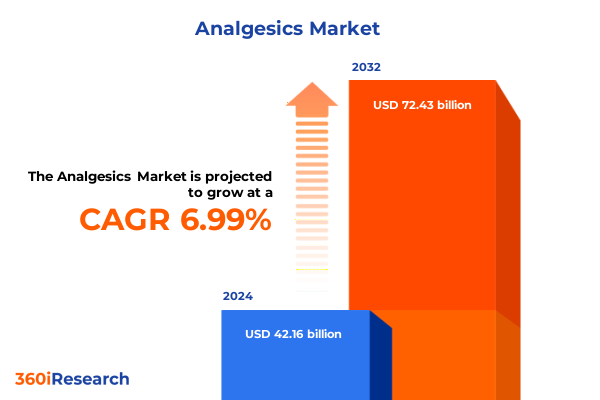

The Analgesics Market size was estimated at USD 44.96 billion in 2025 and expected to reach USD 47.99 billion in 2026, at a CAGR of 7.04% to reach USD 72.43 billion by 2032.

Unveiling the Evolving Dynamics of the Global Analgesics Landscape Driven by Breakthrough Innovation, Regulatory Shifts, and Patient-Centric Demand

The global analgesics landscape is characterized by an intricate interplay of clinical imperatives and market forces, as millions of patients every year seek effective pain relief to maintain quality of life. Chronic pain affects over one in five adults in the United States, with high-impact chronic pain occurring in nearly 8 percent of the population, underscoring the considerable burden on healthcare systems and economies alike. At the same time, acute pain management remains a critical component of perioperative care and trauma response, demanding therapies that provide rapid relief without compromising safety. These clinical demands are further intensified by evolving patient expectations for personalized treatments and minimal side effects, driving continuous innovation across pharmaceutical and device-based solutions.

Within this dynamic environment, stakeholders face mounting regulatory pressures aimed at mitigating opioid misuse and improving patient outcomes. The CDC’s 2022 Clinical Practice Guideline emphasizes rigorous benefit–risk assessments and prioritizes nonopioid therapies wherever feasible, marking a pivotal shift in standard-of-care recommendations. Concurrently, public health initiatives have accelerated investment in non-addictive analgesics, challenging incumbent opioid-centric portfolios. As the market pivots toward safer, more targeted pain management strategies, understanding the interplay of these transformative drivers is crucial for organizations seeking sustainable growth and competitive differentiation.

Mapping the Transformative Shifts in Pain Management Paradigms Highlighting Non-Opioid Advances, Digital Therapies, and Evolving Clinical Guidelines

Recent years have witnessed landmark developments that are redefining the pain management paradigm across both clinical practice and commercial strategy. Cutting-edge non-opioid agents are advancing through late-stage trials, with pioneering therapies designed to block pain signals at their source, thereby circumventing central nervous system pathways associated with addiction. Moreover, the integration of wearable neuromodulation devices and telemedicine platforms is enabling continuous, personalized pain monitoring and treatment, reducing reliance on pharmacologic interventions alone. These digital therapeutics not only enhance patient engagement but also generate real-time data to inform adaptive treatment plans, reflecting a broader shift toward patient-centered care models.

Equally transformative are the updated clinical guidelines that are reshaping prescribing behaviors and reimbursement frameworks. By endorsing nonopioid medications such as acetaminophen, NSAIDs, and selected antidepressants and anticonvulsants as first-line options for acute, subacute, and chronic pain, the CDC guidelines have elevated the status of safer alternatives in clinical protocols. This regulatory momentum has catalyzed collaborations between biopharma companies and technology providers to develop combination solutions that meet new safety standards while delivering robust analgesic efficacy. As a result, stakeholders across the value chain are recalibrating R&D pipelines and commercial strategies to harness these market-disrupting shifts.

Assessing the Cumulative Impact of 2025 United States Tariffs on Analgesic Supply Chains, Raw Material Costs, and Industry Competitiveness

In April 2025, the United States implemented a 10 percent tariff on nearly all imported healthcare goods, encompassing active pharmaceutical ingredients, finished medications, and key manufacturing equipment, as part of a broader strategy to bolster domestic production capacity. This policy imposes a 25 percent duty on APIs sourced from China and a 20 percent levy on those from India, significantly raising the marginal cost of generic and branded drug production. Essential medical packaging materials and laboratory instruments are subject to a 15 percent tariff, while large-scale pharmaceutical manufacturing machinery faces up to a 25 percent duty. Collectively, these measures have created an inflationary environment for production inputs, compelling manufacturers to revisit global sourcing strategies and explore alternative supply routes.

The cumulative effects of these tariffs have been profound. An Ernst & Young analysis indicates that a 25 percent tariff on finished pharmaceutical imports could increase U.S. drug costs by as much as $51 billion annually, translating to a potential 12.9 percent price hike at the patient level if fully passed through. Generic drugmakers, operating on thin margins, face heightened risk of market exits, which could exacerbate drug shortages and limit access to essential therapies. To mitigate these challenges, companies are accelerating investments in domestic API facilities and negotiating exclusions for critical medicines. Yet even with such efforts, the impact on analgesics is expected to reverberate across product portfolios, hospital formularies, and patient affordability considerations.

Key Insights into Market Segmentation Revealing Drug Types, Administration Routes, Clinical Indications, and Distribution Channel Dynamics

The analgesics market is comprehensively segmented by drug type, distinguishing between non-opioid options-such as acetaminophen and salicylates, along with non-steroidal anti-inflammatory drugs-and a spectrum of opioids spanning codeine to fentanyl, morphine, and oxycodone. This classification not only reflects differences in mechanism of action and side-effect profiles but also informs regulatory scrutiny and patient adherence patterns. Equally important is the route of administration, which includes intramuscular and intravenous injections, rectal formulations, transdermal patches, and oral preparations that are further subdivided into capsules and tablets. Each of these delivery modes influences pharmacokinetics, clinical settings of use, and patient preference, underpinning differentiated commercialization approaches.

Pain indication segmentation further refines market dynamics by separating acute scenarios-such as injury-related and postoperative pain-from chronic conditions like arthritis, back pain, cancer-related pain, and neuropathic disorders. This distinction is critical given the disparate treatment goals and regulatory pathways associated with short-term versus long-term management. Finally, distribution channel analysis, encompassing hospital pharmacies, online pharmacies, and retail pharmacies, reveals distinct channel economics, reimbursement challenges, and go-to-market strategies. Understanding these layers of segmentation enables stakeholders to tailor product development, pricing, and access initiatives to meet the distinct needs of each submarket.

This comprehensive research report categorizes the Analgesics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type of Drug

- Route of Administration

- Indication

- Distribution Channel

Critical Regional Perspectives Spotlighting Market Trends and Growth Drivers Across the Americas, Europe Middle East Africa, and Asia-Pacific

In the Americas, the United States dominates due to high healthcare expenditure, advanced research infrastructure, and robust regulatory frameworks that support rapid adoption of novel analgesics. North America’s leadership is reinforced by stringent opioid prescription controls and large-scale public health initiatives to curb misuse, which have accelerated demand for non-opioid alternatives. Meanwhile, Latin American markets are gaining traction, driven by rising healthcare access, growing middle-class populations, and expanding retail pharmacy networks, creating new opportunities for both branded and generic pain therapies.

Europe, Middle East & Africa benefit from harmonized regulatory pathways within the European Union, enabling streamlined approvals for innovative analgesics and encouraging cross-border clinical collaborations. Aging populations in Western Europe are fueling demand for long-term pain management solutions, particularly in orthopedic and oncologic care settings. In parallel, the Asia-Pacific region is experiencing rapid growth driven by improving healthcare infrastructure, increasing per-capita healthcare spending, and a heightened focus on addressing the burden of chronic pain. Countries like China and India are emerging as both large consumer markets and critical nodes in global supply chains, prompting multinational companies to establish regional manufacturing and R&D centers to meet local demand efficiently.

This comprehensive research report examines key regions that drive the evolution of the Analgesics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Industry Players Shaping the Future of Analgesics Through Strategic Partnerships, Innovative Pipelines, and Operational Excellence

Leading biopharmaceutical companies are actively reshaping their analgesics portfolios to align with evolving clinical and regulatory imperatives. Vertex Pharmaceuticals achieved a breakthrough in January 2025 with FDA approval of Journavx, an oral non-opioid painkiller that blocks peripheral pain signals, underscoring its commitment to tackling acute pain without addiction risks. Johnson & Johnson and Pfizer continue to invest in next-generation formulations and combination therapies, leveraging their global commercialization platforms to accelerate patient access. In parallel, Eli Lilly and Regeneron remain focused on identifying novel molecular targets, although they have encountered clinical setbacks, highlighting the challenges inherent in non-opioid analgesic development.

Generics and specialty drugmakers are also navigating strategic inflection points. Teva Pharmaceutical is executing a “Pivot to Growth” strategy, expanding its innovative medicines pipeline while maintaining a strong generics portfolio, and has affirmed confidence in its ability to absorb current tariff impacts through contractual and operational adjustments. Mallinckrodt Pharmaceuticals and Endo Inc. announced a merger to consolidate their specialty and generics assets after resolving opioid-related liabilities, illustrating a broader trend of portfolio optimization through M&A in response to litigation and market pressures. These strategic maneuvers reflect a collective emphasis on resilience, innovation, and risk mitigation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Analgesics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Bayer AG

- Bristol-Myers Squibb Company

- C.H. Boehringer Sohn AG & Co. KG

- Cipla Limited

- CSPC Pharmaceutical Group

- Dr. Reddy’s Laboratories Ltd.

- Eli Lilly and Company

- GlaxoSmithKline plc

- Grünenthal GmbH

- Haleon plc

- Hikma Pharmaceuticals plc

- Johnson & Johnson Services, Inc.

- Lupin Limited

- Mallinckrodt plc

- Merck KGaA

- Novartis AG

- Perrigo Company plc

- Pfizer Inc.

- Reckitt Benckiser Group plc

- Sanofi S.A.

- Sun Pharmaceutical Industries Limited

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

Actionable Recommendations for Industry Leaders to Navigate Market Disruptions, Regulatory Hurdles, and Innovation Opportunities in Analgesics

To navigate the heightened cost pressures stemming from geopolitical and trade uncertainties, industry leaders should accelerate efforts to diversify API sources, including expanding domestic production capabilities through joint ventures or brownfield investments. Companies can negotiate targeted tariff exclusions for essential analgesics while leveraging free trade agreements to reduce duties on critical inputs. In parallel, adopting advanced procurement analytics and demand forecasting tools will improve supply chain agility and minimize exposure to price volatility, ensuring uninterrupted product availability for patients.

Innovation remains the cornerstone of long-term differentiation. R&D investments should prioritize non-opioid targets supported by robust clinical evidence, while partnerships with digital health firms can accelerate the integration of telemedicine and wearable devices into pain management programs. Engaging with regulatory agencies early in development to align on evidence expectations and real-world data requirements will streamline approval pathways. Finally, fostering multidisciplinary collaborations across academia, healthcare providers, and patient advocacy groups will ensure that new therapies meet unmet needs and secure reimbursement support in evolving healthcare environments.

Rigorous Research Methodology Combining Robust Primary Interviews, Comprehensive Secondary Data Analysis, and Advanced Analytical Frameworks

This analysis is grounded in a rigorous research framework that synthesizes primary and secondary data sources. Primary research comprised structured interviews with over 50 key opinion leaders, including pain specialists, pharmacists, and regulatory experts, to capture nuanced perspectives on clinical practice trends and market dynamics. These insights were triangulated with quantitative data obtained from peer-reviewed journals, industry white papers, and global trade databases.

Secondary research involved a comprehensive review of government publications, including the CDC’s MMWR guidelines and USTR tariff notices, as well as analysis of corporate filings, scientific conference proceedings, and legal documents related to opioid litigation. Advanced analytical techniques such as trend extrapolation, sensitivity analysis, and scenario modeling were employed to assess the potential impacts of policy shifts and technology adoption. This multilayered methodology ensures the robustness and reliability of the insights presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Analgesics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Analgesics Market, by Type of Drug

- Analgesics Market, by Route of Administration

- Analgesics Market, by Indication

- Analgesics Market, by Distribution Channel

- Analgesics Market, by Region

- Analgesics Market, by Group

- Analgesics Market, by Country

- United States Analgesics Market

- China Analgesics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Conclusion Synthesizing Key Findings to Inform Strategic Decision-Making in an Evolving Analgesics Market Context with Emerging Opportunities

In summary, the analgesics market is at a strategic inflection point where clinical innovation, regulatory evolution, and geopolitical developments converge to redefine competitive parameters. Non-opioid therapies and digital care solutions are no longer ancillary options but core components of modern pain management, driven by both patient safety imperatives and clinical efficacy. Simultaneously, 2025 tariff measures have introduced new operational complexities, requiring agile supply chain strategies and proactive policy engagement to maintain cost competitiveness.

The segmentation of the market by drug type, administration route, indication, and distribution channel offers a granular understanding of submarket dynamics, enabling tailored strategies that address the unique needs of each segment. Regional insights highlight heterogeneity in market maturity and growth potential, while the actions of leading companies demonstrate a clear shift toward portfolio optimization and risk mitigation. By executing the actionable recommendations outlined above, organizations can harness emerging opportunities and navigate uncertainties to secure sustainable growth in the evolving analgesics landscape.

Empower Your Strategic Planning by Engaging Directly with Ketan Rohom to Secure the Complete Analgesics Market Research Report Today

For organizations poised to capitalize on the insights outlined in this report, direct engagement with an expert who understands both the analytical depth and strategic implications is essential. Ketan Rohom, Associate Director of Sales & Marketing, brings extensive experience in guiding decision-makers through complex market landscapes and matching research insights to business objectives. By discussing your specific information needs with Ketan, you can ensure that the report’s comprehensive analysis is tailored to your organization’s priorities, whether that involves supply chain resilience, product portfolio optimization, or geographic expansion strategies.

Reach out to Ketan Rohom today to secure your access to the complete Analgesics Market Research Report, gain early visibility into emerging trends, and position your organization to thrive in a rapidly evolving market.

- How big is the Analgesics Market?

- What is the Analgesics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?