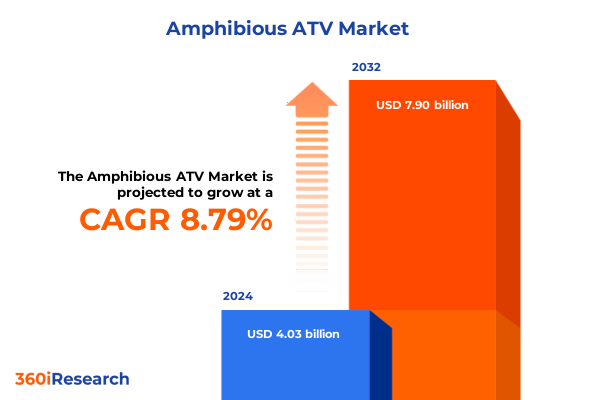

The Amphibious ATV Market size was estimated at USD 4.38 billion in 2025 and expected to reach USD 4.73 billion in 2026, at a CAGR of 8.77% to reach USD 7.90 billion by 2032.

Discover the versatile potential of amphibious all-terrain vehicles across sectors with an in-depth strategic overview of emerging market opportunities

The amphibious all-terrain vehicle represents a remarkable fusion of land and water mobility, crafted to meet the evolving demands of multiple industries. Historically reserved for specialized military and exploratory missions, these versatile machines have transcended their niche origins to serve a wide array of applications spanning agriculture, defense, recreation, and emergency response. Their inherent adaptability makes them indispensable in challenging environments where traditional vehicles falter, from submerged wetlands to rugged coastal marshes. In agriculture, operators utilize amphibious ATVs to navigate flooded paddies and wet soil, gaining operational efficiencies in aquaculture, crop farming, and livestock management. Meanwhile, defense agencies integrate these vehicles into patrol, logistics, and reconnaissance operations, capitalizing on their amphibious capabilities to traverse both water obstacles and difficult terrain. This diversification of use cases underscores a broader trend toward multifunctional equipment designed to optimize productivity across adjacent sectors and environments.

At the core of this evolution lies a series of technological enhancements that have significantly expanded the vehicle’s performance envelope. Improved propulsion systems now enable seamless transitions between land and water travel, while advanced suspension technologies absorb shocks across uneven surfaces. Fuel efficiency and navigation aids have also matured, empowering operators to undertake extended missions without compromising endurance or safety. These developments contribute to a growing user base that ranges from thrill-seeking recreationists-who command vehicles during hunting excursions, leisure riding adventures, and off-road racing-to search and rescue teams tasked with swift border rescues and flood response efforts.

Looking ahead, the amphibious ATV is poised to play an even greater role in sectors that require reliable, all-terrain mobility solutions. As climate change intensifies the frequency of extreme weather events, the need for vehicles capable of conducting rescue operations in inundated regions will become increasingly urgent. At the same time, ongoing digitalization and the integration of real-time monitoring systems are likely to unlock new service models centered on remote asset management and predictive maintenance, further broadening market appeal.

Uncover the transformative technological and operational shifts redefining amphibious ATV capabilities for modern applications in defense, agriculture, and recreation

Over recent years, the amphibious ATV landscape has undergone a profound metamorphosis fueled by convergence in material science, propulsion innovation, and digital integration. Manufacturers have embraced advanced composites and corrosion-resistant alloys to reduce vehicle weight while enhancing structural integrity, enabling higher payload capacities without sacrificing buoyancy. Concurrently, innovations in water jet and track-based propulsion systems have improved navigational responsiveness, affording operators precise control when transitioning between land and aquatic environments. On the digital front, the incorporation of satellite-aided positioning, onboard diagnostics, and IoT-enabled connectivity has revolutionized fleet management, allowing real-time monitoring of vehicle health, route optimization, and remote troubleshooting. These technological leaps have not only improved reliability and safety but also attracted new customer segments seeking intelligent mobility solutions.

Regulatory shifts have also played a critical role in reshaping the market. Governments are increasingly implementing stringent environmental and safety standards, prompting manufacturers to adopt cleaner engine technologies and rigorous testing protocols. In sectors such as agriculture and rescue, certification requirements for emissions and noise levels are driving the development of hybrid and electric amphibious variants. Meanwhile, the defense sector’s emphasis on rapid deployment and modular payload capabilities has pushed suppliers to design vehicles with interchangeable mission kits, facilitating swift configuration for logistics, patrol, or reconnaissance tasks.

Furthermore, customer expectations are evolving in tandem with broader market trends. Buyers now demand greater customization across performance parameters-including engine capacity ranges from under 500cc for maneuverability to over 1000cc for heavy-duty operations-as well as user-friendly interfaces and serviceable designs that minimize downtime. This shift toward tailored solutions has encouraged strategic partnerships between OEMs and component specialists, fostering ecosystems of innovation that extend beyond the vehicle itself to encompass after-sales support, data analytics, and training services. Collectively, these transformative shifts underpin a market poised for sustained diversification and resilience.

Examine the cumulative effects of evolving United States tariff policies on amphibious ATV manufacturing imports and supply chains through 2025

The cumulative impact of United States tariff policies through 2025 is reshaping the cost structure and global sourcing strategies of amphibious ATV manufacturers. Section 232 measures, originally enacted in 2018 under the Trade Expansion Act, imposed a 25 percent duty on steel and a 10 percent duty on aluminum imports to address purported national security risks. These levies were reinstated at a uniform 25 percent rate on all steel and aluminum imports in March 2025, eliminating previous exemptions and escalating input costs for vehicle frames and chassis components that rely on these metals. As a direct consequence, manufacturers have confronted compressed margins, spurring investments in domestic forging and casting capabilities to qualify for duty-free status under the latest requirements of domestically ‘‘melted and poured’’ or ‘‘smelted and cast’’ metal content.

Concurrently, Section 301 tariffs on goods imported from China have undergone significant adjustments. Initial levies of 25 percent on a broad range of components, including electric vehicle systems and batteries, were elevated to 50 percent for semiconductors and certain critical raw materials effective January 1, 2025, further inflating costs for advanced propulsion and control modules. To alleviate some of these pressures, the Office of the United States Trade Representative extended exclusions on select technology and innovation goods through August 31, 2025, preserving duty relief on targeted subcomponents vital to emerging powertrain and digital navigation systems.

In aggregate, these tariff actions have prompted amphibious ATV manufacturers to reassess supply chains, localize production of key components, and seek alternative sourcing from allied markets. While short-term cost increases have led some OEMs to absorb tariffs, prolonged exposure risks eventual price adjustments at the customer level, potentially moderating demand. Moreover, the shifting trade landscape underscores the strategic imperative of supply chain resilience, compelling stakeholders to balance tariff avoidance with proximity to end-user markets and rapid response capabilities.

Explore key segmentation insights revealing how application, engine capacity, product type, end user, drive configuration, sales channels, and pricing tiers shape market dynamics

Segmentation analysis reveals a complex interplay of factors shaping amphibious ATV adoption across diverse end-use landscapes. In application terms, vehicles designed for agricultural tasks span aquaculture operations-where sub-500cc platforms deliver precision in flooded coastal farms-to crop farming and livestock carriage on waterlogged terrains, while military configurations support logistics convoys, border patrol routines, and reconnaissance missions. Recreational iterations cater to hunting excursions, leisure riding trails, and high-speed off-road racing circuits, with multi-rider and side-by-side formats accommodating both team challenges and individual pursuits. Rescue variants, attuned to emergency response, excel in border rescue scenarios and flood operations, offering rapid deployment when conventional transport is rendered inoperative.

Engine capacity represents another critical dimension, with under-500cc models valued for their nimble handling in tight environments, 500–1000cc variants striking a balance between agility and torque for mixed-terrain use, and over-1000cc machines meeting the demands of heavy-duty commercial and defense tasks. Product type diversification further segments the market into single-rider units prized for solo missions, multi-rider vehicles serving cooperative work crews, and side-by-side platforms that facilitate coordinated operational tasks. End-user orientation bifurcates demand between commercial fleets-operated by agricultural service providers, defense contractors, and emergency agencies-and individual consumers seeking leisure and sporting enjoyment.

Drive type configurations, spanning four-wheel drive solutions for flexible maneuvering to six-wheel and eight-wheel drive systems engineered for maximal traction and payload capacity, influence performance specifications in challenging environments. Sales channels also manifest distinct dynamics: traditional dealerships offer hands-on demonstrations and service packages, while online platforms enable direct procurement and virtual customization, appealing to tech-savvy buyers. Finally, pricing tiers range from economy machines aimed at cost-sensitive entrants to midrange models balancing features and affordability, and premium offerings that integrate advanced propulsion, connectivity suites, and luxury ergonomics. Together, these segmentation insights illuminate pathways to targeted product development and market positioning strategies.

This comprehensive research report categorizes the Amphibious ATV market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Engine Capacity

- Product Type

- Drive Type

- Price Range

- Application

- End User

- Sales Channel

Analyze pivotal regional dynamics highlighting emerging trends and strategic implications for amphibious ATV adoption across the Americas, EMEA, and Asia-Pacific landscapes

Regional landscapes exert profound influence on amphibious ATV adoption trajectories, reflecting disparate environmental conditions, regulatory frameworks, and infrastructure needs. In the Americas, the United States leads deployment across agricultural operations in the Mississippi Delta and Florida Everglades, where water-resilient vehicles support aquaculture and crop cultivation in seasonally flooded zones. Canada leverages amphibious ATVs for forestry management and remote community access, while Brazil’s flood-prone regions see growing use in flood mitigation and emergency rescue initiatives. Across the broader hemisphere, Mexico capitalizes on these vehicles to navigate mangrove ecosystems and support ecotourism ventures.

Within Europe, Middle East, and Africa, varied geographies spur diverse applications. In Northern Europe, environmental regulations drive the adoption of cleaner-emission variants for wetland conservation projects, while Mediterranean nations employ amphibious ATVs for coastal tourism and search missions in seagrass-rich shorelines. The Middle East’s oil exploration fields utilize heavy-duty six- and eight-wheel drive configurations to traverse saline flats, and Gulf rescue services integrate amphibious units into flood response protocols following seasonal rains. Sub-Saharan Africa sees interest in wildlife reserve patrolling and humanitarian logistics, with NGOs deploying vehicles for border rescue and medical supply delivery across riverine corridors.

Asia-Pacific dynamics further diversify market patterns. Australia’s mining sector integrates amphibious ATVs to survey flooded quarries and wet tunnel shafts, and Southeast Asian governments deploy them for rice field irrigation management and disaster relief after typhoons. In India and Bangladesh, seasonal monsoon inundations create demand for rescue-capable vehicles, while Japan and South Korea explore hybrid-electric variants to align with stringent environmental policies. As regional infrastructure investments accelerate, the Asia-Pacific market emerges as a critical growth horizon, driven by large-scale agricultural modernization and robust disaster preparedness mandates.

This comprehensive research report examines key regions that drive the evolution of the Amphibious ATV market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Gain insights into leading amphibious ATV manufacturers’ strategic initiatives, competitive positioning, and innovation pipelines driving industry leadership and differentiation

A cadre of established OEMs and innovative challengers are actively defining the competitive architecture of the amphibious ATV market. Gibbs Sports Amphibians has solidified its leadership by pioneering high-speed water jet technology integrated into all-terrain platforms, while Argo ATV’s modular design philosophy has enabled rapid adaptation to diverse mission profiles across agriculture and defense applications. Mudd-Ox and Hydratrek stand out for their heavy-load capabilities, addressing commercial needs in mining and industrial logistics, and Quadski’s revival under new ownership underscores sustained consumer appetite for sport-oriented amphibious craft. Meanwhile, Hisun Motors and Tinger are leveraging cost-effective manufacturing in Asia to capture price-sensitive segments, investing in local partnerships to expand distribution networks.

Global conglomerates such as BRP Inc., Honda Motor Company, Yamaha Motor Company, Textron Inc., and Suzuki Motor Corporation continue to refine their amphibious portfolios through incremental engine enhancements and strategic acquisitions. These industry leaders are directing R&D toward hybrid powertrains, autonomous navigation systems, and lightweight composite materials to meet tightening emissions regulations and rising performance expectations. Concurrently, mid-tier players are forging alliances with component innovators, integrating advanced safety features such as obstacle detection and remote diagnostics to differentiate on reliability and total cost of ownership.

Collectively, this diverse competitive ecosystem fosters a vibrant innovation cycle, balancing heritage brands’ scale advantages with agile newcomers’ specialized solutions. As barriers to entry remain substantial due to regulatory certifications and capital-intensive manufacturing requirements, strategic collaborations and technology licensing agreements will continue to shape market share dynamics and accelerate time to market for next-generation amphibious vehicles.

This comprehensive research report delivers an in-depth overview of the principal market players in the Amphibious ATV market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Argo

- Atlas ATV

- Fat Truck by Zeal Motor Inc

- Gibbs Technologies

- Green Scout

- Hydratrek Inc

- Iguana Yachts SA

- Land Tamer

- Lite Technologies

- MAX ATVs

- MUDD-OX

- Sherp LLC

- Terra Jet

- Tinger

- WaterCar Inc

Implement actionable recommendations designed to guide industry leaders in optimizing product portfolios, supply chains, and market engagement for sustainable growth

Industry leaders should prioritize the development of modular vehicle architectures that allow swift reconfiguration for distinct missions, enabling operators to optimize asset utilization across agriculture, defense, recreation, and rescue. By adopting flexible platforms, companies can streamline production, shorten lead times, and address evolving customer requirements without extensive redesign cycles. Complementary to this, investing in advanced materials and hybrid propulsion technologies will position manufacturers to meet upcoming environmental standards and differentiate on fuel efficiency and emission reductions.

Supply chain resiliency emerges as a critical imperative amid volatile tariff landscapes. Stakeholders must conduct comprehensive audits to identify single-source vulnerabilities, then diversify component sourcing across allied markets or nearshore partners. Establishing strategic alliances with metal fabricators and semiconductor suppliers can mitigate the impact of Section 232 and Section 301 tariffs while ensuring reliable access to high-grade materials. Manufacturers should also explore vertical integration of key subassemblies and consider localized production hubs to circumvent trade barriers and optimize logistics costs.

Finally, an accelerated shift toward digital engagement models-encompassing virtual demonstrations, online customization portals, and remote diagnostics-can expand market reach beyond traditional dealership networks. Cou pled with robust after-sales service frameworks and data-driven maintenance offerings, companies can enhance customer satisfaction and unlock recurring revenue streams. These combined actions will empower industry leaders to navigate regulatory complexities, harness technological advances, and cultivate sustainable growth in the dynamic amphibious ATV market.

Understand the rigorous research methodology underpinning this comprehensive market analysis through primary interviews, secondary data triangulation, and expert validation processes

This comprehensive market analysis was underpinned by a rigorous research methodology combining primary and secondary data sources to ensure accuracy and depth. Primary research encompassed structured interviews with key stakeholders, including OEM executives, component suppliers, end-user representatives in agriculture and defense, and regulatory agency officials. These dialogues provided firsthand insights into emerging challenges, technology adoption rates, and policy impacts.

Secondary research involved systematic review of government publications-such as Department of Defense procurement reports, United States Trade Representative notices, and Department of Agriculture usage statistics-alongside industry white papers and technical journals. Data triangulation techniques were employed to reconcile discrepancies across sources and to validate quantitative and qualitative findings. Proprietary databases and patent filings were also analyzed to map innovation trajectories and identify leading technology trends.

To further enhance methodological robustness, the research team applied expert validation workshops, bringing together subject-matter experts to critique preliminary findings and refine interpretive frameworks. Segmentation models were tested through cross-validation against historical usage patterns, and geopolitical scenario analyses were constructed to assess the potential impact of future policy shifts. This multi-layered approach delivers a comprehensive, defensible view of the amphibious ATV market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Amphibious ATV market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Amphibious ATV Market, by Engine Capacity

- Amphibious ATV Market, by Product Type

- Amphibious ATV Market, by Drive Type

- Amphibious ATV Market, by Price Range

- Amphibious ATV Market, by Application

- Amphibious ATV Market, by End User

- Amphibious ATV Market, by Sales Channel

- Amphibious ATV Market, by Region

- Amphibious ATV Market, by Group

- Amphibious ATV Market, by Country

- United States Amphibious ATV Market

- China Amphibious ATV Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Conclude with a synthesis of key findings underscoring the strategic imperatives for stakeholders navigating the dynamic amphibious ATV landscape

In synthesizing these insights, it becomes clear that the amphibious ATV market stands at the intersection of technological innovation, regulatory complexity, and evolving end-use demands. The proliferation of advanced propulsion systems, composite materials, and digital connectivity has broadened the vehicle’s operational envelope, unlocking new value propositions across agriculture, defense, recreation, and emergency response. At the same time, tariff dynamics-particularly under Sections 232 and 301-have introduced cost pressures that necessitate strategic supply chain realignment and local production initiatives.

Segmentation analysis highlights the importance of tailored solutions that reflect specific operational contexts, from under-500cc single-rider units optimized for environmental monitoring to heavy-duty eight-wheel drive platforms supporting industrial logistics in extreme conditions. Regional variations underscore diverse adoption drivers, with flood-prone regions demanding rescue capabilities and resource-rich territories incentivizing industrial applications. Leading players continue to jockey for position through technology partnerships, product diversification, and geographic expansion, while agile newcomers capitalize on niches through specialized offerings and cost-effective manufacturing.

Ultimately, stakeholders who align their strategies with these multidimensional trends-leveraging modular designs, resilient supply chains, and digital engagement models-will be best positioned to capture emerging opportunities and navigate the complexities of the amphibious ATV landscape. The convergence of market forces signals a period of robust innovation and competitive realignment, underscoring the strategic imperative of agility, collaboration, and insight-driven decision-making.

Engage directly with Ketan Rohom to secure exclusive access to the detailed amphibious ATV market research report and drive informed strategic decision-making

Begin by reaching out to Ketan Rohom, Associate Director of Sales & Marketing, to explore how this comprehensive amphibious ATV market research report can inform your strategic roadmap. Discuss your specific operational needs, whether it’s evaluating entry into new application segments, optimizing product portfolios, or understanding the regulatory environment. Ketan can tailor a consultation to highlight the most relevant insights for your organization’s goals, ensuring you capitalize on emerging opportunities and mitigate potential risks.

Securing this report provides a deep dive into the factors shaping the amphibious ATV landscape, from evolving tariff regimes to consumer segmentation and regional dynamics. With Ketan’s guidance, you can navigate complex market forces with confidence, leveraging data-driven recommendations to drive growth and innovation. Engage now to position your company at the forefront of this dynamic market and achieve a competitive edge through informed decision-making.

- How big is the Amphibious ATV Market?

- What is the Amphibious ATV Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?