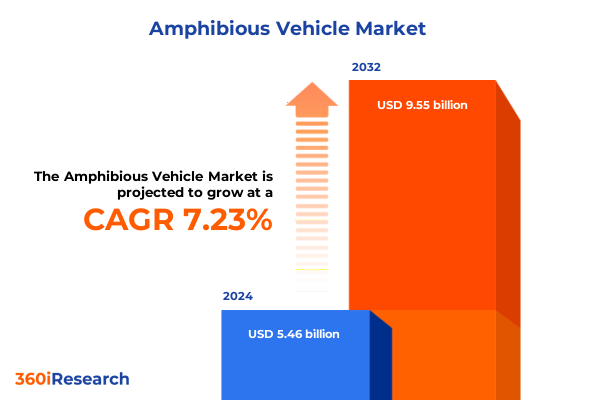

The Amphibious Vehicle Market size was estimated at USD 5.84 billion in 2025 and expected to reach USD 6.25 billion in 2026, at a CAGR of 7.27% to reach USD 9.55 billion by 2032.

Exploring the Evolution of Amphibious Vehicles in Dual-Terrain Mobility and Their Growing Significance Across Civilian and Defense Sectors

Amphibious vehicles have transcended their niche origins to become pivotal platforms in modern dual-terrain operations, seamlessly navigating land and water with increasing sophistication. In recent years, the confluence of advanced materials, efficient propulsion systems, and digital integration has reshaped the landscape of these versatile machines. Decision-makers across defense, commercial services, and recreational segments are recognizing their potential for rapid deployment, search and rescue, environmental monitoring, and adventure tourism. This introduction presents an overview of the fundamental forces that have driven amphibious vehicle adoption beyond traditional markets.

Moreover, the evolution of hybrid electric powertrains and modular chassis designs has enabled manufacturers to deliver improved performance metrics while reducing lifecycle costs. As governments prioritize coastal defense and littoral security, and as private operators demand greener, quieter solutions for eco-tourism, industry stakeholders are forging cross-sector partnerships to meet these complex requirements. These trends set the stage for an in-depth examination of the transformative shifts, regional dynamics, and strategic imperatives that define the current state of the amphibious vehicle market.

Unveiling Key Technological and Market Shifts Reshaping the Amphibious Vehicle Industry Toward Sustainability, Efficiency, and Enhanced Performance

The amphibious vehicle sector is undergoing transformative shifts driven by technological breakthroughs, evolving regulatory frameworks, and changing end-user expectations. In particular, the rapid maturation of battery and fuel cell technologies has expanded the feasibility of hybrid propulsion systems that combine electric motors with traditional combustion engines. This hybridization trend is complemented by advances in track and wheel configurations, which now incorporate high-durability materials such as steel-reinforced tracks and foam-filled pneumatic tires to optimize traction across sand, mud, and shallow waters.

In parallel, the integration of digital control architectures and real-time telemetry has elevated operational safety and maintenance efficiency. Manufacturers are embedding sensor arrays and predictive analytics software that enable remote diagnostics and adaptive driving modes. Meanwhile, regulatory bodies in key markets have introduced stringent emission standards that incentivize the adoption of axial and mixed flow water jet units over conventional impellers, reducing environmental footprints in sensitive marine zones.

Furthermore, the convergence of military requirements for rapid insertion capabilities and commercial demand for all-terrain leisure experiences has stimulated cross-pollination of design philosophies. Companies once focused exclusively on defense platforms are now introducing scaled-down variants tailored for research vessels, tour operators, and private enthusiasts. As a result, collaborative ventures between OEMs and aftermarket specialists are forging new pathways for customization, spare part support, and performance upgrades, signaling a new era of adaptability and user-centric innovation.

Analyzing the Cumulative Effects of 2025 United States Tariff Measures on Supply Chains, Component Costs, and Competitive Dynamics in Amphibious Vehicles

The imposition of targeted tariffs by the United States in 2025 has created a ripple effect across global supply chains for amphibious vehicle components. With duties applied on imported steel-reinforced track modules and select hybrid powertrain elements, manufacturers have been compelled to reassess sourcing strategies and localize production of critical subsystems. This recalibration has led to an uptick in domestic fabrication of rubber-bonded tracks and foam-filled wheel assemblies, thereby preserving cost competitiveness while ensuring compliance with trade regulations.

At the same time, aftermarket suppliers have felt upward pressure on prices for axial and mixed flow water jet parts, prompting both OEMs and end users to explore alternative distribution channels. Cross-border partnerships have emerged to facilitate bulk procurement agreements that mitigate tariff burdens, though these arrangements require careful navigation of domestic content requirements and certification processes. Notably, private owners and tour operators have demonstrated resilience by adopting extended maintenance schedules that optimize part lifespans and reduce replacement frequency.

In defense segments, the United States Marine Corps and Navy have initiated accelerated evaluation programs for domestically sourced battery systems and fuel cell stacks, aiming to offset volatility in international markets. These programs underscore a strategic shift toward self-reliance and underline the broader cumulative impact of tariff policies on procurement cycles, vehicle readiness, and long-term modernization objectives.

Deriving Actionable Insights from Detailed Segmentation Across Propulsion Types, Seating Capacities, End Users, and Distribution Channels

Under the lens of propulsion types, hybrid systems combining battery and fuel cell modules have gained traction among operators seeking lower emissions without sacrificing range. Concurrently, rubber-based track solutions have been reinforced with steel inserts to navigate unforgiving terrains, while water jet propulsion now leverages both axial designs for high efficiency and mixed flow units for superior maneuverability in variable conditions. Pneumatic wheels outfitted with advanced foam cores are increasingly deployed for rapid transitions between land and water, particularly in recreational and expedition contexts.

Seating capacity distinctions also inform product customization and market positioning. Manufacturers targeting group transport scenarios have developed robust platforms accommodating more than eight passengers, prioritizing stability and onboard amenities. Conversely, compact models designed for one to four occupants emphasize agility and ease of handling, with modular seating layouts that enable swift reconfiguration. Mid-capacity vehicles seating between five and eight strike a balance between payload versatility and operational footprint, making them well suited for research institutions and rental services.

End-user segmentation has spurred tailored value propositions across commercial, defense, and individual cohorts. Rental and tour operators demand turnkey solutions with integrated safety systems and straightforward maintenance protocols, while defense branches require hardened designs rated for amphibious assaults and rapid amphibious insertions. At the individual level, enthusiasts and private owners seek lightweight, trailered platforms that deliver both off-road thrills and on-water performance.

Meanwhile, distribution strategies are evolving in tandem. Original equipment manufacturers maintain direct sales channels to large fleet purchasers and government agencies, whereas aftermarket distributors specialize in accessories and spare parts to support localized service networks. This dual-channel ecosystem enables operators to access both complete vehicle solutions and tailored component upgrades, fostering a robust aftermarket community.

This comprehensive research report categorizes the Amphibious Vehicle market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Propulsion Type

- Seating Capacity

- End User

- Distribution Channel

Assessing Regional Variations and Growth Drivers in the Americas, Europe Middle East Africa, and Asia-Pacific Amphibious Vehicle Markets

Regional nuances play a pivotal role in shaping amphibious vehicle requirements and adoption rates around the world. In the Americas, vast coastal frontiers and extensive river systems have catalyzed demand for heavy-duty platforms optimized for search and rescue, oil spill response, and eco-tourism. Manufacturers in North America have responded by reinforcing hull designs and integrating advanced navigation suites capable of operating in remote, GPS-denied environments.

Across Europe, the Middle East, and Africa, regulatory emphasis on emission reduction and waterway preservation has driven the uptake of hybrid electric systems and axial water jet units. Cross-continental collaborations between maritime research centers and defense consortia have accelerated testing of fuel cell prototypes under extreme temperature variations, from arid desert lagoons to frigid northern fjords. The proliferation of shared procurement frameworks among neighboring countries has streamlined certification and logistics, reducing barriers to entry for new market entrants.

In the Asia-Pacific region, rapid infrastructure development and expanding adventure tourism portfolios have sparked growth in lightweight amphibious utility vehicles. Local OEMs have capitalized on cost-effective manufacturing bases to offer competitively priced models, while global brands have established joint ventures to penetrate emerging markets. Government incentives aimed at bolstering coastal security and supporting disaster relief efforts further underpin rising orders for specialized amphibious platforms in this diverse and dynamic market.

This comprehensive research report examines key regions that drive the evolution of the Amphibious Vehicle market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Amphibious Vehicle Manufacturers and Their Strategic Initiatives to Drive Innovation, Partnerships, and Market Penetration

Leading manufacturers continue to redefine competitive boundaries by investing in next-generation amphibious platforms and forging strategic alliances. Established pioneers such as Gibbs Technology have enhanced their propulsion portfolios by integrating cutting-edge fuel cell modules and predictive maintenance software. Meanwhile, high-performance innovators like WaterCar have introduced sports-oriented models that blend sleek automotive design with marine capabilities, appealing to affluent private buyers and boutique tour operators.

At the same time, defense-focused suppliers including defense contractors specializing in marine systems have collaborated with military research labs to validate new track and wheel configurations under combat simulation. Smaller disruptors have carved out niches by focusing on modular aftermarket solutions, offering a spectrum of accessory upgrades and retrofit kits that boost vehicle longevity and performance.

Across the board, strategic partnerships have emerged as a key driver of innovation. Joint ventures between propulsion specialists, sensor manufacturers, and software developers have accelerated the integration of autonomous navigation features and remote diagnostics. These collaborations underscore a shared commitment to elevating safety standards, reducing total cost of ownership, and unlocking new application areas in both civilian and defense operations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Amphibious Vehicle market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ARGO ULC

- BAE Systems plc

- General Dynamics Corporation

- Gibbs Technologies Limited

- Hydra-Trek, Inc.

- Iguana Yachts SAS

- Panther Westwinds Limited

- Rheinmetall AG

- Sealegs International Limited

- Textron Inc.

- WaterCar, Inc.

Strategic Recommendations for Industry Leaders to Capitalize on Emerging Trends, Optimize Operations, and Sustain Competitive Advantage in Amphibious Vehicles

To capitalize on the breadth of emerging opportunities in amphibious mobility, industry leaders should prioritize investment in hybrid and fuel cell technologies that align with tightening emission regulations while enhancing operational range. By establishing joint development agreements with battery and fuel cell innovators, organizations can advance platform standardization and accelerate time-to-market for next-generation models. In addition, streamlining supply chains for steel-reinforced tracks and mixed flow water jets through regional manufacturing hubs will mitigate tariff impacts and reduce lead times.

Furthermore, executives must foster collaboration with defense agencies and commercial end users to co-create tailored solutions that meet mission-critical requirements. Actively engaging in pilot programs and live-field demonstrations will yield valuable feedback for optimizing vehicle configurations and validating performance in real-world scenarios. In parallel, enhancing the aftermarket proposition by expanding the portfolio of certified accessories and spare part kits will strengthen customer loyalty and support recurring revenue streams.

Finally, companies should adopt a data-driven approach to market expansion, leveraging advanced analytics to identify under-served regions and niche use-cases. By aligning product roadmaps with regional policy incentives and end-user pain points, organizations can differentiate their offerings and achieve sustainable growth in this competitive environment.

Outlining the Rigorous Research Approach, Data Validation Processes, and Methodological Framework Underpinning Amphibious Vehicle Market Analysis

This analysis synthesizes insights from a multi-tiered research framework encompassing primary interviews with fleet operators, defense procurement officers, and private owners, complemented by consultation with propulsion experts and component suppliers. Secondary intelligence was gathered through trade publications, regulatory filings, and patent databases to ensure comprehensive coverage of technological evolutions and policy shifts. Data validation was conducted via cross-referencing supplier catalogs, certification records, and third-party maintenance logs to verify component performance and service frequency.

Geographical segmentation was mapped using regional deployment statistics, government incentive programs, and import-export data, allowing for nuanced insight into localized growth drivers and regulatory dynamics. The methodological framework also incorporated scenario analysis to evaluate the sensitivity of cost components and supply chain disruptions under varying tariff scenarios. Qualitative assessments were enriched with expert judgment, weighting factors such as environmental mandates, end-user adoption barriers, and aftermarket support infrastructure.

This rigorous approach ensures that the findings present an accurate reflection of current market realities and equip stakeholders with the analytical foundation required to make informed strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Amphibious Vehicle market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Amphibious Vehicle Market, by Propulsion Type

- Amphibious Vehicle Market, by Seating Capacity

- Amphibious Vehicle Market, by End User

- Amphibious Vehicle Market, by Distribution Channel

- Amphibious Vehicle Market, by Region

- Amphibious Vehicle Market, by Group

- Amphibious Vehicle Market, by Country

- United States Amphibious Vehicle Market

- China Amphibious Vehicle Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Synthesizing Critical Findings and Implications to Provide a Comprehensive Perspective on the Future Trajectory of Amphibious Vehicles

In conclusion, the amphibious vehicle landscape is undergoing a pronounced transformation propelled by advancements in hybrid propulsion, modular design innovations, and heightened environmental imperatives. The cumulative impact of 2025 tariff measures has underscored the strategic importance of localized manufacturing and supply chain resilience. When viewed through the lens of detailed segmentation, end users benefit from platforms tailored to specific capacity, propulsion, and performance needs, while regional dynamics reveal distinct regulatory and growth profiles across global markets.

As leading manufacturers and emerging disruptors deepen collaborations across defense, academic, and commercial spheres, the collective emphasis on digital integration and sustainable technologies will further accelerate market evolution. Organizations that adopt the actionable recommendations outlined herein-prioritizing next-generation powertrains, optimizing distribution channels, and leveraging data analytics-are best positioned to capture value and drive the future trajectory of amphibious mobility.

Ultimately, this report provides a holistic synthesis of trends, challenges, and opportunities, offering stakeholders a clear roadmap for navigating the complex interplay of innovation, regulation, and shifting end-user demands in the amphibious vehicle sector.

Engage with Ketan Rohom to Secure Your Comprehensive Amphibious Vehicle Market Research Report and Unlock Strategic Industry Insights Today

To secure unparalleled strategic insights and gain a competitive edge in the rapidly evolving amphibious vehicle market, engage directly with Ketan Rohom, Associate Director of Sales & Marketing. His deep expertise in market trends and buyer requirements ensures that your organization receives tailored guidance on translating data-driven findings into actionable strategies. By purchasing the comprehensive research report, you will obtain exclusive access to in-depth analyses of propulsion innovations, regional dynamics, segmentation nuances, and tariff impacts specific to 2025.

Partnering with Ketan Rohom guarantees hands-on support throughout your decision-making process, from interpreting complex market signals to crafting bespoke go-to-market plans that resonate with key stakeholders. Reach out to initiate a personalized consultation, review sample report excerpts, and unlock priority delivery options. Your investment in this research will empower your leadership team to anticipate emerging opportunities, mitigate potential risks, and accelerate growth in both civilian and defense sectors. Act now to transform insights into measurable results and position your organization at the forefront of amphibious vehicle innovation.

- How big is the Amphibious Vehicle Market?

- What is the Amphibious Vehicle Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?