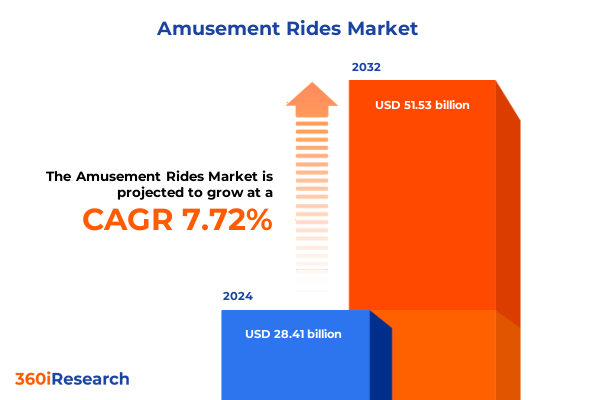

The Amusement Rides Market size was estimated at USD 30.59 billion in 2025 and expected to reach USD 32.94 billion in 2026, at a CAGR of 7.73% to reach USD 51.53 billion by 2032.

Setting the Stage for Innovation and Growth in the Amusement Rides Industry Amidst Shifting Consumer Preferences and Technological Advances

The amusement rides sector is undergoing a period of remarkable transformation driven by evolving consumer preferences for immersive and experiential leisure activities. As families and thrill-seekers increasingly prioritize unique, memorable outings, operators are under mounting pressure to innovate across ride design, guest engagement and operational efficiency. Driven by rising disposable incomes and pent-up travel demand, the industry has witnessed a resurgence in attendance, supported by forecasts from the U.S. Travel Association projecting nearly two billion domestic trips in 2025 which underscores the scale of opportunity for parks to capture new and returning visitors.

While traditional factors such as location and seasonal programming remain foundational, technology has emerged as a key differentiator. Amusement parks are integrating artificial intelligence to monitor ride occupancy in real time, dynamically adjusting operations to reduce wait times and optimize throughput. This convergence of data-driven decision-making and guest-centric design is reshaping how operators configure park layouts and sequence attractions to sustain engagement throughout the day.

Unprecedented Technological Sustainable and Experiential Shifts Redefining the Amusement Rides Landscape for Operators and Visitors Alike

Over the past twelve months, the industry has experienced transformative shifts as operators leverage emerging technologies to elevate guest experiences while balancing cost pressures. Artificial intelligence platforms now enable predictive maintenance and real-time queue management, reducing downtime and improving ride reliability. Vision AI systems monitor ride capacity, alerting staff to potential delays before they escalate and ensuring more seamless guest flows.

Simultaneously, sustainability has become a core strategic pillar, with parks investing in energy-efficient ride systems and green infrastructure. Solar arrays are powering select attractions, while innovations such as kinetic-energy recovery on water rides are minimizing environmental impact. Parks are also exploring eco-friendly materials for construction and operation, responding to growing consumer demand for responsible entertainment venues amidst increasing regulatory scrutiny on carbon emissions.

Assessing the Far-Reaching Consequences of 2025 Tariff Volatility on Ride Manufacturing Costs Operators Supply Chains and Profitability

The volatility of U.S. trade policy in 2025 has exerted significant influence on ride manufacturing and supply chain economics. Over the first half of the year, tariffs on imports from China oscillated sharply, beginning at 10% in February, spiking to 145% in April, then stabilizing around 55% by mid-year. This unpredictability has elevated costs for steel structures, ride components and game prizes sourced abroad, creating a ripple effect across procurement strategies.

To mitigate these headwinds, many operators have accelerated procurement cycles, ordering parts months in advance of planned ride installations. Some have elected to absorb the additional levies rather than pass costs onto visitors, prioritizing price stability for local communities. Looking ahead, long-term contracts and diversified sourcing from lower-tariff regions are emerging as essential measures to shield operators from further policy-driven cost escalations.

Deep Dive into Critical Segmentation Dimensions Shaping Ride Types End-Users Operational Modes Materials and Installation Environments

Insight into the amusement rides market emerges from a multifaceted segmentation framework that captures the diversity of offerings and end-user environments. By ride type, the sector spans from immersive dark rides to family-oriented carousels, observation towers and train experiences, through high-thrill roller coasters powered by steel or wooden tracks, right down to water attractions like flume rides, river rapids and water slides, and simulator experiences requiring advanced projection systems.

From the perspective of end users, the demand landscape encompasses large-scale amusement and theme parks, family entertainment centers, and water parks-each differentiated by indoor facilities, public venues or resort-based operations. Operationally, rides fall into portable units suited for temporary carnivals or fairs, while stationary installations serve as permanent fixtures within major parks.

Material construction further distinguishes offerings, with composite assemblies, steel frameworks and wooden structures each presenting unique maintenance and aesthetic considerations. Finally, installation location-whether indoors under controlled climates or exposed outdoor environments-shapes engineering requirements, affecting design for weather resilience, lighting integration and guest comfort.

This comprehensive research report categorizes the Amusement Rides market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Ride Type

- Operation Mode

- Construction Material

- Installation Location

- End User

Regional Dynamics Shaping Amusement Rides Growth Patterns Insights from the Americas EMEA and Asia-Pacific Markets in 2025

Regional dynamics play a pivotal role in defining growth trajectories and investment priorities across the global amusement rides arena. In the Americas, domestic travel trends remain robust as operators capitalize on local vacation patterns and affordable staycation alternatives. Many mid-size parks are reporting rising attendance as families pivot from international trips to regional destinations where ticket prices and ancillary spend align with tightened budgets.

Across Europe, the Middle East and Africa, market recovery continues at varied paces, influenced by economic cycles and tourism inflows. Western Europe’s established parks emphasize experiential upgrades and sustainable retrofits, while Middle Eastern megaprojects are rolling out expansive new developments such as Qiddiya’s multi-billion-dollar entertainment hub that integrates immersive technologies with large-scale attractions to appeal to a broad demographic.

In Asia-Pacific, burgeoning demand in China, India and Southeast Asia is driving rapid expansion of both domestic and foreign flagship parks. Investments are focused on technology-rich attractions and VR-integrated experiences designed to meet the expectations of a digitally native consumer base, positioning the region as a key growth frontier in the amusement rides landscape.

This comprehensive research report examines key regions that drive the evolution of the Amusement Rides market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Manufacturers and Innovators Steering the Future of Amusement Ride Design Engineering and Global Deployment Strategies

The amusement ride manufacturing ecosystem is dominated by a handful of leading engineering firms that set global benchmarks for innovation, safety and customization. Intamin, headquartered in Switzerland, commands one of the largest shares of custom coaster installations worldwide and is renowned for record-breaking thrill rides that combine hydraulic launch systems with advanced control architectures.

Vekoma, based in the Netherlands, offers a versatile portfolio encompassing dark rides, roller coasters and family attractions, leveraging modular design principles to enable rapid deployment across diverse market segments. Its global after-sales service network ensures consistent performance for long-term ride operations. Germany’s Mack Rides, with its centuries-old heritage, focuses on family-friendly attractions and bespoke coaster configurations, emphasizing smooth ride dynamics and robust safety certification. Collectively, these manufacturers and several specialized boutique firms continue to shape industry standards through relentless R&D investment and close collaboration with theme park operators around the globe.

This comprehensive research report delivers an in-depth overview of the principal market players in the Amusement Rides market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABC Engineering AG

- Amusement Devices Manufacturing, LLC

- Antonio Zamperla S.p.A.

- Bolliger & Mabillard Inc.

- Chance Rides, LLC

- Fabbri Group

- Gerstlauer Amusement Rides GmbH

- Great Coasters International, Inc.

- Intamin AG

- MACK Rides GmbH & Co. KG

- Majestic Manufacturing Inc.

- Maurer Rides GmbH

- MOSER’S RIDES SRL

- Pinfari Coaster Co. LTD. Srl

- Premier Rides

- qitele GROUP CO.,Ltd

- Rocky Mountain Construction

- S&S Worldwide

- Sally Industries, Inc.

- Six Flags Entertainment Corporation

- Sunkid GmbH

- TECHNICAL PARK S.N.C.

- The Gravity Group, LLC

- Vekoma Rides Manufacturing B.V. by Sansei Technologies Inc.

- ZIERER Karussell‐ und Spezialmaschinenbau GmbH & Co. KG

Strategic Recommendations for Industry Leaders to Navigate Tariff Pressures Embrace Innovation and Capitalize on Emerging Market Opportunities

To navigate the prevailing policy and market uncertainties, industry leaders should adopt a proactive supply chain strategy that includes securing long-term component contracts and establishing relationships with secondary suppliers outside of high-tariff territories. This approach reduces exposure to sudden cost shifts and enhances negotiation leverage.

Simultaneously, operators must prioritize the integration of advanced digital solutions-ranging from AI-driven queue management to VR-enhanced ride experiences-to foster differentiated offerings that command premium engagement. Investing in modular, sustainable ride systems will enable swift adaptation to evolving consumer expectations and regulatory requirements, while partnerships with technology providers can accelerate the introduction of next-generation attractions without the burden of full in-house development.

Robust Research Framework Combining Primary Interviews Secondary Data Triangulation and Expert Validation for Comprehensive Industry Analysis

This analysis is founded on a robust methodology that combines comprehensive secondary research with targeted primary interviews. Industry publications, trade association reports and financial filings were systematically reviewed to establish a data-driven foundation. Supplementary insights were gathered through in-depth interviews with park operators, ride manufacturers and technology suppliers to capture firsthand perspectives on operational challenges and strategic priorities.

Data triangulation techniques were employed to reconcile disparate information sources and validate emerging trends. The resulting findings were further refined through expert workshops and peer review sessions, ensuring that the conclusions presented herein reflect an accurate and holistic understanding of the current state and future trajectory of the amusement rides industry.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Amusement Rides market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Amusement Rides Market, by Ride Type

- Amusement Rides Market, by Operation Mode

- Amusement Rides Market, by Construction Material

- Amusement Rides Market, by Installation Location

- Amusement Rides Market, by End User

- Amusement Rides Market, by Region

- Amusement Rides Market, by Group

- Amusement Rides Market, by Country

- United States Amusement Rides Market

- China Amusement Rides Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesis of Critical Findings Charting the Path Forward for Amusement Ride Stakeholders in an Era of Dynamic Change and Emerging Technologies

The collective insights assembled in this executive summary underscore an industry at an inflection point, driven by technological innovation, shifting consumer behavior and evolving policy dynamics. While tariff volatility has introduced complexity to cost management, forward-looking operators are leveraging advanced procurement techniques and supply diversification to mitigate risk.

At the same time, the adoption of immersive technologies such as augmented reality, AI-driven operations and sustainable ride designs is redefining guest experiences and elevating park differentiation. As regional growth patterns diverge across the Americas, EMEA and Asia-Pacific, strategic agility and investment in modular, eco-conscious infrastructure will be paramount for sustaining competitive advantage. By aligning operational excellence with a commitment to innovation, industry stakeholders can chart a resilient path forward amid a landscape of continuous change.

Engage with Ketan Rohom to Access Tailored Market Insights That Drive Strategic Decisions and Accelerate Growth

Elevate your strategic planning and operational excellence by partnering with Ketan Rohom, Associate Director of Sales & Marketing, who brings deep industry knowledge and a keen understanding of market dynamics tailored to your needs. Engage directly to discuss how this comprehensive executive summary can guide your decision-making, optimize your investment roadmap, and fortify your competitive positioning. Reach out today to secure the full market research report and unlock actionable insights that will drive growth and innovation across your amusement rides portfolio.

- How big is the Amusement Rides Market?

- What is the Amusement Rides Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?