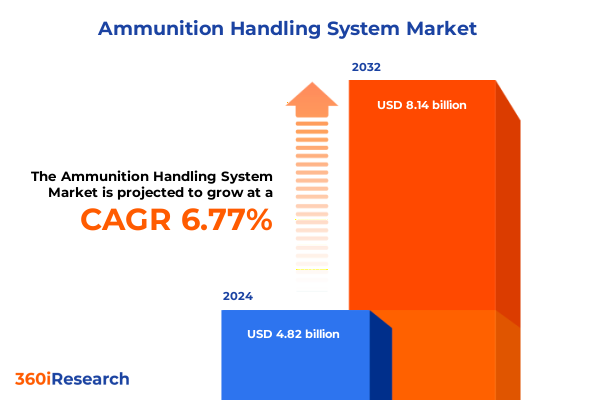

The Ammunition Handling System Market size was estimated at USD 5.12 billion in 2025 and expected to reach USD 5.45 billion in 2026, at a CAGR of 6.83% to reach USD 8.14 billion by 2032.

Introducing the Critical Role and Strategic Significance of Advanced Ammunition Handling Systems within Modern Defense Operations

In today’s defense environment, the ability to efficiently manage ammunition flow underpins mission success and battlefield readiness. Advanced ammunition handling systems have emerged as indispensable components within modern weapon platforms, enabling rapid reloading, minimizing human exposure to hazards, and enhancing operational tempo. These solutions integrate sophisticated conveyors, loaders, and storage modules to support an array of munitions types, ensuring that armed forces can respond swiftly to evolving threats. As defense budgets expand and modernization efforts accelerate, the demand for high-performance handling systems has intensified, driven by an imperative to achieve greater precision, reliability, and safety across land, air, and naval domains.

Moreover, the strategic importance of these systems extends beyond mere logistics. They serve as critical enablers for platform survivability and sustained firepower, reducing downtime and optimizing crew workflows. Innovations in automation and robotics are redefining traditional manual processes, delivering unprecedented levels of efficiency while mitigating risks associated with human error and fatigue. Concurrently, fluctuations in raw material availability and geopolitical tensions impose additional pressure on suppliers and integrators, underscoring the need for resilient supply chains and adaptive design architectures.

This executive summary synthesizes key market dynamics, transformative shifts, tariff impacts, segmentation insights, and regional variations to equip defense planners, systems integrators, and procurement professionals with a holistic understanding of the ammunition handling system landscape. It further profiles leading industry participants and offers actionable recommendations to inform strategic decision-making and investment prioritization.

Identifying Pivotal Technological and Operational Transformations Redefining Ammunition Handling Capabilities Across Global Defense Markets

In recent years, the ammunition handling system category has undergone a series of pivotal transformations driven by breakthroughs in automation and digital integration. Sophisticated robotic arms and conveyor belt architectures now operate in concert with advanced control systems, employing sensor arrays and real-time monitoring to precisely track munitions throughout the supply chain. The integration of Internet of Things platforms and digital twin modeling has enhanced predictive maintenance capabilities, reducing unexpected downtimes by simulating wear patterns and replenishment cycles under diverse operational scenarios. Such technological shifts have elevated system reliability and enabled dynamic resource allocation across multiple platforms simultaneously.

Alongside these innovations, the industry has embraced modular and scalable design philosophies to accommodate rapidly changing mission requirements. Prefabricated storage modules and plug-and-play feeder units allow armed forces to customize configurations in the field, shortening deployment timelines and streamlining logistics. At the same time, lean inventory management practices-borrowed from commercial sectors-promote just-in-time resupply approaches, minimizing warehousing footprints and reducing capital tied up in munitions stockpiles. Additive manufacturing has further accelerated component fabrication, facilitating rapid prototyping and localized production of critical parts.

Operational imperatives have also shaped the landscape, with an emphasis on cyber-physical security and remote operation capabilities in contested environments. Capabilities for unmanned resupply and teleoperated handling systems are maturing, reinforcing force protection and extending logistical reach into high-risk theaters. These cumulative trends are redefining traditional ammunition handling paradigms, setting new standards for speed, safety, and strategic flexibility.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Adjustments on Ammunition Handling System Supply Chains and Cost Structures

In 2025, the United States government implemented a series of tariff revisions targeting key defense-relevant materials and components, exerting significant influence on the ammunition handling system supply chain. Additional duties on steel and aluminum imports raised manufacturing costs for conveyor belts, storage drums, and structural frames, while Section 301 measures applied to electronic modules and robotic subsystems sourced from certain jurisdictions further inflated component expenses. Originally introduced to bolster domestic production, these tariff adjustments have reverberated throughout the defense industrial base, prompting both prime contractors and small-to-medium-size enterprises to reassess their sourcing strategies and cost models.

The cumulative impact of these measures has manifested in upward pressure on system pricing and extended lead times for critical parts. Suppliers with vertically integrated facilities have mitigated some exposure by reallocating production to domestic plants or free-trade agreement partners. Conversely, firms reliant on specialized imports have encountered inventory backlogs and unpredictable cost escalations. These dynamics have encouraged widespread adoption of tariff engineering techniques, wherein design modifications reclassify certain assemblies under lower-duty codes, thereby alleviating some of the financial burden without compromising functionality or reliability.

Moving forward, strategic procurement teams and program managers are balancing near-term cost containment with long-term resilience. Collaborative efforts between integrators and material suppliers aim to diversify vendor portfolios and invest in alternative manufacturing processes less susceptible to trade policy volatility. These adaptations underscore the growing importance of flexible supply architectures and proactive tariff risk management in sustaining uninterrupted delivery of advanced ammunition handling capabilities.

Unveiling Critical Segmentation Insights to Illuminate Trends and Strategic Dynamics within the Ammunition Handling System Market Landscape

To illuminate the nuanced dynamics of the ammunition handling system market, segmentation analysis reveals critical differentiators across six distinct axes. Component segmentation highlights the interactions between feeders, loaders, and storage subsystems, where belt conveyors deliver continuous flow, drum modules enable bulk containment, and magazine assemblies facilitate rapid sequential loading. System type segmentation further distinguishes between fully automated installations driven by conveyor belt lines and robotic arm integrations, semi-automated hybrids that blend machine precision with operator control, and entirely manual configurations favored in austere environments.

Platform segmentation underscores the broad spectrum of deployment contexts, encompassing airborne installations on fighter aircraft and rotary-wing helicopters, land-based solutions for armored vehicles such as APCs and main battle tanks, as well as artillery support units, and naval mounts aboard submarines and surface combatants. Mount type segmentation differentiates between mobile configurations-either ship-mounted or vehicle-mounted-and stationary applications, including fixed installations in ordnance depots and ground-mounted systems at forward operating bases. End-user segmentation distinguishes between commercial logistics providers and military customers, with sub-categories detailing air force, army, and navy operators. Finally, application segmentation delineates combat operations where instantaneous ready-for-use capacity is paramount, testing scenarios that validate system performance and safety compliance, and training environments that emphasize reliability and throughput under simulated conditions. This multilayered approach to segmentation enables stakeholders to tailor strategies to specific operational requirements and market niches.

This comprehensive research report categorizes the Ammunition Handling System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- System Type

- Platform

- Mount Type

- End User

- Application

Highlighting Regional Market Dynamics and Growth Drivers Shaping the Deployment of Ammunition Handling Systems Across Global Territories

Regional analysis of the ammunition handling system market uncovers distinct trends in the Americas, Europe, Middle East & Africa, and Asia-Pacific, each shaped by unique defense priorities and procurement strategies. In the Americas, robust modernization programs within the United States and Canada drive adoption of advanced automation technologies, while escalating security concerns in several Latin American countries spur demand for modular and mobile handling solutions. Domestic manufacturing incentives and collaborative industrial partnerships facilitate local assembly and maintenance, enhancing supply chain resilience.

Across Europe, the Middle East, and Africa, interoperability requirements among NATO members and joint exercises in the Middle East sustain investments in standardized handling interfaces capable of accommodating allied munitions profiles. European Union defense initiatives emphasize digital integration and cyber-secure communication protocols, whereas Middle Eastern operators prioritize high-capacity storage systems to support enduring operations in remote theaters. In Africa, budgetary constraints and logistical challenges favor cost-effective manual or semi-automated systems that can be deployed with minimal infrastructure.

In the Asia-Pacific region, shifting geopolitical dynamics and burgeoning defense budgets in nations such as India, Japan, and Australia accelerate the deployment of both naval and land-based handling platforms. Indigenous development programs and technology transfer agreements underscore a drive toward self-sufficiency, with local firms collaborating on conveyor and robotic solutions. Southeast Asian marine forces are enhancing ship-board ammunition cycles, while East Asian armies emphasize armored vehicle integration. Collectively, these regional variations inform targeted entry strategies and partnership models for manufacturers and integrators operating on a global scale.

This comprehensive research report examines key regions that drive the evolution of the Ammunition Handling System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants and Strategic Collaborations Driving Innovation in Ammunition Handling System Development and Deployment

Leading industry participants in the ammunition handling system sector continue to innovate through strategic investments, collaborative ventures, and continuous product enhancements. A prominent global defense contractor has leveraged its extensive ordnance expertise to expand its conveyor belt and storage drum offerings, integrating advanced sensor technologies that enable real-time diagnostics and predictive maintenance. This approach has cemented its position among prime integrators supporting major weapon platforms.

Another major systems integrator has focused on modular robotics and artificial intelligence, delivering semi-automated loading solutions that have gained traction in both air force and naval applications. By establishing joint development agreements with robotics pioneers, the company has accelerated the fielding of teleoperated arms capable of intricate munition handling tasks, reducing crew exposure to live ammunition hazards. Its emphasis on open architecture controls has fostered interoperability across allied fleets.

Additionally, a leading European defense electronics firm has distinguished itself by tailoring compact magazine and feeder assemblies for armored vehicle and artillery programs. Through partnerships with regional ordnance manufacturers and local machine shops, the firm has optimized logistics for forward-deployed units. Smaller specialized suppliers complement these players by offering niche feeders and loader attachments designed for emerging unmanned vehicle platforms. Across the competitive landscape, strategic mergers and acquisitions are further reshaping market share, as established prime contractors acquire niche robotics startups to broaden their portfolios and accelerate time to market. This dynamic interaction fosters an ecosystem where legacy capabilities converge with cutting-edge technologies, driving continuous improvement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ammunition Handling System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BAE Systems plc

- Dillon Aero Inc.

- General Dynamics Corporation

- Hanwha Defense Corporation

- Kongsberg Defence & Aerospace AS

- Leonardo S.p.A

- Lockheed Martin Corporation

- Oshkosh Defense, LLC

- Rheinmetall AG

- Textron Systems Corporation

- Thales S.A.

Formulating Actionable Recommendations to Empower Defense Stakeholders in Optimizing Ammunition Handling System Efficiency and Strategic Readiness

To capitalize on evolving defense requirements, industry leaders should prioritize modular design frameworks that enable rapid reconfiguration of feeders, loaders, and storage modules without extensive system overhauls. Tailoring solutions to the unique demands of air, land, and naval platforms will facilitate streamlined logistics and enhance platform readiness. Integrating standardized interfaces and plug-and-play components can accelerate deployment cycles and reduce total ownership costs.

Investment in advanced automation and digital integration is also critical. Companies should expand research into artificial intelligence-driven control systems, sensor networks, and digital twin simulations to advance predictive maintenance capabilities and optimize throughput. Collaboration with technology firms and academia can catalyze innovation in robotic arms and conveyor belt automation, improving speed and precision while safeguarding personnel.

Given the shifting tariff environment, proactive supply chain diversification is essential. Manufacturers and integrators must assess potential exposure to additional duties on key raw materials and electronic subsystems, and explore alternative suppliers or re-shoring strategies. Employing tariff engineering techniques and pursuing trade agreement partnerships can mitigate cost volatility and ensure continuity of critical component flows.

Engaging with government research and development initiatives can unlock co-funding opportunities and facilitate field trials in realistic operational environments. Moreover, investing in workforce training programs that cultivate digital proficiency and systems engineering expertise will ensure that personnel can effectively operate and maintain next-generation handling assets.

Finally, fostering strategic regional alliances with defense ministries, local integrators, and research institutions will enhance market access and facilitate technology transfer. Co-development programs tailored to regional operational contexts can strengthen collaborative bonds and secure long-term procurement agreements, positioning companies to respond nimbly to emerging threats and budgetary constraints.

Explaining a Robust Research Methodology Underpinning the Comprehensive Analysis of Ammunition Handling Systems Market Dynamics and Trends

This report’s methodology combines rigorous primary research with comprehensive secondary data analysis to deliver an authoritative assessment of the ammunition handling system market. Primary research entailed structured interviews with program managers, systems integrators, defense procurement officers, and component suppliers. These discussions provided deep insights into operational pain points, procurement criteria, and emerging technology requirements.

Secondary research encompassed a thorough review of publicly available defense budgets, procurement notifications, technical standards, patent filings, and company press releases. Industry journals, conference proceedings, and governmental reports were analyzed to ensure coverage of the latest regulatory developments and technology demonstrations. Trade association data and open-source intelligence further enriched the contextual understanding of market drivers.

A detailed supply chain mapping exercise identified key tiers of component producers, subsystem integrators, and aftermarket service providers. Data triangulation techniques were employed to validate findings across multiple sources, ensuring consistency and accuracy. Quantitative data on material costs, production lead times, and installation cycles were synthesized to inform qualitative assessments of efficiency and reliability.

Rigorous quality assurance protocols and peer reviews were implemented throughout the research process. Internal experts in defense systems and logistics reviewed the analysis for technical accuracy, while external subject matter specialists contributed strategic perspectives. Together, these methodological steps guarantee that the insights presented are robust, actionable, and reflective of real-world market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ammunition Handling System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ammunition Handling System Market, by Component

- Ammunition Handling System Market, by System Type

- Ammunition Handling System Market, by Platform

- Ammunition Handling System Market, by Mount Type

- Ammunition Handling System Market, by End User

- Ammunition Handling System Market, by Application

- Ammunition Handling System Market, by Region

- Ammunition Handling System Market, by Group

- Ammunition Handling System Market, by Country

- United States Ammunition Handling System Market

- China Ammunition Handling System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2544 ]

Drawing Conclusive Perspectives on Market Trajectories and Strategic Imperatives for Ammunition Handling System Stakeholders

As defense organizations worldwide seek to maintain strategic advantage, the ammunition handling system market occupies a central role in enabling rapid, safe, and reliable munition workflows. Technological transformations encompassing automation, digital integration, and modular design are redefining system capabilities, driving performance improvements while reducing risks to personnel. Meanwhile, policy factors such as tariff adjustments in 2025 have underscored the necessity for resilient supply networks and adaptive sourcing strategies.

Segmentation insights reveal that customized approaches aligned with component choices, system types, platform demands, mount configurations, end-user requirements, and application contexts will determine competitive positioning. Regional variations from the Americas through EMEA to Asia-Pacific further emphasize the importance of targeted solutions that address distinct procurement landscapes and interoperability standards.

Leading companies are charting pathways to innovation through strategic partnerships, technology alliances, and open-architecture platforms. To thrive in this dynamic environment, stakeholders must act swiftly on the actionable recommendations outlined, embracing modular frameworks, digital modernization, supply chain diversification, and regional collaboration.

Looking ahead, stakeholders should monitor ongoing advancements in materials science, battery technologies for mobile mounts, and sustainability trends that will shape lifecycle management. Committing to eco-friendly materials and energy-efficient designs will not only comply with emerging regulatory standards but also reinforce long-term operational viability.

By synthesizing market dynamics, segmentation analyses, regional assessments, and company profiles, this executive summary provides a comprehensive lens through which decision-makers can navigate opportunities and challenges within the ammunition handling system domain.

Driving Growth Conversations and Enabling Strategic Engagements Through Direct Collaboration with Ketan Rohom to Access Comprehensive Market Insights

Unlock the full potential of your strategic planning by engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, to gain unrivaled clarity on ammunition handling system market insights. With deep domain expertise and a keen understanding of evolving defense requirements, Ketan can guide you through the report’s comprehensive analysis, helping you pinpoint the opportunities that align with your organization’s objectives. This personalized interaction ensures you harness the report’s findings to inform procurement strategies, technology investments, and regional expansion plans.

Don’t miss the chance to accelerate your competitive edge. Arrange a consultation with Ketan to explore tailored briefings, address specific operational challenges, and discuss how to implement the actionable recommendations detailed in the summary. His strategic perspective will illuminate pathways to optimize system performance, mitigate supply chain risks, and capitalize on emerging trends in automation, segmentation, and tariff risk management.

Secure access to the full market research report today, and position your team at the forefront of ammunition handling system innovation. Reach out to Ketan Rohom to schedule a comprehensive demonstration of the report’s insights and to explore customized solutions that drive sustained readiness, cost efficiency, and mission success. Contact Ketan to tailor a corporate subscription plan, request sample executive dashboards, or integrate data feeds into existing analytics platforms.

- How big is the Ammunition Handling System Market?

- What is the Ammunition Handling System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?