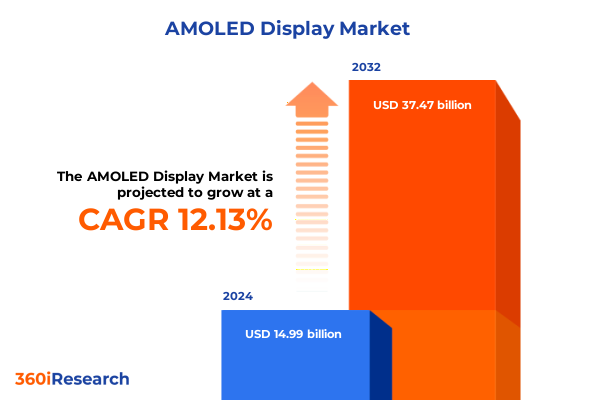

The AMOLED Display Market size was estimated at USD 16.77 billion in 2025 and expected to reach USD 18.77 billion in 2026, at a CAGR of 12.16% to reach USD 37.47 billion by 2032.

Unveiling the Strategic Evolution of AMOLED Displays Shaping Immersive, Energy-Efficient Visual Experiences Across Emerging Technology Platforms

The emergence of Active Matrix Organic Light-Emitting Diode (AMOLED) display technology represents a paradigm shift in contemporary visual systems, offering unparalleled contrast, color gamut, and energy efficiency compared to traditional LCD solutions. Since the introduction of the first flexible AMOLED panels, manufacturers and OEMs have accelerated investments in advanced materials and production techniques to meet the growing consumer and industrial demand for high-performance screens. As end-users seek richer viewing experiences and longer battery life, AMOLED has transcended from a premium smartphone feature to a versatile platform for a broad spectrum of electronics, from automotive dashboards to wearable health devices.

In today’s competitive technology landscape, understanding the underlying factors that drive AMOLED adoption is critical for decision-makers in product development, supply chain management, and strategic planning. By offering direct pixel illumination, slim form factors, and robust low-temperature performance, AMOLED panels enable designers to pioneer new form factors, such as foldable screens and curved automotive clusters, that capture consumer attention and redefine ergonomic standards. Consequently, staying informed about the latest material innovations, manufacturing processes, and industry collaborations lays the groundwork for capturing market share and sustaining competitive advantage in next-generation display solutions.

Navigating the Paradigm Shifts Redefining AMOLED Display Innovation from Flexible Form Factors to Sustainable Manufacturing Breakthroughs

Over the past three years, the AMOLED landscape has undergone transformative shifts driven by breakthroughs in flexible substrates, quantum dot integration, and eco-friendly manufacturing practices. Flexible AMOLED sheets, once constrained by brittle glass backplanes, now leverage ultra-thin polyimide films that facilitate curved, foldable, and even rollable screens without compromising durability. These innovations have catalyzed new product categories-particularly in consumer electronics-where bendable wearables and roll-up tablets are moving from prototype to mass production.

Simultaneously, advances in color conversion layers and quantum dot coatings have enhanced brightness and color accuracy while reducing power consumption. This progress has been accelerated by collaborative R&D efforts among material science firms, photonics researchers, and pilot fab facilities. At the same time, sustainability concerns have spurred the adoption of low-waste deposition techniques, solvent-recovery systems, and recyclable component designs that minimize environmental impact. As a result, industry stakeholders are balancing performance gains with carbon footprint reductions, creating a more resilient value chain.

Moreover, the integration of in-panel touch sensors and mini-LED backlighting into hybrid AMOLED architectures illustrates how modular innovation strategies can optimize efficiency and cost. These concurrent developments demonstrate that the AMOLED market is no longer limited to handheld consumer devices but is rapidly expanding into automotive cockpits, industrial monitoring, and large-format digital signage, setting the stage for the next wave of display innovation.

Assessing the Cascading Economic and Supply Chain Consequences of 2025 United States Tariff Policies on AMOLED Component Sourcing

In 2025, the United States implemented a new tranche of import duties targeting a broad spectrum of electronic components, including specialized OLED substrates and finished display modules. These tariffs, aimed at shifting production incentives back to domestic or allied manufacturing centers, have created measurable changes in procurement strategies. Original equipment manufacturers now face elevated landed costs on panels sourced from key East Asian suppliers, prompting some to reevaluate long-term contracts and staggered procurement schedules.

As a direct consequence, several global panel producers have begun establishing or expanding local fabrication footprints in North America to mitigate tariff exposure and secure preferential domestic status. This reshoring trend, while beneficial for supply chain resilience, has introduced short-term capital expenditures and extended equipment qualification timelines. Product roadmaps have been adjusted accordingly, with some OEMs deferring next-generation feature rollouts to align with in-region capacity ramp-up.

Furthermore, the tariff landscape has accelerated the adoption of regional sourcing strategies across the Americas, Europe, and Asia-Pacific. Procurement teams are diversifying their vendor base to include emerging suppliers in Europe and Southeast Asia, thereby spreading risk and ensuring continuity of supply. While these changes have increased complexity in logistics and quality assurance, they have also fostered closer partnerships and co-development agreements, laying a more robust groundwork for sustainable growth in the global AMOLED ecosystem.

Leveraging Detailed AMOLED Display Segmentation Insights to Illuminate Strategic Opportunities Across Applications, Technologies, Sizes, and Resolutions

Across application domains, AMOLED displays have transcended traditional smartphone and tablet usage to enable advanced automotive displays, ultra-thin laptop screens, foldable wearables, and expansive television panels. Smartphone manufacturers capitalize on the panels’ deep blacks and high refresh rates to enhance user engagement, while producers of automotive clusters integrate curved form factors to deliver panoramic instrument panels that improve driver ergonomics and aesthetic appeal.

When considering the underlying technology, rigid AMOLED sheets remain the backbone of cost-effective mass production, whereas flexible variants unlock premium segments. These flexible panels accommodate curved edges on high-end phones, permit foldable devices that open to tablet-sized canvases, and even allow rollable prototypes that disappear into retractable housings. The progression from curved to foldable, and ultimately to rollable, underscores a strategic journey toward seamless, space-saving designs.

Delving into panel size, screens between five and seven inches dominate handheld devices, striking a balance between visibility and pocket portability, whereas larger seven- to ten-inch formats are gaining traction in gaming-oriented tablets and portable monitors. Displays below five inches, particularly the three-and-a-half to four-and-a-half-inch class, continue to power smartwatches and compact fitness trackers, while the burgeoning category above ten inches, ranging from large-format ten-to-twenty-inch gaming displays to ultra-expansive panels exceeding twenty inches for digital signage, addresses diverse industrial and commercial requirements.

Resolution segmentation further refines differentiation: mainstream devices rely on HD and Full HD that deliver sharp visuals at moderate power draw. Premium smartphones and laptops increasingly adopt Quad HD to accommodate high-definition content, while Ultra HD panels, featuring groundbreaking 4K and emerging 8K variants, serve flagship televisions and professional visualization platforms. This layered segmentation framework highlights not only the depth of market choice but also the nuanced design trade-offs that industry stakeholders must navigate.

This comprehensive research report categorizes the AMOLED Display market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Panel Size

- Resolution

- Application

Decoding Regional Dynamics and Growth Drivers Shaping the Global AMOLED Display Industry Across the Americas, EMEA, and Asia-Pacific Markets

The Americas continue to drive innovation and adoption in AMOLED display technology, with North American automakers pioneering mass-market integration of curved instrument clusters and heads-up displays that rely on flexible panels. Electronics manufacturers in Silicon Valley and adjacent tech hubs focus on consumer devices, leveraging local design talent to optimize screen junctions, software integration, and energy management. Policy support for domestic production facilities, coupled with regional trade agreements, has encouraged investment in advanced fabrication equipment, fostering an ecosystem that balances high-performance panel demand with rigorous environmental standards.

In Europe, the Middle East, and Africa, diverse economies are integrating AMOLED technology in applications ranging from luxury automotive interiors to medical imaging displays. European research consortia collaborate on next-gen materials, emphasizing sustainability and recyclability to meet stringent regulatory requirements. Meanwhile, Middle Eastern smart city initiatives deploy large-format digital signage powered by industrial-grade AMOLED, showcasing dynamic content with minimal maintenance overhead, and Africa’s emerging tech centers are exploring handheld and wearable displays to support telemedicine and remote education, harnessing mobile broadband growth.

Asia-Pacific remains the epicenter of both manufacturing and demand, with leading producers in South Korea and China scaling rigid and flexible AMOLED capacity at record pace. Innovation clusters in Taiwan focus on advanced transfer printing techniques for rollable prototypes, while Southeast Asian nations attract investments in downstream assembly and packaging facilities. This concentration of talent and infrastructure continues to lower production costs, accelerate technology diffusion, and reinforce the region’s position as the primary source for global AMOLED supply.

This comprehensive research report examines key regions that drive the evolution of the AMOLED Display market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry-Leading AMOLED Display Innovators and Strategic Collaborations Driving Competitive Advantage in a Rapidly Evolving Market Landscape

Samsung Display upholds its leadership position by ramping next-generation flexible AMOLED fabs and securing long-term supply agreements with major smartphone OEMs. The company’s investments in tandem deposition processes and in-line quality inspection systems have reinforced its technological edge and throughput efficiency. In parallel, LG Display leverages its expertise in large-format OLED to pioneer rollable television panels, entering strategic partnerships with major home entertainment brands to co-engineer premium smart displays suited for luxury residences.

Chinese competitors such as BOE Technology and Visionox have intensified their focus on cost optimization and yield improvement, adopting advanced pixel architectures that reduce power draw while maintaining brightness. These firms engage in cross-border joint ventures to access critical materials, and they accelerate in-house driver IC development to streamline integration. Meanwhile, emerging players in Japan are exploring micro-OLED architectures tailored for augmented reality headsets, combining ultra-high pixel density with wafer-level vacuum sealing techniques to ensure long-term reliability.

Collaborative ecosystems are further enriched by specialty material suppliers and equipment manufacturers. Companies providing novel phosphorescent emitters, encapsulation films, and micro-LED hybridization platforms play a pivotal role in expanding the AMOLED frontier. Together, these strategic partnerships create a multilayered value chain where performance, cost, and scalability are optimized through co-development, knowledge sharing, and shared sustainability goals.

This comprehensive research report delivers an in-depth overview of the principal market players in the AMOLED Display market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AU Optronics Corp.

- AU Optronics Corp.

- BOE Technology Group Co., Ltd.

- China Star Optoelectronics Technology Co., Ltd.

- EverDisplay Optronics Co., Ltd.

- Futaba Corporation

- Huaxing Optoelectronics Technology Co., Ltd.

- Innolux Corporation

- Japan Display Inc.

- Kyocera Corporation

- LG Display Co., Ltd.

- Panasonic Corporation

- RITEK Corporation

- Royole Corporation

- Samsung Display Co., Ltd.

- Sony Group Corporation

- TCL Technology Group Corporation

- Tianma Microelectronics Co., Ltd.

- Truly International Holdings Limited

- Visionox Information Technology Co., Ltd.

Implementing Forward-Looking Strategies and Tactical Recommendations to Enhance AMOLED Display Value Chains and Accelerate Sustainable Growth Trajectories

To capitalize on the proliferation of foldable and rollable AMOLED devices, industry leaders should forge early alliances with flexible substrate suppliers, securing priority access to cutting-edge polyimide films and anisotropic conductive adhesives. By integrating material roadmaps with product development cycles, engineering teams can expedite prototype validation and mitigate yield risks associated with novel form factors. Simultaneously, procurement professionals are encouraged to adopt multi-source strategies that balance cost management with supply assurance, thereby reducing dependency on single-region fabrication hubs.

Given the evolving tariff environment, manufacturers should evaluate joint investment opportunities in regional pilot production lines to pre-empt import duties and shorten lead times. Collaborative ventures with local fabrication partners not only unlock tariff relief but also enhance brand reputation by demonstrating commitment to regional economic growth. At the same time, R&D divisions must intensify efforts in sustainable manufacturing, prioritizing low-temperature processing and solvent-recovery systems to address regulatory pressures and long-term resource constraints.

Marketing and sales functions should leverage the nuanced segmentation framework-highlighting product differentiation across application, technology, size, and resolution-to tailor offerings for distinct customer cohorts. Crafting targeted narratives around energy efficiency, ergonomic design, and visual fidelity will reinforce value propositions in both B2B and B2C channels. Finally, executive leadership should establish cross-functional governance councils to ensure that strategic investments in AMOLED innovation align with overarching corporate sustainability and profitability objectives, thus fostering holistic growth in the display ecosystem.

Elucidating Rigorous Research Frameworks and Analytical Methodologies Underpinning Comprehensive AMOLED Display Market Insights and Data Integrity

This report synthesizes insights drawn from a rigorous combination of secondary desk research and primary engagement with industry stakeholders. Secondary research encompassed analysis of technical journals, patent filings, and public financial disclosures, enabling a comprehensive mapping of material innovations and capacity expansions. Concurrently, primary interviews with display engineers, procurement directors, and C-level executives across leading OEMs provided qualitative depth, validating key assumptions and uncovering emerging use-cases that frequently escape purely quantitative models.

Data triangulation was undertaken by correlating historical production volume estimates-sourced from independent trade associations-with proprietary survey responses to ensure integrity and consistency. The segmentation framework was validated through scenario analyses that examined technology adoption curves, application lifecycles, and pricing benchmarks. Throughout the research process, stringent protocols were maintained for ethical sourcing and confidentiality, with all interview participants granting informed consent and proprietary insights anonymized to protect competitive positions.

Finally, the analytical methodology integrated cross-market benchmarking and sensitivity testing to stress-test the resilience of identified trends against potential market disruptions, such as supply chain interruptions or regulatory adjustments. This multidimensional approach ensures that the report’s findings are both robust and actionable, equipping decision-makers with a reliably calibrated foundation for strategic planning in the evolving AMOLED display landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our AMOLED Display market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- AMOLED Display Market, by Technology

- AMOLED Display Market, by Panel Size

- AMOLED Display Market, by Resolution

- AMOLED Display Market, by Application

- AMOLED Display Market, by Region

- AMOLED Display Market, by Group

- AMOLED Display Market, by Country

- United States AMOLED Display Market

- China AMOLED Display Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Concluding Insights That Synthesize Key Trends and Strategic Imperatives Guiding the Future Trajectory of the AMOLED Display Ecosystem

Synthesizing the key trends, it is evident that AMOLED technology has matured beyond conventional display applications into a versatile platform enabling flexible, high-resolution, and energy-efficient visual systems. Transformative shifts in material science, sustainable manufacturing, and integrated module design have converged to expand the addressable market across consumer electronics, automotive interfaces, and professional visualization.

Regional dynamics underscore a multipolar ecosystem: North America’s strategic focus on near-shoring and environmental compliance, EMEA’s nexus of research and premium automotive displays, and Asia-Pacific’s dominant production scale and cost leadership collectively shape global supply and demand. Leading companies are reinforcing competitive moats through collaborative R&D, vertical integration, and incremental capacity investments, while proactive tariff mitigation strategies are reshaping supply chain footprints and cost structures.

Looking ahead, the interplay between emerging form factors-such as rollable screens-and accelerated sustainability initiatives will redefine competitive advantage. Industry participants that adeptly align material innovation with operational agility, regulatory foresight, and nuanced segmentation strategies will be poised to lead the next chapter in AMOLED evolution, unlocking new revenue streams and forging deeper engagements with end-users.

Empower Your Strategic Decisions Today by Engaging with Ketan Rohom to Secure Comprehensive AMOLED Display Market Research Insights

If you are ready to harness the strategic insights and competitive intelligence presented in this report, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing, to secure your comprehensive market research on AMOLED displays. Ketan offers personalized guidance on how these findings can be applied to your unique business context, ensuring that you derive maximum value from our in-depth analysis. Engage today to transform these actionable insights into measurable outcomes and position your organization at the forefront of the AMOLED display revolution.

- How big is the AMOLED Display Market?

- What is the AMOLED Display Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?