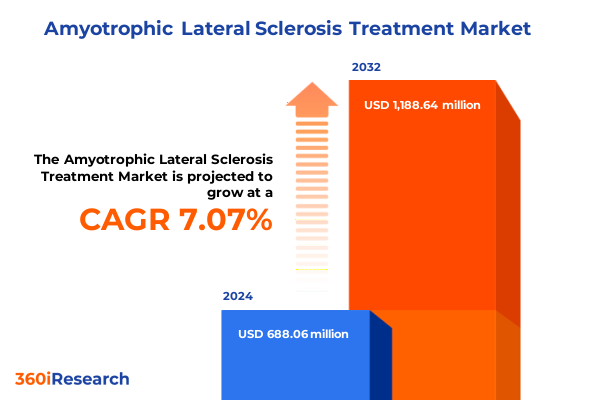

The Amyotrophic Lateral Sclerosis Treatment Market size was estimated at USD 761.13 million in 2025 and expected to reach USD 816.08 million in 2026, at a CAGR of 7.38% to reach USD 1,253.38 million by 2032.

Pioneering the fight against ALS with evolving therapeutic breakthroughs that redefine patient care and address unmet clinical needs

Amyotrophic lateral sclerosis (ALS) is a relentlessly progressive neurodegenerative disorder characterized by the irreversible loss of motor neurons in the brain and spinal cord. Over time, this neuronal damage manifests clinically as muscle weakness, impaired speech, dysphagia, and ultimately respiratory failure, leading to an average life expectancy of three to five years following symptom onset. Despite decades of research, the precise etiology of ALS remains multifactorial, involving genetic predispositions, oxidative stress pathways, excitotoxicity, and neuroinflammation. Traditionally, treatment options were limited to symptomatic care and modestly effective therapies aimed at slowing disease progression rather than halting or reversing neuronal damage.

The first pharmacologic milestone arrived in 1995 with the approval of riluzole, an oral antiglutamatergic agent that demonstrated a modest extension of survival by reducing excitotoxic motor neuron death. More than two decades later, edaravone gained regulatory approval in 2017 as an intravenous free-radical scavenger that slowed functional decline by approximately one-third over six months in pivotal clinical trials. Edaravone’s oral suspension formulation received FDA endorsement in 2022, enhancing patient convenience without compromising efficacy. In late 2022, the fixed-dose combination of sodium phenylbutyrate and taurursodiol (Relyvrio) emerged as an oral therapy demonstrating the potential to slow motor function loss, though ongoing confirmatory studies will determine its long-term clinical benefit.

In April 2023, the RNA-targeted antisense oligonucleotide tofersen received accelerated approval for SOD1-mutant ALS, marking the first therapy to directly target a genetic cause of the disease. This milestone underscores a broader shift toward precision medicine, biomarker-driven development, and innovative modalities such as gene therapy and stem cell approaches that are now advancing through clinical pipelines. As research efforts intensify and regulatory agencies adapt to novel endpoints, the ALS therapeutic landscape is poised for transformative growth.

Embracing paradigm-shifting innovations across RNA therapies, gene and cell modalities, and digital endpoints that reshape future ALS treatment strategies

The ALS treatment landscape is undergoing a series of paradigm-shifting developments that extend far beyond incremental improvements. RNA-targeted approaches like tofersen have opened the door to genetic precision therapies, validating neurofilament light chain as a surrogate biomarker and accelerating development pathways for other mutation-specific candidates. Concurrently, the oral antioxidant combination of sodium phenylbutyrate and taurursodiol has demonstrated the feasibility of repurposing metabolic and mitochondrial modulators to mitigate neuronal stress, challenging the assumption that high-complexity infusions are the only avenue for meaningful impact.

Advances in gene transfer technologies are leveraging adeno-associated viral vectors to deliver neuroprotective genes directly to affected motor neurons, with several early-stage studies reporting encouraging safety and distribution profiles. On the cell therapy front, mesenchymal stem cells and induced pluripotent stem cell-derived motor neuron progenitors have progressed into Phase 2 trials, signaling confidence in their translational potential to support neural repair. These innovative modalities benefit from adaptive trial designs and real-world evidence frameworks that streamline enrollment and generate actionable clinical insights more rapidly than traditional models.

Beyond laboratory innovation, digital health platforms are integrating remote monitoring, wearable sensors, and patient-reported outcome analytics to capture subtle changes in motor performance, respiratory function, and quality of life. These data-driven methodologies are reshaping endpoint selection, enabling more efficient go-no-go decisions and fostering patient-centric trial experiences. As regulators and payers align on value-based reimbursement and accelerated evidence pathways, the ALS therapy ecosystem is poised to deliver increasingly personalized, mechanism-driven interventions that redefine standards of care.

Understanding the unfolding effects of comprehensive 2025 U.S. tariffs on ALS therapy supply chains, ingredient costs, and strategic manufacturing shifts

The introduction of sweeping import tariffs in 2025 has created a complex cost and supply chain environment for ALS therapies and their raw materials. A blanket 10 percent global tariff on nearly all goods entering the United States has directly increased the cost of active pharmaceutical ingredients sourced internationally, prompting pharmaceutical manufacturers to reassess sourcing strategies and absorb elevated production expenses. Further compounding these challenges, tariffs of up to 245 percent on Chinese imports-encompassing critical generic drug APIs-risk substantial cost escalation and potential shortages if alternative suppliers cannot meet demand.

In North America, the imposition of 25 percent duties on medical devices and materials from Canada and Mexico has pressured device manufacturers and healthcare providers to consider reshoring or diversifying production, often at the expense of operational efficiency. Stakeholder concern is mounting that continued tariff volatility could undermine patient access to infusion pumps, diagnostic tools, and neurorehabilitation devices essential for comprehensive ALS care. Major players have responded by negotiating long-term supply contracts with domestic producers, investing in localized manufacturing capacity, and collaborating with government agencies to obtain targeted tariff exemptions.

Although temporary exclusions have shielded some critical medical supplies, their expiration timeline remains uncertain, reinforcing the need for robust supply chain resilience. Industry leaders are accelerating onshore API synthesis capabilities and exploring strategic partnerships with regional CDMOs to minimize tariff exposure. By proactively diversifying supplier networks and championing policy dialogue, biopharma companies can navigate this turbulent trade landscape while safeguarding continuity of care for ALS patients.

Deep strategic insights into ALS treatment segmentation across modalities, disease profiles, administration routes, and distribution pathways

A granular understanding of ALS treatment segmentation reveals the nuances driving therapeutic differentiation and adoption. Treatment modalities encompass both traditional small-molecule medications-such as the antiglutamatergic agent riluzole, the free-radical scavenger edaravone, the mitochondrial and ER-stabilizing combination sodium phenylbutyrate/taurursodiol, and the mutation-targeted antisense oligonucleotide tofersen-and emerging advanced therapies, including gene transfer vectors and stem cell-derived neuronal progenitors. These categories reflect a continuum from symptomatic modulation to precision-driven disease interception.

Disease type segmentation distinguishes the approximately two percent of patients with familial SOD1-mutation ALS from those with sporadic presentations, underscoring the need for both broad-spectrum neuroprotective strategies and highly focused genetic interventions. Treatment stage considerations further stratify the population into early, mid, and advanced cohorts, with early-stage interventions increasingly leveraging biomarker-guided enrollment and adaptive dosing to optimize long-term functional preservation. Route of administration also plays a pivotal role in patient and caregiver burden, spanning intrathecal delivery for ASOs, intravenous infusions for monoclonal and neuroprotective biologics, and oral formulations that offer at-home convenience.

Finally, distribution pathway segmentation highlights the central role of institutional channels-hospital pharmacies equipped for complex infusible regimens-versus retail specialty pharmacies that facilitate outpatient access to oral and subcutaneous therapies. Understanding these layered segmentation dimensions allows stakeholders to tailor clinical development, market access, and patient support programs to the unique needs of each ALS subpopulation.

This comprehensive research report categorizes the Amyotrophic Lateral Sclerosis Treatment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Treatment

- Type

- Treatment Stage

- Route of Administration

- Line Of Therapy Strategy

- Patient Age Group

- Care Setting

- Distribution Channel

Regional differentiation in ALS treatment uptake shaped by regulatory frameworks, reimbursement models, and local manufacturing capabilities

Regional landscapes for ALS treatment are characterized by varying regulatory pathways, infrastructure capabilities, and adoption rates. In the Americas, the United States leads with a robust regulatory framework that has approved multiple therapies-ranging from riluzole and edaravone to Relyvrio and the antisense oligonucleotide tofersen-while Canada offers conditional authorizations for select agents, reflecting collaborative Health Canada and FDA review processes and expanding patient access to innovative modalities.

Europe, the Middle East, and Africa present a heterogeneous environment in which the European Medicines Agency’s centralized approval of advanced therapies sits alongside country-specific reimbursement policies that influence real-world adoption. The combination therapy Relyvrio is under EMA review for marketing authorization, while edaravone’s intravenous and oral formulations have garnered approvals in key European markets. National funding mechanisms and orphan drug incentives across Europe and select Middle Eastern nations are pivotal in enabling early access programs and shaping commercial viability.

Asia-Pacific markets display a dynamic convergence of public and private sector initiatives. Japan was an early adopter of edaravone in 2015, with subsequent approvals in South Korea and Southeast Asian countries accelerating adoption. Regulatory authorities in Australia and New Zealand have also embraced conditional approvals for genetic and metabolic therapies, driving clinical trial activity in collaboration with regional centers of excellence. Across Asia-Pacific, investments in domestic manufacturing, governmental orphan drug incentives, and growing patient advocacy networks are fostering a fertile ecosystem for next-generation ALS interventions.

This comprehensive research report examines key regions that drive the evolution of the Amyotrophic Lateral Sclerosis Treatment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlight on leading ALS industry participants forging breakthroughs through antisense, oxidative stress modulation, gene transfer, and collaborative partnerships

The competitive landscape for ALS therapies features a blend of established pharmaceutical giants and emerging biotech innovators driving pipeline diversification. Biogen, in partnership with Ionis Pharmaceuticals, achieved a landmark approval with tofersen for SOD1-ALS, leveraging antisense technology and biomarker validation to secure accelerated pathways. Mitsubishi Tanabe Pharma has extended edaravone’s clinical utility by introducing its oral suspension, expanding options for outpatient and home-based administration while reinforcing commitment to oxidative stress reduction as a therapeutic mechanism.

Amylyx Pharmaceuticals’ Relyvrio demonstrated the strategic value of targeting cellular stress pathways through small-molecule combinations, although its mixed clinical outcomes underscore the importance of robust phase 3 validation. Emerging players are exploring gene therapy platforms, with several RNA-interference and viral-vector programs in early development targeting C9orf72, FUS, and other ALS-related genes. Stem cell-focused companies are advancing mesenchymal and neural progenitor formulations that aim to support neuroprotection and local trophic signaling.

Strategic collaborations and licensing agreements are accelerating access to proprietary technologies, with cross-sector partnerships enabling innovative trial designs and co-development of companion diagnostics. CDMOs and specialty pharmacies play essential roles in scalable manufacturing and distribution, ensuring that infusion centers and home-based infusion programs can efficiently deliver complex biologics and nucleic acid therapeutics. As global leaders align on value-based contracts and patient support initiatives, competitive dynamics will center on differentiating real-world efficacy, safety, and patient experience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Amyotrophic Lateral Sclerosis Treatment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Tanabe Pharma Corporation

- Biogen Inc.

- Novartis AG

- Amylyx Pharmaceuticals, Inc.

- Dewpoint Therapeutics, Inc.

- Zydus Lifesciences Limited

- Sun Pharmaceutical Industries Ltd

- Otsuka Pharmaceutical Co., Ltd.

- Sanofi SA

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

- Cipla Limited

- F. Hoffmann-La Roche Ltd

- GlaxoSmithKline PLC

- AB Science SA

- Alector, Inc.

- Apotex Inc.

- Aquestive Therapeutics, Inc.

- AstraEureka Pharmaceuticals

- BrainStorm Cell Limited

- CorestemChemon Inc.

- Coya Therapeutics, Inc.

- Cytokinetics, Incorporated

- DR. REDDY’S LABORATORIES LIMITED

- Genervon Biopharmaceuticals, LLC

- Implicit Bioscience Ltd.

- Ionis Pharmaceuticals, Inc.

- ITF Pharma, Inc.

- Kringle Pharma, Inc.

- Neurimmune AG

- ONO PHARMACEUTICAL CO., LTD.

- Orion Corporation

- Orphazyme A/S

- Pfizer, Inc.

- Treeway B.V.

Actionable strategies for industry stakeholders to optimize supply resilience, accelerate evidence generation, and secure market access in ALS therapeutics

To navigate the rapidly evolving ALS treatment arena, industry leaders should prioritize integrated strategies that balance innovation, access, and evidence generation. First, investing in flexible manufacturing networks that combine domestic API synthesis with regional CDMO partnerships can mitigate tariff risks and ensure supply continuity. Such diversification bolsters resilience while enabling rapid scale-up for advanced modalities.

Second, embracing adaptive clinical trial designs and real-world data integration will accelerate proof-of-concept and de-risk development pathways, particularly for precision therapies targeting genetic subtypes. By establishing biomarker analytics and patient registry collaborations early, sponsors can streamline enrollment and optimize dosing regimens for heterogeneous ALS populations.

Third, proactive engagement with regulatory and payer authorities to align on value-based reimbursement models is paramount. Collaborative pilot programs demonstrating long-term functional benefits and quality-of-life improvements can underpin outcomes-based contracts, reducing the financial burden on healthcare systems while reinforcing the value proposition of novel interventions.

Finally, cultivating patient-centric support programs that address route-specific adherence challenges, caregiver training, and telehealth integration will drive therapy uptake and enhance long-term outcomes. By investing in digital tools and multidisciplinary care networks, organizations can reinforce patient engagement and differentiate their offerings in a competitive landscape.

Comprehensive research methodology combining primary stakeholder insights with authoritative secondary sources to underpin ALS treatment market analysis

This analysis synthesized insights from a comprehensive research framework integrating primary and secondary methodologies. Secondary research encompassed reviewing peer-reviewed journals, regulatory disclosures, company filings, clinical trial registries, and authoritative press releases to map the evolving ALS therapy landscape. Key sources included FDA approval announcements for edaravone, Relyvrio, and tofersen, alongside specialized industry reports on trade policy impacts.

Primary research involved structured interviews with thought leaders across neurology centers of excellence, biopharma executives, patient advocacy representatives, and reimbursement experts. These qualitative engagements illuminated real-world challenges in clinical trial recruitment, supply chain vulnerabilities under new tariff structures, and payer considerations for innovative endpoints. In addition, data triangulation from patient registries and expert surveys provided context on regional adoption trends and segmentation nuances.

Rigorous validation processes ensured consistency between primary feedback and secondary findings. Cross-referencing emerging gene and cell therapy pipelines with regulatory guidance and payer frameworks enabled robust scenario planning. This mixed-method approach yielded actionable insights, grounded in the latest scientific developments and market dynamics, to inform strategic decision-making for stakeholders in the ALS treatment ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Amyotrophic Lateral Sclerosis Treatment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Amyotrophic Lateral Sclerosis Treatment Market, by Treatment

- Amyotrophic Lateral Sclerosis Treatment Market, by Type

- Amyotrophic Lateral Sclerosis Treatment Market, by Treatment Stage

- Amyotrophic Lateral Sclerosis Treatment Market, by Route of Administration

- Amyotrophic Lateral Sclerosis Treatment Market, by Line Of Therapy Strategy

- Amyotrophic Lateral Sclerosis Treatment Market, by Patient Age Group

- Amyotrophic Lateral Sclerosis Treatment Market, by Care Setting

- Amyotrophic Lateral Sclerosis Treatment Market, by Distribution Channel

- Amyotrophic Lateral Sclerosis Treatment Market, by Region

- Amyotrophic Lateral Sclerosis Treatment Market, by Group

- Amyotrophic Lateral Sclerosis Treatment Market, by Country

- United States Amyotrophic Lateral Sclerosis Treatment Market

- China Amyotrophic Lateral Sclerosis Treatment Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1908 ]

Concluding perspectives on the transformative journey of ALS treatment innovation and strategic imperatives for collaborative stakeholder impact in patient care

The journey from symptomatic interventions to precision-driven genetic and cellular therapies underscores the remarkable evolution of the ALS treatment ecosystem. Early milestones, such as the approvals of riluzole and edaravone, laid the foundation for targeting fundamental disease mechanisms. Subsequent breakthroughs-ranging from combination metabolic therapies to RNA-based antisense oligonucleotides-have expanded the therapeutic armamentarium and catalyzed a shift toward personalized care.

Concurrently, external factors like 2025 trade policies have highlighted the critical importance of supply chain agility and partnership models that accommodate dynamic tariff environments. Navigating these complexities requires proactive collaboration across manufacturers, regulators, payers, and patient communities to ensure uninterrupted access to life-extending therapies.

Looking ahead, the convergence of advanced gene therapies, stem cell modalities, and digital health platforms promises to redefine standards of care for ALS patients worldwide. Stakeholders who embrace flexible manufacturing, adaptive trial designs, and value-based engagement will be best positioned to drive clinical innovation while meeting evolving reimbursement and patient support expectations. The transformative trajectory of ALS research offers hope for new generations of patients and underscores the power of integrated, strategic approaches in delivering meaningful therapeutic advances.

Engage with our Associate Director of Sales & Marketing to unlock tailored ALS treatment market intelligence and empower your strategic decision making

For a tailored discussion on how these insights can inform your strategic planning and drive competitive advantage in the evolving ALS treatment ecosystem, engage with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan brings deep expertise in life sciences market analysis and can guide you in leveraging our comprehensive report to identify high-impact opportunities, refine your go-to-market strategies, and strengthen stakeholder engagement. Reach out to schedule a personalized briefing and secure your access to the full Amyotrophic Lateral Sclerosis Treatment Market Research Report today to accelerate your decision-making process and stay ahead in this rapidly transforming field

- How big is the Amyotrophic Lateral Sclerosis Treatment Market?

- What is the Amyotrophic Lateral Sclerosis Treatment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?