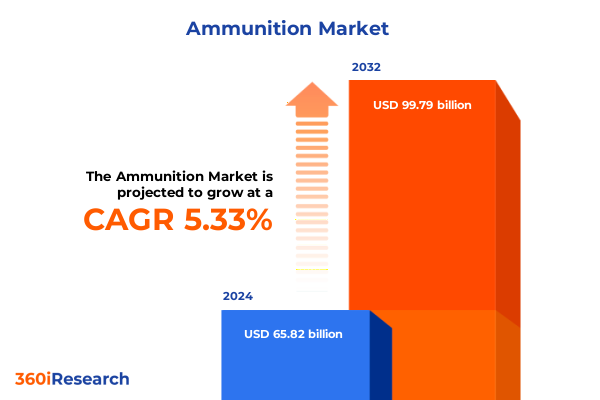

The Ammunition Market size was estimated at USD 69.16 billion in 2025 and expected to reach USD 72.72 billion in 2026, at a CAGR of 5.37% to reach USD 99.79 billion by 2032.

Setting the Stage for Global Ammunition Dynamics Amidst Rising Defense Expenditure, Technological Innovation, and Shifting Security Landscapes

The global ammunition landscape is experiencing a profound shift driven by unprecedented defense spending increases and rapid technological modernization. In response to significant aid packages and stockpiling initiatives, major defense contractors have ramped up production to meet surging demand, yet the sustainability of these production volumes remains in question amidst evolving political priorities and supply chain constraints. Recent funding surges for allied nations have stimulated a temporary surge in munitions output, highlighting the industry’s capacity to scale quickly while underscoring the necessity for consistent, long-term investment strategies to ensure preparedness for future contingencies.

Alongside military demand, the civilian and law enforcement segments are reshaping market dynamics. Increased interest in recreational shooting, self-defense, and hunting has bolstered small caliber ammunition consumption, prompting manufacturers to innovate with enhanced terminal ballistics and reduced recoil designs. Simultaneously, law enforcement agencies are diversifying their procurement to include specialty rounds that prioritize both performance and minimal collateral impact, reflecting a nuanced balance between operational effectiveness and community safety concerns. Transitional investments in manufacturing infrastructure and streamlined logistics further tether these end-user trends to broader supply chain strategies, laying the groundwork for sustained market resilience.

Unprecedented Technological Innovations and Strategic Realignments Are Reshaping Ammunition Development, Supply Chains, and Combat Effectiveness Worldwide

The ammunition industry is navigating transformative shifts as precision guidance and smart munitions transition from experimental capabilities to mainstream military assets. The integration of programmable fuses and digital targeting systems with traditional artillery rounds has enabled unprecedented accuracy, reducing collateral damage and enhancing mission success in complex operational environments. This technological pivot aligns with the broader trend toward networked warfare, wherein AI-driven targeting algorithms and unmanned platforms demand munitions capable of seamless connectivity and real-time data exchange.

Concurrently, sustainability imperatives are catalyzing the development of eco-friendly ammunition alternatives. Manufacturers are exploring lead-free projectiles, biodegradable polymers, and advanced composite materials to mitigate environmental impact while preserving ballistic performance. This shift not only addresses regulatory pressures and training-range contamination issues but also opens niche market opportunities within civilian and law enforcement training programs. As these innovations gain traction, they are poised to redefine industry benchmarks for material composition and life-cycle management.

Ongoing US Tariffs on Steel, Aluminum, and Critical Components Are Driving Cost Pressures, Supply Chain Realignment, and Domestic Production Expansion in Ammunition Sector

Since the implementation of Section 232 steel and aluminum tariffs in 2018, ammunition manufacturers have grappled with elevated raw material costs and supply chain realignments that persist into 2025. The cumulative effect has been a recalibration of sourcing strategies, with domestic steel producers scaling capacities to offset import constraints, while manufacturers negotiate long-term contracts to stabilize input prices. These measures aim to mitigate the volatility introduced by 25 percent steel tariffs, which have reverberated through production budgets and pricing structures across large-caliber and small-caliber lines alike.

In parallel, Section 301 tariffs on electronic components and specialty alloys, particularly those originating from key suppliers in Asia, have prompted a reconfiguration of procurement networks. Manufacturers are diversifying their vendor base by establishing strategic alliances with non-tariffed regions and investing in localized processing facilities to circumvent steep duties. This dual-front approach has strengthened supply chain resilience, but it has also introduced complexity in inventory management and increased lead times for guided munitions. As a result, industry players are accelerating automation investments and digital supply chain solutions to navigate these challenges while maintaining production agility.

Comprehensive Market Segmentation Reveals Diverse Ammunition Product Types, Caliber Variations, Materials, Guidance Systems, and End-User Requirements Across Sectors

Examining market segmentation reveals that product type diversity-from artillery and large-caliber rounds to specialized grenade ammunition and warheads-caters to distinct operational requirements and mission profiles. Each category demands precise manufacturing protocols, whether for high-volume shotshell production or the intricate assembly of programmable warheads. Caliber size further delineates product design, as sub-20mm rounds emphasize portability and rapid deployment, whereas 100mm to 200mm shells prioritize range and destructive capability.

Material composition also plays a pivotal role in performance characteristics. Copper-jacketed projectiles deliver consistent terminal ballistics, while steel-cased ammunition offers cost advantages in high-volume applications. Meanwhile, polymer components are emerging as lightweight alternatives that reduce overall round weight without compromising integrity. The introduction of guided versus non-guided variants underscores the technological stratification within the market, with guidance mechanisms integrated into select munitions to meet precision strike objectives. Finally, end-user segmentation highlights nuanced demand patterns: civilian applications lean toward small-caliber rounds for sport shooting and hunting, law enforcement prioritizes specialty non-lethal or reduced-recoil options, and military procurement spans air force, land forces, naval artillery, and specialized task units, each with tailored specifications that drive manufacturing and distribution strategies.

This comprehensive research report categorizes the Ammunition market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Caliber Size

- Material Used

- Guidance Mechanism

- End User

Regional Dynamics Highlight Americas’ Dominance, EMEA’s Collaborative Production Initiatives, and Asia-Pacific’s Rapid Modernization and Strategic Stockpiling Trends

In the Americas, the ammunition market remains anchored by the United States, where robust defense budgets and a vibrant civilian shooting culture underpin sustained demand. Recent contracts aimed at scaling 155 mm artillery shell production from 20,000 to 90,000 rounds per month underscore the region’s capacity for rapid expansion and strategic stockpiling under NATO initiatives. Canada and Latin American nations are scaling selectively, focusing on border security and partner-nation support programs that influence medium-caliber and small-caliber segment growth.

Across Europe, the Middle East, and Africa, collaborative procurement frameworks spearheaded by NATO and the European Defense Agency have stimulated cross-border manufacturing partnerships to address stockpile shortfalls. The United Kingdom’s eightfold increase in 155 mm artillery production capacity exemplifies this cooperative resurgence, while Gulf states continue to invest in precision-guided munitions to bolster deterrence postures. In Africa, counterinsurgency operations and peacekeeping missions drive demand for lightweight, mobile ammunition systems.

Meanwhile, Asia-Pacific is emerging as a high-growth market fueled by military modernization and regional security tensions. Nations are prioritizing domestic production in line with self-reliance policies, while major importers supplement capacity through joint ventures with established Western and European manufacturers. This dual approach facilitates rapid adoption of smart ammunition technologies and offsets tariff-induced cost increases.

This comprehensive research report examines key regions that drive the evolution of the Ammunition market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Defense Contractors and Innovators Are Expanding Production Capacities, Forging Strategic Partnerships, and Accelerating Next-Generation Ammunition Solutions

Industry leaders are actively expanding production footprints and pursuing strategic acquisitions to secure technology pipelines. General Dynamics’ multi-billion-dollar contract for medium-caliber ammunition reflects a commitment to scale and diversify product offerings across 20 mm to 50 mm lines, with long-term ceilings exceeding $3 billion through 2029. Similarly, Rheinmetall and BAE Systems have enhanced their guided munitions portfolios through collaborative ventures that blend electronic guidance kits with established artillery platforms.

Nammo and RUAG have concentrated on specialized segments, including mortar ammunition and high-attrition warheads, to meet NATO stockpile replenishment objectives, while Elbit Systems has secured key procurement contracts in the Middle East for precision-guided artillery shells. Meanwhile, Olin Corporation’s Winchester Ammunition division continues to lead the civilian and law enforcement markets by offering premium small-caliber rounds with advanced terminal ballistics features. Across the sector, these major players are integrating digital manufacturing tools and additive technologies to streamline production cycles and reduce unit costs in response to evolving demand patterns.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ammunition market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arsenal JSCo.

- BAE Systems PLC

- CBC Global Ammunition

- Denel SOC Ltd.

- EDGE PJSC Group

- Elbit Systems Ltd.

- FN Herstal by FN Browning Group

- FRITZ WERNER Industrie-Ausrüstungen GmbH

- General Dynamics Corporation

- Hanwha Corporation

- Hornady Manufacturing, Inc.

- Leonardo S.p.A.

- Nammo AS

- Norma

- Northrop Grumman Corporation

- Nosler Inc.

- Remington Ammunition

- Rheinmetall AG

- RWS GmbH by Beretta Holding Group

- Saab AB

- Singapore Technologies Engineering Ltd.

- Thales Group

- Winchester Ammunition by Olin Corporation

Strategic Imperatives for Industry Leaders Include Supply Chain Resilience, Technological Differentiation, and Sustainable Practices to Capitalize on Emerging Ammunition Demands

To navigate the shifting terrain of ammunition demand and regulatory landscapes, industry leaders must prioritize supply chain diversification and capacity agility. Investing in both domestic and allied production facilities will mitigate tariff vulnerabilities while shortening lead times for critical munitions. Concurrently, channeling R&D resources toward precision-guided and eco-friendly ammunition will align product portfolios with emerging defense and sustainability mandates.

Organizations should also leverage digital transformation across manufacturing and logistics operations, deploying advanced analytics and automation to optimize inventory, forecast demand fluctuations, and enhance traceability. Strategic partnerships-from joint ventures for material sourcing to collaborative innovation consortia-can accelerate market entry for novel ammunition technologies. By balancing operational resilience with forward-looking investment in guidance systems, composite materials, and polymer integration, companies can position themselves to capitalize on both defense and civilian growth trajectories.

Robust Research Methodology Combines Secondary Data, Expert Interviews, and Rigorous Triangulation to Deliver Accurate, Actionable Ammunition Market Insights

This analysis synthesizes comprehensive secondary research across defense spending databases, government procurement portals, and strategic publications, complemented by expert interviews with industry practitioners and subject-matter analysts. Data triangulation techniques were applied to reconcile contract award figures, production capacity announcements, and tariff schedules, ensuring a holistic view of market dynamics.

Segmentation definitions were derived from standardized classifications by caliber range, material composition, guidance capability, and end-use application, facilitating consistent comparability across regions and product categories. Quality controls included cross-verification of procurement data against multiple sources and iterative validation with defense industry advisors. Statistical methods were employed to interpret trends without projecting market size estimates, focusing instead on qualitative assessments and directional insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ammunition market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ammunition Market, by Product Type

- Ammunition Market, by Caliber Size

- Ammunition Market, by Material Used

- Ammunition Market, by Guidance Mechanism

- Ammunition Market, by End User

- Ammunition Market, by Region

- Ammunition Market, by Group

- Ammunition Market, by Country

- United States Ammunition Market

- China Ammunition Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Informed Conclusions underscore the critical interplay of Innovation, Policy, and Global Security Trends Shaping the Future Trajectory of the Ammunition Market

The ammunition market stands at a crossroads defined by innovation, policy shifts, and evolving threat environments. Precision guidance technologies and sustainable materials are reshaping development pipelines, while tariff regimes and geopolitical alliances recalibrate supply chain strategies. Regional collaborations are bolstering production capacity in NATO territories, even as Asia-Pacific nations pursue self-reliant modernization programs. Civilian and law enforcement segments continue to drive small-caliber demand, underscoring the industry’s multifaceted nature.

In this complex landscape, manufacturers and stakeholders must remain adaptable, leveraging strategic investments in technology and infrastructure to navigate cost pressures and regulatory requirements. The interplay of defense modernization, environmental considerations, and market segmentation will ultimately determine competitive positioning and growth potential within the ammunition sector.

Secure Your Competitive Edge with a Comprehensive Ammunition Market Report by Engaging Ketan Rohom for Customized Strategic Insights and Guidance

To gain a deeper understanding of evolving ammunition market dynamics and to equip your organization with strategic actionable insights, reach out to Ketan Rohom. As Associate Director of Sales & Marketing, he can provide you with tailored guidance on leveraging detailed segmentation analyses, tariff impact assessments, and regional forecasts to drive informed decision-making and competitive advantage. Contact Ketan today to secure your copy of the comprehensive market research report and embark on a data-driven path toward resilience and growth in the ammunition industry.

- How big is the Ammunition Market?

- What is the Ammunition Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?