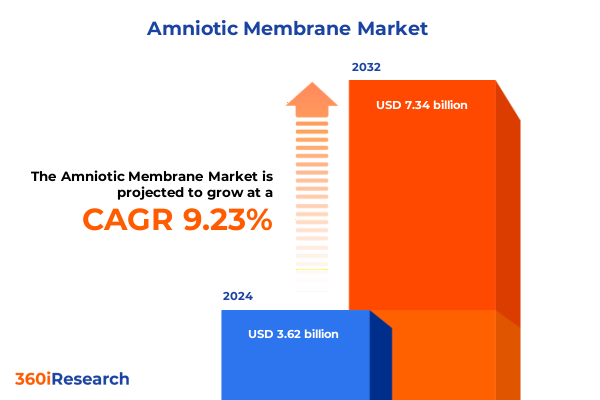

The Amniotic Membrane Market size was estimated at USD 3.94 billion in 2025 and expected to reach USD 4.29 billion in 2026, at a CAGR of 9.28% to reach USD 7.34 billion by 2032.

Understanding the Rising Importance of Amniotic Membrane Products in Modern Healthcare and Their Potential to Revolutionize Patient Outcomes

Amniotic membrane products have emerged as a cornerstone of regenerative medicine, offering a biologically active scaffold capable of modulating inflammation, promoting tissue repair, and supporting cellular regeneration. Initially leveraged in ophthalmic procedures to treat corneal ulcers, these membranes have seen rapid adoption across dental, orthopedic, and wound care applications. Their unique composition, rich in growth factors and extracellular matrix proteins, positions them as a versatile therapeutic modality that can significantly improve patient outcomes while reducing recovery times and complication rates.

Consequently, market participants-from tissue banks to biotechnology firms-are investing heavily in advanced processing techniques, regulatory submissions, and clinical collaborations. This influx of research and development activity underscores a broader shift toward personalized and precision-based therapies. Furthermore, as healthcare providers seek cost-effective alternatives to conventional grafts and synthetic materials, the appeal of amniotic membrane solutions continues to strengthen. By synthesizing historical foundations with the latest clinical evidence, this report sets the stage for a comprehensive exploration of market drivers, transformative trends, policy impacts, and strategic imperatives that will shape the sector’s trajectory through 2025 and beyond.

Exploring the Key Technological and Clinical Advancements That Are Dramatically Shifting the Amniotic Membrane Landscape Worldwide

Over the last several years, the amniotic membrane landscape has experienced a cascade of technological breakthroughs and clinical refinements that are fundamentally reshaping both research priorities and commercial strategies. Innovations in lyophilization and cryopreservation have extended product shelf life and improved logistical scalability, enabling broader distribution across domestic and international markets. At the same time, advances in decellularization protocols have enhanced biosafety profiles while preserving the critical bioactive components that drive therapeutic efficacy.

On the regulatory front, new guidance documents and accelerated approval pathways have reduced time-to-market for novel formulations. Initiatives such as the FDA’s regenerative medicine advanced therapy designation exemplify this trend, allowing developers to navigate more streamlined evidence requirements while maintaining rigorous safety standards. Concurrently, the integration of artificial intelligence and machine learning in process optimization is unlocking deeper insights into donor variability, membrane integrity, and batch consistency. These transformative shifts, driven by converging scientific, regulatory, and digital forces, are elevating amniotic membranes from niche specialty products to mainstream regenerative solutions, thereby redefining competitive parameters and opening new avenues for cross-industry collaboration.

Analyzing the Comprehensive Effects of Recent United States Tariffs Implemented in 2025 on the Amniotic Membrane Supply Chain and Pricing Dynamics

In early 2025, the United States introduced a series of tariffs targeting imported amniotic membrane products and raw materials, aiming to bolster domestic manufacturing and address perceived trade imbalances. These levies have ranged from intermediate duties on composite tissue constructs to higher rates on unprocessed membranes sourced from specific regions. As a result, importers and distributors have faced immediate cost escalations, prompting many to reevaluate their supply strategies and negotiate revised agreements with domestic tissue banks.

While the introduction of tariffs has driven up landed costs, it has simultaneously incentivized local production facilities to expand capacity and invest in enhanced manufacturing infrastructure. Consequently, prime domestic suppliers have accelerated capital projects, secured additional regulatory clearances, and forged strategic alliances to meet rising demand. Despite the initial inflationary pressures on pricing, several end-user segments-including ophthalmology clinics and wound care centers-have begun to benefit from shorter lead times and improved product consistency. Ultimately, the cumulative impact of 2025 tariffs is inducing a market realignment, in which supply chain agility, regulatory compliance, and cost efficiency will serve as the new benchmarks for competitive success.

Unveiling Critical Segmentation Insights That Illuminate How Form, Source, Application, and End User Dynamics Drive the Amniotic Membrane Market

When considering form, the amniotic membrane market spans cryopreserved, dehydrated, fresh, and lyophilized variants, each offering distinct advantages in terms of storage requirements and clinical handling. Cryopreserved formats maintain near-native tissue architecture and protein activity, making them a preferred choice for delicate ocular procedures. In contrast, dehydrated products deliver logistical simplicity and ambient stability, appealing to surgical centers that require flexible inventory management. Fresh membranes, while offering maximal bioactivity, demand stringent cold-chain protocols that limit geographic reach, whereas lyophilized options balance long-term shelf life with rapid rehydration capabilities.

Turning to source, the market draws upon bovine, equine, and human origins, with each donor type presenting unique immunological profiles and ethical considerations. Bovine membranes provide scalable volume at competitive price points, whereas equine tissues are prized for their robust matrix strength. Human-derived membranes, often sourced from elective cesarean procedures, command premium valuations due to their close biological compatibility and reduced risk of cross-species reactions. Application dynamics further segment the landscape across dental, ophthalmic, orthopedic, and wound healing uses, reflecting the diverse clinical requirements and procedural workflows inherent to each therapeutic area. End-user segmentation encompasses ambulatory surgical centers, clinics, hospitals, and research institutes, highlighting the varied purchasing protocols, procurement cycles, and clinical adoption rates that drive both volume and value in the global amniotic membrane ecosystem.

This comprehensive research report categorizes the Amniotic Membrane market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Source

- Application

- End User

Mapping Major Regional Trends That Highlight Growth Drivers and Challenges for Amniotic Membrane Adoption Across Key Global Territories

The Americas region continues to lead in both volume adoption and innovation, fueled by a strong network of tissue banks, advanced healthcare infrastructure, and supportive reimbursement landscapes. North America, in particular, benefits from robust clinical trial activity in ophthalmology and wound care, whereas Latin American countries are gradually expanding access through public-private partnerships and regional manufacturing hubs. Transitional regulatory harmonization efforts are also fostering cross-border collaboration, enabling faster market entry for novel formulations.

Across Europe, the Middle East & Africa, patient demand is growing steadily, propelled by rising awareness of regenerative therapies and increasing healthcare investment. Western Europe’s established reimbursement frameworks underpin high uptake in dental and orthopedic applications, while emerging markets in the Middle East are prioritizing local production to reduce import dependencies. In Africa, pilot programs in specialized clinics are demonstrating proof-of-concept for both burn care and chronic wound management, setting the stage for broader expansion.

Asia-Pacific exhibits dynamic growth driven by large populations, rising disposable incomes, and a surge in medical tourism. China and India, in particular, are accelerating clinical validation studies and regulatory filings, while regional clusters in Australia and Southeast Asia are nurturing biotech startups focused on next-generation tissue products. Collectively, these regional trends underscore the global evolution of the amniotic membrane market and point toward an increasingly decentralized, collaborative ecosystem.

This comprehensive research report examines key regions that drive the evolution of the Amniotic Membrane market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Players Shaping the Competitive Landscape of the Amniotic Membrane Industry Through Collaboration and Innovation

The competitive environment is shaped by an array of established tissue technology firms and emerging biotech innovators. Leading companies have adopted varied approaches, from forging strategic partnerships with academic medical centers to acquiring niche processing facilities that expand their product portfolios. Several market players have prioritized proprietary decellularization technologies and patented preservation methods to secure exclusivity and defend against commoditization. Others have focused on vertical integration, controlling upstream sourcing, processing, and distribution to optimize cost and quality.

Collaboration remains a hallmark of this sector, with alliances between device manufacturers and pharmaceutical companies catalyzing combination therapies that integrate amniotic membranes with drug delivery platforms. At the same time, select startups are differentiating through advanced analytics, leveraging donor screening algorithms and quality-control software to optimize batch consistency. Partnerships with contract research organizations and regulatory consultants are also prominent, reflecting the intricate pathways required for product approvals. Overall, the competitive landscape is characterized by a blend of consolidation, innovation, and strategic collaboration, with each company vying to deliver the next breakthrough in regenerative care.

This comprehensive research report delivers an in-depth overview of the principal market players in the Amniotic Membrane market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alliqua BioMedical, Inc.

- Amniox Medical, LLC

- Bio-Tissue, Inc.

- Integra LifeSciences Corporation

- MiMedx Group, Inc.

- NuTech Medical, Inc.

- Organogenesis Inc.

- Osiris Therapeutics, Inc.

- Smith & Nephew plc

- TFC TissueTech, Inc.

- VIVEX Biologics, Inc.

Delivering Strategic and Actionable Recommendations Enabling Industry Leaders to Capitalize on Opportunities in the Evolving Amniotic Membrane Market

Industry leaders should begin by prioritizing research and development investments that focus on next-generation preservation techniques and bioengineered enhancements. By fostering collaboration between internal R&D teams and external academic partners, organizations can accelerate proof-of-concept studies and secure intellectual property that underpins sustainable differentiation. Simultaneously, diversifying sourcing strategies across multiple donor pools and processing sites will mitigate risks associated with supply disruptions and tariff-induced cost fluctuations.

Moreover, forging strategic alliances with clinical networks and specialty societies can drive adoption through co-developed protocols and shared real-world evidence. Establishing clear value propositions for each end-user segment-highlighting cost offsets, clinical outcomes, and workflow efficiencies-will enhance engagement with purchasing committees and payers. From a regulatory standpoint, investing in dedicated compliance teams and leveraging accelerated pathways can reduce time-to-market. Finally, leaders should explore digital enablement tools that integrate inventory management, traceability modules, and telehealth services, particularly within ophthalmology, to support remote consultations and broaden market access. These actionable recommendations will empower companies to seize emerging opportunities and navigate an evolving global environment with confidence.

Detailing the Rigorous Research Methodology and Analytical Approaches Underpinning the Comprehensive Study of the Amniotic Membrane Market

This research employs a mixed-methods approach combining extensive secondary research with targeted primary interviews. Secondary data sources include peer-reviewed journals, regulatory filings, conference proceedings, and patent registries. Regulatory databases from authorities such as the FDA, EMA, and PMDA provide insights into recent approvals, guidance revisions, and compliance trends. Proprietary industry newsletters and financial disclosures from public companies offer additional context regarding investment flows and competitive strategies.

Primary research involved in-depth interviews with key opinion leaders, including tissue bank directors, clinical trial investigators, and laboratory process engineers. These conversations were supplemented by surveys conducted among procurement officers at hospitals and ambulatory centers, offering firsthand perspectives on purchasing criteria and usage patterns. Data triangulation techniques were applied to reconcile quantitative metrics-such as shipment volumes and pricing data-with qualitative insights into end-user decision-making. Advanced analytical frameworks, including SWOT analysis and Porter’s Five Forces, facilitated a robust competitive assessment. Collectively, these methodological rigor and transparent sourcing underpin the reliability and actionability of the report’s findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Amniotic Membrane market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Amniotic Membrane Market, by Form

- Amniotic Membrane Market, by Source

- Amniotic Membrane Market, by Application

- Amniotic Membrane Market, by End User

- Amniotic Membrane Market, by Region

- Amniotic Membrane Market, by Group

- Amniotic Membrane Market, by Country

- United States Amniotic Membrane Market

- China Amniotic Membrane Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Summarizing Core Findings and Strategic Implications Emphasizing the Future Trajectory of the Amniotic Membrane Sector and Investment Potential

The analysis reveals that the amniotic membrane market stands at a pivotal crossroads, propelled by convergent technological advancements, shifting regulatory landscapes, and evolving tariff structures. Form and source diversification are unlocking niche applications, while strategic collaborations and digital integration are enhancing operational efficiencies. Regionally, balanced growth across the Americas, Europe, Middle East & Africa, and Asia-Pacific confirms the segment’s global resonance, though localized challenges-such as tariff pressures and infrastructure limitations-continue to shape execution strategies.

Key players have demonstrated that differentiated preservation methods and vertical integration can yield competitive advantages, but sustained leadership will require ongoing innovation and agility. The cumulative effects of U.S. tariffs underscore the importance of resilient supply chains and diversified sourcing strategies. By combining rigorous R&D, targeted clinical partnerships, and proactive regulatory planning, stakeholders are well positioned to harness the next wave of opportunities. As healthcare systems worldwide emphasize value-based care, the ability of amniotic membrane solutions to deliver superior outcomes at controlled costs will determine future success. This conclusion underscores the strategic imperatives that industry players must embrace to thrive in an increasingly dynamic ecosystem.

Engaging Decision Makers with Ketan Rohom Behind the Scenes to Secure Exclusive Insights and Purchase the Definitive Amniotic Membrane Market Research Report

If you’re ready to equip your leadership team with the most granular insights and forward-looking strategies, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to secure your copy of the definitive Amniotic Membrane Market Research Report. Engage directly with Ketan to explore bespoke options, customized briefing sessions, and exclusive add-ons that align with your organizational objectives. Whether you represent a clinical distributor, a biotech innovator, or an institutional investor, Ketan will guide you through the report’s comprehensive chapters, detailed appendices, and proprietary datasets that illuminate both current performance and emerging trajectories.

Contact Ketan to schedule a one-on-one consultation, obtain premium executive summaries, and unlock the competitive intelligence you need to accelerate your growth plans. Ensure your team capitalizes on the latest breakthroughs, regulatory developments, and tariff-related impacts shaping the amniotic membrane landscape. Take this opportunity to transform data into strategy, risk into resilience, and insights into market leadership-connect with Ketan Rohom today to secure your strategic advantage.

- How big is the Amniotic Membrane Market?

- What is the Amniotic Membrane Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?