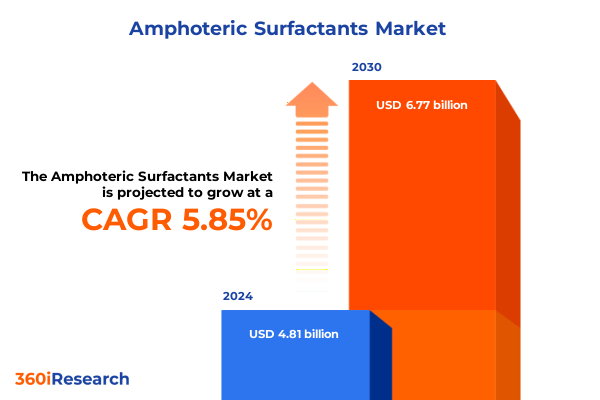

The Amphoteric Surfactants Market size was estimated at USD 4.81 billion in 2024 and expected to reach USD 5.08 billion in 2025, at a CAGR of 5.85% to reach USD 6.77 billion by 2030.

Unveiling Foundations of Amphoteric Surfactants and Their Integral Importance Across Cosmetic, Industrial, and Pharmaceutical Formulation Landscapes

Amphoteric surfactants occupy a unique position in the world of surface-active agents, exhibiting both cationic and anionic characteristics depending on the surrounding pH. This dual-charge behavior imparts exceptional versatility, making these molecules invaluable in applications ranging from personal care formulations to industrial cleaning processes. Unlike purely anionic or cationic surfactants, amphoteric varieties can adapt their charge state in situ, which enhances their mildness on skin and hair surfaces and ensures compatibility with a broad spectrum of active ingredients and raw materials.

Emerging alongside the demand for gentler and multifunctional ingredients, these surfactants have steadily gained prominence within rigorous regulatory environments that prioritize biodegradability and low toxicity. Innovations in synthetic pathways and renewable feedstocks have further broadened the scope of available chemistries, opening new pathways for formulation scientists. As a result, formulators now enjoy a rich palette of molecular structures-ranging from amine oxides to sulfobetaines-that can be fine-tuned to meet specific performance metrics such as foaming, conditioning, emulsification, and antimicrobial efficacy.

Exploring Cutting-Edge Material Innovations and Digitalization Driving Next-Generation Amphoteric Surfactant Development

The amphoteric surfactant ecosystem has undergone transformative shifts driven by evolving consumer preferences, stringent sustainability mandates, and breakthroughs in green chemistry. In recent years, the rise of bio-based feedstocks has fueled the development of natural-based materials that reduce environmental impact without compromising performance. Concurrently, improvements in catalyst systems have enabled more efficient manufacturing processes, thereby lowering production costs and minimizing waste streams.

Alongside these material advancements, digitalization and enhanced analytical methods have revolutionized quality control and product development timelines. High-throughput screening and predictive modeling now allow formulators to simulate surfactant behavior under diverse conditions, accelerating innovation cycles. Furthermore, the convergence of personal care and home care sectors has spurred the creation of multifunctional products that leverage the adaptive charge properties of amphoteric surfactants to deliver cleansing, conditioning, and antimicrobial benefits in a single formulation. As a result of these shifts, industry participants are increasingly prioritizing R&D collaborations, tech partnerships, and bespoke ingredient design to stay ahead of the competition and meet the nuanced demands of modern consumers.

Assessing How Newly Introduced U.S. Tariff Measures in 2025 Have Reshaped Supply Chains and Cost Dynamics for Amphoteric Surfactants

The imposition of new tariffs by the United States government in early 2025 has introduced a complex layer of cost considerations for manufacturers relying on imported amphoteric surfactant raw materials. Although some domestic capacity expansion efforts are underway to alleviate dependence on foreign supply, the current tariff structure has elevated landed costs and prompted several buyers to revisit their procurement strategies. These increased costs have translated into higher input prices for downstream formulators, who are now tasked with balancing margin preservation against the imperative of maintaining product affordability for end consumers.

In response, many organizations have undertaken supply chain reconfiguration initiatives, forming closer alliances with domestic producers and exploring alternative chemistries that may be sourced outside tariff jurisdictions. Simultaneously, lean manufacturing and continuous-flow reaction technologies are being prioritized to optimize raw material yields and reduce waste. These strategic adjustments are instrumental in mitigating the impact of tariffs while preserving the robust performance attributes that amphoteric surfactants contribute to diverse applications from home care formulations to advanced pharmaceutical intermediates.

Delving into Comprehensive Segmentation Perspectives to Uncover Niche Opportunities and Formulation Advantages

A closer examination of the market through multiple lenses reveals distinct areas of opportunity and differentiation. When categorized by chemical classification, the spectrum ranges from Amine Oxide-Based materials-where formulators may choose between Alkylamidoamine Oxides or simpler Alkylamine Oxides-to Betaine-Based variants that include Sulfobetaines alongside Alkylbetaines and Alkylamidobetaines. Beyond these dominant types, Amphopropionates offer unique mildness profiles, appealing to sensitive-skin applications. Product form choices between liquid and powder formats address diverse logistical and formulation needs, with powders often favored for concentrated, dry-mix applications and liquids preferred for rapid solubilization.

Source considerations span natural-based feedstocks, which align with green marketing narratives, versus synthetic-based routes that offer tighter consistency and scale. Grade distinctions-cosmetic, food, industrial, and pharmaceutical-dictate purity thresholds and regulatory compliance parameters. Functional applications encompass roles as cleansing agents, conditioning agents, disinfectants and sanitizers, emulsifiers, foaming agents, and wetting agents, each requiring tailored performance specifications. Finally, end-use industries stretch across food and beverage, home care (including dishwashing liquids, laundry detergents, and surface cleaners), oil and gas, paints and coatings, personal care and cosmetics (covering baby products, hair care, and skin care), pharmaceutical, and textile sectors. Distribution channels balance traditional offline procurement against the growing influence of online platforms, which increasingly serve as important gateways for specialty ingredient sourcing.

This comprehensive research report categorizes the Amphoteric Surfactants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Product Form

- Source

- Grade

- Application

- End-Use Industry

- Distribution Channel

Evaluating Regional Market Dynamics Highlighting Regulatory Rigor in Europe and Accelerated Growth across Asia-Pacific Nations

Regionally, the Americas continue to hold a significant share of demand, driven by well-established personal care and home care markets in North America as well as a burgeoning interest in natural-based ingredients throughout South America. Manufacturers in this region emphasize regulatory compliance and sustainability certifications, reflecting a mature value chain that supports innovation in green chemistry. Transitioning to Europe, the Middle East, and Africa, regulatory landscapes are particularly rigorous, with the E.U.’s REACH framework imposing strict controls on chemical registrations and ensuring that only the safest, most environmentally considerate amphoteric surfactants penetrate the market.

Meanwhile, the Asia-Pacific region is characterized by dynamic growth, underpinned by rapid urbanization, expanding middle-class populations, and rising per capita spending on personal care and household cleaning products. Domestic capacity investments in China, India, and Southeast Asia are expanding rapidly, supported by government initiatives that incentivize local production of specialty raw materials. These regional developments collectively underscore the need for global manufacturers and distributors to adopt tailored go-to-market strategies that account for distinct regulatory regimes, consumer preferences, and sourcing dynamics across the Americas, EMEA, and Asia-Pacific landscapes.

This comprehensive research report examines key regions that drive the evolution of the Amphoteric Surfactants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting How Industry Leaders and Agile Innovators Are Crafting Strategic Alliances to Advance Next-Generation Surfactant Technologies

Leading the amphoteric surfactant arena, major chemical producers are consistently investing in advanced R&D facilities to develop next-generation formulations that comply with tightening environmental and safety standards. These companies leverage integrated global supply networks to ensure reliable raw material sourcing and to manage cost fluctuations. Through strategic acquisitions and joint ventures, they are broadening their product portfolios-encompassing amine oxide chemistries, betaine variants, and amphopropionate innovations-aimed at serving both established and emerging markets.

In parallel, agile specialty ingredient firms are carving out competitive niches by focusing on highly purified grades for use in pharmaceuticals and premium personal care products. Their expertise in continuous manufacturing and modular plant designs offers an advantage in responding swiftly to bespoke customer requests and small-batch orders. Across the spectrum, strategic alliances between multinational giants and niche innovators are fostering collaborative platforms that accelerate product co-development, driving the rapid commercialization of amphoteric surfactants tailored to specific end-use requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Amphoteric Surfactants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adeka Corporation

- Aekyung Chemical

- Alfa Chemistry

- Arkema S.A.

- ATAMAN Kimya A.S.

- BASF SE

- ChemQuest International, Inc.

- Clariant International Ltd

- Croda International PLC

- Dow Inc.

- Enaspol A.S.

- EOC Group

- Evonik Industries AG

- Galaxy Surfactants Ltd

- Indovinya by Indorama Ventures

- Innospec Inc.

- Julius Hoesch GmbH & Co. KG

- KAO Corporation

- Libra Speciality Chemicals Limited

- LION SPECIALTY CHEMICALS CO., LTD.

- Lubrizol Corporation

- Merck KgaA

- Nanjing Chemical Material Corp.

- New Japan Chemical Co., Ltd.

- NOF Corporation

- Nouryon Chemicals Holding B.V.

- Pilot Chemical Company

- SANYO CHEMICAL INDUSTRIES, LTD.

- Sasol Limited

- SEPPIC S.A.

- Solvay S.A.

- Stepan Company

- STOCKMEIER Group

- Verdant Specialty Solutions by Samyang Holdings Corporation

- Zschimmer & Schwarz GmbH & Co KG

Actionable Strategies for Manufacturers to Navigate Tariff Pressures and Propel Sustainable, Agile Surfactant Production Models

Industry players must prioritize the diversification of their raw material supply base to circumvent tariff-induced cost pressures and ensure uninterrupted production. By deepening partnerships with regional producers and exploring alternative natural feedstocks, formulators can achieve greater security and cost-effectiveness. Integrating robust digital tools-such as predictive formulation software and real-time quality monitoring-will further streamline product development cycles and enhance process efficiencies.

Moreover, investing in sustainability certifications and life-cycle assessments will be critical to demonstrating compliance and building brand trust among eco-conscious consumers. We recommend adopting flexible manufacturing infrastructures, including continuous-flow reactors, to quickly switch between surfactant chemistries and respond to market shifts. Finally, establishing cross-functional teams that bridge R&D, regulatory affairs, and commercial strategy will enable organizations to accelerate innovation and launch differentiated products that address diverse application needs from cleansing to emulsification.

Outlining a Robust Research Approach Integrating Stakeholder Engagement, Data Triangulation, and Regulatory Analysis

The insights presented here are derived from a rigorous research process combining primary stakeholder interviews with chemical manufacturers, formulators, and end users across key regions. Secondary data was gathered through an exhaustive review of patent filings, scientific journals, industry white papers, and regulatory documentation. In addition, comprehensive analyses of trade flow data and tariff schedules were performed to evaluate cost impact scenarios. This multi-faceted approach ensured a balanced view that integrates quantitative data with qualitative perspectives.

Furthermore, custom surveys and focus group discussions provided a granular understanding of formulator preferences and emerging performance expectations. All findings were validated through triangulation across multiple information sources to minimize bias and enhance reliability. The final report structure balances market segmentation insights, competitive benchmarking, and actionable recommendations, supported by detailed appendices that document research methodologies and data sources for full transparency.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Amphoteric Surfactants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Amphoteric Surfactants Market, by Type

- Amphoteric Surfactants Market, by Product Form

- Amphoteric Surfactants Market, by Source

- Amphoteric Surfactants Market, by Grade

- Amphoteric Surfactants Market, by Application

- Amphoteric Surfactants Market, by End-Use Industry

- Amphoteric Surfactants Market, by Distribution Channel

- Amphoteric Surfactants Market, by Region

- Amphoteric Surfactants Market, by Group

- Amphoteric Surfactants Market, by Country

- United States Amphoteric Surfactants Market

- China Amphoteric Surfactants Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Synthesizing Key Findings on Amphoteric Surfactant Evolution and Strategic Imperatives for Future Growth

Amphoteric surfactants stand at the crossroads of innovation and sustainability, offering versatile performance that meets the stringent demands of modern applications. Their adaptive chemistry, coupled with advancements in green feedstocks and digital development tools, has redefined formulation possibilities in personal care, home care, pharmaceuticals, and beyond. While recent tariff developments introduce new complexities, they also serve as catalysts for supply chain optimization and strategic realignment.

As market participants navigate these evolving dynamics, those who embrace diversified sourcing, sustainable manufacturing, and collaborative product development will secure a competitive edge. The integration of advanced manufacturing technologies and data-driven decision-making will further empower industry leaders to deliver differentiated, high-performance formulations. In this rapidly changing environment, a comprehensive understanding of segmentation nuances, regional dynamics, and competitive landscapes is essential for driving growth and resilience.

Unlock Strategic Advantages and Detailed Insights on Amphoteric Surfactants by Engaging Directly with Our Associate Director

Ready to gain a deeper understanding of how amphoteric surfactants can transform your product formulations and drive competitive advantage? Contact Ketan Rohom, Associate Director of Sales & Marketing at 360i, to learn more about the comprehensive market research report that provides actionable insights, detailed segmentation analysis, and strategic guidance tailored to your business needs. Elevate your decision-making process by accessing exclusive data and customized recommendations that will empower you to capitalize on emerging opportunities and navigate market challenges with confidence.

- How big is the Amphoteric Surfactants Market?

- What is the Amphoteric Surfactants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?