reflect Defense Against Tariffs Pursuit of Eco-Innovations and Tech-Driven Expansion by Market Leaders

Leading companies in the ammonium phosphate domain are navigating complex interplay between trade defense measures, sustainability goals, and technological innovation. The Mosaic Company’s petition that initiated U.S. countervailing duties underscores its strategic emphasis on defending domestic production capacities and influencing policy outcomes. Its integrated operations span phosphate rock mining to finished fertilizer blending, positioning it to capitalize on on-farm value-added services amid tariff-induced supply constraints.

On the global front, OCP Group continues to challenge tariff determinations through legal avenues, emphasizing its role as a key exporter and innovator in specialty phosphate products. European firms such as Yara International and The Phosphates Company are advancing low-cadmium and heavy-metal-minimized formulations to align with stringent EU directives, leveraging their research pipelines to extend product portfolios into food-grade and technical-grade segments. Meanwhile, regional champions in Asia, including Indian public-sector enterprises, are expanding granular and liquid ammonium phosphate facilities in partnership with agtech providers. These collaborative ventures drive both capacity growth and digital integration, reflecting an industry-wide commitment to sustainable production and advanced agronomic solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ammonium Phosphate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Coromandel International Ltd

- EuroChem Group AG

- Grupa Azoty S.A.

- Innophos Holdings, Inc.

- Jordan Phosphate Mines Company (JPMC) PLC

- Nutrien Ltd

- Office Chérifien des Phosphates

- PhosAgro PJSC

- Prayon S.A.

- The Mosaic Company

- Wengfu Group Co., Ltd.

- Yara International ASA

Strategic Imperatives for Industry Stakeholders to Enhance Supply Chain Resilience Drive Product Innovation and Leverage Digital Agronomy

To thrive in the rapidly evolving ammonium phosphate industry, leaders should adopt a multifaceted action plan that addresses regulatory, technological, and supply chain imperatives. Diversifying sourcing strategies by establishing direct agreements with non-traditional phosphate exporters can mitigate tariff risks and ensure consistent feedstock availability. Concurrently, investing in on-site blending and storage infrastructure enhances logistical resilience by reducing reliance on imported finished products.

Embracing digital agriculture platforms and precision application tools will further distinguish market participants, enabling real-time nutrient management and tailored recommendations that improve crop performance while curbing environmental impact. Formulating low-impurity and controlled-release ammonium phosphate blends aligned with regional sustainability mandates can unlock premium segments in food-grade and industrial markets. Finally, fostering strategic partnerships between producers, distributors, and technology providers will accelerate R&D output, streamline market entry for novel products, and bolster collective responsiveness to policy shifts. By integrating these initiatives, industry leaders can secure competitive advantage and drive long-term value creation.

Comprehensive Research Approach Integrating Primary Stakeholder Interviews Trade Data Analysis and Patent Review for Credible Market Insights

This research synthesis is grounded in a structured methodology combining primary and secondary data collection. Industry insights were garnered through interviews with key executives across fertilizer manufacturers, distributors, and agritech suppliers, as well as consultations with trade associations, regulatory bodies, and farming cooperatives. These dialogues provided contextual understanding of operational challenges, technology adoption rates, and policy impacts.

Secondary research encompassed analysis of trade data from government customs and tariff databases, review of technical publications on fertilizer chemistry, and scrutiny of patent filings to trace innovation trajectories. Regional regulatory documents and sustainability directives informed the assessment of evolving compliance landscapes. Where quantitative data were cited, sources included reputable market intelligence reports and peer-reviewed studies, ensuring the factual integrity of the insights presented. Cross-validation of findings through triangulation of multiple data streams enhances the credibility and reliability of the conclusions drawn.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ammonium Phosphate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ammonium Phosphate Market, by Type

- Ammonium Phosphate Market, by Grade

- Ammonium Phosphate Market, by Form

- Ammonium Phosphate Market, by Application

- Ammonium Phosphate Market, by Region

- Ammonium Phosphate Market, by Group

- Ammonium Phosphate Market, by Country

- United States Ammonium Phosphate Market

- China Ammonium Phosphate Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Strategic Conclusion Emphasizes Collaboration Risk Management and Segmentation Alignment Amid Regulatory and Demand Shifts

The ammonium phosphate sector is undergoing a period of significant transformation as stakeholders navigate heightened regulatory scrutiny, tariff uncertainties, and shifting end-use demands. The confluence of sustainability imperatives and precision agriculture has catalyzed a wave of product innovations and digital integration, positioning enhanced efficiency formulations and variable-rate technologies at the forefront of market evolution.

At the same time, the United States’ tariff adjustments and reciprocal duty policies have underscored the critical importance of supply chain diversification and strategic sourcing to maintain cost competitiveness. Companies that proactively align their portfolios with segmentation insights-addressing specific requirements of feed additives, fertilizers, food-grade applications, and metal treatment-stand to capture differentiated value. Regional dynamics further accentuate the need for market‐sensitive strategies, whether in the Americas’ trade-exposed environment, the EMEA’s sustainability-driven market structure, or the rapid growth corridors of Asia-Pacific.

Against this backdrop, collaborative innovation, robust risk management practices, and agile commercial models will define the next wave of leadership in the ammonium phosphate market. Vigilant monitoring of policy developments, coupled with targeted investments in R&D and digital tools, will enable companies to seize emerging opportunities and fortify their positions amid this era of change.

Empower Your Strategic Decisions with Expert Guidance on Ammonium Phosphate Market Dynamics from 360iResearch’s Sales Leadership

For tailored insights into how evolving trade policies, technological advancements, and shifting demand patterns will affect your organization’s position in the ammonium phosphate market, reach out directly to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). His expertise offers you a strategic roadmap for navigating complex market dynamics and ensuring resilient growth amid regulatory changes and competitive pressures. Engage today to secure your access to the full report and detailed recommendations that will empower your decision-making and fuel your next phase of market leadership.

- How big is the Ammonium Phosphate Market?

- What is the Ammonium Phosphate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?