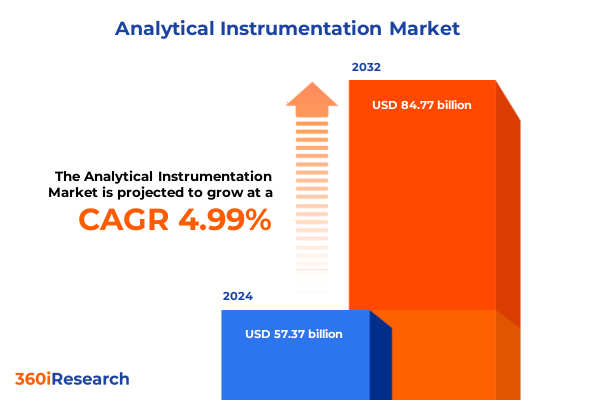

The Analytical Instrumentation Market size was estimated at USD 60.22 billion in 2025 and expected to reach USD 63.08 billion in 2026, at a CAGR of 5.00% to reach USD 84.77 billion by 2032.

Navigating the Evolving Terrain of Analytical Instrumentation by Exploring Core Innovations, Advanced Technologies and Impact for Modern Laboratories

The analytical instrumentation landscape is undergoing an era of rapid innovation and strategic transformation, driven by an ever-growing demand for precision, speed, and reliability in laboratory environments. As cutting-edge technologies continue to converge, laboratories worldwide are rethinking traditional workflows and investing in solutions that deliver high-throughput capabilities without compromising data integrity. Moreover, breakthroughs in miniaturization and portability are expanding the frontiers of on-site testing, enabling real-time insights in fields as diverse as environmental monitoring, pharmaceutical development, and food safety. Furthermore, the integration of cloud connectivity and data analytics platforms is empowering scientists to harness vast datasets, uncover hidden patterns, and optimize experimental protocols with unprecedented efficiency.

Against this backdrop, stakeholders must navigate a complex web of regulatory requirements, supply chain challenges, and competitive pressures. As a result, organizations are placing a premium on partnerships with instrument providers that can demonstrate both technological leadership and robust service support. In addition, the growing focus on sustainable practices is reshaping procurement priorities, motivating end users to seek energy-efficient instruments and green consumables. This introduction sets the stage for an in-depth exploration of the forces reshaping analytical instrumentation, laying the foundation for strategic decision makers to capitalize on emerging opportunities and mitigate evolving risks.

Unleashing Disruptive Forces Reshaping Analytical Instrumentation with Digital Transformation, Automation, Artificial Intelligence and Sustainability Priorities

Digital transformation has emerged as the most profound catalyst in reshaping analytical instrumentation, enabling seamless integration of automated sample handling, remote monitoring, and AI-driven analytics. In particular, the deployment of machine learning algorithms is streamlining complex data interpretation, thereby reducing analysis times and increasing throughput. As a consequence, laboratories can accelerate time to insight while allocating skilled personnel to high-value tasks rather than routine instrument operation. Moreover, the push toward miniaturized and portable platforms is eroding the historical divide between centralized and field applications, empowering on-site quality control and diagnostic testing even in resource-constrained environments.

Furthermore, environmental and sustainability mandates are driving manufacturers to optimize instrument efficiency, reduce solvent consumption, and source eco-friendly reagents. These imperatives are converging with growing end-user expectations for instruments that support circular economy models, including modular designs that facilitate easy component replacement and upgrade. Finally, the proliferation of software-as-a-service offerings is transforming the vendor-customer relationship from transactional equipment sales to ongoing partnerships centered on data insights and continuous performance enhancements. Collectively, these shifts are redefining competitive strategies and unlocking new value propositions in the analytical instrumentation sector.

Examining the Layered Effects of 2025 United States Tariffs on Analytical Instrumentation Supply Chains, Costs and Global Sourcing Strategies

In 2025, the United States implemented a series of tariffs targeting imported analytical instrumentation and related consumables, significantly altering cost structures and sourcing strategies across the industry. These measures, designed to shore up domestic manufacturing and address perceived trade imbalances, have raised import duties on key instruments and reagents, particularly those sourced from certain Asian markets. Consequently, end users are facing elevated acquisition costs, prompting many to reevaluate their supplier portfolios and negotiate new contracts that factor in tariff-induced price escalations.

At the same time, manufacturers and distributors are accelerating supply chain diversification to mitigate exposure to tariff volatility. In addition to forging partnerships with domestic component suppliers, several leading companies have redirected production lines to low-tariff regions, optimizing assembly footprints and logistics networks. As a result, the global flow of chromatography columns, mass spectrometers, and spectroscopic accessories is being rerouted through multi-regional hubs that balance cost, delivery speed, and regulatory compliance. While these adaptations have introduced short-term operational complexities, they are also driving long-term resilience by reducing dependency on any single region. This evolving landscape underscores the critical importance of dynamic procurement strategies and agile supplier management in the face of shifting trade policies.

Decoding Critical Segmentation Insights to Illuminate Market Dynamics Across Technology, Product Type, End Users and Deployment Models

A nuanced understanding of market segmentation is essential for uncovering hidden growth pockets and tailoring product roadmaps. When viewed through the lens of technology, the analytical instrumentation arena encompasses chromatography solutions-spanning gas chromatography, high-performance liquid chromatography and ion chromatography-alongside mass spectrometry techniques including GC-MS, ICP-MS, LC-MS and MALDI-TOF. Microscopy plays its role with electron, optical and scanning probe variants, while spectroscopy features atomic absorption, FTIR, NIR, Raman and UV-Vis methods. Thermal analysis further augments the toolkit via DMA, DSC and TGA procedures.

From the perspective of product type, demand is distributed across consumables and reagents, instruments that range from benchtop to portable formats, as well as software and services that underpin data management and instrument maintenance. End-user activities extend from academic and research institutions to biotechnology and pharmaceutical laboratories, chemical and petrochemical facilities, environmental testing centers and food and beverage quality labs. Additionally, application segments cover diagnostics, process control, quality assurance and fundamental research and development. Finally, deployment models are bifurcated into cloud-enabled solutions and on-premise installations. By mapping these dimensions against market requirements, stakeholders can forge targeted strategies for product development, marketing investments and customer engagement.

This comprehensive research report categorizes the Analytical Instrumentation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Product Type

- End User

- Application

- Deployment

Highlighting Key Regional Perspectives to Uncover Distinct Drivers in the Americas, Europe Middle East Africa and Asia Pacific Markets

Regional dynamics play a pivotal role in shaping adoption patterns and innovation trajectories. In the Americas, strong regulatory frameworks and significant research funding have fueled early adoption of high-throughput chromatography and mass spectrometry systems. Meanwhile, North American end users are increasingly seeking integrated software platforms to align with their digital laboratory strategies. Transitioning to Europe, the Middle East and Africa, sustainability regulations and cross-border trade agreements are influencing procurement cycles and encouraging consolidation among local distributors.

Looking eastward, the Asia-Pacific region is experiencing rapid expansion driven by growing investments in life sciences research, expanding environmental compliance protocols and burgeoning pharmaceutical manufacturing hubs. In many PALOP and Southeast Asian markets, infrastructure development and foreign direct investment are catalyzing demand for portable instruments and cloud-based analysis services. Across all regions, evolving healthcare priorities and environmental mandates are creating differentiated feature requirements and service expectations. By juxtaposing these distinct regional narratives, industry leaders can align their go-to-market approaches with local nuances and maximize commercial impact.

This comprehensive research report examines key regions that drive the evolution of the Analytical Instrumentation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Profiles and Innovation Trajectories of Leading Analytical Instrumentation Companies Driving Competition and Collaboration

Leading industry participants are jockeying to establish technological leadership through continuous innovation, strategic acquisitions and service excellence. A few prominent players have expanded their product portfolios by integrating AI-driven software tools into existing chromatography and mass spectrometry platforms, enabling seamless workflows from sample preparation to result interpretation. Others have differentiated themselves through modular instrument architectures that support rapid customization and field upgrades.

Moreover, collaborations between instrumentation vendors and specialized software firms are gaining traction, enhancing data analytics capabilities and facilitating compliance with evolving regulatory landscapes. Partnerships with academic and research institutions are also on the rise, delivering early insights into emerging methodologies and enabling co-development of novel modules. Meanwhile, service and maintenance divisions are being reimagined to offer predictive diagnostics, guided by real-time performance metrics and remote assistance features. These strategic moves underscore a broader trend toward blurring the lines between hardware, software and services, as companies strive to deliver end-to-end solutions that address complex analytical challenges.

This comprehensive research report delivers an in-depth overview of the principal market players in the Analytical Instrumentation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies Inc.

- Anton Paar GmbH

- Avantor Inc.

- Bio-Rad Laboratories Inc.

- Bruker Corporation

- Danaher Corporation

- Eppendorf SE

- F. Hoffmann-La Roche AG

- Hanna Instruments Inc.

- Hitachi High-Tech Corporation

- HORIBA Ltd.

- Illumina Inc.

- JASCO Corporation

- JEOL Ltd.

- LECO Corporation

- Malvern Panalytical Ltd.

- Merck KGaA

- Metrohm AG

- Mettler-Toledo International Inc.

- Nikon Instruments Inc.

- PerkinElmer Inc.

- Rigaku Corporation

- Sartorius AG

- Shimadzu Corporation

- Thermo Fisher Scientific Inc.

- Waters Corporation

- ZEISS Group

Empowering Industry Leaders with Actionable Recommendations to Accelerate Digital Adoption, Enhance Resilience and Foster Sustainable Growth

To thrive in this dynamic environment, industry leaders should prioritize investment in digital infrastructure, ensuring that instruments seamlessly connect with cloud platforms and analytics engines. In addition, cultivating a workforce adept at managing AI-augmented workflows and interpreting large datasets will prove vital for unlocking the full potential of next-generation instrumentation. Strategic partnerships with software developers and data science consultancies can accelerate these capabilities while minimizing internal resource constraints.

At the same time, diversifying component sourcing and establishing dual-sourcing agreements will mitigate risks associated with tariff fluctuations and geopolitical tensions. Embracing circular economy principles-such as reusable consumables and modular upgrade paths-can further enhance sustainability credentials and create new service revenue streams. Finally, ongoing engagement with regulatory bodies and industry consortia will ensure alignment with emerging standards around data integrity, cybersecurity and environmental impact. By adopting a holistic approach that balances innovation, resilience and regulatory compliance, leaders can position themselves for long-term success.

Ensuring Rigor Through a Robust Research Methodology Combining Primary Engagements, Secondary Data Integration and Comprehensive Quality Validation

Our research methodology combines in-depth primary engagements with instrument manufacturers, end users and distribution partners, alongside rigorous secondary data integration. Initially, expert interviews and targeted surveys provided qualitative insights into technology adoption drivers, procurement criteria and service expectations. These perspectives were then triangulated against publicly available financial reports, peer-reviewed publications and patent filings to validate core assumptions and identify emerging trends.

Subsequently, large-scale data sets on trade flows and regulatory filings were analyzed to quantify supply chain shifts and tariff impacts. Advanced data analytics techniques, including cluster analysis and scenario modeling, were employed to explore how different segmentation and regional variables influence market dynamics. Finally, a comprehensive quality validation process-encompassing peer reviews, editorial oversight and fact checks-ensured the robustness and reliability of our findings. This multi-layered approach delivers a balanced, evidence-based portrait of the analytical instrumentation landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Analytical Instrumentation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Analytical Instrumentation Market, by Technology

- Analytical Instrumentation Market, by Product Type

- Analytical Instrumentation Market, by End User

- Analytical Instrumentation Market, by Application

- Analytical Instrumentation Market, by Deployment

- Analytical Instrumentation Market, by Region

- Analytical Instrumentation Market, by Group

- Analytical Instrumentation Market, by Country

- United States Analytical Instrumentation Market

- China Analytical Instrumentation Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesizing Key Findings to Illuminate the Strategic Imperatives and Future Trajectories in Analytical Instrumentation Markets Worldwide

In summary, the analytical instrumentation market is being redefined by the convergence of digital transformation, regulatory shifts and sustainability imperatives. Rapid advances in microfluidics, AI-driven analytics and modular instrument designs are expanding application horizons, while 2025 tariffs have introduced new complexity to global sourcing and cost structures. Detailed segmentation analysis reveals that chromatography and mass spectrometry continue to command significant attention, further bolstered by rising adoption in pharmaceuticals, environmental testing and academic research.

Regionally, the Americas maintain a leadership position in high-end instrument deployment, while Europe, the Middle East and Africa balance regulatory compliance with strategic consolidation. Asia-Pacific stands out for its growth momentum, driven by infrastructure investments and evolving healthcare priorities. Through strategic company initiatives-ranging from software integration to predictive maintenance services-industry leaders are crafting competitive advantage. Ultimately, organizations that embrace agility, data-centric workflows and sustainable practices will be best positioned to navigate the complexities of this evolving market landscape.

Unlock Comprehensive Insights Today by Connecting with Ketan Rohom to Secure Your Copy of the Definitive Analytical Instrumentation Market Research Report

To unlock the full depth of analysis, strategic insights, and industry intelligence captured in this comprehensive analytical instrumentation market research, reach out today to Ketan Rohom, Associate Director, Sales & Marketing. Ketan will guide you through the rich findings, tailor additional data to your specific interests, and streamline the acquisition process to ensure your organization gains a competitive edge through actionable, data-driven decision making.

- How big is the Analytical Instrumentation Market?

- What is the Analytical Instrumentation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?