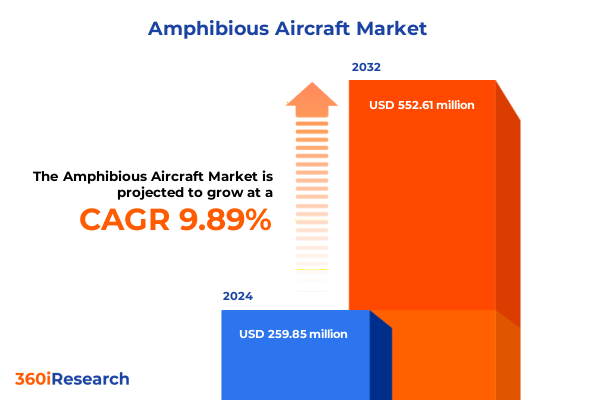

The Amphibious Aircraft Market size was estimated at USD 283.79 million in 2025 and expected to reach USD 310.72 million in 2026, at a CAGR of 9.98% to reach USD 552.61 million by 2032.

Discover How Amphibious Aircraft Are Redefining Operational Flexibility Across Firefighting Maritime Patrol Search And Rescue Tourism Cargo And Passenger Transport

Amphibious aircraft have long captured the imagination of both industry professionals and aviation enthusiasts, combining the agility of fixed-wing platforms with the adaptability to operate seamlessly on water or land. These versatile aircraft enable operators to reach remote locations, such as islands, coastal regions, and inland water bodies, which conventional runways cannot serve. With capabilities ranging from firefighting water scooping to search and rescue missions, amphibious aircraft offer a multifaceted solution to a diverse set of operational challenges.

As global demand for resilient and flexible aerial assets continues to rise, the amphibious segment is experiencing renewed interest across both public and private sectors. Operators are increasingly prioritizing rapid deployment, minimal infrastructure requirements, and mission-specific performance. Moreover, environmental considerations and regulatory focus on noise and emissions are driving manufacturers to explore advanced materials and propulsion systems. Consequently, this report sets the stage by framing the current state of amphibious aviation and outlining the key forces shaping its trajectory in the broader aerospace landscape.

Uncover The Latest Technological Innovations Partnerships And Operational Strategies Driving The Next Generation Of Amphibious Aircraft Deployment Globally

Throughout the past decade, amphibious aircraft have undergone significant evolutionary shifts fueled by technological breakthroughs and strategic collaborations. Advances in composite materials have reduced airframe weight and enhanced corrosion resistance, allowing modern designs to achieve higher payload capacities and longer service lives. Concurrently, developers are integrating next-generation avionics suites and sensor packages that enable precision navigation, automated water landings, and real-time data sharing with ground operations.

In parallel, partnerships between aerospace manufacturers, defense agencies, and environmental organizations have opened new pathways for amphibious platforms. Joint ventures and research consortia are exploring hybrid-electric propulsion concepts that promise lower operating costs and reduced carbon footprints. Additionally, simulation-driven design methodologies accelerate prototyping cycles, empowering manufacturers to iterate rapidly and tailor aircraft to niche missions. Collectively, these shifts are redefining the amphibious market landscape by enabling operators to adopt more sustainable, efficient, and mission-adapted aircraft.

Analyze The Far Reaching Consequences Of United States Tariffs Imposed In 2025 On Amphibious Aircraft Supply Chains Manufacturing Costs And Competitive Dynamics

In early 2025, the United States government implemented a set of tariffs targeting key aerospace components and imported amphibious aircraft, aiming to bolster domestic manufacturing and protect critical supply chains. These measures have prompted aircraft producers to re-evaluate their procurement strategies and adapt production footprints. While the tariffs have increased costs for certain imported airframes and parts, they have also incentivized investment in local suppliers and vertical integration initiatives.

Consequently, operators have begun adjusting maintenance, repair, and overhaul processes to mitigate the impact of higher component expenses. Maintenance cycles are being optimized through predictive analytics, and manufacturers are exploring alternative raw materials and subcomponent sources that can comply with tariff thresholds. Furthermore, domestic producers are capitalizing on government incentives to expand assembly lines and research facilities. As a result, the combined impact of the 2025 tariffs is fostering a more resilient supply network, albeit with short-term cost pressures for both manufacturers and operators.

Gain In Depth Insights Into Amphibious Aircraft Market Segmentation From End Use Propulsion Platform To Seating Capacity Revealing Critical Growth Drivers And Trends

A closer examination of end-use categories reveals diverse demand drivers across firefighting, maritime patrol, search and rescue, tourism, and transportation missions. Firefighting operators value rapid scooping cycles and water drop precision, which influences both airframe strength and tank integration requirements. In maritime patrol roles, advanced radar and surveillance systems integrate closely with avionics stacks to deliver extended mission endurance and data clarity. Search and rescue teams prioritize short takeoff and landing performance alongside cabin modularity to accommodate medical equipment and rescue hoists. Meanwhile, tourism operators seek comfort and panoramic visibility for passenger experiences, and cargo and passenger transport providers demand robust load-bearing structures coupled with efficient ramp operations.

Propulsion preferences further underscore the market’s heterogeneity. Multi-engine piston systems continue to serve ultra-light and general aviation niches, but multi-engine turboprops dominate missions that require higher payloads and altitudes. Single-engine configurations offer cost advantages for entry-level operators, yet larger operators are progressively shifting toward turboprop platforms to achieve superior climb rates and fuel efficiency. Platform types diverge between floatplanes and flying boats, each presenting unique hull and float configurations. Single-float and twin-float designs provide straightforward maintenance and retrofit pathways, whereas catamaran hulls enhance hydrodynamic stability for rough-water operations. Seating capacity also stratifies the market, from ultra-light and general aviation in light categories to midsize and regional commuter layouts for medium models, up to heavy-category designs engineered for larger crews and mission-critical payloads.

This comprehensive research report categorizes the Amphibious Aircraft market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Aircraft Type

- Propulsion Type

- Operation Type

- Range Class

- Payload Capacity

- End User

Explore Regional Variations In Amphibious Aircraft Adoption Across The Americas Europe Middle East Africa And Asia Pacific Highlighting Unique Opportunities And Challenges

Regional analysis highlights distinct dynamics shaping amphibious aircraft adoption across the Americas, Europe Middle East and Africa, and Asia Pacific. In the Americas, abundant inland waterways and wildland fire risks have driven heavyweight firefighting and search and rescue fleets, while Caribbean islands and coastal communities rely on floatplanes for tourism and inter-island connectivity. Additionally, North American defense agencies continue to modernize maritime patrol inventory against evolving security challenges.

Shifting attention to Europe Middle East and Africa, operators navigate stringent environmental mandates and airspace regulations that influence propulsion and noise-reduction strategies. Government-sponsored pilot programs in southern Europe and North Africa demonstrate hybrid-electric amphibious prototypes geared toward ecological tourism and coastal surveillance missions. At the same time, Middle Eastern nations emphasize search and rescue capabilities across vast maritime zones. Meanwhile, the Asia Pacific region is witnessing accelerated infrastructure development in archipelagic states, fueling growth in cargo and passenger transport applications. Southeast Asian tourism operators are expanding expedition-style services, and governmental agencies are commissioning fleets to improve disaster response readiness.

This comprehensive research report examines key regions that drive the evolution of the Amphibious Aircraft market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examine Leading Amphibious Aircraft Manufacturers Strategic Partnerships And Innovation Portfolios Shaping Competitive Dynamics And Market Leadership In The Sector

Several industry players are competing to differentiate their amphibious aircraft offerings through product innovation, strategic alliances, and service expansions. Long-standing manufacturers have prioritized upgrading legacy models with modern avionics packages and composite hull reinforcements to extend operational lifespans. Concurrently, emerging startups are leveraging digital design platforms to introduce lightweight airframes with reduced environmental footprints.

Collaborations between propulsion specialists and airframe designers are unlocking hybrid and fully electric prototypes, while partnerships with software companies are enhancing predictive maintenance and flight planning capabilities. In addition, select manufacturers are forming alliances with international maintenance organizations to establish regional support hubs, thus improving aircraft uptime and customer satisfaction. As a result, the competitive landscape is evolving into a blend of established incumbents and agile disruptors, all striving to capture new market niches and deliver comprehensive lifecycle support.

This comprehensive research report delivers an in-depth overview of the principal market players in the Amphibious Aircraft market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AirCam

- Airtime Aircraft Inc

- Amphibian Aerospace Industries, Pty Ltd

- Atol Aviation Oy

- Aviat Aircraft, Inc.

- Colyaer SL

- De Havilland Aircraft of Canada Limited

- Dornier Seawings GmbH

- Equator Aircraft AS

- Glasair Aviation

- ICON Aircraft, Inc.

- Kitfox Aircraft, LLC

- Lake Aircraft

- LISA AERONAUTICS, SA

- Maule Air Inc.

- Murphy Aircraft Manufacturing Ltd

- Scandinavian Seaplanes Oy

- Seamax LLC

- Selina Aircrafts

- ShinMaywa Industries, Ltd.

- Super Petrel USA

- Textron Aviation Inc.

- United Aircraft Corporation

- Vickers Aircraft Company Limited

- WACO Aircraft Corporation

- Zenith Aircraft Company

Implement Actionable Strategies For Industry Leaders To Optimize Amphibious Aircraft Development Supply Chain Resilience And Market Engagement For Sustainable Growth

Industry leaders should prioritize investment in next-generation composite materials and hybrid propulsion systems to meet rising demand for efficiency and environmental compliance. By establishing strategic partnerships with universities and research institutes, organizations can accelerate the development of lightweight hull designs and energy-efficient powerplants. Furthermore, diversifying the supplier base will mitigate risks associated with trade policy fluctuations and component shortages.

Simultaneously, companies must deepen engagement with regulatory authorities to influence emerging standards on noise, emissions, and waterway operations. Implementing modular design principles will allow platforms to adapt to multiple missions, maximizing return on investment and fleet utilization. In addition, embracing digital twins and predictive analytics for maintenance planning will enhance operational readiness and reduce downtime. By executing these actionable steps, decision-makers can secure competitive advantages and position their amphibious aircraft offerings for long-term success.

Understand The Comprehensive Research Methodology Employed To Deliver Reliable Amphibious Aircraft Market Insights Including Data Collection Analysis And Validation Protocols

This report synthesizes data drawn from primary interviews with senior aerospace executives, regulatory agency representatives, and mission operators to ensure direct insights into operational requirements and strategic priorities. These firsthand perspectives are complemented by secondary research, including technical journals, white papers, and publicly available regulatory filings, which collectively ground the analysis in verifiable information.

The research methodology also incorporates quantitative data validation through cross-referencing industry databases, trade publications, and on-site facility visits to manufacturing plants and maintenance centers. Throughout the process, data triangulation techniques ensured consistency across multiple sources, while expert review panels vetted key findings to uphold analytical rigor. Quality control protocols, such as standardized data input templates and peer reviews, were applied at every stage, guaranteeing that conclusions are both robust and actionable.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Amphibious Aircraft market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Amphibious Aircraft Market, by Aircraft Type

- Amphibious Aircraft Market, by Propulsion Type

- Amphibious Aircraft Market, by Operation Type

- Amphibious Aircraft Market, by Range Class

- Amphibious Aircraft Market, by Payload Capacity

- Amphibious Aircraft Market, by End User

- Amphibious Aircraft Market, by Region

- Amphibious Aircraft Market, by Group

- Amphibious Aircraft Market, by Country

- United States Amphibious Aircraft Market

- China Amphibious Aircraft Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Summarize The Strategic Implications Of Evolving Technologies Regulations And Market Dynamics On The Future Trajectory Of Amphibious Aircraft Operations And Investment

The amphibious aircraft sector stands at a pivotal juncture, where technological innovation, shifting policy environments, and evolving mission demands converge. Operators seeking firefighting, maritime patrol, search and rescue, tourism, or transportation solutions now benefit from platforms that combine enhanced performance with environmental responsibility.

Moving forward, success will hinge on the industry’s ability to embrace advanced materials, modular architectures, and digital capabilities while navigating complex trade and regulatory landscapes. By fostering strategic collaborations and proactively addressing emerging standards, manufacturers and operators can unlock new opportunities and drive sustainable growth. Ultimately, amphibious aircraft will continue to play a critical role in connecting remote communities, safeguarding coastlines, and responding to humanitarian and environmental challenges.

Engage Directly With Ketan Rohom Associate Director Of Sales And Marketing To Secure Your Comprehensive Amphibious Aircraft Market Research Report Today

To learn more about the comprehensive insights and strategic analysis compiled in this report, reach out to Ketan Rohom, Associate Director of Sales and Marketing, who will guide you through the various packages and customization options available. Ketan brings extensive expertise in aerospace sector research and will help you identify the best solution tailored to your organization’s decision-making needs. Whether you require a deep dive into specific market segments, region-focused studies, or advanced competitive landscaping, Ketan will walk you through the process, answer your questions, and ensure you receive the actionable intelligence needed to stay ahead in a rapidly evolving amphibious aircraft industry. Connect with Ketan today to secure your copy of the full market research report and take the next step towards driving growth and innovation within your business.

- How big is the Amphibious Aircraft Market?

- What is the Amphibious Aircraft Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?