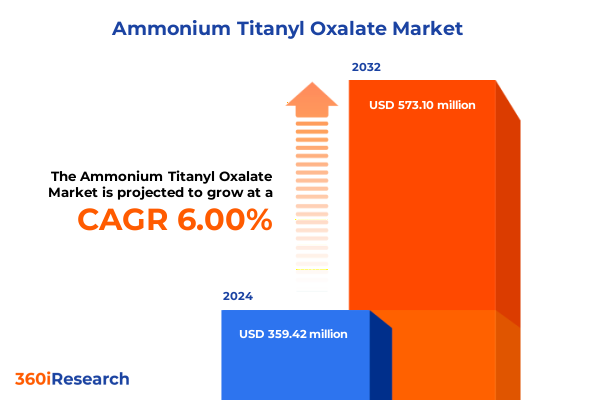

The Ammonium Titanyl Oxalate Market size was estimated at USD 376.42 million in 2025 and expected to reach USD 400.80 million in 2026, at a CAGR of 6.18% to reach USD 573.10 million by 2032.

Setting the Stage for Ammonium Titanyl Oxalate with a Comprehensive Overview of Its Chemical Profile and Emerging Relevance in Multiple Industries

Understanding the foundational characteristics and industrial significance of ammonium titanyl oxalate is essential for stakeholders seeking a grounded perspective on its evolving market dynamics. This compound, characterized by its distinctive coordination of titanium and oxalate ligands, has garnered attention for its versatile chemical stability and tunable crystallinity. These inherent properties underpin its widespread suitability across high-precision applications, establishing it as a key intermediate in galleries of advanced materials research.

Moreover, the historical evolution of synthesis techniques-from batch precipitation methods to more refined controlled crystallization protocols-has refined purity levels and enabled broader commercial availability. Such progression has directly influenced end-user confidence, fostering deeper integration into processes that demand reproducibility and high analytic fidelity. In this context, the introduction provides not only a chemical snapshot but also situates ammonium titanyl oxalate within the broader spectrum of specialty chemicals that underlie next-generation technological advancements.

By setting the stage with a clear grasp of its molecular attributes and production milestones, this overview primes decision-makers for the detailed insights and strategic narratives that follow. Transitioning from the compound’s scientific foundation, subsequent sections will unpack the market forces and industry shifts reshaping its demand and deployment.

Unveiling the Transformative Shifts Reshaping the Ammonium Titanyl Oxalate Market in Response to Technological Advances and Sustainability Imperatives

Recent years have witnessed seismic shifts in the ammonium titanyl oxalate landscape, driven by an accelerating convergence of sustainability demands and advanced functional material requirements. For instance, the surge in clean energy mandates has elevated photocatalytic applications of this compound, spurring refinements in surface morphology to optimize light absorption and conversion efficiency. Simultaneously, breakthroughs in nano-scale control have broadened its deployment in structural ceramics, enabling manufacturers to tailor mechanical resilience at the microstructural level.

At the same time, regulatory frameworks emphasizing environmental remediation have catalyzed interest in oxalate complexes as greener catalysts and absorbents. This momentum has prompted R&D teams to explore hybrid composites that integrate ammonium titanyl oxalate with bio-based matrices, thereby reinforcing circular economy objectives. Furthermore, digital tools have transformed lab-to-market timelines, with machine learning-driven process models reducing crystallization trials by up to 40 percent compared to traditional experimentation.

As these transformative influences coalesce, the market is pivoting toward cross-sectoral partnerships, where chemical specialists collaborate closely with electronics and pharmaceutical innovators. Such alliances signal a departure from siloed development, fostering a dynamic ecosystem where knowledge sharing accelerates both product performance and time-to-market.

Assessing the Cumulative Impact of 2025 United States Tariffs on Ammonium Titanyl Oxalate Supply Chains and Cost Structures in Critical Sectors

The United States’ imposition of targeted tariffs in early 2025 has introduced multifaceted effects on the ammonium titanyl oxalate supply chain and cost structure. Initially intended to bolster domestic production of titanium‐based compounds, these measures have driven importers to renegotiate terms and explore alternative sourcing from non-tariffed regions. As a result, procurement cycles have lengthened, with lead times stretching by as much as six weeks for certain crystal grades, thereby compelling end users to build larger safety stocks.

Cost pass-through has varied across industry segments. In high-value applications such as chromatographic reagents, vendors have absorbed portions of the tariff to maintain competitive pricing, whereas large-volume buyers in the functional ceramics sector have borne the brunt of surcharges averaging 12 percent on landed costs. This divergence has reshaped contractual negotiations, spurring suppliers to offer hedged agreements and multi-year fixed-price contracts to mitigate exposure.

Looking ahead, these tariff dynamics are expected to recalibrate manufacturing footprints, with some players evaluating nearshore expansions to South America and Europe. Consequently, the interplay of trade policy and strategic sourcing underlines the importance of agile supply chain strategies, positioning industry leaders to navigate the evolving trade landscape.

Deriving Actionable Segmentation Insights to Navigate Diverse Applications Forms and Purity Grades Driving Demand in the Ammonium Titanyl Oxalate Market

Examining demand through a segmentation lens reveals nuanced drivers of growth and optimized targeting strategies. In the realm of applications, functional ceramics have emerged as the fastest-growing subcategory, propelled by tailored crystallography that enhances piezoelectric response in actuator and sensor devices. Conversely, structural ceramics continue to dominate in bulk consumption, underscoring their foundational role in high-temperature component manufacturing.

Chemical analysis uses of ammonium titanyl oxalate bifurcate between chromatography and spectroscopy, where analytical-grade forms of the compound are prized for their reproducibility and minimal impurity profiles. Photocatalyst applications further split between energy conversion platforms and environmental remediation efforts, each benefiting from customized surface areas to maximize reaction kinetics. Within the piezoelectric domain, actuator manufacturers value crystal forms that deliver high coupling coefficients, while sensor producers increasingly prefer fine powders that integrate seamlessly into thin-film depositions.

Shifting to end-user dimensions, electronics companies are driving demand for high-purity materials, whereas pharmaceutical firms prioritize reagent-grade quality to comply with stringent regulatory standards. Research institutions remain key adopters of analytical grade crystal forms, leveraging them for academic and industrial R&D. Form dictates handling characteristics, with crystal grades offering ease of filtration and powder grades aligning with precise metering in automated production lines.

Finally, purity grade considerations span analytical, reagent, and technical classifications, each calibrated to specific performance benchmarks. Sales channels vary from direct sales agreements that facilitate custom formulations to distributor networks enabling rapid replenishment and digital platforms that cater to niche volume orders. These segmentation insights collectively inform targeted go-to-market strategies, ensuring alignment with the unique requirements of each customer cohort.

This comprehensive research report categorizes the Ammonium Titanyl Oxalate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Purity Grade

- Application

Distilling Key Regional Dynamics Influencing Ammonium Titanyl Oxalate Adoption across Americas Europe Middle East Africa and Asia Pacific

Regional dynamics underscore divergent growth patterns driven by economic, regulatory, and technological factors. In the Americas, strong investments in semiconductor and green energy infrastructure have fueled demand for photocatalytic and piezoelectric applications. Producers in North America are responding by localizing high-purity production facilities, mitigating the impact of trade policies and reducing lead times for critical industries.

Across Europe Middle East and Africa, stringent environmental directives and incentives for sustainable chemistry have catalyzed uptake of ammonium titanyl oxalate in environmental remediation projects. Collaborations between chemical suppliers and regional research consortia have accelerated the validation of this compound in large-scale water treatment systems, establishing new use cases beyond traditional laboratory contexts.

Meanwhile, Asia Pacific remains the largest consumption hub, led by robust manufacturing bases in China, Japan, and South Korea. Here, growth in consumer electronics and automotive applications is driving significant expansion in both structural and functional ceramics segments. Moreover, increasing focus on pharmaceutical manufacturing in India has amplified requirements for reagent and analytical grade materials, prompting international vendors to forge local partnerships to ensure consistent supply and compliance.

Taken together, these region-specific trends highlight the complexity of navigating global operations, where tailored strategies are paramount to capturing value in distinct markets.

This comprehensive research report examines key regions that drive the evolution of the Ammonium Titanyl Oxalate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Ammonium Titanyl Oxalate Producers and Their Strategic Positions Shaping Competitive Landscape and Innovation Trajectories

A select group of leading chemical manufacturers and specialty suppliers commands significant influence in the ammonium titanyl oxalate arena. These players have established competitive moats through diversified portfolios that span high-purity research-grade compounds to technical-grade bulk offerings. Strategic investments in crystallization technology and process analytics have enabled them to maintain stringent quality thresholds, thereby securing long-term contracts with major electronics, pharmaceutical, and materials science customers.

Furthermore, partnerships with academic institutions and national laboratories have bolstered their R&D pipelines, yielding proprietary formulations tailored for advanced photocatalytic and piezoelectric applications. Some firms have also pursued vertical integration by acquiring oxide precursor specialists, ensuring greater control over raw material sourcing and enabling cost efficiencies in production.

Geographic footprint is another differentiator, as leading suppliers operate multi-continent manufacturing networks that facilitate agile response to shifting regional demand patterns and trade policy fluctuations. Additionally, select companies have embraced digital sales platforms to capture niche volume orders, complementing traditional direct and distributor channels.

Collectively, these strategic positions underscore the critical role of scale, innovation, and operational resilience in shaping competitive dynamics and driving future growth trajectories in the ammonium titanyl oxalate sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ammonium Titanyl Oxalate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acros Organics BVBA

- Alfa Aesar, LLC

- Avantor, Inc.

- Inorganic Ventures, LLC

- KRONOX Lab Sciences Pvt. Ltd.

- Loba Chemie Pvt. Ltd.

- Merck KGaA

- Sisco Research Laboratories Pvt. Ltd.

- Spectrum Chemical Manufacturing Corp.

- Thermo Fisher Scientific Inc.

- Tokyo Chemical Industry Co., Ltd.

Formulating Actionable Recommendations to Empower Industry Leaders Navigating Challenges Opportunities in the Ammonium Titanyl Oxalate Domain

Industry leaders should prioritize investments in sustainable synthesis routes that reduce energy consumption and minimize hazardous byproducts. By integrating greener antisolvents and exploring solvent-recycling systems, manufacturers can not only lower operational costs but also align with increasingly rigorous environmental standards. In tandem, forming consortiums with end-users in the electronics and pharmaceutical sectors can accelerate co-development of application-specific grades, thereby shortening product development cycles.

Supply chain diversification remains imperative. Companies are advised to establish secondary sourcing agreements in regions outside traditional hubs, leveraging nearshore partnerships to mitigate tariff impacts and logistical disruptions. Simultaneously, implementing digital procurement platforms enhances visibility into inventory levels and demand forecasts, empowering procurement teams to make proactive adjustments.

On the front of market engagement, augmenting direct-sales capabilities with robust e-commerce portals enables tailored order configurations and batch traceability, appealing to research institutions and small-volume industrial customers alike. Complementary investments in technical service teams will reinforce value propositions by providing end-to-end support, from material selection to process optimization.

By executing these recommendations, industry participants can strengthen their competitive positioning, adapt to evolving trade landscapes, and deliver differentiated value across the full spectrum of ammonium titanyl oxalate applications.

Detailing Robust Research Methodology Integrating Primary Secondary Data and Analytical Techniques to Ensure Rigorous Ammonium Titanyl Oxalate Market Insights

This analysis synthesizes insights derived from a rigorous combination of primary interviews and secondary research. On the primary side, in-depth conversations were conducted with senior executives at major manufacturing and distribution firms, procurement leads at end-user organizations, and subject matter experts in materials science. These interviews provided qualitative perspectives on supply chain dynamics, tariff impacts, and product performance requirements.

Secondary research encompassed a comprehensive review of peer-reviewed journals, patent filings, industry white papers, and regulatory filings. Proprietary databases were also leveraged to track shipment volumes, historical pricing trends, and production capacities. Data triangulation techniques ensured consistency across multiple inputs, while an analytical framework was applied to categorize findings into thematic segments related to applications, regions, and purities.

A bottom-up approach was employed to map demand corridors, beginning with end-user consumption patterns and working backwards to raw material sources and synthesis methods. Quality assurance protocols included cross-verification of data points and iterative stakeholder validations to confirm accuracy and relevance. This methodology underpins the robustness of the presented market narratives and strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ammonium Titanyl Oxalate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ammonium Titanyl Oxalate Market, by Form

- Ammonium Titanyl Oxalate Market, by Purity Grade

- Ammonium Titanyl Oxalate Market, by Application

- Ammonium Titanyl Oxalate Market, by Region

- Ammonium Titanyl Oxalate Market, by Group

- Ammonium Titanyl Oxalate Market, by Country

- United States Ammonium Titanyl Oxalate Market

- China Ammonium Titanyl Oxalate Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1272 ]

Synthesizing Key Takeaways and Forward Looking Perspectives to Conclude the Comprehensive Analysis of the Ammonium Titanyl Oxalate Market Landscape

Bringing together the chemical fundamentals, market drivers, and strategic considerations paints a comprehensive portrait of the ammonium titanyl oxalate landscape. Demand is being propelled by dual imperatives of sustainability and high-performance functionality, fueling innovation in photocatalysis, advanced ceramics, and analytical applications. Trade policy shifts in the United States have introduced both challenges and strategic opportunities, compelling supply chain realignments that underscore the importance of agility.

Segmentation analysis highlights the diverse requirements across application subsegments, form factors, purity grades, and sales channels, while regional dynamics reveal distinct growth trajectories in the Americas, Europe Middle East Africa, and Asia Pacific. Leading companies are consolidating their positions through technological investments and geographic diversification, setting the stage for competitive non-price differentiation.

Looking ahead, stakeholders who embrace greener synthesis methods, diversify sourcing, and enhance digital engagement will be best positioned to capture emerging growth pockets. This conclusion synthesizes the key insights and charts a forward path for market participants aiming to leverage the full potential of ammonium titanyl oxalate.

Engaging with Ketan Rohom to Unlock Comprehensive Ammonium Titanyl Oxalate Market Intelligence and Propel Strategic Decision Making Today

To explore the full breadth of insights and opportunities within the ammonium titanyl oxalate landscape, engage with Ketan Rohom in his role as Associate Director, Sales & Marketing at 360iResearch for a personalized consultation. He will guide you through the comprehensive research findings, address your organization’s specific objectives, and walk you through the purchase process to equip your team with the data and strategic guidance required to gain a competitive edge. Reach out today to transform market intelligence into actionable strategy.

- How big is the Ammonium Titanyl Oxalate Market?

- What is the Ammonium Titanyl Oxalate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?